Yields rise with muni one-year topping 2.50%

7 min read

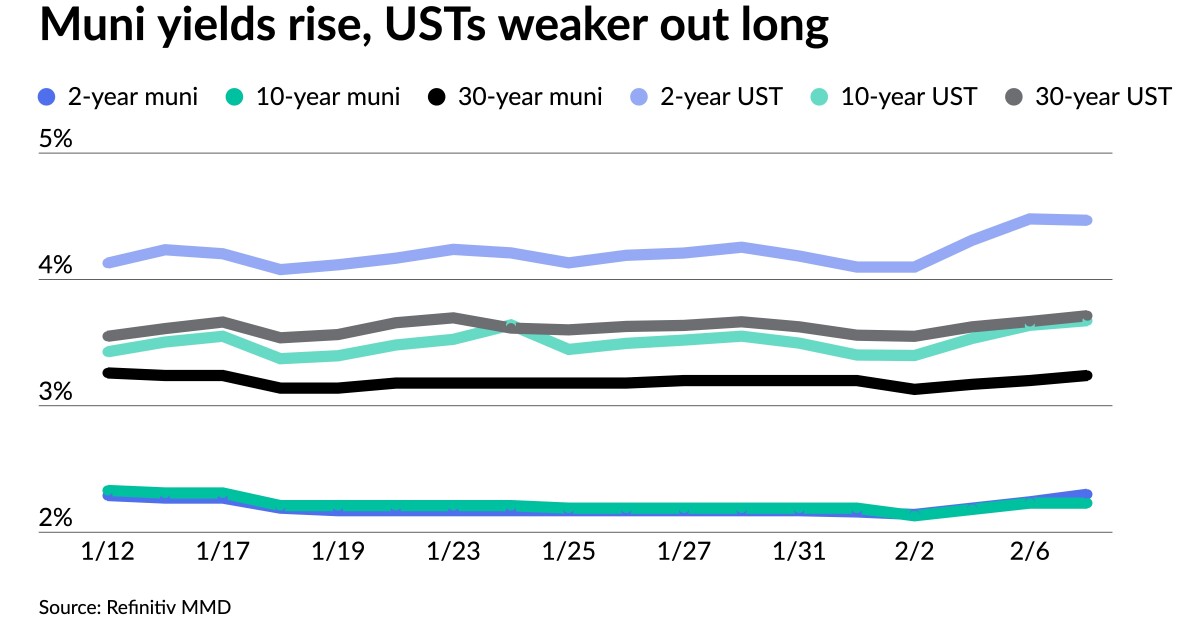

Municipals were weaker once more, while U.S. Treasury yields rose out long, and equities ended up.

Triple-A benchmark yields were cut up to seven basis points, depending on the scale, pushing the one-year above 2.50%. The last time the one-year was above 2.50% was Jan. 10.

The three-year muni-UST ratio was at 53%, the five-year at 54%, the 10-year at 61% and the 30-year at 87%, according to Refinitiv MMD’s 3 p.m. ET read. ICE Data Services had the three at 53%, the five at 55%, the 10 at 61% and the 30 at 89% at 4 p.m.

“The market started the year with a reduction of the oppressive pressure caused by last year’s heavy net outflows from mutual funds,” said CreditSights strategists Pat Luby and Sam Berzok.

The massive outflows from muni mutual funds were interrupted in January with $5.7 billion of new inflows — the best monthly total since August 2021, they said.

The shift to positive net flows, they said, “boosted market psychology, but more importantly reduced the volume of bonds being sold into the secondary market to help fund mutual fund redemptions.”

In 2022, the average daily par amount of institutional bid wanteds was $1.4 billion, according to Bloomberg. In December the average was $1.6 billion, and January’s average was $978 million.

“The net inflow of net money now allows mutual fund portfolio managers to be more focused on buying than on selling bonds,” they said.

The CreditSights strategists “remain constructive about municipal market conditions for the year, yet we still anticipate choppy market conditions for the next few months as the [Federal Open Market Committee] is expected to continue to raise the fed funds target rate.”

Additionally, since tax-exempt yields in the front part of the curve “are too rich to appeal to corporate investors, such as banks and insurance companies, the market depends on direct and indirect demand from individual investors,” they said.

Without a diversified source of demand, they noted, “the market remains subject to exaggerated volatility if supply surges or demand wanes.”

After three consecutive months where bond redemptions exceeded new issue supply, new issue supply in January was positive, totaling $2.4 billion, they said.

Redemptions in January totaled $19.9 billion. February’s redemption flows, which are expected to total $27.5 billion, are sharply higher than January’s and the most until June.

The surge in reinvestment demand, they said, “will be supportive of the market but compounds the challenge for investors to find value in what is already a supply-constrained market.

The potential increase in demand will be tempered by the fact that almost half the redemptions will occur on Feb. 15, they noted.

As the summer months approach, the CreditSights strategists “expect the market to benefit from an uptick in reinvestment demand that will be fueled by maturing and called bond principal and the approach of the expected peak in the fed funds target rate.”

Fundamentals are starting to peak, said Jonathan Mondillo, head of North American fixed income at abrdn.

“We’re extremely constructive on municipal fundamentals,” he noted. “Things look about as strong as they have in maybe the last 20 years, certainly at a high level.”

States and local municipalities have benefited from significant federal monies and federal policies.

“In addition to that, you can look at their sales tax revenue collections,” said Mondillo. “You can look at income tax revenue collections on the back of strong wage growth, which continues to persist as well as property tax revenues — maybe less so but certainly speaks to the strength of fundamentals with property valuations still north of their pre-COVID levels.”

“That should all filter over into tax receipts that municipalities see or at least a slowdown in those tax receipts, which we’re starting to see in select areas of the of the U.S. and the economy,” he noted.

Muni-UST ratios are rich. The front part of the curve is around 50%, and “as you get out longer on the curve in that 60% to mid-80% range,” he said.

He thinks February will be largely positive in terms of total returns but not to the extent seen in January.

“Relative to other fixed income assets, munis may not look as attractive as an entry point as we get to the first part of first part of February,” he said.

Additionally, the “super strong” technicals are likely to pull back a bit.

“I don’t think we get a negative total return print at the end of February but certainly less positive than what we’ve seen from a total return standpoint in January,” he said.

In the primary, BofA Securities held a one-day retail order period for $1.090 billion of tax-exempt future tax secured subordinate bonds, Fiscal 2023 Series E, Subseries E-1, for the New York City Transitional Finance Authority (Aa1/AAA/AAA/), with 5s of 11/2024 at 2.46%, 5s of 2028 at 2.32%, 5s of 2033 at 2.55%, 5s of 2038 at 3.25% and 5s of 2041 at 3.40%, callable 5/1/2033.

Secondary trading

North Carolina 5s of 2024 at 2.50% versus 2.41%-2.40% Monday. Georgia 5s of 2024 at 2.57%. Maryland 5s of 2025 at 2.38%.

Ohio 5s of 2028 at 2.28%-2.27%. NYC 5s of 2030 at 2.33%. Washington 5s of 2031 at 2.20% versus 2.20%-2.18% Monday.

DC 5s of 2033 at 2.37%. Montgomery County, Pennsylvania, 5s of 2035 at 2.53%-2.52% versus 2.51%-2.50% Monday. Maryland 5s of 2037 at 2.84%-2.82%.

San Antonio ISD, Texas, 5s of 2047 at 3.53% versus 3.50% on 1/31. Massachusetts Bay Transportation Authority 5s of 2052 at 3.61%.

AAA scales

Refinitiv MMD’s scale was cut up to six basis points. The one-year was at 2.53% (+6) and 2.30% (+6) in two years. The five-year was at 2.09% (unch), the 10-year at 2.23% (unch) and the 30-year at 3.24% (+4) at 3 p.m.

The ICE AAA yield curve was cut two to seven basis points: at 2.53% (+7) in 2024 and 2.35% (+3) in 2025. The five-year was at 2.13% (+3), the 10-year was at 2.20% (+2) and the 30-year yield was at 3.28% (+3) at 4 p.m.

The IHS Markit municipal curve was cut up to seven basis points: 2.53% (+4) in 2024 and 2.28% (+7) in 2025. The five-year was at 2.09% (unch), the 10-year was at 2.24% (+4) and the 30-year yield was at 3.22% (+4) at a 4 p.m. read.

Bloomberg BVAL was cut one to five basis points: 2.53% (+5) in 2024 and 2.26% (+5) in 2025. The five-year at 2.13% (+2), the 10-year at 2.25% (+1) and the 30-year at 3.27% (+3).

Treasury yields were weaker out long.

The two-year UST was yielding 4.468% (-1), the three-year was at 4.121% (-3), the five-year at 3.836% (+1), the seven-year at 3.768% (+3), the 10-year at 3.674% (+4), the 20-year at 3.868% (+5) and the 30-year Treasury was yielding 3.714% (+5) at 4 p.m.

More rate hikes on the horizon

Interest rates will continue rising and may go higher than previously believed if the labor market strength persists, Fed Chair Jerome Powell said during a moderated conversation at the Economic Club of Washington.

Powell “didn’t reveal anything new, but it will probably go down as a missed opportunity as he could have pushed back on what the market is pricing in,” said Edward Moya, senior market analyst at OANDA. “Rate cut bets for next winter firmly remain intact and that should be an issue for a Fed trying to get inflation somewhere near target.”

Powell had his “first chance to take a bite out of the apple since Friday’s blowout payrolls report,” where he “struck a more hawkish tone compared to his pre-payrolls Q&A and reaffirmed the Committee’s December projection that the peak funds rate would likely land between 5.00% to 5.25%,” Morgan Stanley Research strategists said.

Powell “emphasized that there was ‘significant road ahead’ before policymakers could be comfortable with inflation returning to the 2% target,” they noted. Persistent labor market strength, they said, “could see the peak rate be even higher than the Fed currently anticipates.”

“There was no suggestion in the speech of a complete rethink after last Friday’s jobs number, but the numerous references to excess labor demand and stubbornly high inflation in services excluding housing underscores that the FOMC still believes they have a way to go to get on top of inflation,” said Fitch Chief Economist Brian Coulton.”Powell pushed back on the idea that reducing inflation will be painless, which is consistent with the Fed raising rates again and keeping rates in restrictive territory for quite a while.”

The Morgan Stanley strategists expect a 25bp rate hike at the March FOMC meeting and “flagged that we would closely follow upcoming public speeches to hone our policy expectation.” On the heels of Powell’s appearance, they “are adding a 25bp to the May FOMC meeting, bringing our expectation for the peak rate to 5.00% to 5.25%.”

“We continue to see the first 25bp rate cut in December this year, followed by 200bp of additional easing through yearend-2024 to 2.75% to 3.00%,” they said.

Primary to come:

The Lamar Consolidated Independent School District, Texas, (Aa3/AA//) is set to price Wednesday $648.615 of unlimited tax schoolhouse bonds, Series 2023, serials 2024-2058. Raymond James & Associates.

The Massachusetts Development Finance Agency (Baa2/BBB//) is set to price Thursday $229.195 million of Boston Medical Center Issue sustainability refunding revenue bonds, Series G, serials 2023-2029, terms 2048 and 2052. RBC Capital Markets.

The Little Elm Independent School District, Texas, (/AA-//) is set to price Wednesday $173.905 million of unlimited tax school building bonds, Series 2023, serials 2026-2043, terms 2048 and 2053. BOK Financial Securities.

The Shawnee Mission Unified School District #512, Kansas, (Aaa///) is set to price Wednesday $137.575 million of GOs, consisting of $132.110 million of Series 23A, serials 2024-2043, and $5.464 million of Series 23B, serials 2024 and 2026. Stifel, Nicolaus & Co.

The Massachusetts Housing Finance Agency (Aa2/AA+//) is set to price Wednesday $132.960 million of non-AMT sustainability housing bonds, consisting of $46.870 million of Series A-1, serials 2025-2035, terms 2038, 2044, 2048, 2053, 2058 and 2065, and $86.090 million of Series A-3, serials 2024-2027. UBS Financial Services.

The Florida Housing Finance Corp. (Aaa///) is set to price Wednesday $130 million of non-AMT homeowner mortgage revenue bonds, 2023 Series 1, serials 2025-2035, terms 2038, 2043, 2048, 2053 and 2054. RBC Capital Markets.

The Health Care Authority for Baptist Health, Alabama, (A3/BBB+//) is set to price Thursday $119.195 million of refunding bonds, Series 2023, serials 2023-2037. Morgan Stanley & Co.

Competitive:

The New York City Transitional Finance Authority is set to sell $119.580 million of taxable future tax-secured subordinate bonds, Fiscal 2023 Series E, Subseries E-2, at 11:15 a.m. eastern Wednesday.