Munis somewhat firmer in spots, USTs weaker

6 min read

Municipals were steady to firmer in spots Tuesday, while U.S. Treasuries were weaker and equities ended down.

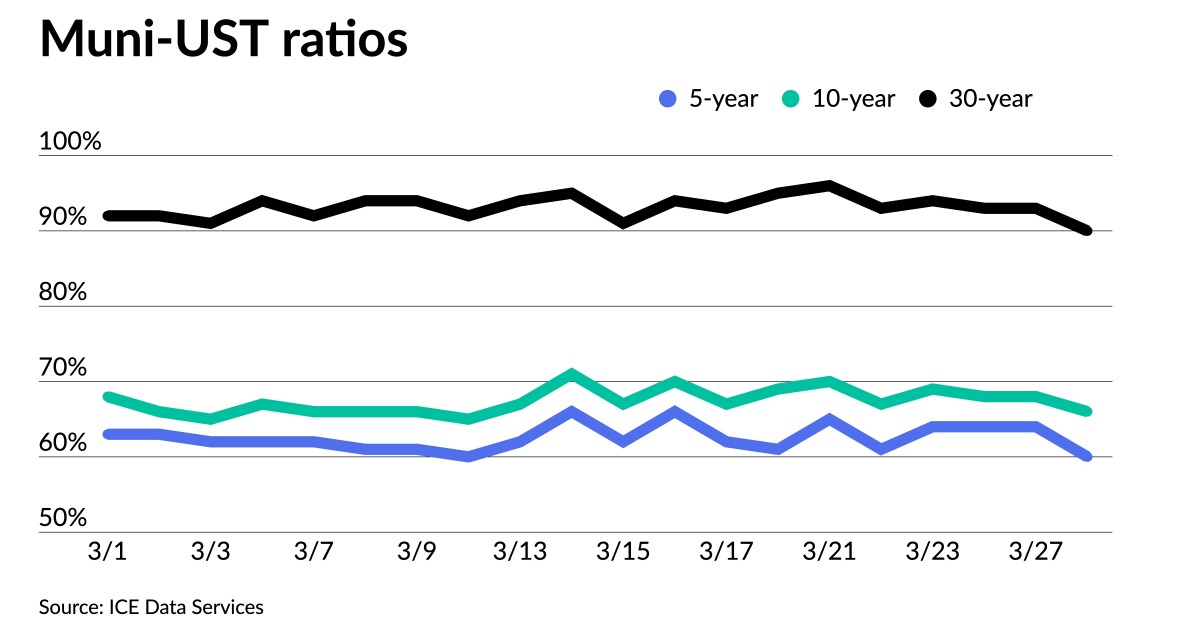

The two-year muni-UST ratio was at 59%, the three-year at 60%, the five-year at 61%, the 10-year at 64% and the 30-year at 89%, according to Refinitiv MMD’s 3 p.m. ET read. ICE Data Services had the two-year at 60%, three-year at 59%, the five-year at 60%, the 10-year at 66% and the 30-year at 90% at 3 p.m.

Munis are directionally trading with USTs but underperforming in days where USTs rally and outperforming in days where USTs sell-off, said Greg Gizzi, head of U.S. fixed income and head of municipal bonds at Macquarie Asset Management.

“That stems from the favorable technical that’s in the marketplace right now,” he said.

Aggregate supply is down about 20%, and the market is coming off a period “where we went from record outflows to one in which fund flows are starting to stabilize — still negative on the year but trending in the in the right direction,” he said.

There have been five consecutive weeks of combined mutual fund and exchanged-traded fund outflows, according to Matt Fabian, a partner at Municipal Market Analytics.

These were “not necessarily large but still depict an unhappy momentum that may dissuade inflows and keep fund managers diffident when buying less liquid instruments,” he said.

Munis, Fabian noted, are also “contending with a very shallow primary calendar and related scarcity issues that encourage buying, holding.”

He said this “may not be the best perspective at present: not only is expected reinvestment low, even for April, but mutual fund outflows have been consistent, bank demand is likely to weaken, and credit issues among hospitals are building rapidly.”

Bloomberg data shows the “total for principal to be returned via scheduled maturities and calls in the next 30 days is just $10.5 billion,” according to Fabian. This is the lowest since before Christmas last year, he noted.

The Fed “raised rates an additional 25 basis points last week in its continued effort to combat inflation,” said Nuveen strategists Anders S. Persson and John V. Miller.

With the fed funds rate now with the top of range at 5%, they noted, “borrowing may not be profitable, which should cool the economy.”

“Banks are also more reluctant to lend money in general, as they want to maintain their capital in ultra-high quality, ultra-low duration investments,” they said.

Munis, Nuveen strategists noted, do not seem to be “affected by the banking industry woes.” They said, “the market remains well bid and expect this trend to continue for the foreseeable future.”

Gizzi said, “At the end of the day, we’re going to expect more volatility as a result of the banking sector,” which he doesn’t see as a systemic issue. The only significant impact on muniland, he said, would be if banks decided to sell their muni holdings.

Banks, he said, own a little over $400 billion in munis, over half of which is held by small banks with assets of less than $25 billion. These munis tend to be high-quality bonds, he said.

“If [banks] were to switch over and take the valuation hit — which I don’t believe banks will — the type of paper that we’re likely to see enter the marketplace is the type of paper that’s in demand right now,” Gizzi said.

With uncertainty around interest rates, he said, there has been a resurgence of demand in the front end of the curve, so separately managed accounts are starting to see flows again.

First Citizens Bank, which had zero municipal holdings in the fourth quarter of 2022 has acquired Silicon Valley Bank, which had $7.4 billion of munis during the same period. Fabian said this is not an encouraging sign.

“First Republic Bank, arguably the strongest/most consistent bank buyer of municipals since 2020, and holder of $19.5 billion in municipal securities in 4Q22, is still searching for a buyer,” he said.

“While the back of the yield curve appears to be very cheaply priced/oversold as new issue underwriters price the primary to sell with less risk of unsold certificates, there are material near-term risks to performance that should drive buyers to overweight safer, more defensive positions when possible,” Fabian noted.

In the primary market Tuesday, Ramirez & Co. priced for the City of Los Angeles Department of Airports (Aa3/AA-/AA-/) $299.930 million of Los Angeles International subordinate refunding revenue bonds. The first tranche, $251.875 million of green private activity/AMT bonds, Series 2023A, saw 5s of 5/2024 at 3.09%, 5s of 2028 at 3.09%, 5s of 2033 at 3.30%, 5s of 2038 at 3.92%, 4.125s of 2043 at 4.34% and 5.25s of 2048 at 4.25%, callable 5/15/2033.

The second tranche, $48.055 million of governmental purpose/non-AMT bonds, Series 2023B, saw 5s of 5/2024 at 2.39%, 5s of 2028 at 2.14%, 5s of 2033 at 2.30% and 5s of 2038 at 3.11%, callable 5/15/2033.

Raymond James & Associates priced for the Columbia County School District, Georgia, (Aa1/AA+//) $107.33 million of GOs, Series 2023, with 5s of 4/2028 at 2.30%, 5s of 10/2028 at 2.34%, 5s of 4/2033 at 2.48%, 5s of 10/2033 at 2.50% and 5s of 10/2036 at 2.88%, callable 4/1/2033.

In the competitive, Wake County, North Carolina, (Aaa/AAA/AAA/) sold $309.675 million of general obligation public improvement bonds, Series 2023A, to J.P. Morgan Securities, with 5s of 5/2024 at 2.49%, 5s of 2028 at 2.22%, 5s of 2033 at 2.28%, 5s of 2038 at 3.02% and 3.75s of 2041 at 3.82%, callable 5/1/2034.

The city and county of San Francisco (Aaa/AAA/AA+/) sold $170.780 million of taxable affordable housing social bonds, Series 2023C, to Baird, with 6s of 6/2023 at 4.55%, 6s of 2028 at 4.20%, 6s of 2033 at 4.40%, 4.65s of 2038 at par, 4.9s of 2043 at par and 5s of 2045 at par, callable 7/1/2033.

Oklahoma City (Aaa/AAA//) sold $117 million of GOs, Series 2023, to Morgan Stanley & Co., with 5s of 2025 at 2.42%, 5s of 2028 at 2.31%, 4s of 2033 at 2.45%, 4s of 2038 at 3.50% and 4s of 2043 at 3.75%, callable 3/1/2031.

Secondary trading

California 5s of 2024 at 2.50%-2.68%. DC 5s of 2024 at 2.53% versus 2.55% Monday. Washington 5s of 2025 at 2.46% versus 2.47% Monday.

NYC TFA 5s of 2028 at 2/31%-2.30%. California 5s of 2029 at 2.25%. Portland, Oregon, 5s of 2030 at 2.27%.

Maryland 5s of 2031 at 2.29%. Washington 5s of 2032 at 2.32%-2.31%. Minnesota 5s of 2032 at 2.29%.

Texas Water Development Board 5s of 2047 at 3.66% versus 3.74%-3.73% on 3/20. Massachusetts Bay Transportation Authority 5s of 2052 at 3.68%-3.70%.

AAA scales

Refinitiv MMD’s scale was bumped up to two basis points. The one-year was at 2.49% (unch) and 2.40% (unch) in two years. The five-year was at 2.22% (-2), the 10-year at 2.29% (unch) and the 30-year at 3.35% (unch) at 3 p.m.

The ICE AAA yield curve was mixed: 2.49% (-5) in 2024 and 2.43% (-3) in 2025. The five-year was at 2.21% (-1), the 10-year was at 2.31% (+1) and the 30-year was at 3.40% (+1) at 4 p.m.

The IHS Markit municipal curve was bumped up to two basis points: 2.47% (-2) in 2024 and 2.38% (-2) in 2025. The five-year was at 2.21% (-2), the 10-year was at 2.27% (-2) and the 30-year yield was at 3.33% (unch), according to a 4 p.m. read.

Bloomberg BVAL was little changed: 2.47% (unch) in 2024 and 2.41% (unch) in 2025. The five-year at 2.23% (-1), the 10-year at 2.29% (-1) and the 30-year at 3.35% (unch).

Treasuries were weaker.

The two-year UST was yielding 4.044% (+3), the three-year was at 3.854% (+6), the five-year at 3.645% (+5), the seven-year at 3.606% (+3), the 10-year at 3.549% (+2), the 20-year at 3.897% (flat) and the 30-year Treasury was yielding 3.761% (flat) at 4 p.m.

Primary to come:

The City of San Diego Public Facilities Financing Authority’s (Aa2/NR/AA/NR) $226.81 million of Series 2023A senior water revenue bonds. Morgan Stanley. Pricing on Thursday.

The Republic Services Inc. (NR/BBB+/NR/NR) $115 million of remarketing, refunding of Series CMFA and PEDFA. BofA Securities. Pricing on Thursday.

The City of San Diego Public Facilities Financing Authority’s (/AA-/AA-/) $114.24 million of Series 2023A lease revenue refunding bonds for capital improvement projects. RBC Capital Markets. Pricing on Wednesday.

The City of Santa Rosa High School District, California’s (Aa2///) $104 million of Series 2023A GOs. Raymond James. Pricing on Wednesday.

Competitive:

New York City (Aa2/AA/AA/) is selling $240 million of taxable GOs, Fiscal 2023 Series E, Subseries E-2 on Wednesday.

In the short-term sector Wednesday, Anchorage, Alaska, (/SP1+//) is selling $125 million of tax anticipation notes.