SPAC liquidations top $12 billion this year as sponsors grapple with tough market, new buyback tax

2 min read

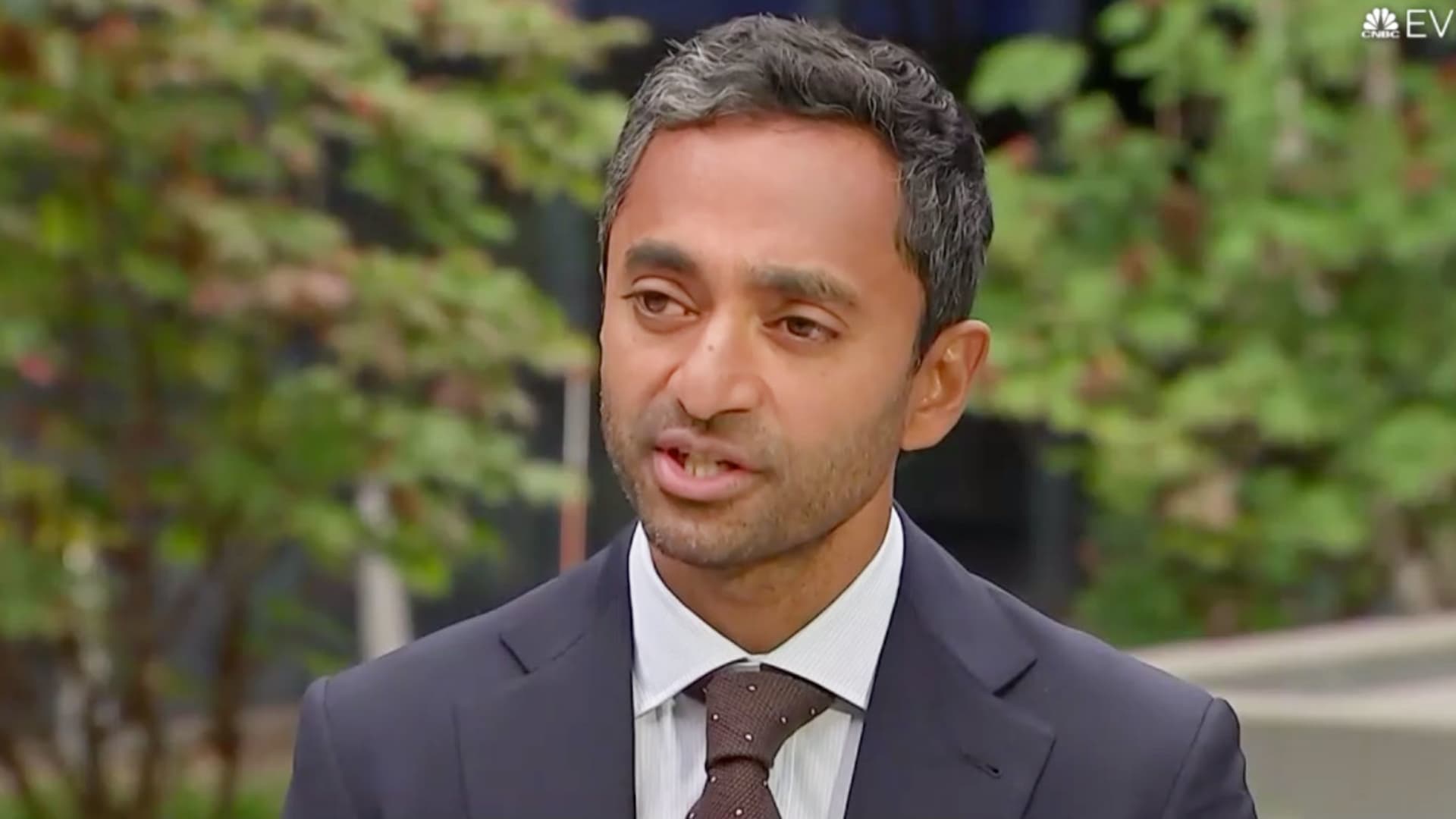

Chamath Palihapitiya, Social Capital Founder and CEO

CNBC

A new buyback tax has motivated more and more SPAC sponsors to close up shop before the year-end, adding another headwind to the blank-check space already roiled by a tough market environment.

A total of 27 SPAC deals, worth $12.8 billion, have been liquidated this year, according to data from SPAC Research. Under the new provision in the Inflation Reduction Act, SPAC sponsors could face a 1% exercise tax if they return cash to investors starting in 2023.

“Market condition is the driving factor, and apart from that, there is the 1% exercise tax,” said Melanie Chen, a partner at UHY LLP. “I think it added a little bit chemistry to accelerate the decision making process.”

SPACs, Wall Street’s hottest tickets in 2020 and 2021, are experiencing a big reset amid increasing economic and regulatory headwinds. There are still more than 450 deals on the market for a merger target ahead of their 2023 deadlines, according to SPAC Research.

Appetite for SPACs, which are often early-stage growth names with little earnings, has diminished in the face of rising rates as well as elevated market volatility. Even deals from some of Wall Street’s most high-profile investors couldn’t come to fruition.

Chamath Palihapitiya, once dubbed SPAC king, has shut down two deals this month after failing to find suitable merger targets within deadline, returning $1.6 billion to investors. Bill Ackman, who raised $4 billion in the biggest-ever SPAC, folded the deal in July amid choppy markets.

SPACs stand for special purpose acquisition companies, which raise capital in an IPO and use the cash to merge with a private company and take it public, usually within two years.

Stocks that did go public via SPACs are among the hardest hit during the market turmoil. The CNBC SPAC Post Deal Index has fallen over 60% in the past year.