Nouriel ‘Dr. Doom’ Roubini Warns About Demise of US Dollar – Economics Bitcoin News

3 min read

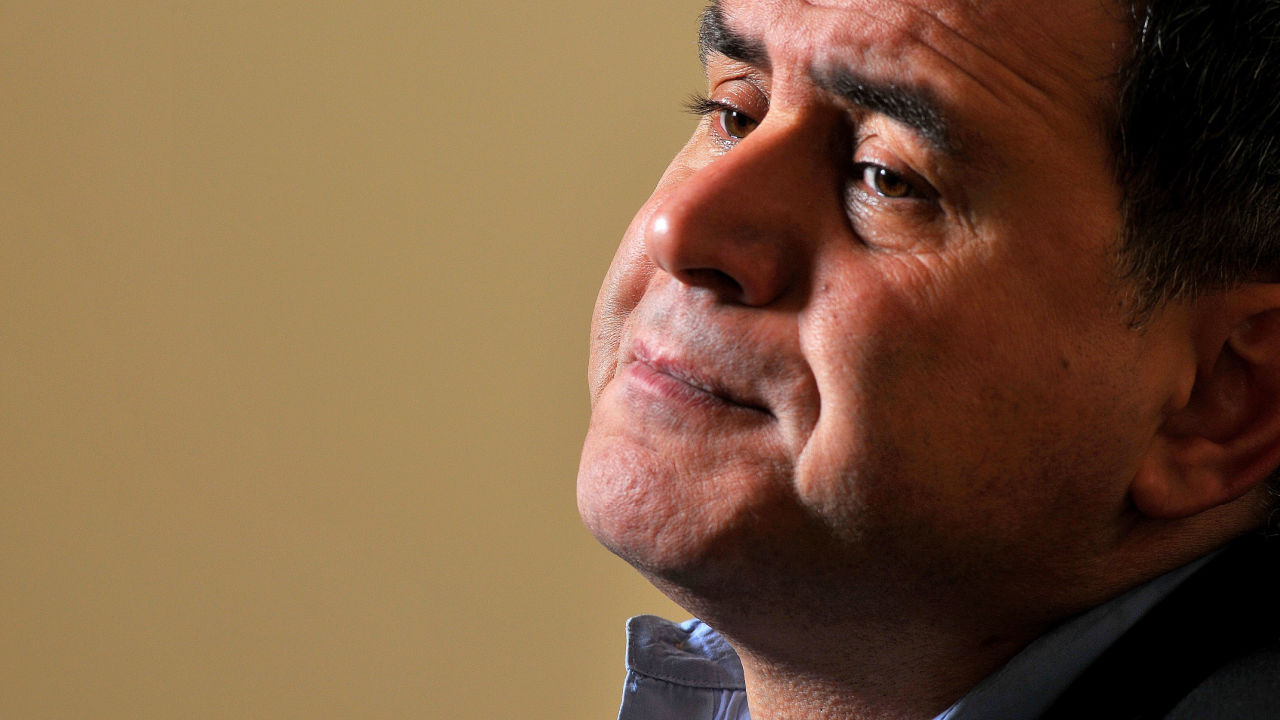

Nouriel Roubini, an economist known as “Dr. Doom,” has warned about the demise of the U.S. dollar and the rise of a “bipolar” world. Roubini believes that the Chinese renminbi might be a substitute for the dollar, as new technologies like central bank digital currencies (CBDCs) and corporate payment rails contribute to a new landscape.

Nouriel Roubini Predicts Greenback’s Fall From Grace

Nouriel Roubini, an economist known for the accuracy of his predictions regarding the 2008 housing crisis, has warned about the rise of a “bipolar currency regime” preceded by the demise of the U.S. dollar as a world currency. The Iranian-American economist, called “Dr. Doom” by some due to his pessimistic predictions, alerted readers in an article about the substitution of the U.S. dollar by the Chinese renminbi due to a series of actions that the Chinese government has been executing since the Covid lockdowns.

Roubini states:

Given the increased weaponization of the dollar for national security purposes, and the growing geopolitical rivalry between the west and revisionist powers such as China, Russia, Iran, and North Korea, some argue that de-dollarisation will accelerate.

Roubini mentions the increasing set of restrictions that the U.S. government exerts over the use of the dollar on its rivals, including primary and secondary financial sanctions, as possible reasons for the emergence of this bipolar system in the next decade.

Aggravating Factors and Dedollarization Efforts

Roubini also argues that the pseudo-adoption of the dollar by economies in less developed countries brings disadvantages derived from the domestic management of the monetary policy. This puts these countries at a disadvantage, without having a say in issuance and monetary control decisions. Roubini states:

The current system makes emerging market economies financially and economically vulnerable to changes in US monetary policy driven by domestic factors such as inflation.

The economist also mentioned that Saudi Arabia has already settled transactions using the Chinese renminbi and that this might cause other countries in the area to follow this example.

There have already been several projects that seek to substitute the dollar for international settlements. In July, the BRICS bloc revealed it was working on the creation of its own currency, in a move to dethrone the influence of the U.S. and the International Monetary Fund over their economies. In January, the presidents of Argentina and Brazil announced they were starting to work in a common currency that would serve as an instrument to settle payments between Mercosur and BRICS countries.

The launch of central bank digital currencies (CBDCs), and the increasing usage of private payment rails, like Wechat in China, will also contribute to this displacement, according to Roubini.

What do you think about Roubini’s opinion on the future of the U.S. dollar? Tell us in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, seyephoto / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer