Bitcoin on-chain data shows miners offloading BTC as revenues shrink

2 min read

Bitcoin’s on-chain data provides evidence that Bitcoin miners are offloading their holdings. The factors influencing the selling pressure could be reduced earnings from a cooldown in Ordinals activity as well as mining difficulty and hash rate reaching an all-time high.

According to on-chain analytics firm Glassnode, “Miners have been sending a significant amount of coins to exchanges.”

Glassnode data shows Bitcoin (

Identifying miners’ stress levels

Currently, the cost of producing Bitcoin for the existing mining hardware lies between $35,532 and $21,244. With Bitcoin’s price holding above $25,000, the downtrend in Bitcoin’s mining hash rate could be limited.

However, if the situation worsens over the summer and the mining cost increases without a proportionate increase in the BTC price, the industry could fall back into capitulation mode, marked by accelerated BTC selling and a reduced network hash rate.

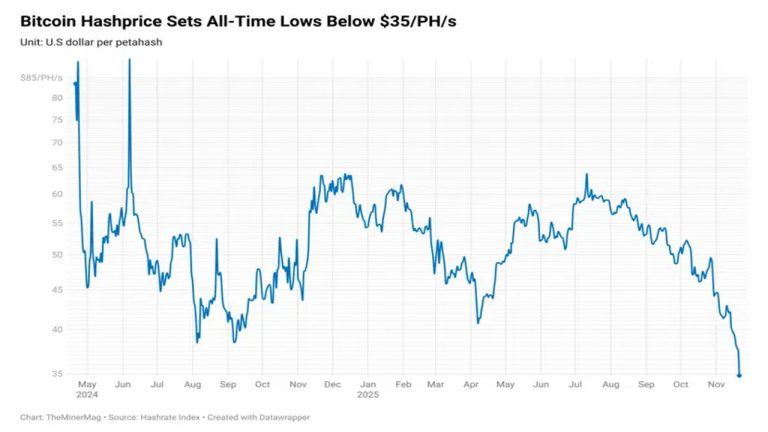

Moreover, while Bitcoin’s hash rate has continued to rise, Bitcoin’s hash price metric — the market value assigned per unit of hashing power — declined significantly in May, suggesting a cooldown in demand for mining hardware.

According to an update from Hashrate Index, the “hashprice [PH] is back below $70.00/PH/day for the first time since mid-March” after touching an average of $82.23 per PH per day in May, a 14.8% decline.

It remains to be seen how far the sell-off extends and whether or not Bitcoin Ordinals activity comes back in the meantime.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.