Better-than-expected jobs numbers send muni, UST yields higher again

10 min read

Municipals were weaker along with U.S. Treasuries Friday following better-than-expected jobs data while equities rallied on the data.

The September non-farm payrolls report dashed any suggestions that the labor market is weakening, but analysts still debate whether the Federal Reserve will need to raise rates again.

In addition to 336,000 jobs being created in the month — nearly twice as many as economists expected — revisions added 119,000 jobs to the July and August gains. The unemployment rate held at 3.8%.

The strength of the report led to “renewed selling in a jittery bond market,” said J.P. Morgan Asset Management Chief Global Strategist David Kelly and market insights research analyst Stephanie Aliaga. But “the economy still appears able to absorb strong job gains without generating higher wage inflation. Because of this, it is still a close call as to whether the Fed will feel the need to raise short-term rates one last time in November or December.”

“This report is clearly going to put a rate increase firmly back on the table,” said Bryce Doty, senior vice president and senior portfolio manager at Sit Investment Associates.

“We have been in the camp that more supply of workers means less wage inflation and that trend continues with hourly earnings only rising 0.2%,” he said. “But the Fed has things backwards and believes more job growth is inflationary.”

But Doty doesn’t expect a rate hike in November. “As the economy seems more and more likely to have a soft rather than a hard landing, the yield curve is normalizing.”

Although still inverted, Doty noted, “the difference between the 2-year and 30-year yields narrowed 70 basis points,” and he expects “the yield curve to become nearly flat across all maturities soon and have an upward slope by year end.”

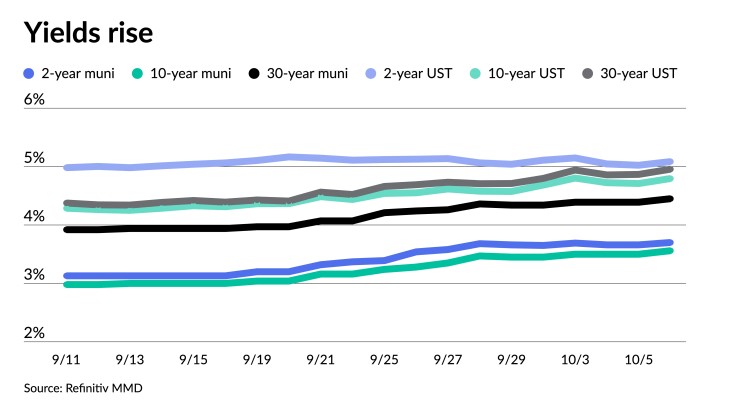

Triple-A muni yields rose two to six basis points while UST rose six to eight.

“The free-fall in rates” has continued, with Treasury yields jumping upwards of 15 to 25 basis points across the curve this week, Barclays PLC noted in a report.

“Following the UST selloff, munis gave back all of their gains for the year, pushing returns into negative territory,” Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel said.

Ratios have risen on the short end. The two-year muni-to-Treasury ratio Friday was at 73%, the three-year was at 73%, the five-year at 74%, the 10-year at 75% and the 30-year at 90%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 74%, the three-year at 75%, the five-year at 75%, the 10-year at 74% and the 30-year at 90% at 4 p.m.

“Higher ratios than what prevailed much of the first eight months of 2023 helped to keep muni bids in during volatile Treasury market moves,” BofA Global Research said in a report. “Although muni bond market volatility may also elevate a bit in the near term due to uncertainty in the Treasury market, over time it should work well to take advantage of the high muni rates not seen in the past 15 years.”

Although Barclays’ strategists said they have a “relatively positive outlook on the municipal market in the medium term, the near term is uncertain.”

“Despite the breathtaking sell-off in longer rates, Barclays’ macro strategists see no clear catalyst to stem the bleeding,” they wrote. “Data are unlikely to weaken quickly or enough to help bonds.”

Barclays said that although rate volatility will likely remain elevated for now, and supply should pick up in October — which is typically one of the heaviest supply months in any year — “we still view late-October or early November as a good time to go long; with just a handful of exceptions, municipals have done very well in November-December, with an average return of about 1% over the past 10 years, and 2.5% since 2018.”

If rates decline in 4Q23, which they said seems plausible, “that should support the market, especially as tax-exempt valuations have become more attractive in this selloff.”

“If municipals are negatively affected by supply in the coming weeks (albeit next week is slated to be light, as some deals have been shelved), which is expected to be heavy in late October, we would view it as an opportunity to start adding exposure,” they said.

However, while they view the opportunity as getting close, they are “not yet ready to recommend buying.”

At this point, BofA strategists said they believe investors “can selectively pick up some 5% coupon bonds in the 4Q,” adding that tax losses can be harvested through swapping trades before year-end.

AAA scales

Refinitiv MMD’s scale rose four to six basis points: The one-year was at 3.78% (+4) and 3.70% (+4) in two years. The five-year was at 3.49% (+6), the 10-year at 3.56% (+6) and the 30-year at 4.45% (+6) at 3 p.m.

The ICE AAA yield curve was cut two to five basis points: 3.76% (+2) in 2024 and 3.72% (+2) in 2025. The five-year was at 3.48% (+3), the 10-year was at 3.51% (+3) and the 30-year was at 4.43% (+5) at 4 p.m.

The S&P Global Market Intelligence municipal curve was cut: The one-year was at 3.81% (+4) in 2024 and 3.73% (+4) in 2025. The five-year was at 3.53% (+6), the 10-year was at 3.57% (+6) and the 30-year yield was at 4.46% (+6), according to a 3 p.m. read.

Bloomberg BVAL was cut: 3.83% (+3) in 2024 and 3.75% (+3) in 2025. The five-year at 3.48% (+3), the 10-year at 3.55% (+3) and the 30-year at 4.52% (+3) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 5.083% (+6), the three-year was at 4.887% (+6), the five-year at 4.753% (+7), the 10-year at 4.79% (+7), the 20-year at 5.149% (+8) and the 30-year Treasury was yielding 4.952% (+7) near the close.

NYC TFA plans $1B bond sale

The New York City Transitional Finance Authority plans to issue $1 billion of future tax secured subordinate bonds to fund capital projects the week of Oct. 16.

Book-running lead manager Ramirez & Co. is expected to price the tax-exempt fixed rate bonds on Wednesday, Oct. 18 after a one-day retail order period.

BofA Securities, Citigroup, J.P. Morgan, Jefferies, Loop Capital Markets, RBC Capital Markets, Siebert Williams Shank, and Wells Fargo Securities are co-senior managers on the deal.

The TFA said the standard non-callable tax-exempts will be subject to a make-whole call provision prior to their stated maturities. This feature, which is usually included only in the agency’s taxable bonds, is intended to provide the TFA with additional flexibility to manage its debt financing program, the TFA said.

Employment report

Mickey Levy, chief economist for Americas and Asia at Berenberg Capital Markets, a member of the Shadow Open Market Committee, noted, “On balance, healthy labor income growth and employment gains that are still running at more than double the pace needed to keep up with population growth raise the odds of another Fed rate hike later this year. However, there is likely enough in the latest employment data to give the Fed pause, at least for the moment.”

The unemployment rate held, he noted, and the report offered “tentative indications” of slowing wage growth.

The numbers indicate “a strong but gradually cooling labor market,” Levy said. While it doesn’t mark “an inflection point in labor markets toward reacceleration, it reinforces the Fed’s higher for longer policy rate projections. Similarly strong data in October would make a firmer case for an additional Fed rate hike.”

The “report was unequivocally strong,” Morgan Stanley said in a note written by Chief U.S. Economist Ellen Zentner and others, “too strong for policymakers to relax their tightening bias.”

While inflation has been cooling more than expected, they said, “continued strength in job gains will fuel doubts that the pace of deceleration in inflation will be sustained.”

Tightening financial conditions, which did the work of more than 50 basis points of tightening, will keep the Fed from hiking, they said, although the tightening bias remains.

“Ultimately, we expect inflation data to support an extended hold while rising real rates do their job to slow the economy, jobs, and inflation,” the Morgan Stanley note continued. Their take is rates remain at the range of 5.25% to 5.50 “until making the first of four 25bp cuts in March 2024.”

The report provided good and bad news, according to Giuseppe Sette, president of Toggle AI. “In the short term, this will fuel fears of further inflationary pressures leading the Fed to hike again. In the mid-term however, this is one more sign of a healthy economy that’s not showing signs of recession.”

At this pace, “the labor market is not going to cool,” said Brian Coulton, Fitch Ratings chief economist, which will pressure wages “making it more likely that the Fed has further to go in raising interest rates.”

The report “allied with the rise in job openings in August and recent upward revisions to estimates of the cushion of excess household savings, point to upside risks to the near-term U.S. economic outlook,” he said.

While the report indicates “incremental progress” in labor market softening, Candice Tse, global head of strategic advisory solutions at Goldman Sachs Asset Management, said, “the balance between supply and demand of workers will keep the Fed focused on managing inflation.”

“This was an extremely strong U.S. employment report that, along with recent economic data, suggest a significant acceleration in economic activity in the third quarter,” noted Scott Anderson is the Chief Economist and Executive Vice President at BMO Economics. The economy continues to grow faster than long-term potential, he added.

The bottom line, Anderson said, is the numbers keep a rate hike on the table for the next meeting.

While the report offers the Fed “cover” should it decide to raise rates again this year, Gary Quinzel, vice president of Portfolio Consulting at Wealth Enhancement Group, said, “this report further demonstrates that September can be a challenging month to predict due to labor trends and adjustments between summer months and fall.”

The fed futures still suggest no hike in November he noted, but odds for a December increase rose 10%. “Obviously, a lot will change between now and then, but this is a key data point that the Fed will monitor as it seeks to tame inflation, which has been leveling off at levels still well above the Fed’s desired target,” Quinzel said. Average hourly earnings on an annual basis remain above historical averages, which “will continue to add to inflationary pressures.”

The October numbers will reflect the United Auto Workers’ strike, which should skew numbers lower.

While the jobs report will keep an increase in play, Sean Snaith, director of the University of Central Florida’s Institute for Economic Forecasting, said, it’s “not a foregone conclusion.”

The labor market strength “is more about duration than intensity. With each strong jobs report, we’re just digging in for a longer battle against inflation,” he said.

Wells Fargo Securities Senior Economists Sarah House and Michael Pugliese noted, “today’s report drove yet another increase in Treasury yields and fanned the flames that the FOMC may hike the federal funds rate one more time at one of its two remaining meetings of the year.”

And while another hike this year is possible, their base case is there won’t be. Still the upcoming consumer price index and the third quarter employment cost index “will help the FOMC determine if progress is continuing in its inflation fight despite the surprising strength of employment gains in recent months.”

The markets will ignore “moderating wage growth and focus on too-hot job creation,” according to Matt Peron, director of Research at Janus Henderson Investors. “This will keep rates higher for longer and challenges the equity market soft-landing narrative as well as valuations.”

The data suggest “the Fed’s Phillips Curve model of inflation is broken,” said Jay Hatfield, CEO at Infrastructure Capital Management, since “employment is strong and wages are moderating.”

Primary to come:

The Triborough Bridge and Tunnel Authority (/AA+/AA+/AA+) is set to price Wednesday $673.885 million of MTA Bridges and Tunnels payroll mobility tax senior lien refunding green bonds, Series 2023C (Climate Bond Certified). J.P. Morgan Securities LLC.

The Allegheny County Airport Authority, Pennsylvania, (A2//A/A+) is set to price Wednesday $394.215 million of Pittsburgh International Airport AMT revenue bonds, consisting of $366.225 million of Series 2023A, serials 2026-2043, terms 2048, 2053, and $27.99 million of Series 2023B, serials 2026-2043, terms 2048, 2053. Citigroup Global Markets Inc.

The Department of Water and Power of the city of Los Angeles (Aa2/AA-//AA) is set to price Thursday $312.39 million of power system revenue refunding bonds, 2023 Series D, serials 2024-2032, 2041-2043. TD Securities LLC.

The Chabot-Las Positas Community College District, California, (Aa2/AA//) is set to price Wednesday $252 million of Alameda and Contra Costa Counties Election of 2016 general obligation refunding bonds, Series C. Morgan Stanley & Co. LLC.

Houston (Aa3//AA/) is set to price Wednesday $248.620 million of public improvement and refunding bonds, Series 2023A, serials 2025-2043. Raymond James & Associates, Inc.

The School Facilities Improvement District No. 1 of Santa Monica-Malibu Unified School District, California, (Aa1/AA+//) is set to price Wednesday $175 million of general obligation bonds, Election of 2018, Series C, consisting of $162.85 million of exempts, serials 2024-2044, and $12.15 million of taxables, serial 2023. Raymond James & Associates, Inc.

The Commonwealth of Kentucky State Property and Building Commission (A1//AA-/) is set to price $144.125 million of Project No. 128 revenue bonds, Series A, serials 2024-2043. BofA Securities.

The Indiana Housing and Community Development Authority (Aaa//AA+/) is set to price Wednesday $134.67 million of non-AMT and AMT single family mortgage revenue social bonds, 2023 Series D-1. J.P. Morgan Securities LLC.

The Georgia Housing and Finance Authority (/AAA//) is set to price Tuesday $130.14 million of non-AMT single family mortgage bonds, serials 2024-2034, terms 2038, 2043, 2048, 2051. Raymond James & Associates, Inc.

Competitive:

Lake Forest Community HSD #115, Illinois, is set to sell $102.49 million of general obligation bonds at 11 a.m. Eastern Wednesday.

Jersey City, New Jersey, is set to sell $124.45 million of bond anticipation notes at 11:15 a.m. Wednesday. The issuer will also sell $19.2 million of taxable BANs at 11:30 a.m.

The Louisville/Jefferson County Sewer District, Kentucky, is set to sell $341.94 million of sewer and drainage revenue bonds at 10:30 a.m. Thursday.

Chip Barnett contributed to this report.