Munis steady, UST yields rise after FOMC minutes show more hikes

6 min read

Municipals were little changed Wednesday as U.S. Treasuries were weaker after the release of the Federal Open Market Committee meeting minutes showed more tightening is likely on the way. Equities were in the red to close the session.

The secondary was uneven but triple-A yield curves were mostly steady, as municipals are wont to do on Fed data release days, especially in a holiday-shortened week, while UST saw yields rise by two to seven basis points. Municipal to UST ratios fell as a result. The two-year muni-to-Treasury ratio Wednesday was at 59%, the three-year at 61%, the five-year at 62%, the 10-year at 65% and the 30-year at 89%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 59%, the three-year at 61%, the five-year at 61%, the 10-year at 67% and the 30-year at 92% at 4 p.m.

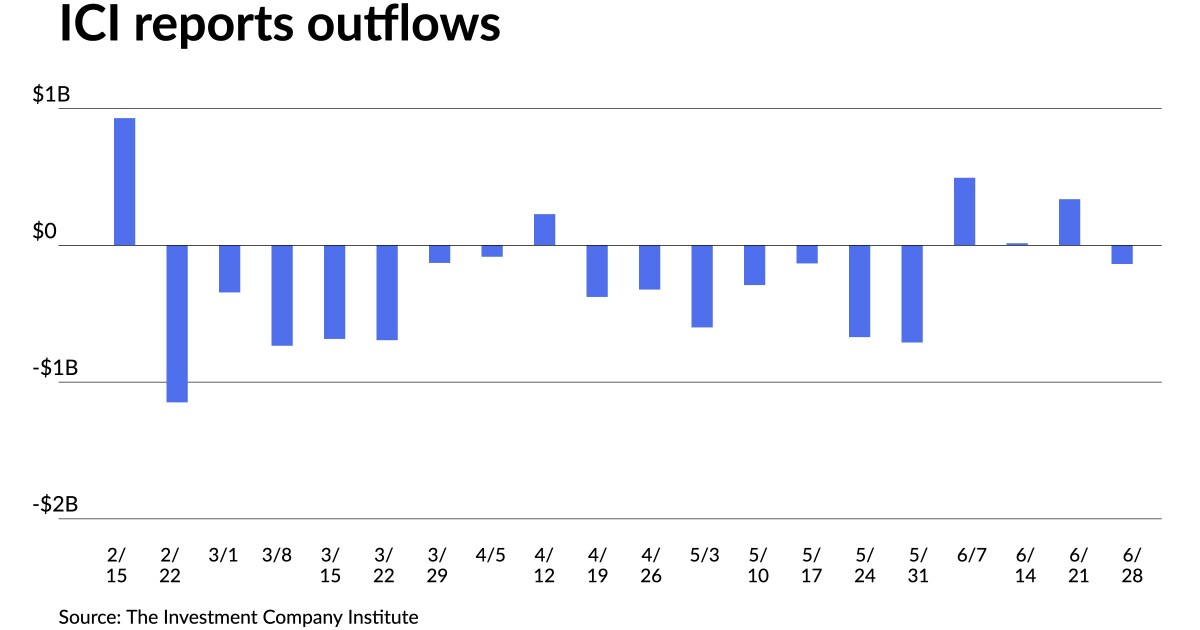

The Investment Company Institute reported investors pulled $136 million from municipal bond mutual funds in the week ending June 28, after $338 million of inflows the previous week. Exchange-traded funds saw inflows of $114 million after $884 million of inflows the week prior.

It’s been “one step forward, two steps back for municipal bond investors this year,” said Lawrence Gillum, chief fixed income strategist for LPL Financial.

Munis started the year out strong — one of the best Januarys in recent memory — but things quickly turned around with one of the worst Februarys on record.

Since then, he said monthly returns have been uneven.

“The muni curve is almost always steeper than the Treasury curve due to uncertainty about future tax rates, as well as strong demand from individuals for bonds maturing within 10 years, and because longer-dated issuance is normally tied to the expected life of an individual project,” he said.

This is still true, he noted, but for “the first time in decades the municipal bond yield curve is inverted … [with] shorter maturity muni securities yielding more than some longer maturity securities.”

Recent data from the Federal Reserve showed that “the total market value of the municipal market increased by 1.9% in the first quarter to $4 trillion,” Gillum noted.

Retail ownership at 66% continues to be the largest ownership category of municipal bonds, followed by banks at 15% and insurance companies at 11%, he said.

“While total yields for muni securities have increased and may be attractive to retail investors, the relative value proposition of munis still isn’t very compelling for banks and/or insurance companies, so the market is unlikely to get additional crossover support from those investors,” he said.

For the second half of the year, he said muni performance “will likely be aided (or not) by the appetite of retail investors.”

Outflows have mostly continued this year though not near the degree of the records seen in 2022, he said.

Despite still strong fundamentals and improved valuations, Gillum said “muni investors have, so far, been unwilling to stay the course.”

After skipping a rate hike at the June Federal Open Market Committee meeting, the Fed has said additional rate hikes are possible for this year.

“Munis, which can provide additional tax-exempt income in higher-rate environments, have generated attractive after-tax returns at the end of Fed rate hiking campaigns,” he said.

Over these last four hiking cycles, Gillum said that “munis averaged a 9.0% after-tax return over the 12-month period after the Fed was done raising rates.”

The Fed is likely to hike rates one or two more times, but it is nearing the end of its tightening cycle, he said.

“Once the Fed is done, we could see lower yields before the Fed even starts to cut rates,” he said. “As such, investors may want to take advantage of longer maturity yields before they are gone.”

Despite munis outperforming “a number of taxable fixed income markets this year, after the historically bad year last year, it probably hasn’t been the year (so far) that many muni investors had hoped for,” he said.

But, as the Fed approaches the end of its rate hiking campaign, “we could see a smoother path for munis in the second half of the year,” Gillum said.

Despite a slowing economy, fundamentals, compared to history, are still strong, he noted.

And while tax revenues may have peaked, he said “high cash balances and reserves should allow most issuers to adapt to an economic slowdown.”

Total yields are still “above longer-term averages and since starting yields are the best predictor of future returns (over longer horizons), we think the prospects of solid returns for munis have improved (no guarantees of course),” he said.

Secondary trading

Ramsey County, Minnesota, 5s of 2024 at 3.06% versus 3.06% on 6/28. Austin, Texas, 5s of 2025 at 2.96%. Utah 5s of 2026 at 2.78% versus 2.81% on 6/12 and 2.83% on 6/9.

DC 5s of 2028 at 2.69%. Georgia 5s of 2029 at 2.60%. Texas 5s of 2030 at 2.72%-2.70% versus 2.75% on 6/22.

Georgia 5s of 2033 at 2.56% versus 2.51% on 6/28. Triborough Bridge and Tunnel Authority 5s of 2033 at 2.84% versus 2.84%-2.86% Monday and 2.88% original on 6/29. Maryland Stadium Authority 5s of 2034 at 2.95% versus 3.06%-3.04% on 6/7 and 3.07%-3.05% on 6/6.

Massachusetts 5s of 2048 at 3.77% versus 3.76%-3.78% Monday and 3.76%-3.81% on 6/29. LA DWP 5s of 2049 at 3.63% versus 3.63% on Friday and 3.57% on 6/23. Indiana Finance Authority 5s of 2053 at 4.07%-4.11% versus 4.07% Monday and 4.06% Friday.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.05% and 2.92% in two years. The five-year was at 2.62%, the 10-year at 2.56% and the 30-year at 3.49% at 3 p.m.

The ICE AAA yield curve was mixed: 3.01% (-1) in 2024 and 2.95% (-1) in 2025. The five-year was at 2.60% (-1), the 10-year was at 2.56% (flat) and the 30-year was at 3.55% (+1) at 4 p.m.

The IHS Markit municipal curve was unchanged: 3.05% in 2024 and 2.93% in 2025. The five-year was at 2.62%, the 10-year was at 2.56% and the 30-year yield was at 3.49%, according to a 3 p.m. read.

Bloomberg BVAL was cut up to a basis point: 3.00% (+1) in 2024 and 2.90% (unch) in 2025. The five-year at 2.60% (+1), the 10-year at 2.53% (unch) and the 30-year at 3.51% (unch) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.938% (+1), the three-year was at 4.605% (+3), the five-year at 4.243% (+5), the 10-year at 3.935% (+8), the 20-year at 4.158% (+8) and the 30-year Treasury was yielding 3.936% (+7) near the close.

Primary to come:

The Dallas Housing Finance Corp. is on the day-to-day calendar with $146.608 million of Fitzhugh Urban Flats social residential development revenue bonds, consisting of $71.985 million of senior lien bonds, Series 2023-A1; serial 2063, $55.115 of senior lien bonds, Series 2023-A2, serial 2063; and $19.508 million of convertible capital appreciation mezzanine lien bonds, Series 2023B, serial 2063. Citigroup Global Markets.

The corporation is also on the day-to-day with $120.300 million of Midtown Park residential development revenue bonds, consisting of $89 million of Series 2023A and $31.300 million of Series 2023B. Goldman Sachs.

The Dickinson Independent School District, Texas (Aaa/AAA//), is set to price Thursday $110.005 million of PSF-insured unlimited tax schoolhouse bonds, Series 2023, serials 2025-2053. Wells Fargo Bank.

The Mississippi Home Corp. (Aaa///) is set to price Thursday $99.850 million of single-family mortgage revenue bonds, consisting of $70 million of non-AMT bonds, Series 2023C, serials 2028-2035, terms 2038. 2043, 2048; and $29.850 million of taxables, Series 2023D, serials 2024-2028, term 2053. Raymond James & Associates.

The Montana Board of Housing (Aa1/AA+//) is set to price Thursday $32 million of non-AMT single-family mortgage bonds, 2023 Series A, serials 2024-2035, terms 2038, 2043, 2048, 2053, 2053. RBC Capital Markets.

Competitive

The Nauset Regional School District, Massachusetts, is set to sell $91 million of unlimited tax GO school bond anticipation notes at 11 a.m. eastern Thursday.

The Fairport Central School District, New York, is set to sell $48.165 million of GO bond anticipation notes, Series 2023, at 11:15 a.m. Thursday.

Jersey City, New Jersey, is set to sell $45.926 million of taxable COVID-19 special emergency notes, Series 2023B, at 11:15 a.m. Thursday.

East Brunswick Township, New Jersey, is set to sell $45.360 million of bond anticipation notes, consisting of $26.760 million of bond anticipation notes and $18.600 water utility bond anticipation notes, at 11:30 a.m. Thursday.

Somerset County, New Jersey, is set to sell $38.962 of GOs, consisting of $35 million of general improvement bonds, Series 2023A; $1.966 million of county college bonds, Series 2023B; and $1.966 county college bonds, Series 2023C, at 11 a.m. Thursday.

The Guilderland Central School District, New York, is set to sell $29.499 million of bond anticipation notes at 10:30 a.m. Thursday.