Another weaker session; heavier new-issue calendar to take focus

7 min read

Municipals were weaker to start the week as triple-A benchmark yields rose in sympathy with U.S. Treasuries. Equities ended up.

Muni yields were cut four to eight basis points, depending on the scale, while UST yields rose seven to nine basis points.

The two-year muni-Treasury ratio was at 54%, the three-year at 56%, the five-year at 58%, the 10-year at 60% and the 30-year at 85%, according to Refinitiv MMD’s 3 p.m. ET read. ICE Data Services had the two-year at 58%, three-year at 58%, the five-year at 58%, the 10-year at 62% and the 30-year at 88% at 4 p.m.

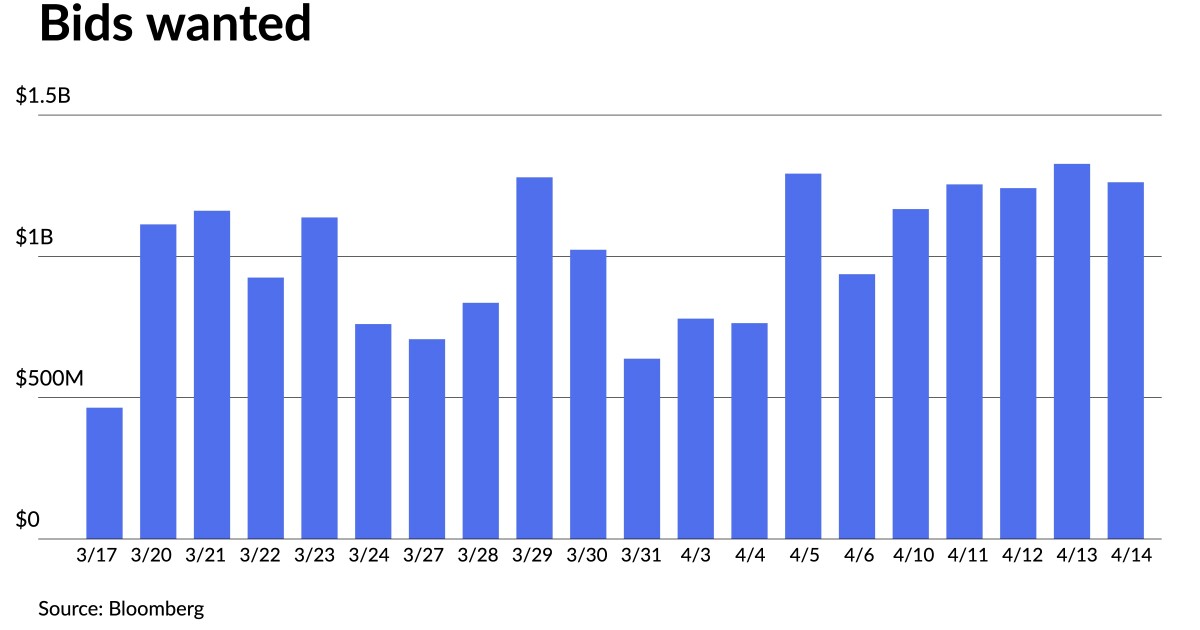

The $11.5 billion new-issue slate begins pricing in earnest Tuesday with several Texas school districts on the calendar. Due to the increase in issuance this week, secondary trading “is expected to be down this week,” said Jason Wong, vice president of municipals at AmeriVet Securities. Bids-wanted were $6.25 billion last week, per Bloomberg and trading last week was “roughly $34.56 billion with 51% of trades being dealer buys.”

Muni yields fell for the sixth consecutive week, “with yields on 10-year notes falling by 1.1 basis points to finish the week at 2.10%,” Wong said.

With yields falling, ratios moved “lower with 10-year notes yielding 59.85% of Treasuries, compared to 62.24% a week ago, and 66.50% a month earlier,” he said. Additionally, the muni curve steepened by 2.9 basis points to 96 basis points, he noted.

Outflows continued, as investors pulled around $256 million from muni mutual funds last week after $92 million of outflows the prior week, according to Refinitiv Lipper.

“We are slowly inching closer to negative territory for muni bond-funds as we are currently at $756 million of outflows for the year,” Wong said.

“With the inflation number coming in lower than what was expected at 5% year-over-year, a sign in which that indicates that the Fed will start to ease after the summer as inflation is trending in the right direction,” he said.

This “pushed yields even lower for the week with the yields falling by an average of 1.8 basis points,” according to Wong.

Munis gained roughly 1.03% for the first two weeks of April, with year-to-date returns at 3.83%. “This has unfortunately caused the muni-Treasury ratio to fall even further to the lowest it’s been in nearly two years,” he said. “Ten-year munis are now yielding around 59.85% when compared to Treasuries, the lowest since June 21, 2021.”

Muni-UST ratios “aren’t at their rock-bottom lowest of the past several years, but they’ve richened significantly since mid-March, making absolute and relative value arguments for the asset class more difficult,” said Eric Kazatsky, head of municipal strategy at Bloomberg Intelligence.

In the coming months, “heavy seasonal cash redemptions … amid stalling new issuance [will] lessen the potential for munis to cheapen,” he said.

For most of the last week, munis were unable to “apply the brakes once in rally mode,” while USTs “turned a corner on weaker pricing around April 6 and haven’t looked back and tax-exempts kept on enjoying stronger bids against the low supply backdrop,” he noted.

During the past five trading days, Kazatsky said “munis appear to have significantly outperformed, while almost all Treasury tenors weakened another 10 bps.”

While the “market saw cuts on [Friday], munis’ performance over the prior week was still positive,” he noted.

Ratios for nearly “all tenors of the municipal yield curve are below 60%, with the 10-year ratio hitting a new one-year low at 59.85% and the very front end dropping to just 49%,” according to Kazatsky.

Investors are left “in somewhat of a quandary” as munis richen, he said.

“If buyers are in strategies that adhere solely to exempt holdings, there’s little to do except to hold their collective noses and proceed forward,” he said. “However, in more flexible strategies that can pivot to taxable alternatives when relative value shifts, it may be time to consider taxable municipal bonds.”

He noted “the same pattern of richening is evident in the ratios of exempts to taxable munis.” “Looking at that ratio in reverse, taxable munis are at some of the cheapest valuations relative to exempts in over a year,” he said.

However, this doesn’t apply across the curve, as the “cheapest options appear to be 10 years and in,” he said.

Secondary trading

California 5s of 2024 at 2.47% versus 2.48% Friday. Maryland 5s of 2024 at 2.40%-2.21% versus 2.40% Friday. Ohio 5s of 2024 at 2.51%.

NYC 5s of 2025 at 2.62% versus 2.80% on 3/14. Triborough Bridge and Tunnel Authority 5s of 2026 at 2.32%. Minnesota 5s of 2026 at 2.18% versus 2.60% on 3/13.

Connecticut 5s of 2030 at 2.30%. Triborough Bridge and Tunnel Authority 5s of 2030 at 2.18%-2.17% versus 2.25% on 4/3. Portland, Oregon, 5s of 2034 at 2.35%-2.31%.

San Jose Financing Authority, California, 5s of 2047 at 3.31% versus 3.24% on 4/6 and 2.43%-2.42% on 3/30. LA DWP 5s of 2052 at 3.44%-3.50% versus 3.67%-3.65% on 3/29 and 3.68% on 3/16. Huntsville, Alabama, 5s of 2053 at 3.63%.

AAA scales

Refinitiv MMD’s scale was cut five to eight basis points: The one-year was at 2.44% (+8) and 2.28% (+5) in two years. The five-year was at 2.13% (+5), the 10-year at 2.15% (+5) and the 30-year at 3.23% (+5) at 3 p.m.

The ICE AAA yield curve was cut five to eight basis points: 2.51% (+8) in 2024 and 2.39% (+78) in 2025. The five-year was at 2.11% (+6), the 10-year was at 2.14% (+5) and the 30-year was at 3.28% (+5) at 4 p.m.

The IHS Markit municipal curve was cut five to eight basis points: 2.43% (+8) in 2024 and 2.27% (+5) in 2025. The five-year was at 2.13% (+8), the 10-year was at 2.13% (+5) and the 30-year yield was at 3.22% (+5), according to a 4 p.m. read.

Bloomberg BVAL was cut four to six basis points: 2.39% (+6) in 2024 and 2.31% (+6) in 2025. The five-year at 2.09% (+5), the 10-year at 2.13% (+5) and the 30-year at 3.22% (+5) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.189% (+9), the three-year was at 3.913% (+9), the five-year at 3.693% (+9), the seven-year at 3.641% (+9), the 10-year at 3.596% (+8), the 20-year at 3.921% (+7) and the 30-year Treasury was yielding 3.808% (+7) at 4 p.m.

Primary market

Illinois (A3/A-/BBB+) is set to price $2.37 billion of taxable and tax-exempt general obligation bonds in four series maturing from 2024 to 2037. Wells Fargo Bank.

Energy Southeast (A1//A+/) is set to price $846.8 million of energy supply revenue bonds in a two-pronged deal consisting of both fixed-rated and index-rate bonds. Morgan Stanley & Co.

The New Jersey Economic Development Authority is set to price $801.5 million of school facilities construction refunding bonds on Thursday, serials, 2024 to 2028, term 2035. Barclays.

The Bay Area Toll Authority is set to price $500 million of toll bridge revenue bonds (A3/AA-/AA-/) and fixed-rated subordinate bonds (A1/AA-/AA-/) Wednesday. BofA Securities.

Austin, Texas, (Aa3/AA-/AA-/) is set to price $428.1 million of electric utility system revenue refunding and improvement bonds, serials 2025 to 2034, terms in 2048 and 2053, Wednesday. Barclays Capital.

Cypress-Fairbanks, Texas, Independent School District is slated to price Tuesday $368.4 million of unlimited tax school building bonds, serials 2024 to 2044 with a term in 2048, insured by the Texas Permanent School Fund Guarantee Program.

Jefferies LLC.

The New Jersey Economic Development Authority (A2/A-/A-/) is set to price $348 million of school facilities construction refunding forward delivery bonds Thursday. Serials 2024 to 2027 with terms from 2033 to 2039. Barclays Capital.

The Ohio Water Development Authority (Aaa/AAA//) is set to price $339 million of water pollution control loan fund refunding revenue bonds on Tuesday. Serial 2024 to 2032. Ramirez & Co.

The Massachusetts Water Resources Authority (Aa1/AA+/AA+/) is set to price $325 million of general revenue and refunding green bonds Wednesday. BofA Securities.

The SSM Health Care Corporation (/A+/AA-/) is set to price $300 million of taxable refunding bonds Tuesday. Bullet maturing 2028. Citigroup Global Markets.

The Missouri Health & Educational Facilities Authority (Aa2/AA//) is set to price Thursday $275 million of health facilities revenue bonds. Bullet maturing 2033. RBC Capital Markets.

Texas (Aaa//) is set to price $250 million of bonds for the Texas Veterans Land Board Wednesday. Jefferies LLC.

The Rockwell, Texas, Independent School District is set to price Thursday $234.1 million of unlimited tax school building bonds and unlimited tax refunding bonds, PSF insured. Jefferies LLC.

The Northside Independent School District is set to price $200 million of variable rate unlimited tax school building bonds, PSF insured. Term 2053. Ramirez & Co.

The Arizona Board of Regents (Aa2/AA//) is set to price $190.33 million of taxable and tax-exempt system revenue bonds on behalf of Arizona State University Wednesday. Tax-exempt Series 2023 A consists of green bonds, and Series 2023 C is taxable. JPMorgan Securities LLC.

The Oklahoma Water Resources Board (/AAA/AAA/) is set to price $175 million of revolving fund revenue bonds for the state’s drinking water program Tuesday. Serials,

2027 to 2043, terms, 2048 and 2053, BofA Securities.

The Frisco, Texas, Independent School District is set to price $150 million of unlimited tax school building and refunding bonds Tuesday. PSF insured. Piper Sandler & Co.

The Ohio Housing Finance Agency (Aaa///) is set to price $149.9 million of non-AMT residential mortgage revenue social bonds Tuesday. J.P. Morgan Securities.

The Northside, Texas, Independent School District (Aaa/AAA//) is set to price Tuesday $136.4 million of unlimited tax school building and refunding bonds. Serials 2024-2025 and 2027 to 2053. PSF insured.Stifel, Nicolaus & Co.

The Jersey City Municipal Utilities Authority is set to price $130 million of project notes on behalf of Hudson County Thursday. Stifel, Nicolaus & Co.

Wake County, North Carolina, (Aa1/AA+/AA+/) is set to price $115.9 million of limited obligation bonds Wednesday. Serials 2024 to 2041. BofA Securities.

Ohio is set to price on behalf of the Ohio Higher Educational Facility Commission (Aa3/AA-//) $108.9 million of climate bond certified higher educational facility green revenue bonds. Morgan Stanley & Co.

The Monmouth County, N.J., Improvement Authority is set to price $104.2 million of government pool loan project notesWednesday. Mature in 2024. Raymond James & Associates.

The Maine State Housing Authority (Aa1/AA+//) is set to price $100 million of mortgage purchase, social bonds. Serials 2026 to 2028, terms, 2043, 2048, and 2053. Barclays Capital.

Competitive:

Boston (Aaa/AAA//) is set to sell $350 million general obligation bonds Thursday.

Boulder, Co., Valley School District #RE-2 (Aa1/AA+//) is set to sell $184.4 million general obligation bonds Tuesday.

Williamson County, Texas, (Aaa//AAA/) is set to sell $150 million of GOs Wednesday.