Munis weaker in both secondary, primary markets

5 min read

Municipals were weaker across the curve as secondary activity showed cheaper trades and primary market deals faced concessions, as the asset class played catch up to recent U.S. Treasury losses.

Triple-A yields rose two to seven basis points, depending on the curve, while USTs were mixed with some weakness on the short end and improvements out long.

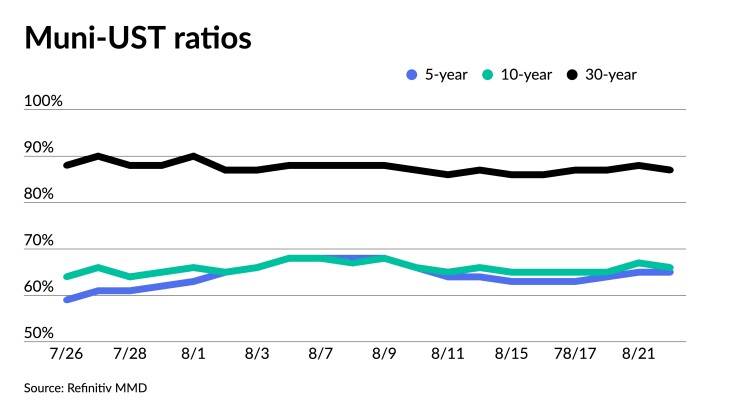

The two-year muni-to-Treasury ratio Tuesday was at 63%, the three-year at 65%, the five-year at 65%, the 10-year at 68% and the 30-year at 89%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 65%, the three-year at 66%, the five-year at 65%, the 10-year at 66% and the 30-year at 87% at 4 p.m.

The primary was led by the $1.2 billion Michigan Trunkline deal, a repricing for which was not yet available, and several other deals including San Antonio, Texas, and the Sacramento Transit Authority.

Jefferies won the Rosemount-Apple Valley-Egan ISD No. 196, while BofA Securities won triple-A Hennepin County, Minnesota.

Still to come is New York City’s Transitional Finance Authority $1 billion of subordinate future tax-secured bonds scheduled to price Wednesday.

New-issue supply was priced to sell last week, yet underwriters struggled to complete deals, noted Nuveen’s Daniel Close and Anders S. Persson in a weekly report. This week’s new-issue supply also needed to be “priced to sell to pique investor interest,” they said.

However, they are “relatively optimistic about fixed income” as yields have returned to levels last seen in October 2022, yet inflation is lower. Yields should remain elevated until inflation declines closer to the U.S. Federal Reserve’s 2% target, they wrote.

“We are also constructive on municipal bonds, but choppiness may extend through the end of 2023,” they said. Tax-exempt bonds are rich relative to taxable bonds due to low tax-exempt new issuance during the summer and more than $100 billion of reinvestment money returning to the market, they said.

“This trend should reverse this fall when we expect supply to pick up and reinvestment money will be comparatively lower,” they said. “In this orderly muni market, institutional investors should be rearranging portfolios back to mandates.”

There may be “pockets of illiquidity through the end of the year, which we would see as buying opportunities,” they added.

While high-yield munis saw modest outflows last week, “demand remained supportive” and the market “remains cushioned by limited secondary trading volume, low new issuance and strong revenue growth,” they said.

Meanwhile, credit conditions “remain favorable for most issuers but have likely peaked,” said Cooper Howard, a fixed-income specialist at Charles Schwab.

Despite favorable credit conditions, he said spreads have moved higher this year.

Currently, spreads for A-rated issuers — which Howard described as a “sweet spot” for credit — are almost 30 basis points above their three-year average “meaning that investors are getting better compensated now than they have been historically,” he said.

In the primary market Tuesday, Wells Fargo preliminarily priced for Michigan (Aa2/AA+//) $1.197 billion of Rebuilding Michigan Program state trunk line fund bonds, Series 2023, with 5s of 11/2024 at 3.35%, 5s of 2028 at 3.11%, 5s of 2033 at 3.26%, 5s of 2038 at 3.76%, 5s of 2043 at 4.12% and 5.25s of 2049 at 4.31%, callable 11/1/5/2033.

Ramirez priced for San Antonio (Aaa/AAA/AA+/) $236.650 million of bonds. The first tranche, $159.510 million of general improvement bonds, Series 2023, saw 5s of 2/2024 at 3.40%, 5s of 2028 at 3.15%, 5s of 2033 at 3.27%, 5s of 2038 at 3.79% and 4s of 2043 at 4.37%, callable 2/1/2033.

The second tranche, $46.605 million of combination tax and revenue certificates of obligation, Series 2023, saw 5s of 2/2024 at 3.40%, 5s of 2028 at 3.15% and 5s of 2033 at 3.27%, noncall.

The third tranche, $30.535 million of tax notes, Series 2023, saw 5s of 2/2024 at 3.40% and 5s of 2025 at 3.40%, noncall.

BofA Securities priced for the Sacramento Transportation Authority (/AAA/AAA/) $295.895 million of limited tax sales tax revenue refunding bonds, Series 2023, with 5s of 10/2028 at 2.70%, 5s of 2033 at 2.86% and 5s of 2038 at 3.38%, callable 10/1/2033.

Citigroup Global Markets priced for South Carolina Jobs-Economic Development Authority (/A+/AA-/) $126.700 million of Anmed Health hospital revenue bonds, Series 2023, with 5s of 2/2040 at 4.17%, 5s of 2043 at 4.55%, 4.25s of 2048 at 4.72% and 5.25s of 2053 at 4.60%, callable 2/1/2033.

In the competitive market, the Rosemount-Apple Valley-Egan ISD No. 196 (Aa1///) sold $300 million of general obligation facilities maintenance and school building bonds, Series 2023A, to Jefferies, with 5s of 2/2026 at 3.20%, 5s of 2028 at 3.08%, 5s of 2033 at 3.05%, 5s of 2038 at 4.07%, 5s of 2043 at 4.32% and 4s of 2044 at 4.33%, callable 2/1/2032.

Hennepin County, Minnesota, (//AAA/) sold $100 million of GOs to BofA Securities, with 5s of 12/2024 at 3.30%, 5s of 2028 at 2.93%, 5s of 2033 at 3.01%, 5s of 2038 at 3.55% and 5s of 2043 at 3.80%, callable 12/1/2033.

Secondary trading

Washington 5s of 2024 at 3.36%. Texas A&M University 5s of 2026 at 3.20% versus 3.18% Friday. Richmond, Virginia, 5s of 2027 at 3.00%.

Charlotte waters, North Carolina, 5s of 2030 at 2.92%. California 5s of 2030 at 2.86%. Connecticut 5s of 2032 at 3.13%.

NYC 5s of 2036 at 3.55%-3.50%. California 5s of 2036 at 3.22% versus 3.01% on 8/15 and 2.96% on 8/10. Massachusetts 5s of 2037 at 3.44%.

Triborough Bridge and Tunnel Authority 5s of 2048 at 4.34% versus 4.12%-4.14% on 8/14 and 4.11%-4.08% on 8/10. LA DWP 5s of 2049 at 4.00% versus 3.90%-3.78% Friday and 3.85%-3.73% Thursday. Massachusetts 5s of 2052 at 4.20% versus 4.02% on 8/11 and 4.01%-3.96% on 8/9.

AAA scales

Refinitiv MMD’s scale was cut four to six basis points: The one-year was at 3.29% (+4) and 3.19% (+4) in two years. The five-year was at 2.93% (+5), the 10-year at 2.95% (+6) and the 30-year at 3.91% (+6) at 3 p.m.

The ICE AAA yield curve was cut three to seven basis points: 3.30% (+3) in 2024 and 3.24% (+5) in 2025. The five-year was at 2.92% (+7), the 10-year was at 2.88% (+5) and the 30-year was at 3.89% (+4) at 4 p.m.

The S&P Global Market Intelligence (formerly IHS Markit) municipal curve was cut three to four basis points: 3.29% (+3) in 2024 and 3.18% (+3) in 2025. The five-year was at 2.92% (+4), the 10-year was at 2.93% (+4) and the 30-year yield was at 3.87% (+4), according to a 4 p.m. read.

Bloomberg BVAL was cut two to three basis points: 3.28% (+2) in 2024 and 3.19% (+2) in 2025. The five-year at 2.89% (+2), the 10-year at 2.88% (+3) and the 30-year at 3.86% (+2) at 4 p.m.

Treasuries were mixed.

The two-year UST was yielding 5.039% (+5), the three-year was at 4.75% (+5), the five-year at 4.481% (+2), the 10-year at 4.328% (-1), the 20-year at 4.613% (-4) and the 30-year Treasury was yielding 4.405% (-5) at the close.

Primary to come:

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price Wednesday $1 billion of future tax-secured subordinate bonds, Fiscal 2024 Series B, serials 2025-2048, term 2053. Wells Fargo Bank.

The Wisconsin Housing and Economic Development Authority (Aa2/AA+//) is set to price $185 million of non-AMT home ownership revenue social bonds, serials 2024-2035, terms 2038, 2043, 2049, 2054. RBC Capital Markets.

The Ohio Housing Finance Agency (Aaa///) is set to price Thursday $145 million of non-AMT mortgage-backed securities program residential mortgage revenue social bonds, Series 2023 B, serials 2025-2035, terms 2038, 2043, 2048, 2054, 2055. Citigroup Global Markets Inc.

The California Infrastructure and Economic Development Bank (Aa2///) is set to price Thursday $113.215 million of Academy of Motion Pictures Arts and Sciences Obligated Group revenue refunding bonds, Series 2023A, serials 2024-2030, 2033-2041. Wells Fargo Bank.

The Dormitory Authority of the State of New York (Aa3//A+/) is set to price Wednesday $111.355 million of State University of New York Dormitory Facilities Revenue Bonds, Series 2023, Series 2023A (Sustainability Bonds) and Series 2023B (Tender). Serials 2024-2043, terms, 2048, 2053. Siebert Williams Shank & Co.

The Indiana Finance Authority (Aaa/AAA/AAA/) is set to price Thursday $100 million of state revolving fund program green bonds, Series 2023B, serials 2030-2044. RBC Capital Markets.