Munis steady, FOMC meeting leads to paltry new-issue calendar

6 min read

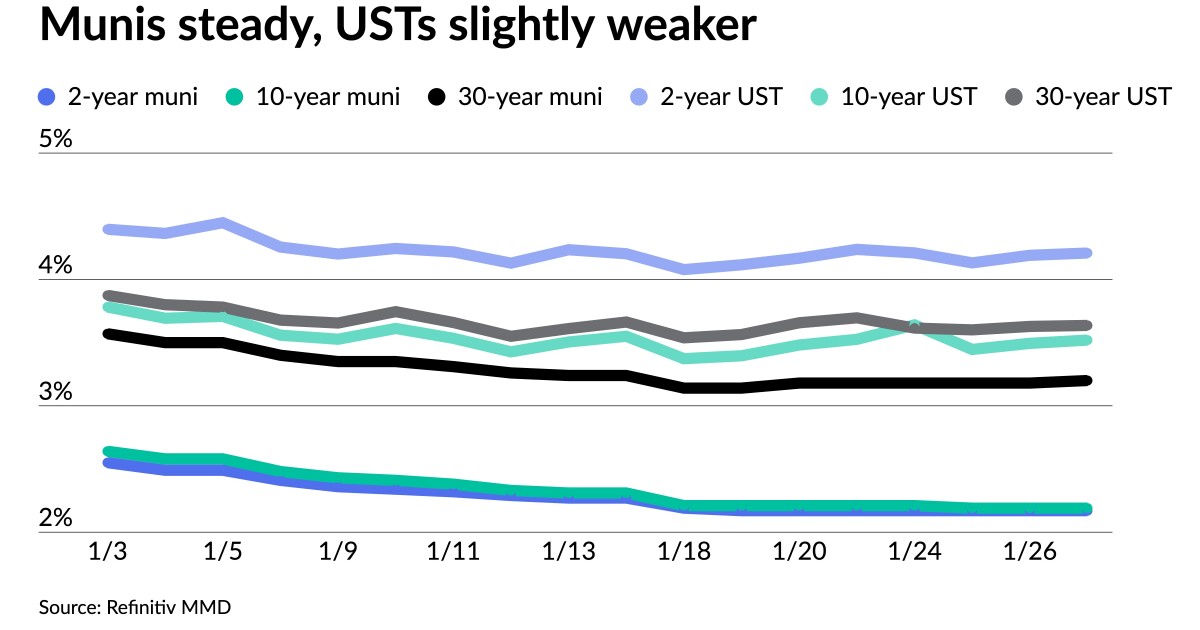

Municipals were steady, down a basis point or two in spots, ahead of a paltry new-issue calendar, courtesy of next week’s Federal Open Market Committee meeting. U.S. Treasuries were slightly weaker and equities ended in the black.

The three-year muni-UST ratio was at 54%, the five-year at 57%, the 10-year at 62% and the 30-year at 88%, according to Refinitiv MMD’s 3 p.m. ET read. ICE Data Services had the three at 54%, the five at 57%, the 10 at 63% and the 30 at 88% at 4 p.m.

“The muni market has become quite rich, and we do not see an obvious trigger for it to adjust to more favorable levels,” said Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel.

Some investors suggest supply “could finally adjust muni valuations, but the pipeline is still rather dry, even though we expect much heavier issuance in March and possibly even in February,” they said.

In general, they “are less preoccupied with supply and much more focused on rate volatility: if Treasury yields are range-bound, municipals will likely remain rich.”

“Munis’ strong rally over the last three months was likely a surprise for issuers, as the volume of new issuance thus far in 2023 has been lackluster,” BofA strategists said. Through Wednesday, there had been $17.6 billion of issuance.

However, “it is encouraging to see refunding issues account for 26% of the total, significantly higher than last year’s 20%,” they noted. Moreover, “almost all of the refunding so far is tax-exempt, underlining tax-exempt refunding volumes can be quite large as long as muni rates levels are right,” they said.

AAA rates shouldn’t decline significantly this quarter “due to rich relative values as well as range bound Treasury rates,” the BofA strategists said.

Easy returns are very likely done, and “investors looking for more yield may need to go to the longer part of the curve, lower coupons or the A-rated and BBB-rated categories,” they said.

None of these are easy decisions and bear risks, but the BofA strategists said, “a combination of all the three have produced the best returns over the past three months.”

“For the longer part of the curve and low coupon structures, the main risk is higher rates; for credit bonds, the main risks are spread widening,” they said. “Short of an economic hard landing, we think credit widening last year has priced in a recessionary scenario.”

As such, the BofA strategists noted, “the current market environment supports significant credit spread compression for the next few months. Any possible risks are likely pushed down to the 2H23.”

Tax-free bonds should provide better returns in 2023, driven by higher demand (because of higher yields and compelling relative value calculations) and lower supply levels, said John Mousseau, president, CEO and director of fixed income at Cumberland Advisors.

“In what was a brutal year, longer term municipal bonds sold off hard enough to move yields from 2% to 5%,” he said.

Since early November longer term munis “have rallied back to begin moving yields back down to 4.25%–4.5% for longer A or better rated bonds,” he said.

“With a slower economy looming (forecast in part by the inverted U.S. Treasury yield curve) and longer taxable equivalent yields ranging from 6.65% to 8% depending on state tax exemption, tax-exempt municipal bonds offer a compelling risk-adjusted alternative to equities at the margin,” Mousseau said. “The driver behind municipal performance will be slowing inflation coupled with positive flows into bond funds, which saw a disastrous year of liquidations.”

“Record-breaking muni fund outflows were one of the main market stories last year, but it seems that they have finally abated, at least for now, as there have been two weeks of solid inflows,” according to the Barclays strategists.

This is not surprising, they said, “given that rate stability has returned and there is a much better market tone in the municipal space.”

In addition to the fund outflows, the Barclays strategists said, exchanged-traded funds “also took center stage last year, and a tax loss trade when investors were selling their muni bond and mutual fund holdings, parking their money in ETFs, was also a hot topic.”

Some investors argued “this trade had to reverse over time, and to support this theory for the first time in a very long while, there were ETF outflows this week, while mutual funds actually had inflows,” they said.

Although the Barclay strategists “agree that some investors parked their money in ETFs, waiting for an opportunity to reallocate back into muni bonds, in general, we believe a very sizable portion of last year’s ETFs inflows will be sticky.”

“Moreover, when selling their ETFs acquired last year, some investors will be hit with short-term capital gains, as the municipal market performed much better in the second half of the year,” they said.

Even though there might be some outflows short term, “we believe that the ETF share will only increase over time; the AUM has already surpassed the total AUM of muni closed-end funds, which always have been a major force in this market,” they said.

Meanwhile, the Barclay strategists said, “a larger ETF share for secondary trading means more volatility, as ETFs are less price-sensitive than other funds when they need to deal with redemptions and inflows.”

Calendar stands at $847M

Investors will be greeted Monday with a new-issue calendar estimated at $847 million.

There are $633.4 million of negotiated deals on tap and $121 million on the competitive calendar.

The negotiated calendar is led by $277 million of PSF-insured unlimited tax school building bonds from the Fort Worth Independent School District, Texas, followed by $125 million of taxable single-family mortgage bonds from the Colorado Housing and Finance Authority and $87 million of GOs from the Alaska Municipal Bond Bank.

Newark, New Jersey, leads the competitive calendar with the sale of $36 million of qualified general capital improvement bonds.

Secondary trading

Maine 5s of 2024 at 2.36%. Ohio 5s of 2024 at 2.23% versus 2.21% Thursday and 2.21% Tuesday. NYC 5s of 2025 at 2.19% versus 2.24% on 1/18.

Maryland 4s of 2029 at 2.24%-2.22%. Wake County, North Carolina, 5s of 2030 at 2.10%. Florida Board of Education 5s of 2031 at 2.17% versus 2.16% original on Tuesday.

Washington 5s of 2038 at 2.98% versus 2.92%-2.90% original on 1/19. LA DWP 5s of 2042 at 3.17%-3.16% versus 2.98%-2.99% on 1/19 and 3.29%-3.28% on 1/11. Tomball ISD, Texas, 2043 at 3.24%-3.23% versus 3.23% Thursday and 3.23%-3.19% on 1/18.

California 5s of 2047 at 3.21%-3.20%. LA DWP 5s of 2052 at 3.42% versus 3.37% Thursday and 3.62%-3.60% on 1/9. San Jose Financing Authority, California, 5s of 2052 at 3.30%-3.31% versus 3.30%-3.29% Tuesday and 3.42%-3.41% on 1/17.

AAA scales

Refinitiv MMD’s scale was cut two basis points out long. The one-year was at 2.33% (unch) and 2.17% (unch) in two years. The five-year was at 2.05% (unch), the 10-year at 2.19% (unch) and the 30-year at 3.20% (+2) at 3 p.m.

The ICE AAA yield curve was cut up to a basis point: at 2.29% (+1) in 2024 and 2.22% (+1) in 2025. The five-year was at 2.08% (+1), the 10-year was at 2.18% (flat) and the 30-year yield was at 3.21% (flat) at 4 p.m.

The IHS Markit municipal curve was cut up to two basis points: 2.33% (unch) in 2024 and 2.16% (unch) in 2025. The five-year was at 2.06% (unch), the 10-year was at 2.20% (+2) and the 30-year yield was at 3.18% (+2) at a 4 p.m. read.

Bloomberg BVAL was cut up to a basis point: 2.32% (unch) in 2024 and 2.15% (unch) in 2025. The five-year at 2.10% (unch), the 10-year at 2.22% (+1) and the 30-year at 3.22% (+1).

Treasuries were weaker.

The two-year UST was yielding 4.204% (+1), the three-year was at 3.907% (+2), the five-year at 3.622% (+3), the seven-year at 3.578% (+3), the 10-year at 3.519% (+3), the 20-year at 3.770% (+1) and the 30-year Treasury was yielding 3.639% (+1) at 4 p.m.

Primary to come:

The Fort Worth Independent School District, Texas, (Aaa///) is set to price Thursday $277.370 million of PSF-insured unlimited tax school building bonds, Series 2023. Piper Sandler.

The Colorado Housing and Finance Authority (Aaa/AAA//) is set to price Thursday $125 million of taxable single-family mortgage bonds, including $84 million of Class I bonds, 2023 Series A-1, serials 2023-2033, terms 2038 and 2049; $21 million of Class II adjustable rate bonds, 2023 Series A-2, term 2043; and $20 million of GNMA MBS Pass-Through Program, Class I bonds, 2023 Series B, term 2053. RBC Capital Markets.

The Alaska Municipal Bond Bank (A1/A+//) is set to price Tuesday $86.935 million of GOs, consisting of $57 million of tax-exempt bonds, 2023 Series One, serials 2023-2042, terms 2047 and 2052, and $29.935 million of AMT bonds, 2023 Series Two, serials 2023-2042, terms 2047 and 2052. Jefferies.

Alaska (Aa3/AA-//) is set to price Monday $56.170 million of general obligation refunding bonds, Series 2023A, serials 2023-2025. Jefferies.

Competitive:

South Windsor, Connecticut, (/AAA//) is set to sell $28.5 million of GOs, Issue of 2023, at 11:30 a.m. eastern Tuesday.

The East Montgomery County Municipal Utility District No. 12, Texas, is set to sell $20.635 million of unlimited tax bonds, Series 2023, at 11:30 a.m. eastern Tuesday.

Newark, New Jersey, is set to sell $35.598 million of qualified general capital improvement bonds, Series 2023, at 11:30 a.m. eastern Thursday.

The Clark County School District Finance Corp., Kentucky, (A1///) is set to sell $22.645 million of school building revenue bonds, Series of 2023, at 12 p.m. eastern Thursday.