A better start for munis ahead of diverse $6B calendar

6 min read

Municipals were steady to firm in spots to kick off the week, while U.S. Treasuries were weaker and equities were mixed as markets digested the latest Fedspeak.

Triple-A yields fell one to four basis points while UST saw losses of five to seven basis points across the curve.

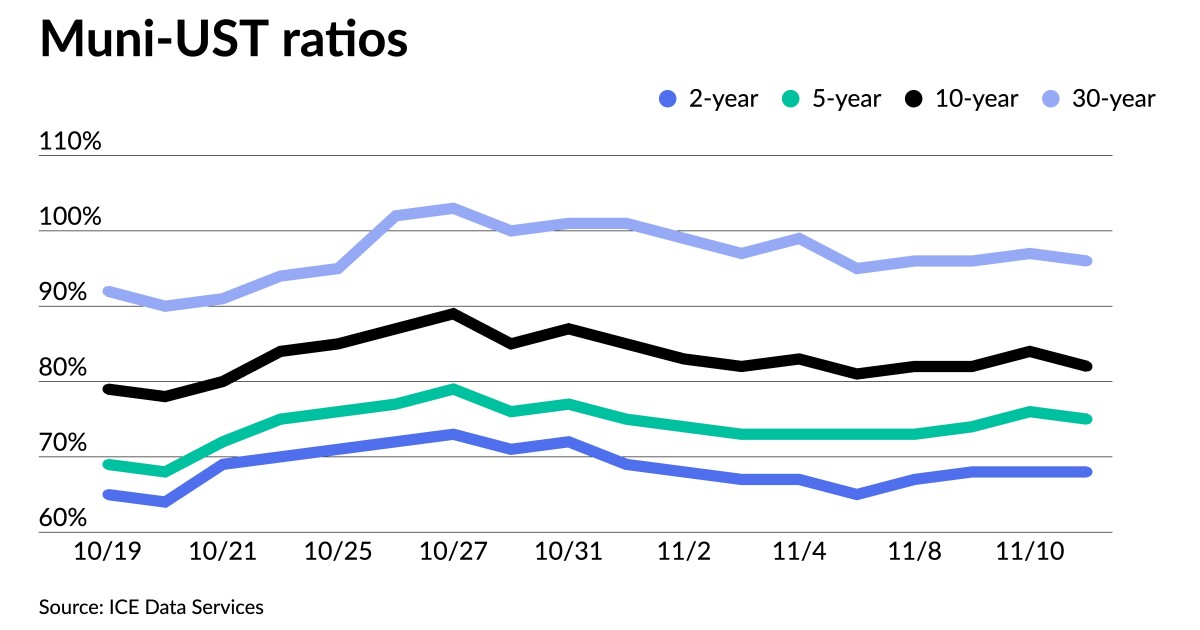

Muni-UST ratios fell on the day’s moves. The three-year muni-UST ratio was at 70%, the five-year at 75%, the 10-year at 81% and the 30-year at 95%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the three at 71, the five at 73%, the 10 at 83% and the 30 at 96% at a 3 p.m. read.

Munis have benefited from the recent trends, said John Hallacy, president of John Hallacy Consulting.

“Yields have decreased by meaningful amounts,” and “despite the outflows that continue to be substantial, supply has been relatively light and is well within the weekly averages for the year,” he said.

Exchange-traded funds continue to be a bright spot, he noted, as “opposed to mutual funds that are experiencing the steady outflows.”

He said that “the ease of selling an ETF at a moment’s notice is contributing to the positive tone.”

Many “retail buyers are once again focused on the taxable equivalent yields and on the relative stability and safety of the asset class,” he said.

And since the “secondary market has become more important in an environment where new-money supply is lighter,” according to Hallacy.

Vikram Rai, head of Citi’s Municipal Strategy group, said he is somewhat bullish on municipal performance.

One of the reasons, he said, is there in no near-term bearish catalysts or performance pitfalls.

The market widely expects the Fed to hike rates by 50 basis points in December. Before that, there is another consumer price index report and jobs report with which to content, he said.

“Unless there’s a considerable surprise, which could mean a 75 basis point hike, there should be little bearish pressure on rates,” he said.

“A sharp rally is required to turn fund flows. We had a sharp rally, so if fund flows have to turn, this is the time for it. This only happens if rates don’t give back the gains as they are doing now,” Rai said.

He doesn’t envision any “big supply weeks” between now and the end of the year, and supply will continue to be scarce in January.

Additionally, supply scarcity, he said, should support municipal performance.

The powerful rally in munis last week “helped to drive heavy new money flows into muni ETFs,” pulling in $1 billion of net new assets just on Thursday, according to CreditSights strategists Pat Luby and John Ceffalio.

That figure was “the best single-day of inflows since at least December 2015,” they noted.

For the week, muni ETFs added $2 billion, the best calendar-week total in 24 weeks, per CreditSights data.

Estimated muni mutual fund flows for the seven-days ended on Wednesday were negative $2.7 billion, the 12th consecutive week of outflows and the 11th week of losing $1 billion or more. Year-to-date, they said outflows total -$127 billion, while muni ETFs have pulled in $20 billion, per CreditSights data.

They expect “that weekly net mutual fund flows will continue to be negative for at least the next several weeks and that a continuation of net outflows should not necessarily be taken as indicative of negative sentiment, even though net redemptions may mean more secondary market selling by portfolio managers (and pressure on secondary market prices).”

Due to the “improved outlook for inflation, the lower expected peak in Fed Funds for the current rate hike cycle and with only a few full weeks left in the year,” they believe that last week’s improved demand will carry over into this week and new issues will receive a warm welcome.

However, CreditSights strategists “also expect that secondary market prices and spreads will lag the new-issue market.”

Secondary trading

Connecticut special tax 5s of 2023 at 2.93% versus 2.98% Thursday. Utah 5s of 2024 at 2.95%.

New York City 5s of 2028 at 3.20%. Massachusetts 5s of 2030 at 3.14% versus 3.17% Thursday. California 5s of 2031 at 3.15%-3.14% versus 3.25% Thursday.

Los Angeles USD sustainability 5s of 2039 at 3.83%-3.81% versus 4.07% original. Broward County, Florida, convention center 5s of 2040 at 4.11%-4.08%. Dallas County 5s of 2040 at 3.89% versus 4.15%-4.14% Thursday.

New York City TFA 5s of 2047 at 4.46%-4.45% versus 4.58% Thursday. Los Angeles DWP 5s of 2052 at 4.16% versus 4.20% Thursday.

AAA scales

Refinitiv MMD’s scale was bumped two to four basis points: the one-year at 2.96% (-4) and 2.97% (-4) in two years. The five-year at 3.02% (-2), the 10-year at 3.12% (-2) and the 30-year at 3.85% (-3).

The ICE AAA yield curve was bumped up to two basis points: 2.96% (flat) in 2023 and 3.00% (-1) in 2024. The five-year at 3.01% (-2), the 10-year was at 3.17% (-2) and the 30-year yield was at 3.95% (-2) at a 2:45 p.m. read.

The IHS Markit municipal curve was bumped three basis points: 2.97% (-3) in 2023 and 2.99% (-3) in 2024. The five-year was at 3.02% (-3), the 10-year was at 3.13% (-3) and the 30-year yield was at 3.84% (-3) at a 3 p.m. read.

Bloomberg BVAL was bumped one to three basis points: 2.97% (-1) in 2023 and 3.02% (-1) in 2024. The five-year at 3.03% (-2), the 10-year at 3.11% (-3) and the 30-year at 3.85% (-3) at 3 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.412% (+7), the three-year was at 4.247% (+6), the five-year at 4.006% (+7), the seven-year 3.952% (+7), the 10-year yielding 3.878% (+7), the 20-year at 4.289% (+6) and the 30-year Treasury was yielding 4.068% (+5) at 3:30 p.m.

Primary to come:

The Duval County School Board, Florida, (/A+/A+/) is set to price Tuesday $575.345 million of Florida Master Lease Program certificates of participation, Series 2022A serials 2023-2035. Citigroup Global Markets.

The Louisiana Local Government Environmental Facilities and Community Development Authority (A1///AA-) is set to price Wednesday $458 million of Louisiana Insurance Guaranty Association Project insurance assessment revenue bonds, Series 2022B, serials 2025-2037. Wells Fargo Bank.

The New York City Municipal Water Finance Authority (Aa1/AA+/AA+/) is set to price next week $425.480 million of water and sewer system second general resolution revenue bonds, Fiscal 2023 Series AA, consisting of $343,910.00 million of AA-1, term 2052, and $81.570 million of Series AA-2, terms 2028, 2029 and 2032. Loop Capital Markets.

The Los Angeles Department of Water and Power (Aa2//AA-/AA/) is set to price next week $239.140 million of power system revenue bonds, 2022 Series E, serials 2023-2030. TD Securities.

The Washington Economic Development Finance Authority (Aaa///) is set to price Thursday $165 million of Mura Cascade ELP LLC Project environmental facilities revenue and refunding bonds, Series 2022. J.P. Morgan Securities.

The Illinois Housing Development Authority (Aaa///) is set to price Thursday $150 million of non-AMT social revenue bonds, 2022 Series G, serials 2023-2034, terms 2037, 2042, 2046 and 2052. RBC Capital Markets.

San Antonio (Aa3/A+/AA-/) is set to price Tuesday $134.620 million of electric and gas systems variable rate junior lien revenue refunding bonds, Series 2018, consisting of $100 million of Series 1 (SIFMA Index), terms 2048, and $34.620 million of Series 2 (term rate), term 2048. Ramirez & Co.

The Santa Clara Valley Water District, California, (Aa1//AA+/) is set to price next week $126.580 million, consisting of $79.370 million of Safe Clean Water Program refunding revenue bonds, Series 2022A, and $47.210 million of Safe Clean Water Program revenue certificates of participation, Series 2022B. J.P. Morgan Securities.

The Ohio Water Development Authority (Aaa/AAA//) is set to price Thursday $125 million of sustainability Drinking Water Assistance Fund revenue bonds, Series 2022A, serials 2025-2035, terms 2036, 2037, 2038, 2039, 2040, 2041 and 2042. Loop Capital Markets.

The Dormitory Authority of the State of New York (A1///) is set to price Thursday $114.975 million of Rochester Institute of Technology revenue bonds, Series 2022A, serials 2028-2042. RBC Capital Markets.

The Mississippi Business Finance Corporation is set to price Thursday $100 million of green Enviva Inc. Project exempt facilities revenue bonds, Series 2022. Citigroup Global Markets.

The State Center Community College District, California, (Aa1///) is set to price Thursday $100 million of Election of 2016 general obligation bonds, Series 2022C. Morgan Stanley & Co.

Competitive:

The Missouri Highways and Transportation Commission (Aa1/AA+/AAA/) is set to sell $488.625 million of third lien state road bonds, Series A 2022, at 11 a.m. eastern Tuesday.

Memphis, Tennessee, is set to sell $142.650 million of general improvement bonds, Series 2022A, at 10:30 a.m. Tuesday.

The Mkilteo School District No. 6, Washington, (Aaa///) is set to sell $116.255 million of Washington State School District Credit Enhancement Program unlimited tax general obligation bonds, Series 2022, at 11:30 a.m. Tuesday.