Another rough session; Connecticut, NYC TFA face higher yields in institutional pricing

7 min read

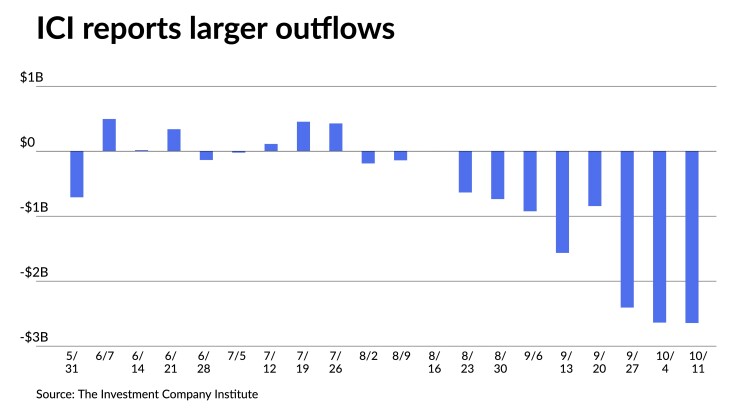

Municipals faced more pressure Wednesday and two billion-dollar-plus deals for Connecticut and the New York City Transitional Finance Authority saw yields rise up to 12 to 13 basis points from Tuesday’s retail pricings while the third consecutive week of $2 billion plus outflows were reported. U.S. Treasuries saw more losses and equities sold off.

Triple-A yield curves were cut up to five basis points with larger cuts out long, depending on the scale, while UST yields rose up to seven basis points at 20 years.

The two-year muni-to-Treasury ratio Wednesday was at 69%, the three-year was at 69%, the five-year at 70%, the 10-year at 72% and the 30-year at 90%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 70%, the three-year at 71%, the five-year at 71%, the 10-year at 73% and the 30-year at 91% at 3:30 p.m.

Municipal mutual fund losses continued last week as the Investment Company Institute Wednesday reported investors pulled $2.645 billion from the funds in the week ending Oct. 11 after $2.638 million of outflows the previous week. This is the second-largest outflow cycle of 2023, only being surpassed by outflows of $3.157 billion for the week ending Jan. 4.

Exchange-traded funds, though, saw another week of inflows to the tune of $681 million after inflows of $601 million the week prior, according to ICI.

This month is “playing out as recent Octobers have with the market realizing losses, albeit of a more contained nature,” said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

Since 2018, the month has seen negative results in all years except for 2019 “when the return was just positive as lower redemptions and higher supply typically enter the fray,” she said.

This year has the “added weight” of a pending Federal Open Market Committee action with strong economic data “counterbalancing a potential pause,” she said.

The tone remains “opportunistic” given the smaller net negative supply figure over the next 30 days at $3.256 billion versus a 2023 high value that neared $20 billion in May, per Bloomberg data, in addition to secondary tax-related selling gaining momentum, Olsan said.

“A set of conditions has developed that has forced higher generic yields and widened out spreads to multi-year highs,” she said.

Exaggerated selling levels have been created due to the “combination of the approach of year-end and rates trending higher,” she noted.

Only one trading session in the past month has seen bids wanted under $1 billion, according to Bloomberg. Daily bids wanted are averaging $1.59 billion this month, which is up 39% from 2023’s daily figure, she said.

“Recent activity suggests a trend toward larger customer buying volumes on the short end of the curve,” she said.

The one- to three-year range captured 60% of customer buys Tuesday, an increase of 7% from last month’s activity, according to data from the Municipal Securities Rulemaking Board data.

Both the three- to seven-year and seven- to 12-year ranges have seen volume drop 2% to 3% over the last 30 days, while “long-maturity buying by customers reached 57% of all flows in the last month but that share has also dropped to 53%,” Olsan noted.

The “availability of higher-yielding short-term maturities” may play a role in recent allocations, she said.

Dealer inventory commitments are responding to recent conditions.

In the first half of the year, she said “dealer positions averaged $13.3 billion per day but had fallen to $12.6 billion during Q3.”

More caution in commitment levels was caused by “a near linear upwardly trending yield curve in that period,” she said.

October’s dealer carry figures have fallen further to an average of $11.3 billion as “a heavy seasonal impact informs risk tolerances,” she said.

If 2022’s trend can be relied on, Olsan said “inventory levels may rise into the end of the year as issuance conditions created a more favorable supply/demand balance.”

In the primary market Wednesday, RBC Capital Markets priced and repriced for institutions $1.224 billion of special tax obligation bonds for transportation infrastructure purposes for Connecticut (Aa3/AA/AA-/AAA/), with yields cut up to 13 basis points from Tuesday’s retail order: The first tranche, $875 million of new-issue bonds, Series 2023A, saw 5s of 7/2024 at 3.80% (+5), 5s of 2028 at 3.68% (+13), 5s of 2033 at 3.84% (+12), 5s of 2038 at 4.35% (+5), 5s of 2043 at 4.68% (+10) and 5s of 2044 at 4.71% (+10), callable 1/1/2034.

The second tranche, $348.560 million of refunding bonds, Series 2023B, saw 5s of 7/2025 at 3.80% (+7), 5s of 2028 at 3.68% (+13), 5s of 2033 at 3.84% (+12) and 5s of 2034 at 3.89% (+10), noncall.

Ramirez & Co. priced and repriced for institutions $1 billion of future tax-secured tax-exempt subordinate bonds, Fiscal 2024 Series C, from the New York City Transitional Finance Authority (Aa1/AAA/AAA/), with yields cut up to 12 basis points from Tuesday’s retail offering: 5s of 5/2025 at 3.75% (+3), 5s of 2028 at 3.67% (+7), 5s of 2033 at 3.85% (+7), 5s of 2038 at 4.40% (+5), 5.25s of 2043 at 4.67% (+10), 5.25s of 2048 at 4.87% (+12), 5.5s of 2053 at 4.88% (+11) and 5s of 2053 at par, callable 11/1/2033.

BofA Securities priced for the Wellstar Health System $504.445 million of revenue bonds and revenue anticipation certificates. The first tranche, $282.620 million of revenue anticipation certificates, Series 2023A (A2/A+//), on behalf of the Columbia County Hospital Authority, saw 5.125s of 4/2048 at 5.34%, 5s of 2048 at 5.20%, 5.125s of 2053 at 5.36%, 5.75s of 2053 at 5.26% and 5s of 2053 at 5.25%, callable 4/1/2033.

The second tranche, $57.445 million of revenue anticipation certificates, Series 2023B (A2/A+//), on behalf of the Columbia County Hospital Authority, saw 5s of 4/2026 at 3.89%, 5s of 2028 at 3.80%, 5s of 2033 at 3.97%, 5s of 2038 at 4.50% and 5s of 2043 at 4.86%, callable 4/1/2033.

The third tranche, $80.465 million of revenue anticipation certificates, Series 2023A (A2/A+//), on behalf of the Cobb County Kennestone Hospital Authority, saw 5s of 4/2028 at 4.10%, 5s of 2030 at 4.16%, 5s of 2041 at 5.06%, 5s of 2043 at 5.16% and 5s of 2053 at 5.25%, callable 4/1/2033.

The fourth tranche, $83.915 million of revenue bonds, Series 2023A (A2/A+//), on behalf of the Development Authority of Augusta Georgia, saw 5s of 5.125s of 4/2053 at 5.36% and 5.125s of 2053 at 55.25%, callable 4/1/2033.

BofA Securities priced for the School District of Philadelphia $400 million of tax revenue anticipation notes, Series A, saw 5s of 6/2024 at 4.20%, noncall.

Secondary trading

Maryland 5s of 2024 at 3.72%-3.70%. Washington 5s of 2024 at 3.75% versus 3.73%-3.75% on 10/2. NYC TFA 5s of 2024 at 3.72% versus 3.85% on 10/4 and 3.87%-3.85% on 10/3.

NYC 5s of 2028 at 3.61%. NYC TFA 5s of 2028 at 3.75%. Ohio 5s of 2029 at 3.58%.

California 5s of 2032 at 3.61%. Iowa Finance Authority 5s of 2033 at 3.67%-3.65% versus 3.58%-3.57% on 10/2. NYC 5s of 2034 at 3.91%.

Battery Park City Authority, New York, 5s of 2048 at 4.69%-4.68% versus 4.66%-4.67% Tuesday and 4.53%-4.52% on 10/2. Massachusetts 5s of 2053 at 4.79% versus 4.67%-4.68% Monday and 4.50% on 10/11.

AAA scales

Refinitiv MMD’s scale was cut up to five basis points: The one-year was at 3.70% (unch) and 3.62% (unch) in two years. The five-year was at 3.44% (+2), the 10-year at 3.53% (+4) and the 30-year at 4.47% (+5) at 3 p.m.

The ICE AAA yield curve saw cuts outside of one year: 3.69% (-1) in 2024 and 3.66% (+1) in 2025. The five-year was at 3.48% (+2), the 10-year was at 3.52% (+3) and the 30-year was at 4.49% (+4) at 4 p.m.

The S&P Global Market Intelligence municipal curve was cut up to five basis points: The one-year was at 3.73% (unch) in 2024 and 3.65% (unch) in 2025. The five-year was at 3.48% (+2), the 10-year was at 3.54% (+4) and the 30-year yield was at 4.48% (+5), according to a 3 p.m. read.

Bloomberg BVAL was cut two to five basis points: 3.75% (+2) in 2024 and 3.69% (+3) in 2025. The five-year at 3.47% (+3), the 10-year at 3.56% (+4) and the 30-year at 4.50% (+4) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 5.206% (flat), the three-year was at 5.033% (+3), the five-year at 4.915% (+5), the 10-year at 4.895% (+6), the 20-year at 5.221% (+7) and the 30-year Treasury was yielding 4.986% (+6) near the close.

Primary to come:

The West Virginia Hospital Finance Authority (Baa1/BBB+//) is set to price Thursday $384.555 million of hospital refunding and improvement revenue bonds (Vandalia Health Group), Series 2023B, serials 2040-2043, terms 2048 and 2053. BofA Securities.

Charlotte, North Carolina (Aaa/AAA/AAA/), is set to price Thursday $219.785 million of GO refunding bonds, Series 2023B, serials 2024-2043. PNC Capital Markets.

The Brownsburg 1999 School Building Corp., Indiana (/AA+//), is set to price Thursday $160.1 million of ad valorem property tax first mortgage bonds, serials 2027-2043. Stifel, Nicolaus & Co.

Cape Coral, Florida (/AA//), is set to price Thursday $138.085 million of Build America Mutual-insured utility improvement assessment refunding bonds (North 1 West Area), Series 2023. Morgan Stanley.

The Washington State Housing Finance Commission (/BBB//) is set to price Thursday $134.06 million of Seattle Academy of Arts and Sciences Project nonprofit revenue and refunding revenue bonds. Piper Sandler & Co.

The Colorado School of Mines Board of Trustees (A1/A+//) is set to price Thursday $133.53 million of institutional enterprise revenue bonds, consisting of $50.06 million of fixed-rate bonds, Series 2023C, and $83.47 million of term-rate bonds, Series 2023D. Morgan Stanley & Co.

The Conroe Independent School District is set to price Thursday $104.98 million of unlimited tax refunding bonds, consisting of $92.225 million of PSF-insured bonds, Series 2023A, and $12.755 million on non-PSF-insured bonds, Series 2023B. Piper Sandler & Co.

Competitive

The Empire State Development Corp., New York (Aa1//AA+/) is set to sell $377.825 million of state sales tax revenue bonds, Series 2023A (Bidding Group 2 bonds), at 11 a.m. eastern Thursday; $347.595 million of state sales tax revenue bonds, Series 2023A (Bidding Group 4 bonds), at 12 p.m. Thursday; $270.365 million of state sales tax revenue bonds, Series 2023A (Bidding Group 3 bonds), at 11:30 a.m. Thursday; and $213.51 million of state sales tax revenue bonds, Series 2023A (Bidding Group 1 bonds), at 10:30 a.m. Thursday.