Bitcoin price continues to fall, but derivatives data hints at a short-term rally to $25K

1 min read

It’s possible that many people have already forgotten that Bitcoin’s (

Notice that the 25% delta skew shifted slightly negative since Feb. 18 after option traders became more confident and the $23,500 support strengthened. A skew reading at -5% denotes a balanced demand between bullish and bearish option instruments.

Derivatives data paints an unusual combination of excessive margin demand for longs and a neutral risk assessment from options traders. Yet, there is nothing concerning about it as long as the stablecoin/BTC ratio returns to levels below 30 in the coming days.

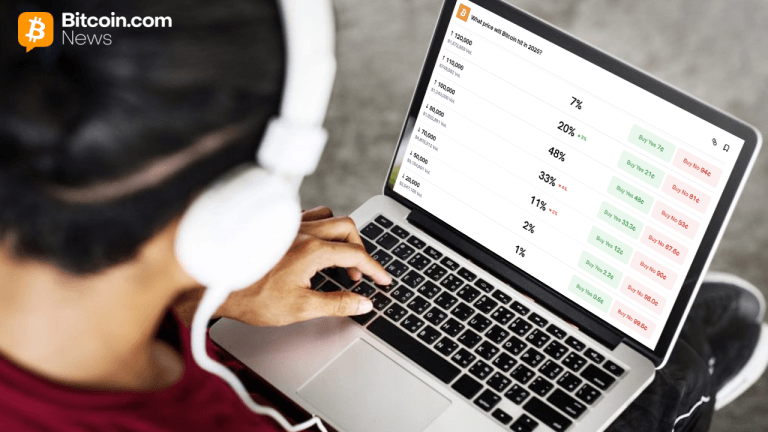

Considering regulators have been applying enormous pressure on the crypto sector, Bitcoin derivatives are holding up nicely. For example, on Feb. 22, the Bank for International Settlements general manager Agustín Carstens emphasized the need for regulation and risk management in the crypto space. The limited impact of the BIS statement on the price is a bullish sign and it possibly increases the odds of Bitcoin price breaking above $25,000 in the short-term.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.