Munis weaker, 10- and 30-year USTs top 4% on strong labor data

8 min read

Municipals were weaker Thursday as outflows from muni mutual funds continued. U.S. Treasury yields rose, with all maturities now yielding above 4%, and equities ended mixed.

Treasury yields rose as initial jobless claims came in below 200,000 for the seventh straight week and unit labor costs for the fourth quarter were revised up to 3.2% gains from the previously reported 1.1% rise. The numbers suggest the Federal Reserve’s terminal rate will climb.

Triple-A benchmark yields were cut up to five basis points, depending on the curve, while UST yields rose one to seven basis points, pushing the 10- and 30-year UST above 4%.

The three-year muni-UST ratio was at 61%, the five-year at 62%, the 10-year at 65% and the 30-year at 90%, according to Refinitiv MMD’s 3 p.m. ET read. ICE Data Services had the three at 63%, the five at 63%, the 10 at 66% and the 30 at 92% at 4 p.m.

Munis “digressed from UST weakness on the opening day of March and select spots showed strength across certain trade prints,” said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

She said, “A lull in supply of benchmark type credits has pushed inquiry into the secondary market — but longer-call protected availability remains elusive as sellers can’t easily replace line items, hence the tail chasing the dog.”

A sale of NR/AA Harris County, Texas, “toll road 5s due 2033 (callable 2032) at +23/MMD compares with recent Texas PSF school issuance,” she noted.

“Local AAAs continue to command strong levels as well — Aaa/NR Montgomery County, [Pennsylvania,] GO 5s due 2035 (callable 2032) were sold +9/MMD,” according to Olsan.

Light supply conditions should ease “with the release of several preliminary official statements announcing sales of $995 million Oregon GOs and $826 million District of Columbia GOs,” she said.

Rate moves in ultra-short munis signify “a push for defensively positioned bonds with muni money-market balances surging $6 billion from the prior week to settle near $110 billion,” she said.

Weekly floating rate bonds saw yields “fall 60 basis points to close through 3% and the SIFMA seven-day rate reset to 2.80%, down by a similar amount after trading to 3.98% just two weeks ago (its average rate in the last year is 1.66%),” she said. The upcoming month, Olsan noted, “can be volatile with cash raises for tax payments” in effect ahead of April 15. She said, “recent years have brought rate fluctuations in the weeks” leading up to tax day.

In February, 10- and 30-year UST yields “advanced by 53 and 38 basis points respectively, while similar maturity municipal yields rose by 40 and 36 basis points respectively,” said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

Both asset classes “had spent last month with inverted yield curves, admittedly a rare occurrence with munis and not so uncommon with USTs,” he said.

Despite the unique investment attributes of munis, there is likely a “greater convergence of market behavior between the two, with munis falling more in lockstep,” he said.

Generally, Lipton noted, “fixed income seems to be walking on eggshells as stakeholders navigate the disruptive forces of prolonged inflationary pressure and uncharted Fed policy.”

“The markets have apparently found religion and although they are now listening to what the policymakers have been messaging for some time now, the upward pressure on bond yields has taken on a life of its own,” he said.

Following a strong January with positive returns, “munis lost 2.26% in February, modestly outperforming the 2.34% deficit earned on U.S. Treasury securities,” Lipton said. Year-to-date, “munis and UST are earning 55 basis points and 11 basis points respectively.”

Fifteen-year and out muni maturities “underperformed the broader market, signaling a lack of comfort with Fed policy and cheaper valuations offered on longer-dated securities,” according to Lipton.

Muni high-yield meaningfully underperformed “the broader market in February to remind us of the consistent underperformance of high-yield throughout 2022 given the presence of greater duration and rate sensitivities as the Fed moved aggressively to combat uncontrollable inflation,” he said.

With a pick-up in fund outflows in February, he said, there was “more active high-yield bid-wanted activity for relatively liquid names as mutual fund complexes had to meet redemption needs.”

“We are entering a period of traditional seasonal weakness as the April 15 tax date often gives rise to selling activity in order to meet tax liabilities, and reinvestment needs over the next 30 days are expected to be relatively light,” Lipton said. “We are still awaiting demand to rise to take advantage of more attractive yields, but concerns over further price erosion seem to take priority.”

Should the “lighter supply dynamic eclipse the impact of tempered demand, we could see a floor placed on price erosion and so muni investors should be seeking to add positions opportunistically,” he said.

In the primary market Thursday, Goldman Sachs & Co. priced for the Port of Portland, Oregon, (/AA-/AA-/) $561.670 million of green AMT Port International airport revenue bonds, Series Twenty-Nine, with 5s of 7/2029 at 3.63%, 5s of 2033 at 3.74%, 5s of 2038 at 4.36%, 5.25s of 2043 at 4.53%, 5.5s of 2048 at 4.61% and 5.5s of 2053 at 4.66%, callable 7/1/2033.

RBC Capital Markets priced for the Washington Metropolitan Area Transit Authority, D.C., (/AA/AA/AA+/) $392 million of dedicated revenue green bonds, Series 2023, with 5s of 7/2024 at 3.08%, 5s of 2028 at 2.82%, 5s of 2033 at 2.90%, 5s of 2038 at 3.53%, 5s of 2043 at 3.85%, 4.125s of 2047 at 4.43% and 5.5s of 2051 at 4.01%, callable 7/15/2033.

BofA Securities priced for the Michigan State Housing Development Authority (/AA+//) $347.360 million of rental housing revenue bonds. The first tranche, $329.450 million of non-AMT bonds, Series 2023A, saw 3.25s of 10/2025 price at par, 3.5s of 4/2028 at par, 3.55s of 10/2028 at par, 3.95s of 4/2033 at par, 4s of 10/2033 at par, 4.5s of 10/2038 at par, 4.875s of 10/2043 at par, 5s of 10/2048 at par, 5.1s of 10/2053 at par and 5.15s of 10/2058 at par, callable 10/1/2032.

Piper Sandler & Co, priced for Portland Community College, Oregon, (/AA+//) $225 million of GOs, Series 2023, with 5s of 6/2024 at 3.03%, 5s of 2028 at 2.74%, 5s of 2033 at 2.84% and 5s of 2038 at 3.52%, callable 6/15/2033.

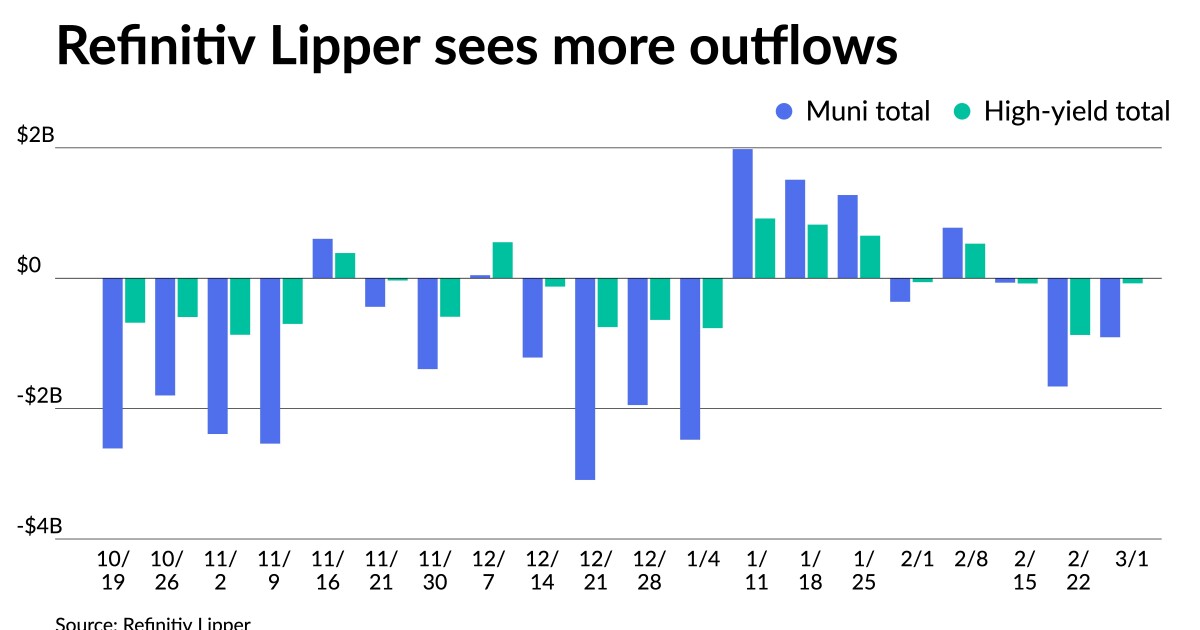

Outflows continued as Refinitiv Lipper reported $905.030 million was pulled from municipal bond mutual funds in the week that ended Wednesday after $1.660 billion of outflows the week prior.

High-yield saw $78.353 million of outflows after $869.861 million of outflows the week prior, while ETFs saw outflows of $264.839 million after $367.788 million of outflows the previous week.

Secondary trading

NYC TFA 5s of 2023 at 3.03%. NYS Environmental Facilities Corp. 5s of 2025 at 3.00%. Wisconsin 5s of 2026 at 2.93%.

NY Dorm PIT 5s of 2029 at 2.85%. California 5s of 2029 at 2.70%-2.68%. Texas Water Development Board 5s of 2031 at 2.80%-2.79%.

Alabama 5s of 2035 at 2.98%-2.97%. Huntsville, Alabama, 5s of 2036 at 3.24%-3.23% versus 3.28% original on 2/24. Maryland 5s of 2036 at 3.07% versus 2.95%-3.01% on 2/16 and 2.84% on 2/15.

LA DWP 5s of 2052 at 3.88% versus 3.89%-3.88% on 2/22 and 3.80% on 2/16.

AAA scales

Refinitiv MMD’s scale was cut four basis points outside one-year. The one-year was at 3.03% (unch) and 2.99% (+4) in two years. The five-year was at 2.68% (+4), the 10-year at 2.63% (+4) and the 30-year at 3.60% (+4) at 3 p.m.

The ICE AAA yield curve was mixed: 3.02% (-6) in 2024 and 2.99% (-2) in 2025. The five-year was at 2.70% (+3), the 10-year was at 2.65% (+2) and the 30-year yield was at 3.64% (+3) at 4 p.m.

The IHS Markit municipal curve was cut four basis points outside one-year: 3.04% (unch) in 2024 and 2.99% (+4) in 2025. The five-year was at 2.66% (+4), the 10-year was at 2.62% (+4) and the 30-year yield was at 3.62% (+4) at a 4 p.m. read.

Bloomberg BVAL was cut two to five basis points: 3.17% (+2) in 2024 and 2.936% (+3) in 2025. The five-year at 2.66% (+3), the 10-year at 2.66% (+3) and the 30-year at 3.64% (+4).

Treasuries were weaker.

The two-year UST was yielding 4.898% (+1), the three-year was at 4.641% (+3), the five-year at 4.319% (+5), the seven-year at 4.236% (+7), the 10-year at 4,062% (+7), the 20-year at 4.233% (+7) and the 30-year Treasury was yielding 4.010% (+6) at 4 p.m.

Recession-ready?

As the debate continues about whether a recession is inevitable, Tony Welch, chief investment officer at SignatureFD, suggests “the economy may be in somewhat of a rolling recession whereby certain industries contract while others continue to expand.”

COVID is still having an impact as “the imbalances” that came about during recovery have yet to clear, he said.

“The January inflation data almost certainly assures more Fed rate hikes in upcoming meetings,” Welch said. “In that regard, it may appear as if the Fed is pushing on a string for a while longer.”

Consumers had taken advantage of low interest rates to lock in loans, “particularly mortgages,” he said, so “they may not be feeling the negative effects of Fed policy for some time.”

Municipal bond investors, for their part, “worry about the impact of a potential recession on the financial health of individual states,” said AllianceBernstein strategists Bryan Lang and Daryl Clements. States, they noted, “represent the largest sector in the $4 trillion muni market — 14% — and provide important funding sources to other municipal issuers.”

Therefore, they said, “state budget challenges can have broad negative consequences if not handled effectively, but the state of the states is strong, and their solid fiscal report cards should help most of them skirt economic speedbumps on the horizon.”

A recession should not surprise state leaders, as “this has been one of the most telegraphed leadups to a possible downturn in decades,” they added. Muni issuers, though, “have the fiscal strength and budget tools to navigate an economic setback.”

“States’ financial health is its strongest in decades, the combined result of years of steady revenue income, increasingly conservative budgeting and leftover federal relief funds in the wake of the COVID-19 pandemic as well as improved pension funding practices since 2008,” the AllianceBernstein strategists said. Total fund balances hit a record $343 billion in 2022.

“With states more prone to banking than spending their growing coffers, rainy-day funds hit a record $134.5 billion in 2022,” they said. “In fact, states have more reserves today than just before 2008’s global financial crisis, which they successfully navigated.”

Along with “money in the bank,” they said, “states also measure fiscal health in terms of revenues, which look steady for most and very bright for some.”

“While the growth rate of state-level tax collections slowed in 2022, it still hovers at a median 10% year-over-year increase,” they said. “Moreover, 49 states collected an average of 20% more tax revenues than they planned for last year and, based on those reporting so far, a similar trend is in scope for 2023.”

Additionally, states “can leverage a deep tool kit to get through difficult economic conditions,” such as line-item spending adjustments, cash reserves, raising taxes, job cuts or furloughs, shifts and delays in priorities or programs and borrowing authority.

States also have flexibility about “which of these levers they pull and to what extent,” they said. “This is why, even when faced with shortfalls, no state has defaulted since the Great Depression.”

And while a recession, and the timing if one occurs, can’t be determined, the AllianceBernstein strategists noted, “we are sure that states have had plenty to time to prep for one and are, as usual, well-equipped to deal with what may come.”

Mutual fund details

Refinitiv Lipper reported $905.030 million of municipal bond mutual fund outflows for the week that ended Wednesday following $1.660 billion of outflows the previous week.

Exchange-traded muni funds reported outflows of $264.839 million after outflows of $367.788 million in the previous week. Ex-ETFs, muni funds saw outflows of $640.191 million after outflows of $1.293 billion in the prior week.

Long-term muni bond funds had outflows of $280.911 million in the latest week after outflows of $1.119 billion in the previous week. Intermediate-term funds had outflows of $162.067 million after inflows of $5.198 million in the prior week.

National funds had outflows of $739.056 million after outflows of $1.526 billion the previous week while high-yield muni funds reported outflows of $78.353 million after outflows of $869.861 million the week prior.