Munis firmer on short end, more billion-dollar deals price

7 min read

Municipals were firmer on the front end of the curve as more billion-dollar deals priced, while Treasuries rallied hard inside 10 years and equities sold off.

The potential for a strong employment report, which would amp up belief of a 50-basis-point move by the Federal Open Market Committee later this month, and higher for longer rates, led to buying on the short end of the UST market.

Triple-A benchmark yields were bumped up to four basis points, depending on the scale, while U.S. Treasury yields fell six to 17 basis points 10 years and in.

The three-year muni-UST ratio was at 60%, the five-year at 62%, the 10-year at 66% and the 30-year at 93%, according to Refinitiv MMD’s 3 p.m. ET read. ICE Data Services had the three at 60%, the five at 61%, the 10 at 66% and the 30 at 94% at 4 p.m.

This week, bond market’s behavior has been mixed, “responding to the hawkish bias exhibited by [Federal Reserve Board] Chair [Jerome] Powell with up, down and sideways movements,” said Jeff Lipton, managing director of credit research at Oppenheimer.

By late Wednesday morning USTs yields were moving lower along the curve, with the exception of shorter tenors, “as upward yield pressure continued in this space, only to be followed by a more visible sell-off along the entire curve during the afternoon,” he said.

On midday Thursday, he said, “the screens were flashing green along the full UST curve.”

“This week’s Powell testimony brought about a 2s/10s inversion of 100 basis points, the first time in over 40 years, as bets on a likely recession accelerated and notions of extended rate volatility took hold,” he said.

Munis, Lipton said, “put forth a good faith effort to flex some independence this week as the Treasury market succumbed to selling pressure, while tax-exempts showed some spotty bumps along the curve by the close of business Wednesday.”

“The weakness in USTs was not able to spill over as munis received support from institutional activity in a busy primary market,” he said. ” With Thursday’s support for UST bond prices, munis, particularly high-grade securities, firmed up,” Lipton added.

The muni yield curve, Lipton said, is “pretty much holding steady.”

“Since the beginning of the month, munis have been displaying uneven performance as technical headwinds have created uneasy sentiment and investor selectivity has become more pronounced,” he said.

With “cash is still awaiting deployment, retail is “quite discerning on structure, and we are seeing a defensive focus on quality, general obligation and essential purpose revenue bonds, inside of 20 years,” he said.

With primary issuance down year-over-year and dealer balances tight, he said, investor interest has been satisfied in the secondary market.

“We are also entering a period where reinvestment needs are relatively light. Bloomberg data indicates that the amount of bond calls and maturing securities over the next 30 days approximates $13.7 billion while supply is projected to be $16.5 billion for the same period, resulting in net supply of $2.8 billion,” Lipton said.

Overall, he said, “the rate volatility has generated a great deal of apprehension for both issuer and investor even though the asset class is in a good place.”

While “the rate uncertainty will persist for a while longer, investors are well-advised to deploy cash opportunistically and position their portfolios as defensively as possible, adhering to investment guidelines and suitability needs,” he noted.

Absolute yield levels are “supporting institutional engagement even at tight spreads, and this is even more pronounced with taxable activity given the lack of taxable muni supply,” he said.

Elsewhere, the muni curve remains inverted. “Structurally, when you get into an inverted muni yield curve, for many folks, this is unchartered territory,” said Dave Rudd, president of InspereX. “So you start to look at how people price callables.”

“With the heavily inverted front of the yield curve for the shorter duration buyers, ‘How do they think about pricing bonds that have shorter call options,'” he asked. “And should they, in fact, be at much higher yields than bonds that are non-callable? And we’re seeing that right now.”

“What we’re trying to really get our hands around is, is there value in that, or is there value in taking on the duration and better structure where you don’t have that call option,” he said.

Rudd said, “We’re seeing a little bit of both play out. There’s the audience that always likes that sort of kicker structure on the front end … But you can also make that argument for the folks that want the convexity and the duration that this is an opportunity for them to continue to add more incremental yield where you’re seeing tax-free yields and call it the 3% range.”

In the primary market Thursday, Jefferies was expected to price the Texas Natural Gas Securitization Finance Corp.’s (Aaa//AAA/) $3.526 billion of taxable customer rate relief bonds (Winter Storm URI), Series 2023. No pricing information was available as of 4 p.m.

BofA Securities priced for the Triborough Bridge and Tunnel Authority (/AA+/AAA/) $1.254 billion of capital lockbox sales tax revenue bonds, Series 2023A, with 5s of 5/2030 at 2.63%, 5s of 2033 at 2.74%, 5s of 2038 at 3.52%, 5s of 2043 at 3.90%, 4s of 2048 at 4.36%, 5s of 2048 at 4.07%, 4.125s of 2053 at 4.45%, 5s of 2053 at 4.16%, 4.25s of 2058 at 4.63%, 5.25s of 2058 at 4.22%, 4.5s of 2063 at 4.78% and 5.5s of 2063 at 4.28%, callable 5/15/2033.

Morgan Stanley & Co. priced for the District of Columbia (Aaa/AA+/AA+/) $823.590 million of GOs. The first tranche, $584.195 million of Series 1, saw 5s of 1/2026 at 2.86%, 5s of 2028 at 2.71%, 5s of 2033 at 2.76%, 5s of 2038 at 3.33%, 5s of 2043 at 3.77% and 5.25s of 2048 at 3.88%, callable 1/1/2033.

The second tranche, $239.395 million of Series 2, saw 5s of 6/2024 at 2.93%, 5s of 2028 at 2.71% and 5s of 2030 at 2.77%, noncall.

BofA Securities priced for the Development Authority of Bartow County, Georgia, (Baa1/BBB+/BBB+/) $173 million of pollution control revenue bonds (Georgia Power Company Plant Bowen Project), First Series 2009, with 3.95s of 12/2032 with a mandatory tender date of 3/8/2028 at par, noncall.

In the competitive, the Santa Clara United School District, California, sold $170 million of Election of 2018 GOs, Series 2023, to Fifth Third Securities, with 5s of 7/2023 at 2.70%, 5s of 2025 at 2.70%, 5s of 2033 at 2.41%, 4s of 2038 at 3.41% and 4s of 2041 at 3.69%, callable 7/1/2031.

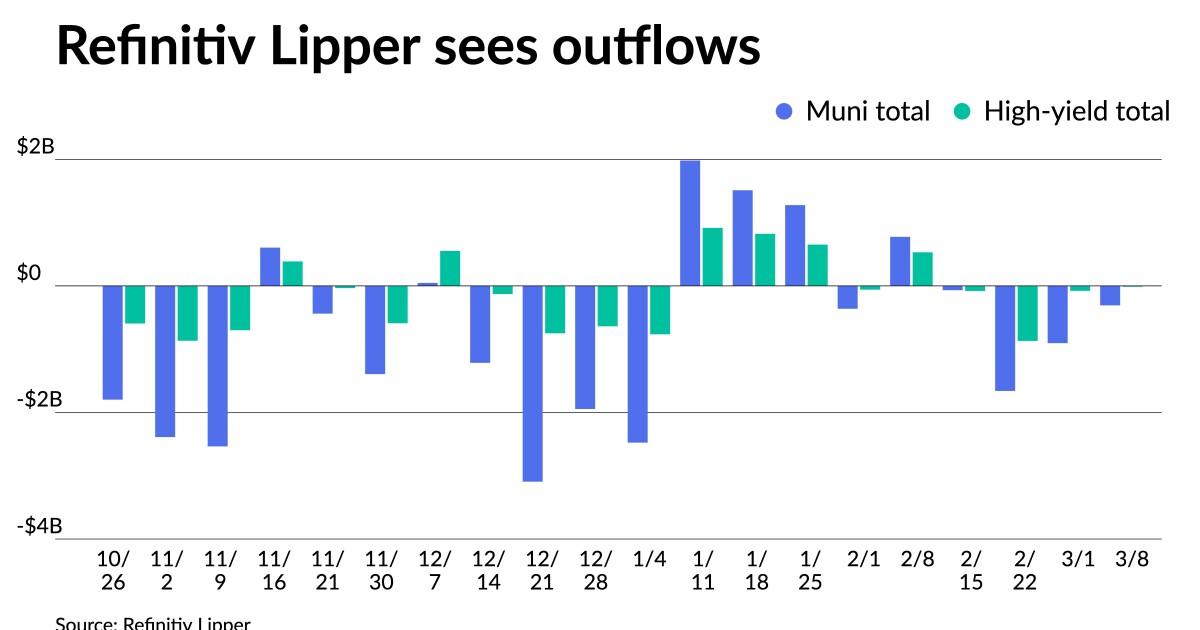

Outflows continued as Refinitiv Lipper reported $307.815 million was pulled from municipal bond mutual funds in the week that ended Wednesday after $905.030 million of outflows the week prior.

High-yield saw $14.749 million of outflows after $78.353 million of outflows the week prior, while ETFs saw inflows of $50.068 million after $264.839 million of outflows the previous week.

Secondary trading

California 5s of 2024 at 2.79% versus 3.05%-2.99% on 2/17. Florida Board of Education 5s of 2024 at 2.88%. Washington 5s of 2024 at 2.89%. Hamilton County, Tennessee, 5s of 2025 at 2.92%.

NY Dorm PIT 5s of 2028 at 2.77%-2.75%. DC 5s of 2028 at 2.67% versus 2.50% on 2/16. Triborough Bridge and Tunnel Authority 5s of 2029 at 2.79%-2.75%.

California 5s of 2030 at 2.65%-2.47% versus 2.66%-2.65% Wednesday. NYC TFA 5s of 2031 at 2.76% versus 2.79% Wednesday. DC 5s of 2033 at 2.74% versus 2.77% Wednesday.

Washington 5s of 2048 at 3.87% versus 3.90% on 2/22. Hayward Area Recreation and Park District, California, 5s of 2052 at 3.77% versus 3.77%-3.71% Wednesday and 3.75%-3.61% on 2/27. San Jose Financing Authority, California, 5s of 2052 at 3.72% versus 3.72%-3.70% Tuesday.

AAA scales

Refinitiv MMD’s scale was bumped four basis points three years and in. The one-year was at 2.89% (-4) and 2.88% (-4) in two years. The five-year was at 2.64% (unch), the 10-year at 2.61% (unch) and the 30-year at 3.58% (unch) at 3 p.m.

The ICE AAA yield curve was bumped one to three basis points: 2.90% (-3) in 2024 and 2.89% (-3) in 2025. The five-year was at 2.62% (-2), the 10-year was at 2.61% (-2) and the 30-year yield was at 3.62% (-1) at 4 p.m.

The IHS Markit municipal curve was bumped two to four basis points: 2.90% (-4) in 2024 and 2.88% (-4) in 2025. The five-year was at 2.62% (-2), the 10-year was at 2.58% (-2) and the 30-year yield was at 3.58% (-2) at a 4 p.m. read.

Bloomberg BVAL was bumped up to four basis points: 2.95% (-4) in 2024 and 2.87% (-3) in 2025. The five-year at 2.62% (-1), the 10-year at 2.62% (-1) and the 30-year at 3.59% (-1).

Treasuries rallied 10 years and in.

The two-year UST was yielding 4.890% (-17), the three-year was at 4.567% (-16), the five-year at 4.212% (-12), the seven-year at 4.087% (-10), the 10-year at 3.916% (-6), the 20-year at 4.081% (-3) and the 30-year Treasury was yielding 3.877% (-1) at 4 p.m.

Mutual fund details

Refinitiv Lipper reported $307.815 million of municipal bond mutual fund outflows for the week that ended Wednesday following $905.030 million of outflows the previous week.

Exchange-traded muni funds reported inflows of $50.068 million after outflows of $264.839 million in the previous week. Ex-ETFs, muni funds saw outflows of $357.883 million after outflows of $640.191 million in the prior week.

Long-term muni bond funds had inflows of $206.540 million in the latest week after outflows of $280.911 million in the previous week. Intermediate-term funds had outflows of $105.304 million after outflows of $162.067 million in the prior week.

National funds had outflows of $260.229 million after outflows of $739.056 million the previous week while high-yield muni funds reported outflows of $14.749 million after outflows of $78.353 million the week prior.

Primary on Wednesday:

Wells Fargo Bank priced for California (Aa2/AA-/AA/) $1.804 billion of taxable various purpose GOs, with 5.222s of 3/2024 at par, 5.1s of 2029 at 4.948%, 6s of 2033 at 4.945%, 5.125s of 2038 at 4.395% and 5.2s of 2043 at 5.477%, callable 3/1/2033.