Munis rally, UST yields fall out long, post-FOMC minutes

7 min read

Municipals rallied Wednesday amid a busy primary market day as U.S. Treasury yields fell out long and equities closed the session up after the Federal Open Market Committee released its minutes with few surprises.

Triple-A yields were bumped seven to 12 basis points, depending on the scale, while U.S. Treasury yields fell up to 12 basis points out long.

As a result, ratios fell. The two-year muni-to-Treasury ratio Wednesday was at 71%, the three-year was at 71%, the five-year at 71%, the 10-year at 73% and the 30-year at 89%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 71%, the three-year at 72%, the five-year at 71%, the 10-year at 72% and the 30-year at 88% at 4 p.m.

Minutes from the September Federal Open Market Committee meeting were “not much of a market mover” Wednesday, said Scott Anderson, chief U.S. economist and managing director at BMO Economics.

For the most part, he said “equities held on to modest gains, and longer-term Treasury yields were generally lower on the day, holding near pre-FOMC Minutes release levels.”

The tone of the minutes was “a bit more dovish than expected, despite the threat of one more rate hike from the Fed still on the table,” he noted.

The minutes noted that “participants generally judged that, with the stance of monetary policy in restrictive territory, risks to achievement of the Committee’s goals had become more two sided.”

On the policy outlook, “all participants agreed that the Committee was in a position to proceed carefully…” though “all participants agreed that policy should remain restrictive for some time until the Committee is confident that inflation is moving down sustainably toward its objective,” according to the minutes.

Several participants commented that, “with the policy rate likely at or near its peak, the focus of monetary policy decisions and communications should shift from how high to raise the policy rate to how long to keep it restrictive,” Anderson said.

At the September meeting, most thought there may be one more rate hike on the table this year while others thought no further rate hikes would be necessary.

Since that meeting, “the 10-year Treasury yield has moved up by around 30 basis points, the UAW strike has gone on for nearly a month, a federal government shutdown is still possible, and a serious military conflict in Israel has erupted,” Anderson noted.

“A vast majority of participants continued to judge the future path of the economy as highly uncertain,” the minutes noted.

The probability of “another Fed rate hike at the November FOMC meeting plunged to just 9.8% in the Fed funds futures market, following the release of the Minutes, with the probability of a December hike at around 19.9%,” Anderson said.

“There are so many crosswinds in the market right now: we’ve got significant geopolitical risk, domestic political uncertainty in the House of Representatives, the inflation print, the Fed,” said CreditSights strategist Pat Luby. “At some point, investors may rightly conclude you can’t figure out all of these things, you can’t forecast all of these different trends.”

At some point, Luby said market participants are going to have put money to work into munis.

A decent supply pipeline may help that effort, Luby said.

“There are nice looking deals on the calendar and this time of the year is when we see new deals [and] new-money borrowing continuing to come to the market,” he said.

With current rates, Luby said refinancings may not contribute to any increase in supply, though.

“How much longer are you supposed to wait? If you wait too long, we’re going to get into Thanksgiving and Christmas and year-end, and you’ll miss the supply boat,” he said.

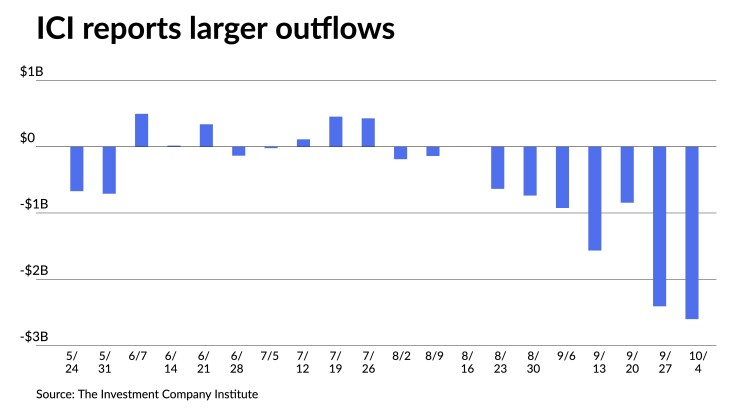

Municipal mutual fund losses continued last week as the Investment Company Institute Wednesday reported investors pulled $2.6 billion from the funds in the week ending Oct. 4 after $2.407 million of outflows the previous week. This is the second-largest outflow cycle of 2023, only being surpassed by outflows of $3.157 billion for the week ending Jan. 4.

Comparatively, for the most recent week, LSEG Lipper reported $1.3 billion of outflows.

Due to this, “negative momentum from such may persist for some time,” said Matt Fabian, a partner at Municipal Market Analytics.

Meanwhile, for the most recent reporting week, ETFs saw inflows of $601 million after $136 million of outflows the week prior, according to ICI.

“To be sure, ETF inflows have been steadily positive, if not robust, with MUB alone collecting over [$3 billion since Sept. 1], but as MUB is often used as a proxy for a cash alternative, MUB-specific inflows are less consoling for demand than otherwise,” Fabian said.

Meanwhile, tax-exempt municipal money market funds saw inflows for the second consecutive week as $1.97 billion was added the week ending Tuesday, bringing the total assets to $120.34 billion, according to the Money Fund Report. The seven-day simple yield reset fell to 2.99%.

Taxable money-fund assets saw $5.03 billion added to end the reporting week.

The average seven-day simple yield for all taxable reporting funds remained at 5.04%.

Elsewhere, “aggregate customer selling totals (by par) were elevated last week boosted by smaller trades, even as bids wanteds topped $8 billion for the first time in months,” he said.

Many of these sell trades, Fabian noted, “will be opportunistic tax swap activity — holders liquidating municipal positions at a loss to rebuy similar bonds — but selling activity is never a constructive vector.”

Meaning, “the more bonds put in play in the secondary market, the more conservative underwriters are compelled to be in the primary, pulling back offered side levels and creating negative momentum in evaluations/indices/NAVs/statements,” he said.

In the primary market Wednesday, J.P. Morgan priced and repriced for institutions an upsized $1.114 billion of MTA Bridges and Tunnels payroll mobility tax senior lien refunding climate-certified green bonds, Series 2023C, for the Triborough Bridge and Tunnel Authority (/AA+/AA+/AA+/), with bumps up to 18 basis points from Tuesday’s retail offering: 5s of 11/2029 at 3.56%, 5s of 2033 at 3.72% (-16), 5s of 2038 at 4.25% (-18) and 5s of 2043 at 4.49%, callable 11/15/2033.

Citigroup Global Markets priced for the Allegheny County Airport Authority, Pennsylvania, (A2//A/A+/) $376.775 million of Assured Guaranty-insured Pittsburgh International Airport AMT revenue bonds. The first tranche, $349.625 million of Series 2023A, saw 5s of 1/2026 at 4.39%, 5s of 2028 at 4.26%, 5s of 2033 at 4.40%, 5.25s of 2038 at 4.81%, 5.5s of 2043 at 4.89%, 5.5s of 2048 at 5.00% and 5.5s of 2053 at 5.06%, callable 1/1/2033.

The second tranche, $27.99 million of Series 2023B, saw 5s of 1/2026 at 3.83%, 5s of 2028 at 3.71%, 5s of 2033 at 3.89%, 5s of 2038 at 4.38%, 5.25s of 2043 at 4.65%, 5.25s of 2048 at 4.76%% and 5.25s of 2053 at 4.84%, callable 1/1/2033.

Raymond James priced for Houston (Aa3//AA/) $271.3 million of public improvement and refunding bonds, Series 2023A, with 5s of 3/2025 at 3.74%, 5s of 2028 at 3.58%, 5s of 2033 at 3.76%, 5s of 2038 at 4.24% and 5.25s of 2043 at 4.44%, callable 3/1/2033.

Morgan Stanley priced for the Chabot-Las Positas Community College District, California, (Aa2/AA//) $243.485 million of Election of 2016 general obligation refunding bonds, Series 2023C, with 5s of 8/2025 at 3.44%, 5s of 2028 at 3.19%, 5s of 2033 at 3.24%, 5s of 2038 at 3.84%, 5s of 2043 at 4.20% and 5.25s of 2048 at 4.32%, callable 8/1/2033.

In the competitive market, Jersey City, New Jersey, sold $124.45 million of tax-exempt bond anticipation notes, Series 2023C, to BofA Securities, with 5s of 10/2024 at 3.92%, noncall.

Lake Forest Community HSD #115, Illinois (/AAA//), sold $101.645 million of GOs, to BofA Securities, with 5s of 11/2024 at 3.75%, 5.5s of 2028 at 3.60%, 5s of 2033 at 3.65%, 5s of 2038 at 4.27% and 4.25s of 2043 at 4.67%, callable 11/1/2032.

Secondary trading

Connecticut 5s of 20224 at 3.70% versus 3.86% on 10/5. NYC TFA 5s of 2024 at 3.73%. California 5s of 2025 at 3.52%-3.45% versus 3.63%-3.55% original on 10/2.

NY Dorm PIT 5s of 2028 at 3.50% versus 3.63% on 10/5. Triborough Bridge and Tunnel Authority 5s of 2028 at 3.43%. Maryland 5s of 2029 at 3.32%.

Energy Northwest 5s of 2032 at 3.55%-3.62% versus 3.65%-3.64% Tuesday and 3.63%-3.60% on 10/2. California Educational Facilities Authority 5s of 2033 at 3.20% versus 3.32% on 10/5. NYC TFA 5s of 2034 at 3.77%-3.72%.

Washington 5s of 2048 at 4.47%. Massachusetts 5s of 2053 at 4.50% versus 4.58% on 10/2.

AAA scales

Refinitiv MMD’s scale was bumped nine to 12 basis points: The one-year was at 3.61% (-9) and 3.53% (-9) in two years. The five-year was at 3.29% (-12), the 10-year at 3.36% (-12) and the 30-year at 4.24% (-12) at 3 p.m.

The ICE AAA yield curve was bumped seven to 12 basis points: 3.60% (-7) in 2024 and 3.54% (-8) in 2025. The five-year was at 3.30% (-10), the 10-year was at 3.33% (-11) and the 30-year was at 4.24% (-12) at 4 p.m.

The S&P Global Market Intelligence municipal curve was bumped nine to 12 basis points: The one-year was at 3.64% (-9) in 2024 and 3.56% (-9) in 2025. The five-year was at 3.33% (-12), the 10-year was at 3.37% (-12) and the 30-year yield was at 4.25% (-12), according to a 3 p.m. read.

Bloomberg BVAL was bumped nine to 12 basis points: 3.62% (-9) in 2024 and 3.54% (-10) in 2025. The five-year at 3.28% (-10), the 10-year at 3.35% (-11) and the 30-year at 4.27% (-11) at 4 p.m.

Treasuries were firmer five years and out.

The two-year UST was yielding 4.994% (+1), the three-year was at 4.756% (flat), the five-year at 4.578% (-4), the 10-year at 4.578% (-8), the 20-year at 4.917% (-11) and the 30-year Treasury was yielding 4.714% (-12) near the close.

Primary to come

The Los Angeles Department of Water and Power (Aa2/AA-//AA/) is set to price Thursday $312.39 million of power system revenue refunding bonds, 2023 Series D, serials 2024-2032, 2041-2043. TD Securities.

Competitive

The Louisville/Jefferson County Sewer District, Kentucky, is set to sell $341.94 million of sewer and drainage revenue bonds at 10:30 a.m. Thursday.