Stocks making the biggest moves midday: Palo Alto Networks, Nvidia, Tesla, Marvell and more

2 min read

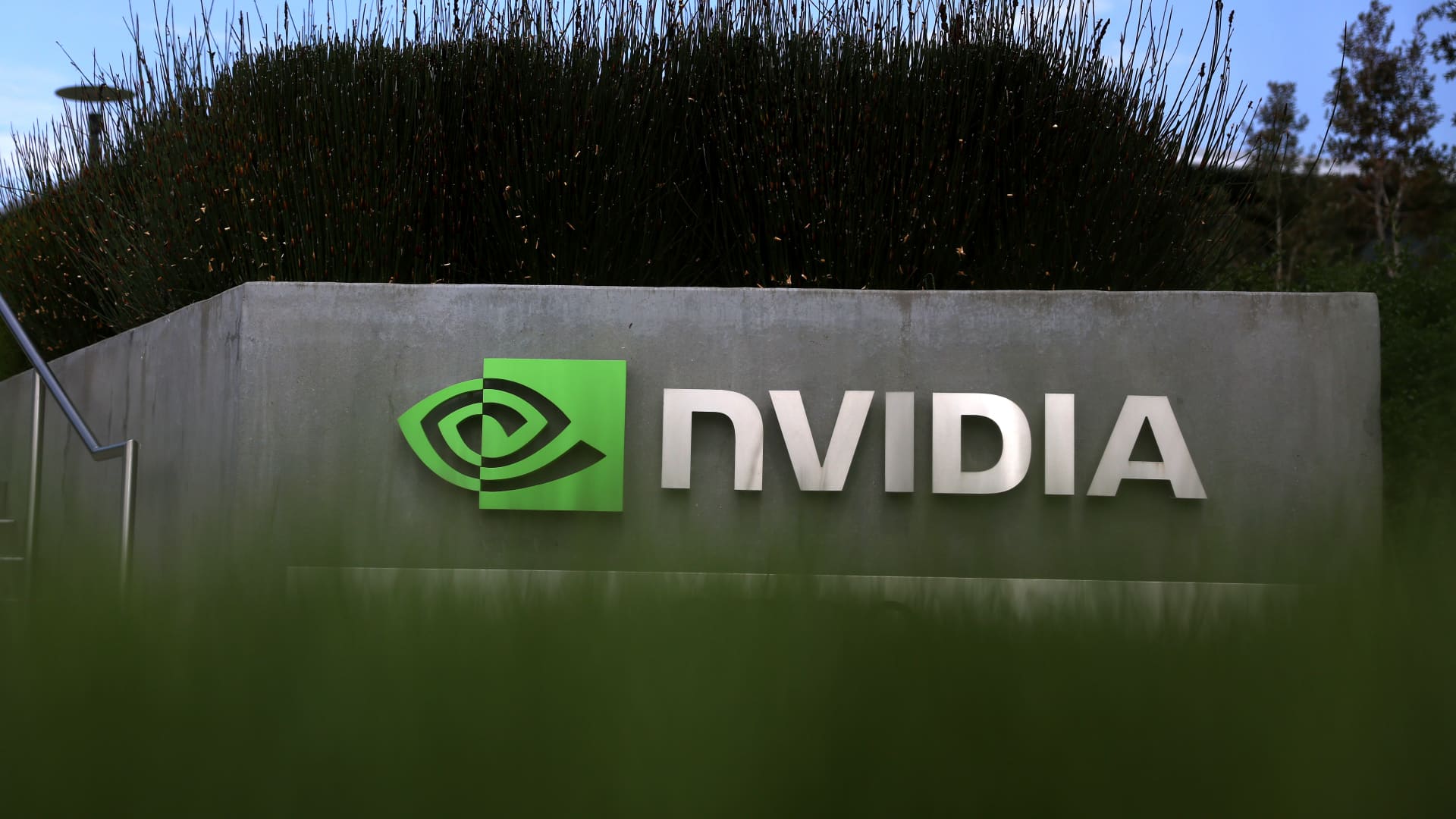

An exterior view of the Nvidia headquarters in Santa Clara, California, May 30, 2023.

Justin Sullivan | Getty Images

Check out the companies making headlines in midday trading.

Palo Alto Networks — The security software provider jumped 15.2% after Palo Alto beat expectations for earnings when reporting after the bell Friday. Goldman Sachs reiterated the stock as buy following its report.

Earthstone Energy, Permian Resources — Earthstone Energy jumped 13% following the announcement that Permian Resources is buying the oil and gas company in an all-stock deal valued near $4.5 billion, including debt. Permian shares were flat.

Nvidia — Shares climbed 4.7% after HSBC reiterated a buy rating and raised its target price on the chipmaker. Baird also named Nvidia a top pick. The company reports earnings Wednesday after the bell.

Napco Security Technologies — The security tech stock plummeted 41% after Napco said Friday that an audit found errors in recent financial statements, with gross profit, operating income and net income overstated.

Xpeng — The Chinese electric vehicle maker jumped 9.8% following an upgrade to buy from neutral by Bank of America. The firm said Xpeng should see improvements in China given its partnership with Volkswagen and better cost structure.

Tesla — The electric vehicle maker added 5.1%, regaining ground after tumbling about 11% last week following news of more price cuts in China.

VMware, Broadcom — VMware and Broadcom added 4.2% and 2.3%, respectively. Broadcom obtained final transaction approval from the U.K.’s Competition and Markets Authority for an acquisition of the cloud computing company and expects other required regulatory approvals before Oct. 30.

Farfetch — The e-commerce fashion company’s shares jumped more than 5% Monday. The stock tumbled more than 45% during Friday’s trading session after posting a revenue miss in the prior quarter. Farfetch’s full-year revenue guidance also came in below analysts’ expectations.

Acushnet Holdings — The golf equipment maker and owner of Titleist added 3.3% after Jefferies upgraded the company to buy from hold. The Wall Street firm excepts Acushnet to defend its top position while expanding margins and growth.

— CNBC’s Sarah Min, Hakyung Kim and Samantha Subin contributed reporting.