Taxable munis a ‘bright spot’; outperform tax-exempts

6 min read

While taxable municipal issuance has plummeted year-to-date, a result of continued market volatility and rising interest rates, the sector is outperforming tax-exempts by wide margins.

There is still value for issuers to price taxables and demand from investors in the U.S. and abroad for them is real, market participants said.

“Yields relative to Treasuries for tax-exempt munis are low relative to historical averages, but taxable munis are a bright spot,” said Cooper Howard, director of fixed income strategy at Charles Schwab Center for Financial Research.

Indeed, year-to-date returns for taxable munis are outpacing most other major fixed income categories. The Bloomberg Taxable Municipal Bond Index has returned 0.35% in April and 5.57% year-to-date. Compare that to the broad Municipal Bond Index, which is at negative 0.29% month-to-date and returning 2.47% year-to-date while the High-Yield Index is at positive 0.45% in April and returning 3.20% so far in 2023.

“We would not be surprised if taxables continue to perform well in the near-term,” Howard said.

Yields for taxable municipals are relatively attractive, yet they tend to have longer durations, and rising rates are a potential risk, but the firm believes that longer-term yields may drift sideways, according to Howard.

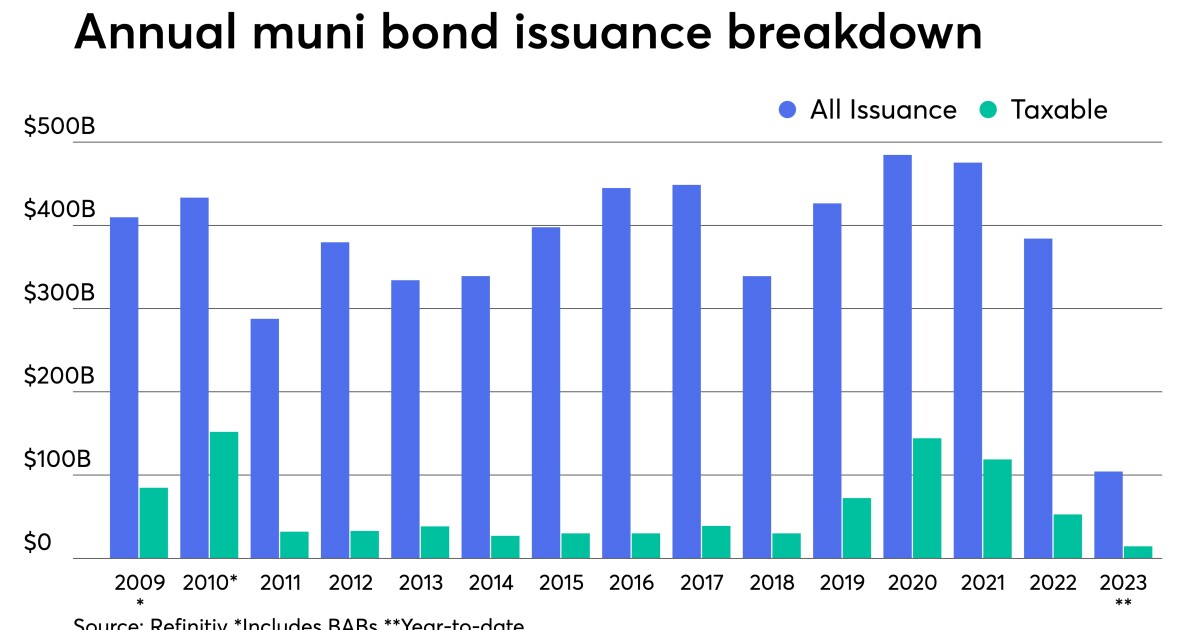

But taxable issuance is down dramatically, falling 56.4% to $52.726 billion in 2022 from $120.835 billion in 2021. The pattern has continued this year, as taxable issuance has decreased to $14.397 billion year-to-date from $24.315 billion last year, or 40.8%.

Total issuance was down 20.5% in 2022 year-over-year, as the muni market saw volume fall to $384.086 billion from 2021’s $483.234 billion. Total issuance is down 25.2% year-to-date, with issuance falling to $107.626 billion from $143.872 billion in the same period of 2022.

Taxable issuance experienced its “heyday” after it replaced tax-exempt advanced refundings due to tax law changes in 2017. It had been a larger part of the market since mid-2019, and topped 30% of all issuance in 2020.

“People back then were refunding tax-exempts with taxables; it was so cheap,” Peter Block, managing director at Ramirez & Co., said. “And that replaced a lot of the advanced refunding activity that we would have had if tax-exempt advanced refunding were permitted.”

However, market volatility over the past year and a half has kept issuers on the sidelines and stymied taxable and refunding volumes. Taxable issuance accounted for 13.7% of all issuance in 2022 and 13.4% of all issuance year-to-date. Block expects taxables to be 10% of total issuance for 2023.

For taxable advanced refundings to make sense in the current market environment, rates would have to fall, but, he said, that probably won’t happen in the near future. While rate increases are tapering off, there are still more Federal Reserve rate hikes ahead.

“Right now, you’re just getting taxable issuance for projects that can’t be funded tax-exempt or are questionable, so they could do taxable to eliminate any potential problems down the road,” he said.

Some firms have already revised their initial forecast for the year. BofA’s prediction of $500 billion of total issuance, $70 billion of which was taxable, was on the higher end of the spectrum. The firm has since revised its prediction for total issuance downward to $400 billion, but did not provide a revised taxable projection.

Barclays predicted issuance would fall to between $400 billion and $420 billion. Taxable issuance would be $40 billion to $50 billion for bonds with muni CUSIPs and $10 billion to $15 billion for corporate CUSIPs. The firm has yet to revise its figures, but Barclays strategist Clare Pickering said that figure may change as taxables are always subject to rates and market volatility.

And while “new-issue supply of taxable municipals will remain suppressed” for the year, Dan Close, head of municipals at Nuveen, said, as 2023 “progresses and interest rates become more range-bound and potentially decline, we could see an uptick in issuance.”

That being said, he noted supply is expected to “remain muted compared to the levels we saw in 2020 and 2021 when U.S. Treasuries were at historically low levels.”

“This low supply environment combined with the solid demand coming from institutional buyers has been a technical tailwind for the market, supporting the strong recovery we’ve seen so far from the October 2022 lows,” Close said.

Wherever taxable issuance ends up, it will be rate policy dependent, but as of late, there has been more issuance, according to Pickering.

One of the largest taxable deals of the year came in early March. Jefferies priced $3.5 billion of taxable bonds for the Texas Natural Gas Securitization Finance Corp.

“The purpose for the issuance of the bonds was to provide customer rate relief to natural gas utility customers,” said Lee Deviney, executive director of the Texas Public Finance Authority, in an email. “The participating natural gas utilities experienced extraordinary costs related to Winter Storm Uri in 2021.” The bonds were issued as taxable as they were not tax-exempt eligible.

“Rates relative to historical levels are attractive for scale issuers in the muni market, [since] then it seems like it’s a good opportunity,” Pickering said.

Market participants also point to interest from investors abroad for taxable munis from an income perspective, because they meet certain regulatory and sustainability requirements.

“Municipal bonds have many applications around the world, not just to top U.S. tax ratepayers,” said James Pruskowski, chief investment officer and head of business development at 16Rock Asset Management LLC, in a report. “Opportunities are driven by the market’s broad and persistent demand, routine supply of credit, favorable capital treatment, and having infrastructure characteristics at corporate equivalent yields.”

Insurers and pension investors globally “should consider taxable municipal bonds, most specifically for regulatory capital-efficiency,” he wrote.

“U.S. taxable municipal bonds are particularly attractive when regulation treats them like corporate bonds,” he said. “They naturally provide insurers with a broader universe of higher-rated debt, thereby receiving a lower credit-risk charge.”

Additionally, municipals finance “vital infrastructure that lend themselves, in general, to the UN Sustainable Development Goals,” Pruskowski said. “Taxable municipal bonds have many positive externalities that also can target various impact initiatives such as sustainability and social.”

Foreign investors typically “represent a substantial share of the investor base that is focused on [environmental, social and governance] bonds, but they are much less active in the muni space compared with other high-quality fixed-income asset classes,” Pickering and fellow Barclays strategists Mikhail Foux and Mayur Patel said.

Such investors focus mainly on taxable bonds, which represent 16% of the ESG-labeled universe, they said.

Close said he sees “interest in taxable munis from both stateside and foreign investors.”

“There are headwinds with certain foreign investors facing higher currency hedging costs,” he said. “But demand remains strong out of the Eurozone and certain Asian investors who are using taxable municipals for asset-liability matching against dollar-based liabilities.”

Domestically, Close said, “interest is building as investors rebalance into more public fixed income due to elevated yields and recession risks.”

He noted a common theme “across the board is that following the municipal market’s resiliency during the COVID-19 pandemic, investors are looking to add to the asset class as recession risks become elevated.”

Market participants also said there is still value for issuers to price taxables.

“There is structural value in building an institutional buyer base by issuing taxable municipal bonds,” Close said.

“We have seen that issuers like to have diversity of investors that they can tap into in different market environments,” he said. “Additionally, issuers have more flexibility with their issuance proceeds in the taxable market for new capital projects and are required to issue advance refunding deals through the taxable municipal market.”

Block added there is still value in pricing taxables, especially if issuers need to come to market immediately. However, he noted, more issuers may try to avoid taxable issuance or forward refundings with tenders of tax-exempts, as Wisconsin did Thursday. In this rate environment, “issuers are trying to do shorter term in hopes that in a couple of years, rates will be lower.”

Despite the challenges, Block said there will always be demand for new-money taxables, as there will be a need to fund non-exempt projects or portions of projects that can’t be funded with tax-exempt proceeds.

But even with billion-dollar taxable deals pricing, Pickering said she would stop short of saying there’s still a “huge pipeline” for taxables.

“That’s hard to judge because you could have something ready, and then volatility kicks in or policy changes,” Pickering said.

Christine Albano contributed to this report.