Issuance drops 17% in 1H

4 min read

Issuance fell below expectations during the first half of the year as issuers dealt with continued market volatility, rising interest rates and uncertain Federal Reserve policy, leaving many to take a wait-and-see approach to their borrowing plans.

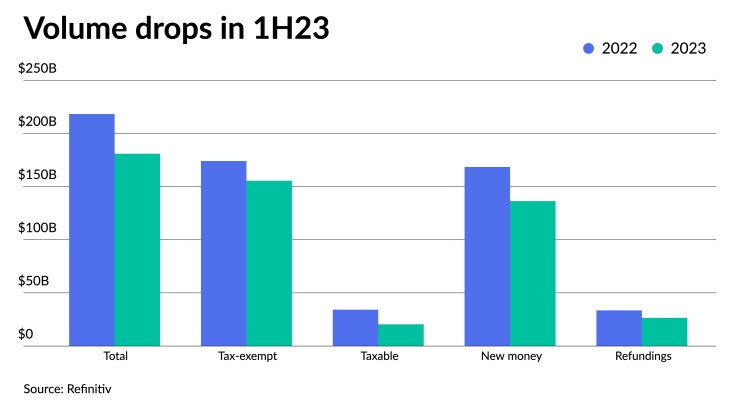

Total volume in the first half of the year was $180.882 billion in 3,853 deals, down 17.1% from the $218.230 billion in 5,444 over the same period in 2022, according to Refinitiv data.

The main drivers of the decrease in issuance stemmed from uncertainty over the Fed.

“The first half of the year was marked by uncertainty as to what the Fed was going to be doing with the fed funds rate,” CreditSights strategist Pat Luby said. “Additionally, the market nearly came to a halt for almost every meeting of the [Federal Open Market Committee].”

The FOMC hiked rates 25 basis points at its January, March and May meetings before opting to skip a rate hike at its June meeting. The FOMC continued to hike rates in July with another 25-basis-point rate hike. Market participants believe the FOMC will hike rates at least one more time this year.

Tax-exempt issuance fell 10.7% in the first six months to $155.503 billion from $174.086 billion in 2022. Taxable issuance dropped 40.3% in the first half of 2023 to $20.424 billion from $34.209 billion in 2022 over the same period, per Refinitiv data.

New-money issuance fell 19.1% to $136.332 billion from $168.482 billion in 2022. Refundings were down 20.9% in the first half of the year to $26.534 billion from $33.551 billion in 2022.

The first quarter saw $78.640 billion. The second quarter hit $102.242 billion. The first half of the year saw three of the six months — March, April and June — have issuance greater than $30 billion. June saw the highest amount of issuance at $39.148 billion.

Bond insurance fell 12% in 1H23 to $15.561 billion covered in 622 issues from $17.689 billion in 844 deals in 1H22, per Refinitiv data.

Revenue bonds made up $101.513 billion in 1,408 issues, a 26.4% decrease from 2022, and general obligation bonds dropped to $79.369 billion in 2,445 issues, a 1.1% decrease from 2022.

“Comparatively, rates in the first half of this year were, overall, notably higher than in the first half of last year. During this same period in 2022, rates were in the process of rising as the result of monetary policy,” said Matthew Gastall, executive director and head of Wealth Management Municipal Research and Strategy at Morgan Stanley.

The rising-rate environment has “slowed new money offerings and some refinancings have, since, fallen ‘out of the money,'” he said.

In the first half of last year, he said a number of issuers sought to access the primary ahead of the possibility that interest rates may continue to rise.

Year-over-year comparisons are now nearing the rate back-up experienced around this time last year, which occurred as the result of the anticipation of the Jackson Hole Economic Symposium.

Overall, the selloff began in January 2022 and found some stability during the first half of 2023.

Another factor was that coming out of the pandemic, many issuers were in “pretty strong financial shape,” Luby said.

Some issuers preferred “to pay as you go rather than finance with debt,” he said.

“So with the inflationary environment, economic uncertainty, that is also going to be less of an impediment to the need to borrowing,” Luby said. “As reserves have been spent down, uncertainty picks up forward-looking tax receipts become less certain.”

Due to the lower issuance seen in the first half of the year, some market participants revised their supply predictions for the 2023 downward.

Beginning with a high of $500 billion from BofA Securities and $450 billion to $480 billion from Citigroup Global Markets to a low of $302 billion to $375 billion from Janney Montgomery Scott and $350 billion from Hilltop Securities, the initial forecast projections for the year covered a broad range.

These estimates are dependent on a number of variables, such as market volatility, the likelihood and severity of a recession, and Federal Reserve policy.

Those with issuance on the higher end opted to revise their forecasts downward earlier this year, with both BofA Securities and Citigroup Global Markets believing issuance will fall around $400 billion earlier this year.

However, those on the lower end, like Janney Montgomery Scott and Hilltop Securities decided against revising their forecasts.

For the remainder of the year, Gastall said rates should continue to be the predominant factor in supply.

Refundings may remain lower due to fewer refinancing candidates. Additionally, the 2017 Tax Cuts and Jobs Act limited the ability of issuers to advance-refund debts with tax-exempt bonds, he said.

Some issuers, though, may “further work to manage the possibility of a ‘higher for longer’ interest rate environment, where some issuers postponed issuance in this year’s first half, believing rates may decline,” he said.

“If we continue to see healthy inflation, even with a Fed that stays firm on rates, some issuers may believe that they will need to work with the possibility of a ‘higher for longer’ rate environment,” he said.

Texas was the biggest state issuer in the first half of the year, per Refinitiv data.

All issuers in the Lone Star State accounted for $27.785 billion. California was second with $26.698 billion, New York was third with $18.077 billion, Illinois followed in fourth with $7.853 billion and Florida rounded out the top five with $6.522 billion.

The rest of the top 10 were: Georgia with $5.200 billion, Wisconsin next with $4.949 billion, followed by Massachusetts at $4.668 billion, then New Jersey with $4.543 billion and Michigan with $4.533 billion.