Munis steady to firmer in spots as FOMC week kicks off

5 min read

Municipals were steady to slightly firmer in spots to kick off a lighter new-issue calendar due to the Federal Open Market Committee meeting. U.S. Treasuries extended Friday’s losses on the short end, while equities ended down.

Triple-A municipal yields fell one to two basis points while UST saw losses of eight on the short end and one out long.

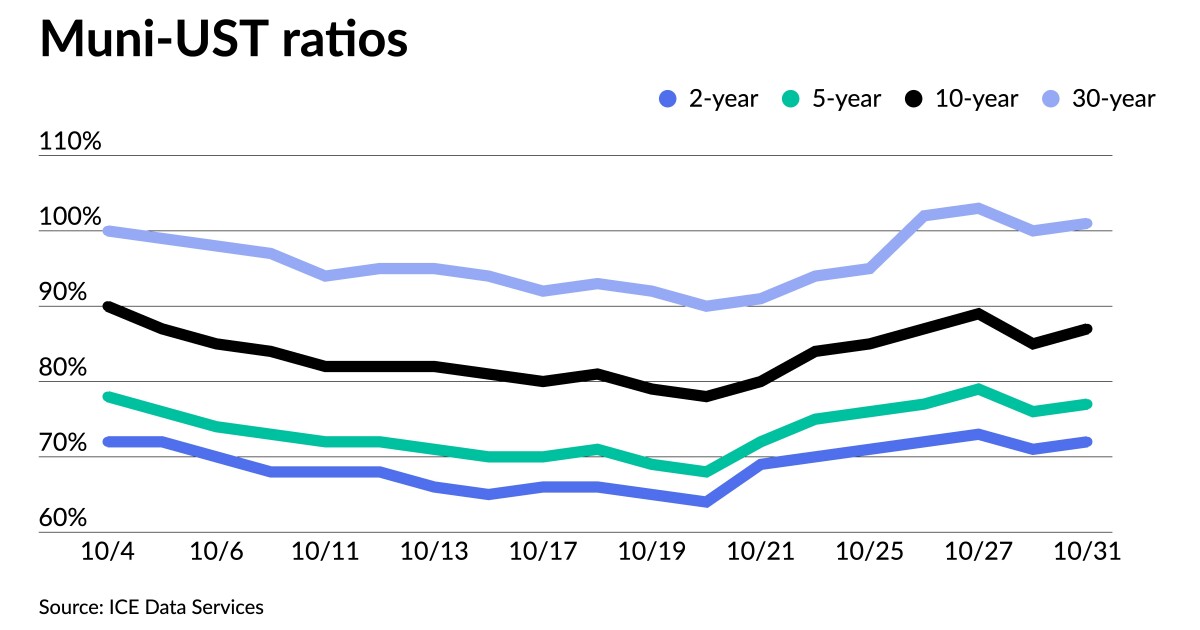

The three-year muni-UST ratio was at 72%, the five-year at 76%, the 10-year at 83% and the 30-year at 98%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the three at 74%, the five at 77%, the 10 at 87% and the 30 at 101% at a 4 p.m. read.

“Supply for this week is expected to be very light and demand will get a modest boost from $24 billion of principal and interest that will be paid out on Tuesday,” said CreditSights strategists Pat Luby and John Ceffalio.

This week’s supply totals only $2.7 billion.

“Chalk it up to Halloween Monday or the fact that muni rates are puzzlingly on the rise; whatever the reason, anyone looking for more clarity through price discovery and less pressure on the secondary market may be out of luck for now,” said Eric Kazatsky, head of municipal strategy at Bloomberg Intelligence.

Bond Buyer 30-day visible supply sits at $9.39 billion. The lower projection “indicates that a typically busy time of year for public-finance bankers may be veering from normal,” he said.

October municipal bond issuance also plummeted 40.3% year-over-year, as issuers dealt with extremely volatile rates and uncertainty over Fed policy.

And with the Federal Open Market Committee meeting this week and the next week shortened by the bond market observance of Veterans Day, CreditSights strategists said investors should be prepared for two weeks of subdued new issuance.

“Last week’s tumultuous adjustments to the benchmark yield curves resulted in the tax-exempt muni indices dramatically underperforming the UST and corporate bond indices,” Luby and Ceffalio said. However, the week ended on a positive note as yields held firm on Friday, and flows into the muni exchange-traded funds were strong.

But the growing disconnect between USTs and AAA tax-exempts became even more apparent over the past week, Kazatsky said.

“U.S. Treasury rates snapped an almost 12-week losing streak on hopes that prior Fed hikes have finally cooled the economy and a slowdown in tightening may be in sight,” he said.

Meanwhile, “tax-exempt rates shot higher, seemingly taking the other side of that market, and underperformed on the week,” Kazatsky said noting, “the largest margin of underperformance came in the long end of the curve as US Treasuries dropped 20 bps and munis rose 10 bps.”

Jason Wong, vice president of municipals at AmeriVet Securities, said the 10-year munis is at its highest since January 2011.

Muni ratios also “rose sharply with ratios on 10-year notes now yielding 84.91% of Treasuries compared to the prior week when the ratios were at 79.71%,” he said.

The muni curve steepened by 7.9 basis points to 98 basis points, Wong said.

And as muni-UST ratios rise, Kazatsky said “more buying from the sidelines would be expected, yet that hasn’t seemed to be the case yet.”

The sharpest increase in ratios came in the long end of the curve to 103% on Oct. 27 from 90% on Oct. 20.

And with the rising yields, investors pull their investments out of muni mutual funds, which saw $1.8 billion flow out of the funds last week, according to Refinitiv Lipper. This marks the 12th consecutive week of outflows.

“Though fund flows aren’t the be-all and end-all of muni sentiment, weeks of multibillion-dollar outflows have weighed heavily and thrown into question stronger technicals that typically support the tax-exempt market,” Kazatsky said.

“Secondary trading for the week totaled to roughly $55.58 billion as the selloff continues as investors continue to expect a few more rate hikes from the Fed,” Wong said.

With the selloff in munis, there continued o be large amounts of customer bids-wanted again last week with a total of just over $10.5 billion with four days of having over $2 billion, per Bloomberg.

“The high number of bids wanted has caused an increased amount of selling pressure in the markets causing more volatility as well,” he said.

Secondary trading

Massachusetts 5s of 2023 at 3.09%. Maryland 4s of 2023 at 3.11% versus 3.18% Friday and 2.97% on 10/13. Washington 5s of 2024 at 3.39%-3.34%.

DC 5s of 2025 at 3,29% versus 3.00%-2.98% on 10/13. Triborough Bridge and Tunnel Authority 5s of 2026 at 3.35%-3.32%. City and County of Denver, Colorado, 5s of 2026 at 3.26%-3.25% versus 3.25%-3.24% on 10/24.

Pennsylvania Higher Education Facilities Authority 5s of 2032 at 4.21%. Elgin ISD, Texas, 5s of 2035 at 3.95%-3.94%. Washington 4s of 2036 at 4.28%.

Greensboro, North Carolina, 5s of 2040 at 3.93% versus 3.95% original on Wednesday. California 5s of 2042 at 4.17% versus 4.21%-4.19% original on Thursday.

Illinois Finance Authority 5s of 2047 at 5.06% versus 5.04%-5.03% on 10/13 and 4.98% on 10/11. Virginia 5s of 2052 at 4.25% versus 4.39% original on Wednesday.

AAA scales

Refinitiv MMD’s scale was bumped two basis points at the one-year and out long: the one-year at 3.12% (-2) and 3.18% (unch) in two years. The five-year at 3.24% (unch), the 10-year at 3.39% (-2) and the 30-year at 4.12% (-2).

The ICE AAA yield curve was bumped two basis points out long: 3.16% (unch) in 2023 and 3.21% (unch) in 2024. The five-year at 3.26% (unch), the 10-year was at 3.47% (unch) and the 30-year yield was at 4.23% (-2) at a 4 p.m. read.

The IHS Markit municipal curve was bumped up to two basis points: 3.12% (-2) in 2023 and 3.18% (unch) in 2024. The five-year was at 3.27% (unch), the 10-year was at 3.39% (-2) and the 30-year yield was at 4.11% (-2) at a 4 p.m. read.

Bloomberg BVAL was bumped up to one basis point: 3.10% (unch) in 2023 and 3.17% (-1) in 2024. The five-year at 3.23% (unch), the 10-year at 3.38% (-1) and the 30-year at 4.11% (-1) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.488% (+7), the three-year was at 4.448% (+8), the five-year at 4.241% (+5), the seven-year 4.152% (+5), the 10-year yielding 4.058% (+4), the 20-year at 4.397% (flat) and the 30-year Treasury was yielding 4.156% (+1) at the close.

Primary to come:

The City and County of Denver, Colorado (Aa3/AA-/AA-/), is set to price Thursday for and on behalf of its Department of Aviation $850 million of fixed rate non-AMT, fixed rate AMT and term rate AMT airport system revenue bonds. Barclays Capital.

The New York State Environmental Facilities Corporation (Aaa/AAA/AAA/) is set to price Tuesday $323.025 million of green state revolving funds revenue bonds, Series 2022 B (2010 Master Financing Program). Jefferies.

The Public Finance Authority, Wisconsin, (Baa2/AA//) is set to price Thursday $210 million of project revenue bonds (CFP3 – Eastern Michigan University Student Housing Project), consisting of $209.250 million of exempts, Series A-1, and $750,000 of taxable, Series A-2, insured by Build America Mutual Assurance. Barclays Capital.

The Kern Community College District Facilities Improvement District No. 1, California, (Aa2/AA-//) is set to price Tuesday $200 million of Election of 2016 general obligation bonds, Series D, serials 2024-2041. Stifel, Nicolaus & Co.

Bexar County, Texas, (Aaa/AAA/AAA/) is set to price Thursday $196 million of combination tax and revenue certificates of obligation, consisting of $46 million of Series 2022A, serials 2023-2048, and $150 million of Series 2022B, serials 2023-2048. HilltopSecurities.

The Colorado Housing and Finance Authority is set to price Tuesday $129.715 million of taxable single family mortgage bonds, consisting of $91.660 million of Class I bonds (Aaa/AAA//), Series H-1, serials 2023-2032, terms 2037 and 2039, and $38.055 million of Class III bonds (Aa3/AA//), Series H-2, terms 2048. RBC Capital Markets.

Competitive:

The Charles County Commissioners, Maryland, (Aaa/AAA/AAA/) is set to sell $50 million of consolidated public improvement bonds of 2022 at 10 a.m. eastern Tuesday.