Munis follow U.S. Treasury flight to quality after Silicon Valley Bank collapse

8 min read

Municipal bond yields continued to fall Monday as traders assessed the effects of Silicon Valley Bank’s failure after federal regulators intervened to protect the banking system from additional failures of weak financial organizations.

In addition, analysts said, this could impact the expected Federal Reserve rate hike, although inflation data this week will be the final determinant.

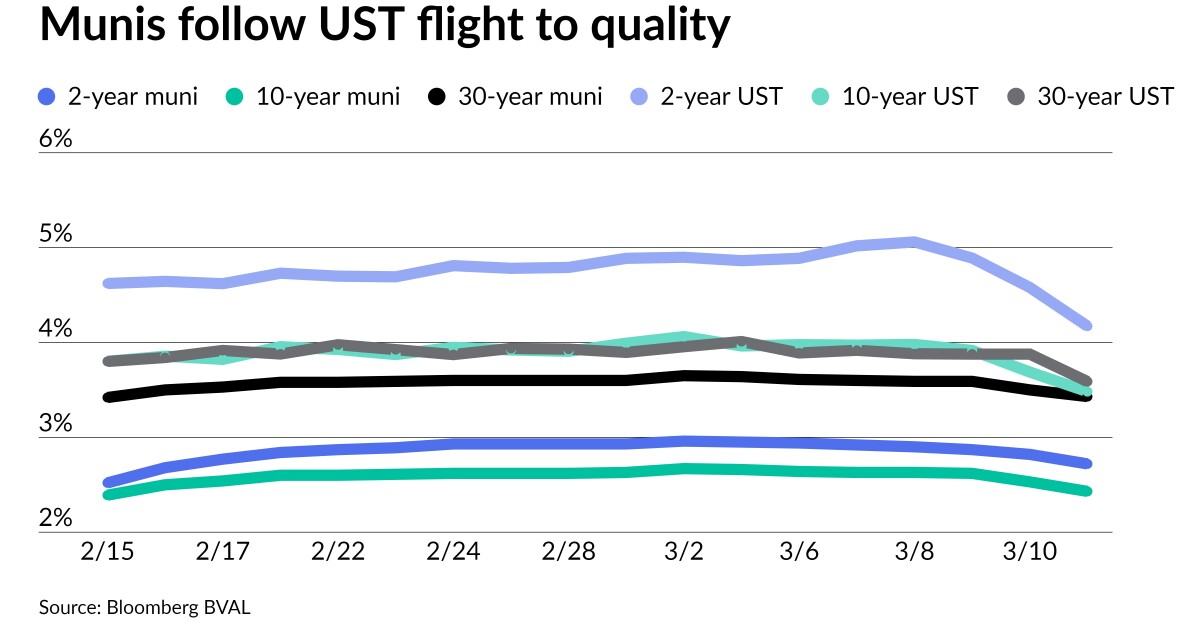

As a result of the SVB collapse, U.S. Treasury yields, in a flight-to-quality move, have fallen 42 basis points on the two-year, now yielding 4.172%, and 22 basis points at 10 years, yielding 3.482%, as of noon Monday. Munis have followed USTs, falling five to 10 basis points, depending on the scale. BVAL has triple-A benchmark yields falling seven to 10 basis points, as of noon, while ICE Data Services has munis bumped six to 10 basis points.

“Fixed income is certainly enjoying a flight to quality,” said Jeff Lipton, managing director of credit research at Oppenheimer Inc. “And, the municipal bond market is happy to hang on the Treasury coattails.”

He said the flight to quality is overshadowing muni market technicals, macro themes and the inflation story.

“Given extraneous events developing into the next Federal Open Market Committee meeting, munis will need to separate the flight-to-quality trade into USTs from their own reality with greater supply in benchmark names,” said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

Although relative value has improved in a week’s time, she said, “the market may struggle to keep pace with dramatic taxable market gains.”

Following the news of Silicon Valley Bank’s seizure, the two-year UST closed 29 basis points lower Friday (and is down another 35 basis points after a Fed backstop was announced) and the 10-year UST rallied 20 basis points,” she said.

By contrast, munis traded lower by five to 10 basis points “as bidders recognize ratios needed to align along better values,” Olsan noted.

The SVB collapse “threatened to prompt a wider financial crisis and the authorities had no choice but to roll out emergency measures,” said Nigel Green, CEO of deVere Group.

Wednesday, the yield on a two-year UST climbed to 5.07% — its highest level since before the financial crisis, as Fed Chair Jerome Powell, “in congressional testimony, pondered reaccelerating the pace of monetary tightening,” said David Kelly, chief global strategist at JPMorgan Funds.

By Friday, it had fallen back to 4.6%, “partly in response to mild wage readings in the February jobs report, but primarily because of the collapse of Silicon Valley Bank — the second largest banking failure in U.S. history,” Kelly said.

The demise of SVB, he said, “does not reflect general weakness in the U.S. economy or in the banking system.” Rather “SVB’s unusual mix of assets and liabilities made it particularly vulnerable to the Fed’s recent aggressive tightening,” he noted.

However, Kelly said, it “does carry with it some contagion risk to other financial institutions which markets will, no doubt, try to ferret out in the week ahead.”

Moreover, he said it “illustrates the damage that is inevitable when a central bank first encourages financial speculation by an extended period of negative real rates and then demands that the whole economy go ‘cold turkey’ with excessive tightening.”

On Monday, the U.S. Treasury, Federal Reserve and Federal Deposit Insurance Corp. “released a joint statement guaranteeing that all depositors in SVB would be made whole and have full access to their funds” as of that day, according to Kelly.

They also announced a “similar systematic risk exception for Signature Bank, the 29th largest U.S. bank in terms of assets, which New York authorities shut down on Sunday,” he noted. Additionally, he said the Federal Reserve announced a new lending facility, the Bank Term Funding Program, offering loans to banks, savings associations, credit unions and other eligible depository institutions, with high-quality securities being accepted as collateral and valued at par.

“A failure to act would have to be a dereliction of duty,” Green said.

“If they hadn’t given customers access to their deposits from Monday, it would have resulted in a loss of confidence in the banking system, leading to a ‘run on the banks’ which, in turn, would have caused a liquidity crisis in the banking and broader financial system, potentially triggering a full-blown global financial crisis,” he said. “The authorities couldn’t let this happen.”

These actions “may be sufficient to stem some of the current turmoil in global markets emanating from smaller U.S. banks,” Kelly said. “However, it should be noted that these problems were largely set up by over-easy Fed policy for many years and are now being triggered by excessive tightening.”

In light of this reality, Kelly said, “it is possible that the Fed will now halt its tightening cycle,” adding, “We should have a much better handle on this possibility later this week.”

For investors who have been waiting to take advantage of higher yields and long-term income, CreditSights strategist Pat Luby said the SVB collapse will create an added “urgency to putting money to work there.”

Municipal primary market supply last week was robust and the new-issue calendar remains heavy this week. Next week’s supply will be light as per usual during Federal Open Market Committee meeting weeks.

“There’s probably not as much selection for investors who do want to try to lock in yields,” Luby said. “But this kind of volatility could certainly overshoot the mark, one way or the other.”

“We’re going to see a lot of folks chasing income and traders are probably marking stuff up aggressively because it’s going to be difficult to replace the existing inventory,” he said. “It’ll be a source of frustration more likely to a lot of participants.”

Luby said it was too early to tell how the SVB collapse will impact the markets in the long run.

“There’s typically not a lot of trading when you get a huge move like this,” he said.

“Inventories are probably getting marked up, benchmark scales are probably getting adjusted,” Luby said. “We’re going to need to wait until some of this week’s deals get priced before we have really compelling evidence of what levels the market is clearing.”

This week, he said, investors “will be watching this story unfold along with a key reading on February inflation,” he said.

So far, “SVB does not appear to represent a ‘breaking point for an economy that has displayed remarkable resilience in recent months,” Kelly said.

However, it may represent a “breaking point” for the Fed, “taking a 50-basis point hike off the table for next week’s FOMC meeting and raising the possibility of an early end to the now-year-old tightening cycle,” he said.

Lipton wants to see how the consumer price index and producer price index reports unfold before making any prognostications in terms of what the Fed may or may not do.

However, he noted there’s a scenario whereby what Treasury, Fed and FDIC have done over the weekend could lead to disinflationary characteristics. “The market is thinking very, very much about that,” he said.

Primary to come:

Oregon will bring $995 million of its general obligation debt on Wednesday in a four-pronged Series 2023. Series A consists of $654.9 million of serial paper maturing from 2024 to 2043 and a term bond in 2048; $155.5 million Series D bonds mature serially from 2024 to 2043.

Series 2023 B and C taxable GOs, will sell on Wednesday. The $176 million Series 2023 B mature serially from 2024 to 2030 and the $8.55 million Series 2023 C mature in 2024.

All the series will be led by book-runner BofA Securities.

Series A and D are rated Aa1 by Moody’s Investors Service and AA by both S&P Global Ratings and Fitch Ratings, while 2023 B is rated Aa1 by Moody’s and AA-plus by both S&P and Fitch.

New York City Transitional Finance Authority has a $950 million sale of future tax-secured subordinated bonds. Fiscal 2023 Series F consists of subseries F1 tax-exempt bonds maturing serially from 2025 to 2028 and 2037 to 2043 and term bonds in 2047 and 2051. Ramirez & Co. will senior manage the deal, which has ratings of Aa1 from Moody’s and AAA from S&P and Fitch.

The Massachusetts Bay Transportation Authority, meanwhile, will sell $618.2 million of 2023 senior sales tax bonds Thursday, following a Wednesday retail order period. The deal, which is rated AA by S&P, and triple-A by both Fitch and Kroll Bond Rating Agency, consists of $510.2 million of Series A-1 bonds structured as serials from 2025-2030, 2032-2033, 2035-2043 and terms in 2048 and 2053; as well as $107.9 million of Series A2 sustainability bonds maturing serially from 2025-2030, 2032-2033, and 2035-2038. The bonds will be senior managed by Barclays Capital.

A $485.7 million sale of gas project revenue bonds is planned by the Black Belt Energy Gas District. The revenue bonds are rated A1 by Moody’s and will be senior managed by Goldman, Sachs & Co.

The Los Angeles Department of Water and Power plans a $305.5 million sale of power system revenue bonds for Thursday. The Series A serial bonds mature from 2023-2024 and 2026-2032 and are being senior managed by Ramirez. The bonds are rated Aa2 by Moody’s, AA-minus by S&P, and AA by Fitch.

Wisconsin is bringing $278.4 million of transportation revenue bonds in a two-pronged offering being underwritten by book-runner Citigroup Global Markets. The structure includes $144.5 million of Series 23 A bonds maturing serially from 2024-2043, as well as $133.8 million of Series 23-1 maturing serially from 2027 to 2035 and a term in 2037. The bonds are rated triple-A by S&P and KBRA, and AA-plus by Fitch.

The Gerald Ford International Airport Authority, Michigan, will sell $165.3 million of revenue bonds in a taxable Series 2023A sale of limited tax GO paper maturing from 2028 to 2038 with terms in 2043 and 2053. The Wednesday sale is rated triple-A by Moody’s and S&P and is being senior-led by Citigroup.

A $150 million sale of homeowner mortgage revenue bonds is planned for Thursday by the State of New York Mortgage Agency. The social bonds will consist of $115.8 million Series 250 non-AMT paper structured with term bonds in 2038, 2043, 2048, and 2053. Series 251 AMT paper will consist of $34.1 million maturing from 2023 to 2034 with a term bond in 2036.

The St. Louis Board of Education is planning a $135 million sale of education GO bonds on Tuesday in a deal led by bookrunner Stifel, Nicolaus & Co. The bonds are rated AA by S&P and are insured by Assured Guaranty Municipal Corp. and will mature serially from 2033 to 2043.

The Idaho Housing & Finance Association will sell $115.2 million of single-family mortgage bonds in a two-pronged offering that is rated Aa1 by Moody’s. The $65.1 million Series A fixed-rated, non-AMT bonds mature serially from 2024 to 2035 with terms in 2038, 2043, 2048, and 2053, while Series B-1 consists of $50 million of fixed-rate taxable paper maturing serially from 2024 to 2035 with term bonds in 2038, 2041, and 2053. Barclays is the lead book runner.

Competitive:

The competitive activity will be led by a two-pronged sale from the New York City Transitional Finance Authority. The first Series is a $119.6 million offering that consists of future tax-secured subordinated bonds in Series F and Subseries F-3 taxable bonds. The second is $180.3 million of future tax secured subordinated fiscal 2023 Series F-2 taxable bonds. The sales are planned for Tuesday.

Maryland will sell $400 million of bonds Wednesday: $50 million taxable state and local facilities loan GOs and $184.1 million and $165.8 million of tax-exempt GOs.

The Davis School District is planning a $100 million sale of GOs backed by the Utah School District Bond Guaranty Program on Monday. The bonds are rated Aaa by Moody’s.