Sberbank Analyst’s Editorial Delves Into the ‘Tremendous Potential’ of a BRICS Reserve Currency Fueling De-Dollarization – Economics Bitcoin News

4 min read

During the last month, Russia’s ruble has dropped 16.48% against the U.S. dollar as energy and commodity prices have slowed over the last few weeks. Russia’s central bank revealed two weeks ago that it is further distancing itself from U.S. dollar dependence by purchasing the Chinese yuan on foreign exchange markets. Roughly around the same time, on Dec. 21, 2022, Sberbank executive and Russian International Affairs Council (RIAC) member, Yaroslav Lissovolik, published an opinion article that talks about exploring the pathway toward a new BRICS reserve currency.

Russia’s Central Bank Seeks to Reduce Dependency on US Dollar with Purchase of Chinese Yuan

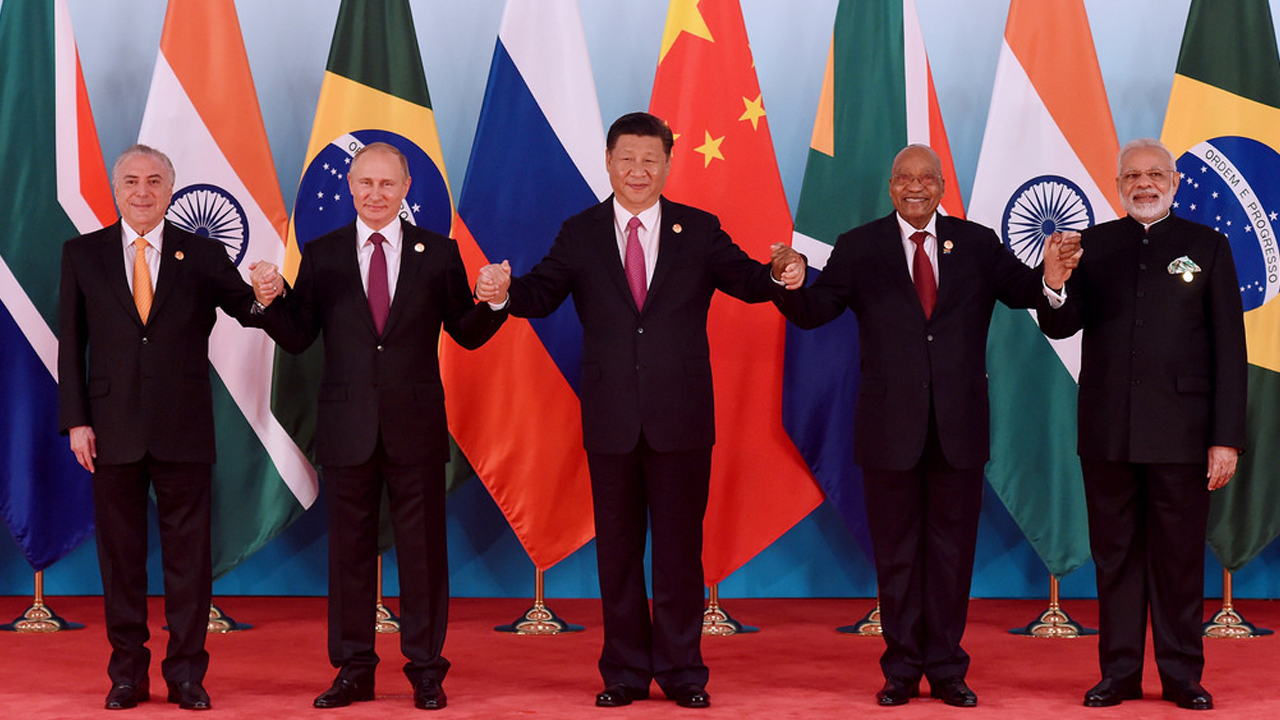

At the end of July, Bitcoin.com News reported on the BRICS nations’ plan to craft a new reserve currency after Russian president Vladimir Putin announced the plan amid the BRICS Summit in June. While the subject was topical at the time, people stopped discussing the BRICS reserve currency for a while. A few months later, in October 2022, the author of the best-selling book Rich Dad Poor Dad, Robert Kiyosaki, discussed the subject and noted that the U.S. dollar is “toast.” Over the last 30 days, energy prices and commodities have subsided in value, but some economists expect a $200-per-barrel run-up in oil prices at some point in 2023.

While energy and commodity values have dropped, Russia’s ruble has dropped against the greenback as well. Statistics show that the ruble has lost 16.48% against the U.S. dollar in 30 days, but five-day metrics show the ruble is up 1.72%. Year-to-date statistics show the Russian currency has increased 5.37% over the last 12 months. Meanwhile, at the end of December 2022, Reuters reported that Russia will be making Chinese yuan purchases on the currency market in 2023. Reporter Elena Fabrichnaya said Moscow’s move was cited by two sources and it opens a “new front in an accelerating de-dollarization drive designed to reduce its dependency on Western finance.”

Sberbank Analyst Discusses Possibility of a BRICS Reserve Currency Complementing National Currencies

The previous day, on Dec. 21, 2022, Yaroslav Lissovolik, a member of the Russian International Affairs Council (RIAC) and head of the analytical department at Sberbank, published a blog post titled “Exploring the Pathways,” discussing the proposed BRICS reserve currency. Lissovolik said the “BRICS reserve currency has taken on particular significance in recent months” following Russian president Putin’s remarks at the BRICS Summit. The analyst detailed that there’s also been recent legislation and debates concerning the “expediency of creating a new reserve currency.”

Lissovolik cited the most recent discussion about the BRICS reserve currency at the Eighth BRICS Parliamentary Forum. At the event, Federation Assembly Speaker Valentina Matvienko suggested that BRICS legislators start to move forward on concrete measures that bolster the countries’ economies. Matvienko singled out specific initiatives, including the new international reserve currency and developing better settlement procedures within the BRICS nations. Lissovolik’s blog post also compared the new BRICS reserve currency idea to the 2018 Valdai Club concept of the R5 currency, a name that signifies the letter “R” for the five currencies: the real, ruble, rupee, renminbi, and rand.

Lissovolik detailed that a new BRICS reserve currency won’t be created to replace the national reserve currencies used by each of the nations, but rather to “complement these national currencies.” The Sberbank analyst said a brand new reserve currency could have a “transformational effect on the international financial system,” as he believes there’s a “notable shortage of reserve currencies” in the global economy.

“Importantly, the scope for employing the new reserve currency in the world economy is sizeable given the tremendous potential for de-dollarization,” Lissovolik’s blog post concludes. “The new BRICS reserve currency can act in concert with the stronger role performed by BRICS national currencies to take on a greater share of the total pie of currency transactions in the world economy.”

What do you think about the Sberbank analyst’s editorial about a new BRICS reserve currency? Share your thoughts about a potential new BRICS reserve currency in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer