Kansas governor vetoes ‘irresponsible’ move to flat income tax

2 min read

Kansas Gov. Laura Kelly on Monday vetoed a tax cut bill she said would cost the state $1.3 billion over three years and put funding for public schools at risk.

from S&P Global Ratings for its AA-minus issuer rating, A-plus appropriation-backed debt rating, and AA Kansas Department of Transportation highway revenue bond rating.

The rating agency cited Kansas’ “very strong” combined general fund and budget stabilization fund balance for the revision from a stable outlook and said there was at least a one-in-three chance of rating upgrades over the next two years.

Kansas House Speaker Dan Hawkins said his chamber, which passed the measure with a super-majority vote, intends to override Kelly’s veto.

“In these times of economic uncertainty when Kansans need tax relief more than ever, it’s especially careless and out-of-touch for Governor Kelly to veto this broad, sustainable tax policy that provides tax relief to all Kansans,” he said in a statement.

Hawkins added, the bill provides “income tax relief regardless of income level, a reduction of the tax on Social Security, a faster end to the food sales tax, tax relief for small businesses, a simpler single income tax rate, and a reduction in residential property taxes.”

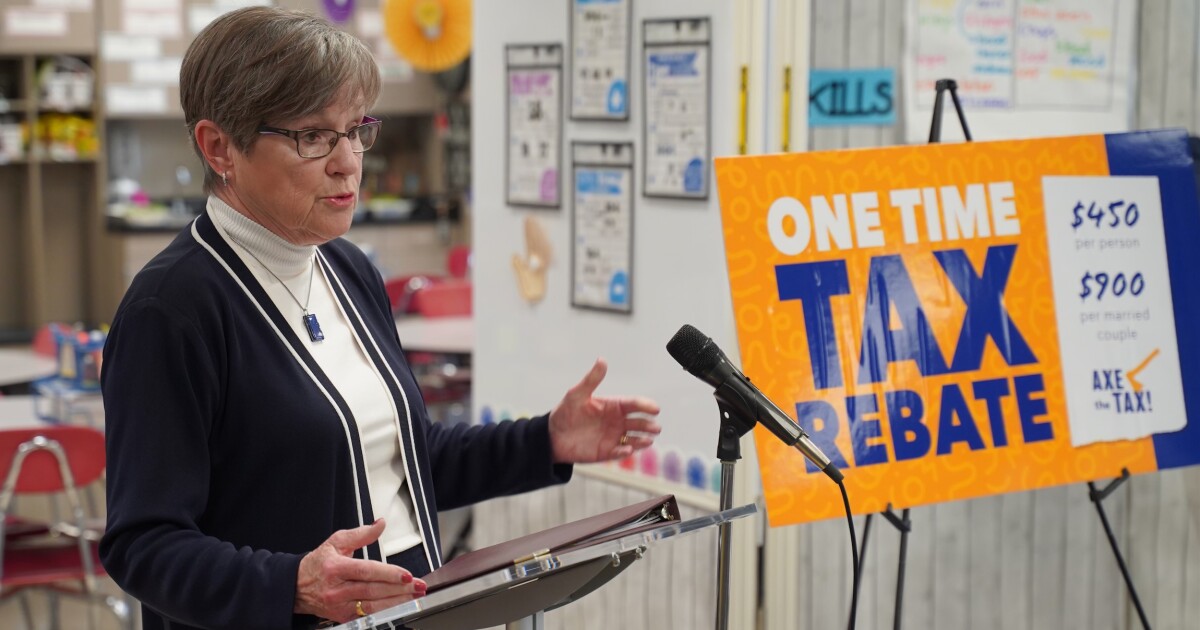

As an alternative, Kelly proposed a one-time $450 rebate for each Kansas taxpayer funded out of the state’s budget surplus.

“Unlike with SB 169, taxpayers would see relief immediately — beginning this summer,” she said at a press conference announcing the veto. “This tax rebate is a way to put this one-time surplus back in the hands of taxpayers in a responsible way that doesn’t put public schools and other critical services at risk in the future.”

On Thursday, the state released a fiscal 2024 general fund revenue estimate of $10.23 billion, which marked a $109 million or 1.1% increase above a November projection. It was based on the expected impact of 2023 legislation that had so far been signed into law.