Munis steady ahead of FOMC; Washington GOs sell to good reception

6 min read

Municipals were little changed in secondary trading Tuesday as the focus was on the primary where the state of Washington sold large general obligation bond deals ahead of the FOMC rates decision. Treasury yields rose a basis point or two throughout most of the curve and equities ended the session in the black.

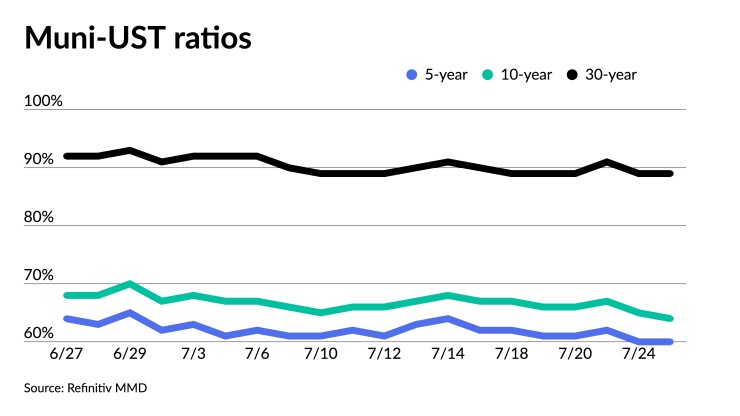

The two-year muni-to-Treasury ratio Tuesday was at 58%, the three-year at 59%, the five-year at 60%, the 10-year at 64% and the 30-year at 88%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 59%, the three-year at 60%, the five-year at 60%, the 10-year at 64% and the 30-year at 88% at 4 p.m.

With this week’s calendar below $6 billion and non-exchanged-traded fund mutual fund flows minimal “despite a recovering NAV story since the beginning of the month, bonds could be again primed for resilience if the Fed does raise, solid gains if it doesn’t,” said Matt Fabian, partner at Municipal Market Analytics.

The offered side, he said, “has continued to pack the primary market with value to manage their (and the market’s) potential downside if disruption did occur; this also helps the context for muni buyers headed into the Fed.”

The muni market is “very technically driven” right now, said Craig Brandon, co-head of municipals at Morgan Stanley Investment Management.

However, he noted that both sides of the technical equation — fund flows and issuance — are “weak.”

Muni mutual funds have seen $7.1 billion of outflows year-to-date, according to Refinitiv Lipper. At this time last year, muni mutual funds saw $47.3 billion of outflows.

Meanwhile, the first half of the year saw issuance fall 20% year-over-year.

“From a technical perspective, the market’s hanging in there because the two pieces of technicals that drive the market, neither of them are really doing it,” he said. “However, what everyone’s been waiting for all year long to see if one of those two sides of technicals becomes unbalanced.”

If there is a large amount of flows into the market, there could be a “gap up” in prices, unless “there’s some issuance on the other side,” according to Brandon.

At the same time, if issuance significantly picks up, and there are not flows to balance that, then “maybe we can trade off and become a little more fair value versus Treasuries.”

“If one of those becomes unbalanced, it could tilt the market in either direction,” he said.

Brandon does not foresee much excitement on the issuance front happening for the rest of the summer, but there could be a “pipeline of deals” that could hit the market all of a sudden after Labor Day.

“There is certainly no shortage of deployable cash and once rates stabilize, we should expect to see more consistent inflow activity,” said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

Even with tempered rate volatility, he said “new-issue volume will likely be lower year-over-year at year-end, at or close to a 20% delta.”

For now, Lipton noted “a net-negative supply backdrop should promote technical support for municipal bonds, and it is this support that will drive performance through the balance of the year.”

New-money issuance “should eclipse refunding volume as the rate environment will not likely provide fertile ground to transact municipal refundings, yet we can still expect to see year-over-year monthly declines in both new-money and refunding issuance,” he added.

Muni credit has also held up quite well, “with upgrades surpassing downgrades and defaults largely confined to inherently weaker sectors of the market, such as senior living, conduit housing and project finance,” he said.

“Prior rounds of stimulus funds have provided issuers with operational and financial flexibility, but as that pipeline closes, many can rely upon strong, albeit softening in places, revenue collections and ample reserve balances,” he said.

In the competitive market Tuesday, Washington (Aaa/AA+/AA+/) sold $381.580 million of motor vehicle fuel tax and vehicle-related fees GOs, Series 2024B, to BofA Securities with 5s of 6/2024 at 3.1%, 5s of 2028 at 2.6%, 5s of 2033 at 2.63%, 5s of 2038 at 3.18%, 5s of 2043 at 3.50%, and 5s of 2048 at 3.76%, callable 6/1/33.

The state also sold $347.615 of various purpose GOs, Series 2024A – Bid Group 1 to BofA Securities, with 5s of 8/2027 at 2.65%, 5s of 2028 at 2.6%, 5s of 2033 at 2.63%, 5s of 2038 at 3.18%, and 5s of 2040 at 3.28%, callable 8/1/2033.

The state $344.630 million of various purpose GOs, Series 2024A – Bid Group 2 to Citigroup Global Markets, with 5s of 8/2041 at 3.35%, 5s of 2043 at 3.45%, and 5s of 2048 at 3.75%, callable 8/1/2033.

Additionally, the state sold $55.105 million of taxable GOs, Series 2024T, to KeyBanc Capital Markets, with 5s of 8/2024 at 5.15% and 4/45s of 2027 at par, noncall

The state last sold $1.3 billion of GOs in four deals on April 26. Spreads were similar to today’s, tightening slightly on bonds 10 years and in and slightly wider out long.

In April, the state saw 5s of 2025 at 2.95% (+11), 5s of 2028 at 2.42% (+12), 5s of 2033 at 2.45% (+13) and 2038 at 3.10% (+ 17).

Today, the state saw 5s of 2025 at 2.66% (+7), 5s of 2028 at 2.60% (+9), 5s of 2033 at 2.63% (+18) and 5s of 2038 at 3.18% (+19).

Elsewhere in the competitive market, Miami-Dade County, Florida (Aa2/AA//), sold $172.385 million of capital asset acquisition special obligation bonds, Series 2023A, to Morgan Stanley, with 5s of 4/2024 at 3.13%, 5s of 2028 at 2.73%, 5s of 2033 at 2.78%, 5s of 2038 at 3.30%, 5s of 2043 at 3.63% and 5s of 2048 at 3.89%, callable 4/1/2032.

In the negotiated market, Goldman Sachs priced for the Black Belt Energy Gas District, Alabama (A2///), $598.21 million of gas project revenue refunding bonds, 2023 Series D. The first tranche, $581.760 million of fixed-rate bonds, 2023 Series D-1, saw 5.5s of 6/2049 price at 4.50%, callable 11/1/2028.

The second tranche, $16.450 million of SOFR Index Rate bonds, 2023 Series D-3, saw 6s of 6/2049 price at par, callable 11/1/2028.

Citigroup Global Markets priced for the National Finance Authority (/BBB//) $270.251 million of social municipal certificates, Series 2023-2 Class A, saw 3.875s of 1/2038 at 4.649%.

BofA Securities priced for the City and County of Denver (Aa1/AA+/AA+/) $245.080 million of Wellington E. Webb Municipal Office Building certificates of participation, Series 2023, with 5s of 12/2023 at 3.19%, 5s of 2028 at 2.67%, 5s of 2033 at 2.79%, and 5s of 2037 at 3.15%, callable 12/1/2033.

FHN Financial Capital Markets priced for the Royse City ISD, Texas (Aaa//AAA/) $185.895 million of PSF-insured unlimited tax school building bonds, Series 2023, with 5s of 2/2030 at 2.81%, 5s of 2033 at 2.85%, 5s of 2038 at 3.24%, 5s of 2043 at 3.63%, 5s of 2048 at 3.86% and 5s of 2053 at 3.96%, callable 2/15/2033.

Secondary trading

Wisconsin 5s of 2024 at 3.07% versus 3.10% Monday. Arlington waters, Texas, 5s of 2025 at 3.08%. Maryland 5s of 2026 at 2.79% versus 2.82% Monday.

Washington 5s of 2028 at 2.61%. NYC 5s of 2028 at 2.69%. Wisconsin 5s of 2029 at 2.54%-2.53%.

Battery Park City Authority, New York, 5s of 2031 at 2.45%-2.42% versus 2.40% Monday and 2.63% on 7/10. Triborough Bridge and Tunnel Authority 5s of 2033 at 2.71%-2.69% versus 2.71%-2.69% Wednesday and 2.79%-2.80% on 7/17. California 5s of 2034 at 2.59% versus 2.67% on 7/5.

NYC TFA 5s of 2053 at 3.90% versus 3.90%-3.89% Monday and 3.89% original on Thursday. Massachusetts 5s of 2053 at 3.80%-3.79% versus 3.78%-3.75% Friday and 3.76% Thursday.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.02% and 2.85% in two years. The five-year was at 2.52%, the 10-year at 2.50% and the 30-year at 3.46% at 3 p.m.

The ICE AAA yield curve was cut at one and two years: 3.02% (+3) in 2024 and 2.91% (+1) in 2025. The five-year was at 2.49% (flat), the 10-year was at 2.47% (flat) and the 30-year was at 3.47% (flat) at 4 p.m.

The IHS Markit municipal curve was unchanged: 3.02% in 2024 and 2.85% in 2025. The five-year was at 2.52%, the 10-year was at 2.51% and the 30-year yield was at 3.47%, according to a 3 p.m. read.

Bloomberg BVAL was little changed: 2.94% (+1) in 2024 and 2.83% (unch) in 2025. The five-year at 2.50% (unch), the 10-year at 2.45% (unch) and the 30-year at 3.45% (+1) at 4 p.m.

Treasuries were slightly weaker outside of two years.

The two-year UST was yielding 4.874% (-4), the three-year was at 4.529% (+2), the five-year at 4.172% (+2), the 10-year at 3.895% (+2), the 20-year at 4.143% (+2) and the 30-year Treasury was yielding 3.940% (+1) near the close.

Primary to come:

The Medina Valley Independent School District, Texas (/AAA//), is set to price Thursday $363.690 million of PSF-insured unlimited tax school building bonds, Series 2023, serials 2026-2053. Raymond James & Associates.

The North Carolina Housing Finance Agency (Aa1/AA+//) is set to price Wednesday $199 million of non-AMT social home ownership revenue bonds, Series 51, serials 2024-2035, terms 2038, 2043, 2048, 2054. RBC Capital Markets.

The Charleston Educational Excellence Financing Corp., South Carolina (Aa3/AA-//), is set to price Thursday on behalf of the Charleston County School District $142.535 million of installment purchase revenue refunding bonds, Series 2023, serials 2023-2026, 2028. Wells Fargo Bank.

The Denison Independent School District, Texas (Aaa/AAA//), is set to price Thursday $131.405 million of PSF-insured unlimited tax school building and refunding bonds, Series 2023, serials 2024-2050. Raymond James & Associates.

The Minnesota Housing Finance Agency (Aa1/AA+//) is set to price Thursday $130 million of taxable social residential housing finance bonds, Series 2023J, serials 2023-2033, terms 2038, 2043, 2047, 2053. RBC Capital Markets.

Christina Baker contributed to this story.