Munis see largest cuts on short end, $1.2B NYC TFA deal prices

6 min read

Municipals were weaker in secondary trading, with the largest cuts seen on the short end, while a $1.2 billion deal from the New York City Transitional Finance Authority took focus in the primary.

U.S. Treasuries were better, and equities ended in the red.

The three-year muni-UST ratio was at 54%, the five-year at 55%, the 10-year at 61% and the 30-year at 87%, according to Refinitiv MMD’s 3 p.m. ET read. ICE Data Services had the three at 54%, the five at 55%, the 10 at 61% and the 30 at 88% at 4 p.m.

Municipal securities had been largely steady to firmer leading into the Federal Open Market Committee meeting, said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

Munis continued to outperform the UST selloff “following the release of January’s hot payrolls print,” with yields advancing seven to 10 basis points on 2- to 30-year maturities over the past two trading sessions following bumps in MMD just after the FOMC meeting, he said.

The one-year tenor “jumped by 20 basis points during the same period, latching on to the sharp spike in front-end Treasury bond yields given expectations for a higher peak in the Fed funds rate,” he noted.

On Wednesday, there were further cuts along the curve.

The outsized payrolls number “may possibly extend issuer hesitancy to access the capital markets should rate volatility and monetary policy uncertainty once again bestow heavy influence upon primary market activity,” according to Lipton.

While the 30-day forward calendar is building, he “will be monitoring rate movements and issuer appetite over the coming days and weeks.”

Should supply remain on the lower side, he thinks “strong demand patterns could support muni out-performance in the event of a short-lived bond market selloff.”

Technicals are “expected to avert a return to an extended cycle of negative flows, assuming that market anxiety in the aftermath of a super-sized employment print can be contained,” he said.

Current valuations, he said, “are less than compelling given how rich munis are relative to UST.”

There are “better valuations today than what were available throughout much of 2021 when munis were even more expensive.”

Although there is some volatility in the municipal market, the landscape is in good shape, according to Cooper Howard, fixed income strategist at Charles Schwab.

The 10-year muni-to-Treasury ratio is roughly 61%, per MMD, which is the lowest level since early 2022, he said.

Historically, Howard noted, when relative yields are low, they have increased over the next 12 weeks, resulting in municipal underperformance of Treasuries.

“Although munis may face near-term headwinds, we think the longer-term prospects are positive since absolute yields are attractive and credit quality remains strong,” he added.

Meanwhile, the municipal market is catching its breath and recalibrating this week on the heels of the quarter-point rate hike last week, according to Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities Inc.

Investor interest in primary market issuance, Kozlik said, was fairly substantial before last week’s Fed meeting.

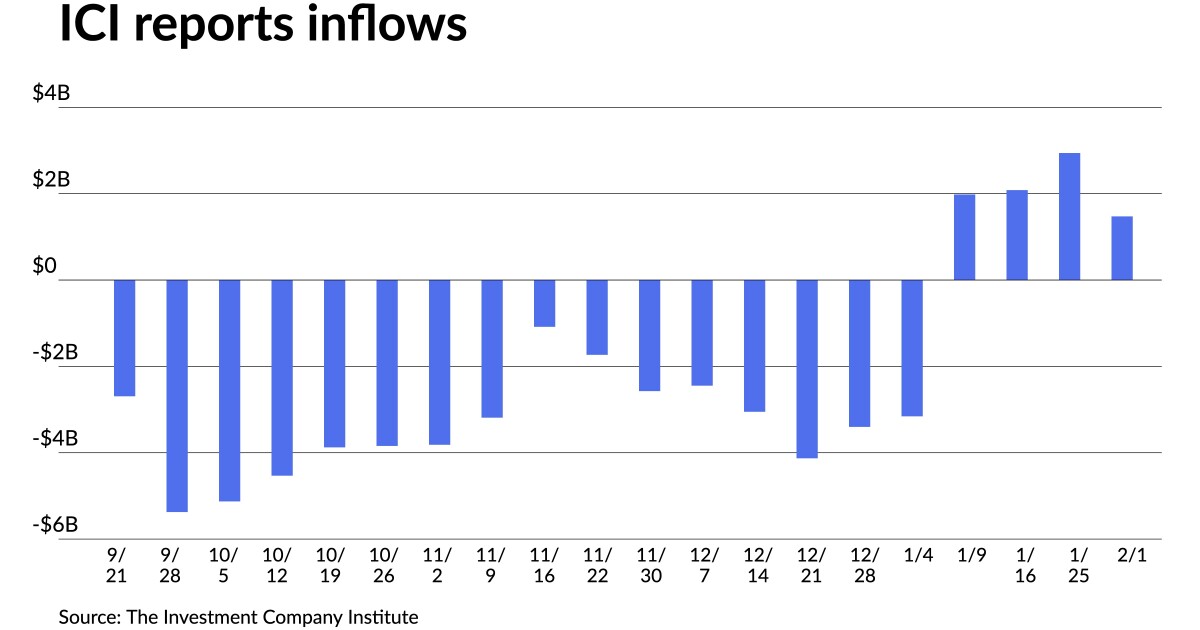

“Municipal bond investor sentiment has been on the upswing to begin 2023, and fund flows have been positive for three of the first five weeks to begin the year,” he said.

Despite a pause after the Fed’s announcement, Kozlik believes investors are generally back to business.

“A good amount of reinvestment dollars are back in the hands of investors and I expect that money is going to be put to work rather quickly,” he said.

On the issuance side of the market, Kozlik said, state and local municipalities should benefit from continued credit strength, which should boost their access to the capital markets and make them appealing to investors.

Healthy revenue collections have led to what Kozlik referred to as a “Golden Age” of public finance — where rating upgrades outpace downgrades — and that is helping build fiscal strength and stability.

“U.S. state government sector credit quality remains strong and most states are well positioned to withstand an economic downturn,” Kozlik said.

At the same time, he said, he is keeping an eye on municipalities’ financial stamina on the heels of the pandemic.

“We are watching to make sure the public finance entities are reacting to the post-COVID-19 fiscal reality that includes less or no federal relief, inflation pressures, and changes related to work-from-home among other difficulties,” Kozlik said.

Inflows continued with the Investment Company Institute reporting investors added $1.474 billion to mutual funds in the week ending Feb. 1, after $2.942 billion of inflows the previous week.

Exchange-traded funds saw outflows of $456 million after $788 million of outflows the week prior, per ICI data.

In the primary, BofA Securities priced for institutions $1.090 billion of tax-exempt future tax-secured subordinate bonds, Fiscal 2023 Series E, Subseries E-1, for the New York City Transitional Finance Authority (Aa1/AAA/AAA/), with cuts of up to seven basis points from Tuesday’s retail offering: 5s of 11/2024 at 2.46% (unch), 5s of 2028 at 2.39% (+7), 5s of 2033 at 2.59% (+4), 5s of 2038 at 3.29% (+4) and 5s of 2041 at 3.46% (+6), callable 5/1/2033.

The TFA sold $119.580 million of taxable future tax-secured subordinate bonds, Fiscal 2023 Series E, Subseries E-2, in the competitive market to BofA Securities 5s of 11/2033 at 4.50% and 5s of 2024 at 4.60%, noncall.

Back in the negotiated sector, Raymond James & Associates priced for the Lamar Consolidated Independent School District, Texas, (Aa3/AA//) $636.360 million of unlimited tax schoolhouse bonds, Series 2023, with 5s of 2/2024 at 2.66%, 5s of 2028 at 2.32%, 5s of 2033 at 2.55%, 5s of 2038 at 3.36%, 5s of 2043 at 3.59%, 4s of 2048 at 4.25%, 4s of 2053 at 4.32%, 4.25s of 2053 at 4.32% and 5.5s of 2058 at 3.75%, callable 2/15/2033.

RBC Capital Markets priced for the Massachusetts Development Finance Agency (Baa2/BBB//) $232.415 million of Boston Medical Center Issue sustainability refunding revenue bonds, Series G, with 5s of 7/2023 at 3.12%, 5s of 2028 at 2.91%, 5.25s of 2048 at 4.39%, 5.25s of 2052 at 4.47% and 4.375s of 2052 at 4.64%.

BOK Financial Securities priced for the Little Elm Independent School District, Texas, (/AA-//) $180.250 million of unlimited tax school building bonds, Series 2023, with 5s of 8/2024 at 2.63%, 5s of 2028 at 2.32%, 5s of 2033 at 2.57%, 5s of 2038 at 3.38%, 4s of 2042 at par, 4s of 2048 at 4.22% and 4.25s of 2053 at 4.32%, callable 8/15/2032.

Muni CUSIP requests

Municipal CUSIP request volume decreased in January on a year-over-year basis, following a decrease in December, according to CUSIP Global Services.

For muni bonds specifically, there was an increase of 1.5% month-over-month but a 26.8% decrease year-over-year.

The aggregate total of identifier requests for new municipal securities, including municipal bonds, long-term and short-term notes, and commercial paper, fell 3.0% versus December totals. On a year-over-year basis, overall municipal volumes were down 21.2%.

Secondary trading

Washington 5s of 2024 at 2.68% versus 2.29% on 1/19. Maryland 5s of 2024 at 2.56%-2.55%. LA DWP 5s of 2025 at 2.25% versus 2.05% on 2/1.

DC 5s of 2027 at 2.22%. University of California 5s of 2028 at 2.03%. Triborough Bridge and Tunnel Authority 5s of 2029 at 2.24% versus 2.09%-2.08% on 1/20. California 5s of 2030 at 2.16%-2.15%.

Maryland 5s of 2037 at 2.82% versus 2.84%-2.82% Tuesday. Washington 5s of 2040 at 3.30%.

Austin ISD, Texas, 4s of 2048 at 4.09% versus 4.07%-4.06% Monday and 3.97% on 2/1. Dallas ISD 5s of 2046 at 3.58% versus 3.40%-3.42% on 2/2 and 3.47% on 1/31. Massachusetts 5s of 2052 at 3.70%-3.69% versus 3.50% on 2/2 and 3.61% on 1/30.

AAA scales

Refinitiv MMD’s scale was cut up to five basis points. The one-year was at 2.58% (+5) and 2.35% (+5) in two years. The five-year was at 2.09% (unch), the 10-year at 2.23% (unch) and the 30-year at 3.24% (unch) at 3 p.m.

The ICE AAA yield curve was cut 10 basis points at the one-year: at 2.63% (+10) in 2024 and 2.39% (+4) in 2025. The five-year was at 2.14% (+1), the 10-year was at 2.21% (+1) and the 30-year yield was at 3.30% (+2) at 4 p.m.

The IHS Markit municipal curve was cut up to five basis points: 2.58% (+5) in 2024 and 2.33% (+5) in 2025. The five-year was at 2.09% (unch), the 10-year was at 2.24% (unch) and the 30-year yield was at 3.24% (+2) at a 4 p.m. read.

Bloomberg BVAL was cut up to five basis points: 2.58% (+5) in 2024 and 2.30% (+3) in 2025. The five-year at 2.14% (+1), the 10-year at 2.26% (+1) and the 30-year at 3.29% (+1).

Treasuries were firmer.

The two-year UST was yielding 4.438% (-3), the three-year was at 4.094% (-3), the five-year at 3.807% (-3), the seven-year at 3.735% (-3), the 10-year at 3.637% (-4), the 20-year at 3.842% (-3) and the 30-year Treasury was yielding 3.688% (-3) at 4 p.m.

Primary to come:

The Health Care Authority for Baptist Health, Alabama, (A3/BBB+//) is set to price Thursday $119.195 million of refunding bonds, Series 2023, serials 2023-2037. Morgan Stanley & Co.