Munis weaker, muni bond mutual fund outflows return

6 min read

Municipals were weaker in spots Thursday amid an active primary market that included two billion-dollar pricings for institutions and the return of outflows. U.S. Treasury yields fell and equities were mixed.

The two-year muni-to-Treasury ratio Thursday was at 63%, the three-year was at 64%, the five-year at 66%, the 10-year at 70% and the 30-year at 90%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 63%, the three-year at 64%, the five-year at 64%, the 10-year at 68% and the 30-year at 90% at 4 p.m.

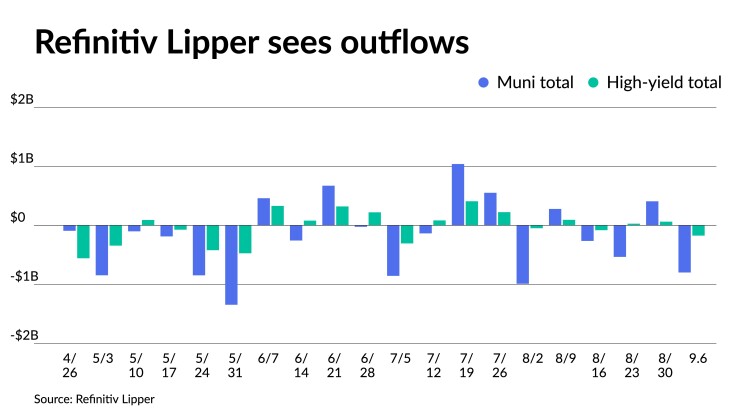

Refinitiv Lipper reported $798.474 million was pulled from municipal bond mutual funds for the week ending Wednesday after $407.976 million of inflows into the funds the previous week.

“As a few new issues begin to cycle through, market tone remains cautious and unconvicted,” said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

Indications of “a muni malaise given lighter fundamentals in place for September” appeared, based on several metrics, she said.

In the last month muni money market balances have increased 4% to end August at $115 billion, she said. This is $2 billion more than 2023’s weekly average figure, she noted.

“Very attractive weekly reset floating-rate levels have offered a median rate of 3.80% since the end of July” and “limited relative value in the three- to eight-year part of the curve, which has offered some consolation positioning in short product,” have fed the balance increase, according to Olsan.

Indicative spreads on an upcoming PSF-backed Pasadena Independent School District, Texas, issue “point to the ongoing value trade in Texas-related debt as compared to comparably rated secondary trades,” she said.

PSF-backed Leander School, Texas, 5s due 2034 (callable 2033) “traded at 3.18% or +22/MMD, while the expected spread in the Pasadena issue falls in the +35-40/MMD area,” she noted.

In longer maturities, she said, “the anticipated spread for the Pasadena issue is around +45/MMD.” A comparable secondary trade is in PSF-backed Denton School, Texas, 5s due 2043 (callable 2033) at +35/MMD, she noted.

“There is less disparity between new issue and secondary spreads across specialty-state credits, notably in the quad states of Connecticut, Massachusetts, New York and New Jersey where successful bidding is taking flat to negative spreads inside 10 years,” Olsan said.

Data from the Municipal Securities Rulemaking Board shows “for lot sizes both below and above $1 million par value the most active buying in the last month occurred in short and long maturities,” she said.

Trades below $1 million saw “21% of all flows in maturities under five years and 25% of the volume took place 20 years and longer on the curve,” Olsan said.

Given the inverted and inflated nature of short-term rates, she said, this is not surprising.

It’s also unsurprising to see “the focus on long-term bonds where 4s are trading around 4.50% and 5% coupons have moved above 4% thresholds with [tax-equivalent yields] over 6%,” Olsan noted.

There is less activity “being booked in the belly, where for part of August a 3% handle was a stretch in strong credits and ratios lagged where most buyers felt compelled to commit,” she said.

Large lot trades are experiencing a similar theme, with long bonds seeing more pronounced activity, according to Olsan.

Data shows that “20% of all August volume over $1 million block sizes had maturities of less than five years, with less support in the [six- to 20-year] area,” she said.

Thirty-five percent of all trades in this size range matured 20 years or longer, she noted.

“Yield and duration considerations would appear to be key inputs, as is the fact that municipal credit remains favorable and encouraging of curve extensions,” Olsan said.

In the primary market, Citigroup Global Markets priced for institutions $2.651 billion of various purpose GOs for California (Aa2/AA-/AA/), with yields cut up to five basis points from Wednesday’s retail offering. A final pricing was not available as of 4 p.m. Thursday.

The first tranche, $1.045 billion of new money bonds, saw 5s of 9/2026 at 3.05% (+2), 5s of 2033 at 3.11% (+4), 5s of 2038 at 3.61% (+4) and 5.25s of 2053 at 4.12% (+4), callable 9/1/2033.

The second tranche, $1.606 billion of refunding bonds, saw 5s of 9/2024 at 3.23% (unch), 5s of 2028 at 3.00% (+2), 5s of 2032 at 3.08% (+5), 4s of 2043 at 4.17% (+2) and 5s of 2043 at 3.89% (+4), callable 9/1/2033.

BofA Securities priced for institutions $1.086 billion of consolidated bonds for the Port Authority of New York and New Jersey (Aa3/AA-/AA-/), with yields falling up to five basis points five years and in but mixed out long from Wednesday’s retail offering. The first tranche, $535.055 million of AMT bonds, Series 242, saw 5s of 12/2024 at 3.88% (-5), 5s of 2028 at 3.71% (-2), 5s of 2033 at 3.82% (+5), 5s of 2038 at 4.26% (-1), 5s of 2043 at 4.52% (+2), 5s of 2048 at 4.64% (+2) and 5s of 2053 at 4.69% (+1), callable 12/1/2033.

The second tranche, $551.150 million of non-AMT bonds, Series 243, saw 5s of 12/2024 at 3.25% (-5), 5s of 2028 at 3.07% (-5), 5s of 2033 at 3.25% (unch), 5s of 2038 at 3.77% (-3) and 5s of 2043 at 4.06% (-4), callable 12/1/2033.

Wells Fargo Bank priced for the Arizona Transportation Board (Aa1/AA+//) $351.370 million of highway revenue and revenue refunding bonds, Series 2023, with 5s of 7/2024 at 3.29%, 5s of 2028 at 3.00% and 5s of 2033 at 3.16%, noncall.

Barclays priced for the Michigan State Housing Development Authority (Aa2/AA+//) $305.910 million of non-AMT social single-family mortgage revenue bonds, 2023 Series B, with all bonds pricing at par — 3.5s of 6/2024, 3.8s of 6/2028, 3.85s of 12/2028, 4.25s of 6/2033, 4.3s of 12/2033, 4.5s of 12/2038, 4.8s of 12/2043, 4.95s of 12/2048, 5s of 6/2054 — except for 5.75s of 6/2054 at 4.41%.

Piper Sandler & Co. priced for the Pasadena Independent School District, Texas, (Aaa/AAA//) $179.860 million of unlimited tax school building bonds, Series 2023, with 5s of 2/2025 at 3.38%, 5s of 2028 at 3.11%, 5s of 2033 at 3.27%, 5s of 2038 at 3.79%, 5s of 2043 at 4.14%, 5s of 2048 at 4.26%, 4.25s of 2053 at 4.52%, callable 2/15/2033.

In the competitive market, Dane County, Wisconsin, (/AAA//) sold $146.260 million of GO corporate purpose bonds, Series 2023B, to Piper Sandler & Co., with 5s of 6/2024 at 3.30%, 5s of 2028 at 3.00%, 5s of 2033 at 3.07%, 4s of 2038 at 4.03% and 4.25s of 2043 at 4.27%, callable 6/1/2033.

The county also sold $64.435 million of GO promissory notes, Series 2023A, to Morgan Stanley, with 5s of 6/2024 at 3.30%, 5s of 2028 at 3.01% and 4s of 2033 at 3.17%, callable 6/1/2030.

Additionally, the county sold $22.460 million AMT GO airport project promissory notes, Series 2023D, to Mesirow Financial, with 5s of 6/2025 at 3.64%, 5s of 2028 at 3.50% and 4s of 2033 at 3.85%, callable 6/1/2030.

Burlington, Vermont, (Aa3///) sold $150.505 million GO public improvement bonds, Series 2023A, to BofA Securities, with 5s of 11/2024 at 3.33%, 6s of 2028 at 3.00%, 5s of 2033 at 3.17%, 5s of 2038 at 3.66% and 5s of 2043 at 3.89%, callable 11/1/2033.

Secondary trading

California 5s of 2024 at 3.06%-3.04%. Triborough Bridge and Tunnel Authority 5s of 2025 at 3.23%-3.26% versus 3.25% Wednesday. Maryland 5s of 2026 at 3.10% versus 3.07%-3.06% Tuesday.

Virginia College Building Authority 5s of 2028 at 2.99%. Maryland DOT 5s of 2028 at 2.97%-2.95%. California 5s of 2030 at 3.00% versus 2.87%-2.86% on 8/31 and 2.92% on 8/30.

Battery Park City Authority 5s of 2033 at 2.98% versus 3.02% Wednesday. Connecticut 5s of 2034 at 3.22%-3.20%. University of California 5s of 2035 at 3.00% versus 2.91%-3.00% Wednesday and 2.96% on 8/30.

LA DWP 5s of 2049 at 3.91%-3.90% versus 3.91%-3.90% Wednesday and 4.00% on 8/22. NYC 5s of 2051 at 4.43%-4.39% versus 4.30%-4.29% Tuesday and 4.30%-4.17% on 8/30. Massachusetts 5s of 2053 at 4.22%-4.23% versus 4.10% Friday and 4.25% on 8/25.

AAA scales

Refinitiv MMD’s scale was cut up to three basis points: The one-year was at 3.25% (unch) and 3.13% (unch) in two years. The five-year was at 2.88% (unch), the 10-year at 2.98% (+2) and the 30-year at 3.92% (unch) at 3 p.m.

The ICE AAA yield curve was cut up to five basis points: 3.26% (+1) in 2024 and 3.19% (unch) in 2025. The five-year was at 2.90% (+2), the 10-year was at 2.93% (+4) and the 30-year was at 3.93% (+5) at 4 p.m.

The S&P Global Market Intelligence (formerly IHS Markit) municipal curve was cut up to three basis points: 3.26% (unch) in 2024 and 3.14% (unch) in 2025. The five-year was at 2.89% (unch), the 10-year was at 2.98% (+2) and the 30-year yield was at 3.91% (+4), according to a 3 p.m. read.

Bloomberg BVAL was cut up to two basis points: 3.25% (+1) in 2024 and 3.16% (+1) in 2025. The five-year at 2.88% (+1), the 10-year at 2.89% (+2) and the 30-year at 3.89% (+2) at 4 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.953% (-7), the three-year was at 4.672% (-7), the five-year at 4.397% (-5), the 10-year at 4.261% (-4), the 20-year at 4.546% (-2) and the 30-year Treasury was yielding 4.355% (-1) near the close.

Mutual fund details

Refinitiv Lipper reported $798.474 million of outflows from municipal bond mutual funds in the week ending Wednesday following $407.976 million of inflows the week prior.

Exchange-traded muni funds reported outflows of $135.277 million versus $759.794 million of inflows in the previous week. Ex-ETFs muni funds saw outflows of $663.197 million after $351.818 million outflows in the prior week.

Long-term muni bond funds had $323.542 million of outflows in the latest week after inflows of $676.451 million in the previous week. Intermediate-term funds had $95.717 million of outflows after $50.794 million of outflows in the prior week.

National funds had outflows of $641.188 million versus $522.487 million of inflows the previous week while high-yield muni funds reported outflows of $174.105 million versus inflows of $62.681 million the week prior.