Munis quiet, awaiting new-issues, while USTs see losses

6 min read

The return from Monday’s Labor Day holiday brought with it a quiet tone in the municipal market and a weaker U.S. Treasury market while muni investors await the $2.6 billion California general obligation deal and $1 billion Port Authority of New York New Jersey consolidated bond offering.

The mood started trending quiet heading into Friday as many traders were hesitant to take positions prior to the long holiday weekend, according to Cooper Howard, Director of Fixed Income Strategy at the Schwab Center for Financial Research.

“Yields relative to Treasuries have been improving, but are still low relative to historical averages,” Howard said on Thursday.

Friday’s Labor Department report showed a slowing labor market in August.

“Regarding absolute yields, we’re nearing a peak in rates for longer-term yields and suggest investors take advantage of the recent move up in yields and extend duration if they’ve been staying too short,” he added.

Overall, “August had the worst performing month since February as munis declined by 1.44% for the month as yields hit their highest this year,” said Jason Wong, vice president of municipal at AmeriVet Securities.

August, which is usually a weak month, marks the fourth consecutive month to be in the red, he said.

Fixed income securities declined in August “as the Fed has signaled that they may continue to hike interest rates as the economy is still robust,” he said.

Investors remain hesitant about “jumping back into munis even as rates are nearing multi-year highs as tax-exempts are still not cheap enough with the front-end ratios still yielding under 70% while the historical averages are around 90%,” Wong noted.

The two-year muni-to-Treasury ratio Tuesday was at 63%, the three-year at 64%, the five-year at 66%, the 10-year at 69% and the 30-year at 89%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 65%, the three-year at 66%, the five-year at 66%, the 10-year at 69% and the 30-year at 90% at 3 p.m.

While August ended in the red, the last week saw some firmness in the muni market, as muni yields fell two to five basis points across the curve, said Birch Creek Capital strategists in a weekly report.

The Refinitiv MMD curve was unchanged on Friday to start September, but they noted “that was largely due to extremely limited trade volume amongst light staffing ahead of the holiday weekend.”

Despite the quiet Friday, they said “secondary activity was surprisingly robust for the last week of August, with customer purchases up over 40% relative to the past few weeks.”

Trading for the week was at $36.23 billion “with 56% of trades being dealer sells and with the majority of the trading being on Tuesday and Wednesday,” Wong said.

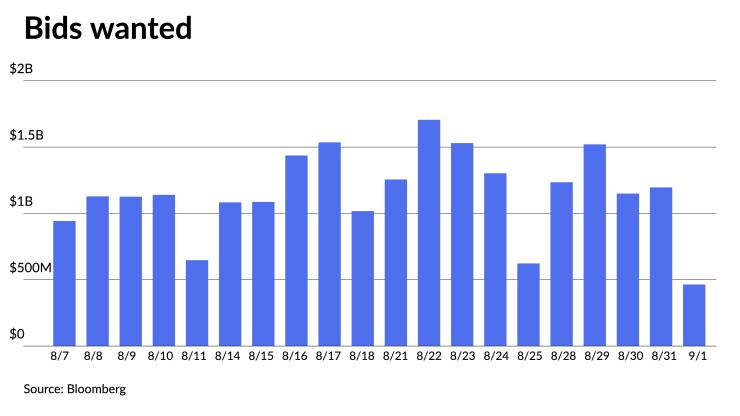

Clients put up around $5.56 billion last week, down from the $6.41 billion the week prior, according to Bloomberg.

“Limited primary supply, more attractive valuations after the recent underperformance, and a sense that the worst of the rate move may be over” drove much of the activity, Birch Creek Capital strategists said.

Inflows returned last week, with Refinitiv Lipper reporting that $408 million was added to muni mutual funds. However, they noted, this was due to exchange-traded fund demand. ETFs saw inflows of $760 million, while ex-ETFs saw $352 million of outflows.

“With the continued outflows, mutual funds have sought to sell short call bonds with poor convexity profiles, while staying on the sidelines and waiting for cheap new issues for their purchases,” they said.

The rise in trade volumes can also be attributed to tax loss swaps, which “will likely remain a theme as we head into the last few months of the year,” they said.

Secondary trading

Georgia 5s of 2024 at 3.27%. DC 5s of 2025 at 3.23%. Maryland 5s of 2026 at 3.07%.

Delaware 5s of 2028 at 2.89%. San Antonio Water System, Texas, 5s of 2028 at 3.05%-3.02%. Tennessee 5s of 2029 at 3.00%-2.98% versus 3.02% Wednesday.

Tennessee 5s of 2032 at 3.01% versus 3.04%-3.01% Wednesday. NYC 5s of 2033 at 3.22%-3.21%. Georgia 5s of 2034 at 3.00%.

Michigan Trunk Line 5s of 2046 at 4.12% versus 4.29%-4.20% original on 8/23. NYC 5s of 2051 at 4.30%-4.29% versus 4.30%-4.17% Wednesday.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.25% and 3.13% in two years. The five-year was at 2.88%, the 10-year at 2.94% and the 30-year at 3.88% at 3 p.m.

The ICE AAA yield curve saw cuts except for two-years: 3.27% (+2) in 2024 and 3.17% (-1) in 2025. The five-year was at 2.88% (+2), the 10-year was at 2.89% (+4) and the 30-year was at 3.87% (+2) at 3 p.m.

The S&P Global Market Intelligence (formerly IHS Markit) municipal curve was unchanged: 3.26% in 2024 and 3.14% in 2025. The five-year was at 2.89%, the 10-year was at 2.94% and the 30-year yield was at 3.87%, according to a 3 p.m. read.

Bloomberg BVAL was cut up to one basis point: 3.23% (unch) in 2024 and 3.14% (unch) in 2025. The five-year at 2.86% (+1), the 10-year at 2.86% (+1) and the 30-year at 3.85% (+1) at 3 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.956% (+9), the three-year was at 4.660% (+9), the five-year at 4.370% (+8), the 10-year at 4.259% (+9), the 20-year at 4.562% (+9) and the 30-year Treasury was yielding 4.375% (+9) at 3 p.m.

Primary to come:

California (Aa2/AA-/AA/) is set to price $2.648 billion of various purpose general obligation bonds Thursday consisting of $1.048 billion of GOs, serials 2026, 2033-2038, 2053 and $1.6 billion of refunding GOs, serials 2024-2032, 2043. Citigroup Global Markets Inc.

The Port Authority of New York and New Jersey (Aa3/AA-/AA-/) is set to price Thursday $1.082 billion of consolidated bonds consisting of $535.09 million of Series 242, serials 2025-2028, 2030-2043, terms 2048, 2053, and $546.975 million of Series 243, serials 2025-2043. BofA Securities.

The Michigan State Housing Development Authority (Aa2/AA+//) is set to price Thursday $428.440 million of social single-family mortgage revenue bonds, consisting of $286.015 million of non-AMT bonds, Series 2023B; $107.425 million of taxable bonds, Series 2023C; and $35 million of taxable variable rate bonds, Series 2023D. Barclays Capital.

Jacksonville, Florida (/AA/AA-/AA), is set to price Wednesday $290.345 million of special revenue and refunding bonds consisting of $259.495 million of Series 2023A, serials 2024-2043, term 2048, 2053, and $30.85 million of Series 2023B, refunding bonds, serials 2024-2026. Raymond James & Associates.

The Arizona Transportation Board (Aa1/AA+//) is set to price Thursday $273.96 million of highway revenue and refunding bonds, Series 2023. Wells Fargo Bank.

The Public Finance Authority is set to price Thursday $171.31 million of student housing revenue bonds (CHF-Manoa, LLC UH Residences for Graduate Students), Senior Series 2023A and Subordinate Series 2023B, consisting of $158.265 million of Series 2023A (/BBB-//), serials 2027-2033, terms 2038, 2043, 2053, 2063, and $13.045 Series 2023B (non-rated), term 2063. Raymond James & Associates.

The Pasadena Independent School District, Texas, is set to price Thursday $166.84 million of unlimited tax school building bonds, Series 2023. Piper Sandler & Co.

The Canadian County Educational Facilities Authority, Oklahoma (/A+//), is set to price Thursday $125.235 million of educational facilities lease revenue bonds (Mustang Public Schools Project) Series 2023A & 2023B. D.A. Davidson & Co.

The Alaska Housing Finance Corporation (Aa2/AA+//) is set to price $99.995 million of State Capital Project Bonds II, 2023 Series A, refunding, serials 2027-2036, term 2037, 2038, 2039, 2040, 2041. Jefferies.

The South Dakota Housing Development Authority (Aaa/AAA//) is set to price Wednesday $99 million of Homeownership Mortgage Bonds 2023 Series D (Non-AMT), serials 2024-2035, term 2038, 2043, 2048, 2054. Citigroup Global Markets.

The Kentucky Housing Corp. (Aaa///) is set to price $98.82 million of single-family mortgage revenue bonds, Series A (non-AMT), serials 2025-2035, term 2038, 2043, 2048, 2054, 2054. Citigroup Global Markets.

Competitive:

Dane County, Wisconsin, is set to sell Thursday $255 million of GO debt in four deals consisting of $156.48 million of GO corporate purpose bonds, Series 2023B, at 11 a.m. eastern, $65.09 million of GO promissory notes, Series 2023A, at 11 a.m., $22.46 million of GO airport project promissory notes, Series 2023D, subject to AMT, at 11:30 a.m. and $10.55 million of taxable GO promissory notes, Series 2023C, at 11:30 a.m.

Burlington, Vermont (Aa3///), is set to sell $150 million of general obligation public improvement bonds, Series 2023A, at 11 a.m. eastern Thursday.

Christine Albano contributed to this story.