Munis close out steady while July jobs report sends USTs rallying

8 min read

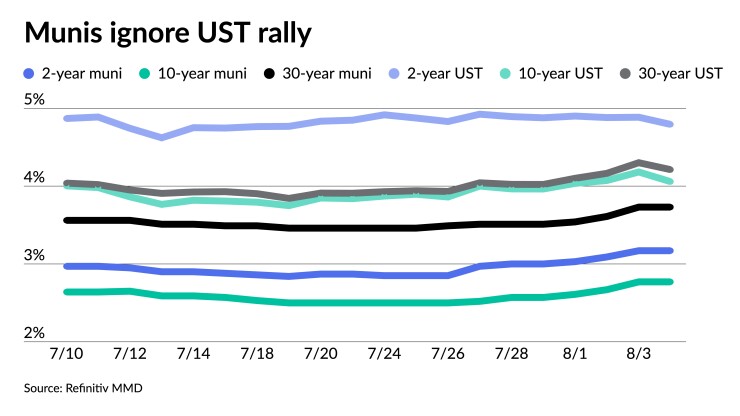

Municipals were steady Friday, sitting out a U.S. Treasury rally after the jobs report showed the labor market continues to cool. Equities ended the session down.

Triple-A yields were largely unchanged across all curves while UST yields fell up to 15 basis points. Muni to UST ratios rose as a result.

The two-year muni-to-Treasury ratio Friday was at 66%, the three-year at 67%, the five-year at 68%, the 10-year at 68% and the 30-year at 88%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 64%, the three-year at 66%, the five-year at 65%, the 10-year at 66% and the 30-year at 87% at 4 p.m.

The U.S. economy “should continue to gradually weaken as the labor market softens,” said Edward Moya, senior market analyst at The Americas OANDA.

July’s job report was mixed, but he noted it “still keeps soft landing hopes alive.”

There were 187,000 jobs added to the economy, “while wage pressures heated up, and as the unemployment rate dipped to 3.5%,” he said.

This jobs report still supports “the argument that the Fed is done raising rates, but everyone will still need to keep their eyes on wages,” Moya said.

The argument can still be made by Wall Street “that the labor market is still too tight as average hourly earnings remain hot, but that should start to weaken going forward,” he said.

The jobs report was another “soft landing-ish” report, said Jeffery Cleveland, principal and chief economist at Payden & Rygel.

Overall, he said the July jobs report “doesn’t change anything for my view — job growth is moderating but is still pretty strong (same story for more than a year), the unemployment rate is near cycle lows, wage growth is decent but nothing alarming.”

This, he said, is “consistent with the soft landing scenario for the time being.”

One more rate hike is “penciled in for the fall bringing the fed funds rate to 5.5%-5.75%,” he said.

While USTs rallied following the release of the jobs report, they sold off earlier in the week “due to an economic soft landing and Fitch’s downgrade of the U.S. sovereign credit rating” which caused munis to retrace a little more than 50% of their entire rally since October 2022, noted BofA strategists in a weekly report.

Muni credit spreads moved lower and should continue to do so, they said.

“It seems that investor focus is shifting away from economic data and central bank action,” Barclays PLC strategists said in a weekly report. “Although today’s non-farm payrolls release received a lot of attention, it was slightly better than expectations, resulting in a relatively muted market reaction despite more and more market participants starting to think about a soft landing scenario.”

Investors are shifting their attention to this week’s refunding announcement from the U.S. Treasury Department “confirmed the view that the worsening fiscal profile, coupled with the Treasury’s desire to keep the share of T-bills within historical ranges, implies a sharp increase in the supply of notes and bonds over the coming quarters,” they said.

After this week’s move, 10- and 30-year Treasury yields got very close to their multi-year highs last reached in October, Barclays noted.

“Last week when we already thought that the muni market started to look vulnerable, it was even prior to this week’s double whammy of a rate sell-off, coupled with heavy issuance,” Barclays said. “Tax-exempts were not fully able to keep up with UST yields, and MMD-UST ratios got extremely rich as a result (trading at the very low end of the 18-month range), while credit spreads actually continued tightening for lower-rated IG credits as well as for HY.”

In just one week, the investment grade muni index lost nearly 1%, and the high-yield index lost even more than that, they said.

“Even though supply for the remainder of August should be relatively subdued, next week will be heavy enough,” they said. “We feel that some deals might struggle, as municipals remain quite vulnerable at the moment, more so if rate volatility persists.”

Late summer, they said, is “rarely a good time for our asset class”: the investment grade index lost money in August three years in a row, and 2023 seems to follow this trend.

“Even if rates stabilize, munis got rich enough and will take some time to adjust to the fair values, which should negatively affect secondary activity, in our view,” they wrote. “Moreover, fund flows are sensitive to rate volatility, and we would not be surprised if we were to see outflows yet again, which would also likely keep investors on the sidelines.”

The muni market environment will likely become “quite difficult in August, and possibly even in early September. Thus, investors should remain light and defensive in the coming weeks,” they added.

BofA noted they previously forecasted August issuance of $36 billion, and total principal redemption and coupon payments as high as $62 billion.

“While the current selloff may put our August issuance forecast at risk, the imbalance should keep muni-Treasury ratios low, easing some pressure on munis amid the current Treasury market selloff,” they said. “Overall, we would view the current selloff as an opportunity.”

JB Golden, executive director and portfolio manager at Advisors Asset Management, said seasonal influences are impacting the current market.

“With heavy July reinvestment demand making it difficult to source bonds, lackluster supply and stretched valuations, the market seems a little worn out,” Golden said on Thursday.

“There continues to be opportunities to pick your spots, but the overall environment is certainly less appealing than it was 60 days ago,” he added.

However, at the same time, Golden expects the impact of strong summer technicals to begin to fade in the near term.

“We expect the interest rate backdrop to play a larger role,” he explained.

“August, at this point, is expected to be one of the higher volume months of the year, municipal-to-Treasury ratios could begin to move higher as we move from summer to fall, and we are beginning to see pressure in rates to the upside,” Golden continued.

Bond Buyer 30-day visible supply is at $10.06 billion.

While the end of the tightening cycle seems to be in view, it likely could entail another round or two of hikes and the market might have not yet priced in the full lagging impact of a 5.5%-plus Fed Funds rate, Golden suggested.

“For municipal investors this could spell opportunity for higher yields as we move into fall,” he added.

Calendar stands at $6.4B

For the coming week, investors will be greeted with a new-issue calendar estimated at $6.434 billion.

There are $5.615 billion of negotiated deals on tap and $818.4 million on the competitive calendar.

The negotiated calendar is led by $1.02 billion of GOs from New York City, followed by $798 million of revenue bonds from the Washington Metropolitan Area Transit Authority and $704 million of revenue bonds from the Sports Authority of the Metropolitan Government of Nashville & Davidson County.

Oyster Bay will lead the competitive calendar with $125 million of bond anticipation notes on Thursday.

Secondary trading

Connecticut 5s of 2024 at 3.45%-3.36%. California 5s of 2024 at 3.17%. Minnesota 5s of 2025 at 3.19%-3.18% versus 3.21% Thursday.

NYC 5s of 2028 at 2.99%-2.98%. Texas 5s of 2028 at 3.07%-3.02%. California 5s of 2028 at 2.82%-2.79%.

Maryland 5s of 2032 at 2.71% versus 2.60% Wednesday. Minnesota 5s of 2033 at 2.85% versus 2.70% original on Wednesday. Georgia 5s of 2034 at 2.91%-2.88% versus 2.67% Monday and 2.69%-2.70% on 7/27.

Massachusetts 5s of 2048 at 4.02% versus 4.03%-4.02% Thursday and 3.78%-3.68% Monday. Washington 5s of 2048 at 3.97% versus 3.75% original on 7/26. NYC TFA 5s of 2053 at 4.18%-4.11% versus 4.20% Thursday and 4.05%-4.12% Wednesday.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.33% and 3.17% in two years. The five-year was at 2.84%, the 10-year at 2.77% and the 30-year at 3.73% at 3 p.m.

The ICE AAA yield curve was bumped up to one basis point: 3.30% (unch) in 2024 and 3.18% (-1) in 2025. The five-year was at 2.81% (-1), the 10-year was at 2.74% (-1) and the 30-year was at 3.73% (-1) at 4 p.m.

The S&P Global Market Intelligence (formerly IHS Markit) municipal curve was unchanged: 3.34% in 2024 and 3.17% in 2025. The five-year was at 2.84%, the 10-year was at 2.78% and the 30-year yield was at 3.72%, according to a 3 p.m. read.

Bloomberg BVAL was cut up to one basis point: 3.23% (+1) in 2024 and 3.12% (unch) in 2025. The five-year at 2.79% (+1), the 10-year at 2.73% (unch) and the 30-year at 3.73% (unch) at 4 p.m.

Treasuries rallied.

The two-year UST was yielding 4.781% (-10), the three-year was at 4.460% (-12), the five-year at 4.147% (-15), the 10-year at 4.048% (-13), the 20-year at 4.375% (-11) and the 30-year Treasury was yielding 4.206% (-9) near the close.

Primary to come

New York City (Aa2/AA/AA/AA+.) is set to price Wednesday $1.015 billion of GOs, consisting of $950 million of Series Fiscal 2024A, serials 2025-2047, term 2053, and $65.460 million of Series 2012, Subseries G-5, serials 2028-2040. Loop Capital Markets.

The Washington Metropolitan Area Transit Authority (/AA//AA/) is set to price Tuesday $797.800 million of second lien dedicated revenue sustainability climate transition bonds, Series 2023A, serials 2024-2053. Wells Fargo.

The Sports Authority of the Metropolitan Government of Nashville & Davidson County (A1/AA//AA+/) is set to price Wednesday $703.860 million of stadium project revenue bonds, consisting of $344.940 million of senior bonds, Series 2023A; $84.925 million of subordinate bonds, Series 2023B; $56.830 million of non-tax revenue pledges, Series 2023C; and $217.365 million of taxable non-tax revenue pledges, Series 2023D.

The Triborough Bridge and Tunnel Authority (Aa3/AA-/AA-/AA) is set to price Tuesday $369.905 million of general revenue bonds, consisting of $300 million of new-issue bonds, Series 2023B-1, serials 2034-2045, terms 2048, 2053; and $69.905 billion of refunding bonds, Series 2023B-2, serials 2024-2030. Siebert Williams Shank & Co.

The Texas Public Finance Authority (/AAA/AAA/) is set to price Wednesday $366.300 million of taxable GO and refunding bonds, Series 2023, serials 2024-2038, term 2043. Ramirez & Co.

The Pecos-Barstow-Toyah Independent School District, Texas (/AAA//), is set to price Thursday $300 million of PSF-insured unlimited tax school building bonds, Series 2023, serials 2024-2043. RBC Capital Markets.

The City and County of Honolulu (/AA+/AA+/) is set to price Wednesday $265.845 million of GOs, consisting of $76.410 million of Series 2023A, serials 2024-2048; $22.890 million of Series 2023B, serials 2024-2032; $26.085 million of Series 2023C, serials 2024-2048; and $140.460 million of Series 2023D, serials 2025-2031. BofA Securities.

Harris County, Texas (Aaa///AAA), is set to price Tuesday $216.295 million of refunding bonds, consisting of $122.160 million of permanent improvement bonds, Series 2023A, serials 2025-2043, term 2048; and $94.135 million of unlimited tax road bonds, Series 2023A, serials 2025-2043, term 2048. Siebert Williams Shank & Co.

The Iowa Student Loan Liquidity Corp. (/AA//) is set to price Tuesday $172.330 million of senior student loan revenue bonds, consisting of $106.790 million of taxable bonds, Series 2023A, serial 2043, term 2033; and $65.540 million of AMT bonds, Series 2023B, serials 2026-2033. RBC Capital Markets.

The Chandler Industrial Development Authority, Arizona (A2/A//), is set to price Tuesday $156.560 million of non-AMT Intel Corp. project industrial development revenue bonds, Series 2005. J.P. Morgan.

The authority is also set to price Tuesday $125 million of Intel Corp. project AMT industrial development revenue bonds, Series 2007. J.P. Morgan.

The Hutto Independent School District, Texas (Aaa/AAA//), is set to price Tuesday $146.040 million of $300 million of PSF-insured unlimited tax school building bonds, Series 2023, serials 2024-2053. Baird.

The Oregon Business Development Commission is set to price $141.855 million of non-AMT Intel Corp. project recovery zone facility bonds, Series 232.

The Washington State Housing Finance Commission (//A-/) is set to price Wednesday $118.175 million of Emerald Heights Project nonprofit housing revenue and refunding revenue bonds, consisting of $88.775 million of Series 2023A, $7 million Series 2023B-1, and $22.400 million of Series 2023B-2. Ziegler.

The Aledo Independent School District, Texas (/AAA/AAA/), is set to price Wednesday $166.255 million of PSF-insured unlimited tax school building bonds, Series 2023. FHN Financial Capital Markets.

The Arkansas Development Finance Authority (/AAA/AAA) is set to price Tuesday $108.470 million of revolving loan funds revenue bonds, Series 2023, serials 2024-2043. Stephens.

The Florida Housing Finance Corp. (Aaa///) is set to price Tuesday $106 million of taxable homeowner mortgage revenue bonds, 2023 Series 4. Morgan Stanley.

Competitive

Oyster Bay, New York, is set to sell $125 million of bond anticipation notes, Series 2023, at 10:45 a.m. Thursday.

Christine Albano and Christina Baker contributed to this story.