With few new deals, focus on secondary as bid lists rise

5 min read

Municipals were slightly weaker in spots, U.S. Treasury yields rose while equities made gains to kick off the FOMC-driven week.

While most analysts do not expect the Fed to raise rates this week, uncertainty over December looms and volatility in U.S. Treasuries continues, moves that have mostly taken municipals along for the ride to higher yields.

With October coming to a close, munis are currently down 0.89% for the month and 2.26% for the year, “keeping us on track for the second straight year of declines due to the Fed’s interest-rate hikes and their intentions to keep rates higher in the longer term to tame inflation,” said Jason Wong, vice president of municipals at AmeriVet Securities.

Another month of losses “may spark additional sale pressure as some investors throw in the towel, but we suspect any further weakness would represent a strong entry point for [investment grade] buyers,” Birch Creek strategists said in a weekly report.

And although the market is poised for another down year, Wong said “yields have surged to their highest points in over a decade, reaching levels that we should expect to see investors re-enter into the muni market bringing demand back into the municipal markets.”

At the start of last week, there was “some broader flight-to-quality U.S. Treasury market strength, but not surprisingly, municipals actually underperformed some of that price action,” said Matthew Gastall, executive director and head of Wealth Management Municipal Research and Strategy at Morgan Stanley.

Muni-UST ratios rose slightly last week as a result.

The two-year muni-to-Treasury ratio Monday was at 73%, the three-year was at 73%, the five-year at 73%, the 10-year at 74% and the 30-year at 91%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 74%, the three-year at 75%, the five-year at 74%, the 10-year at 74% and the 30-year at 91% at 4 p.m.

Part of the underperformance last week was due to “higher supply, lower redemptions, and the general laggard effect that munis tend to exhibit to broader, more globalized rate developments,” Gastall said.

However, Gastall said the market continued to manage its way through a number of “bearish dynamics,” which have softened entry points and impacted trading levels, he said.

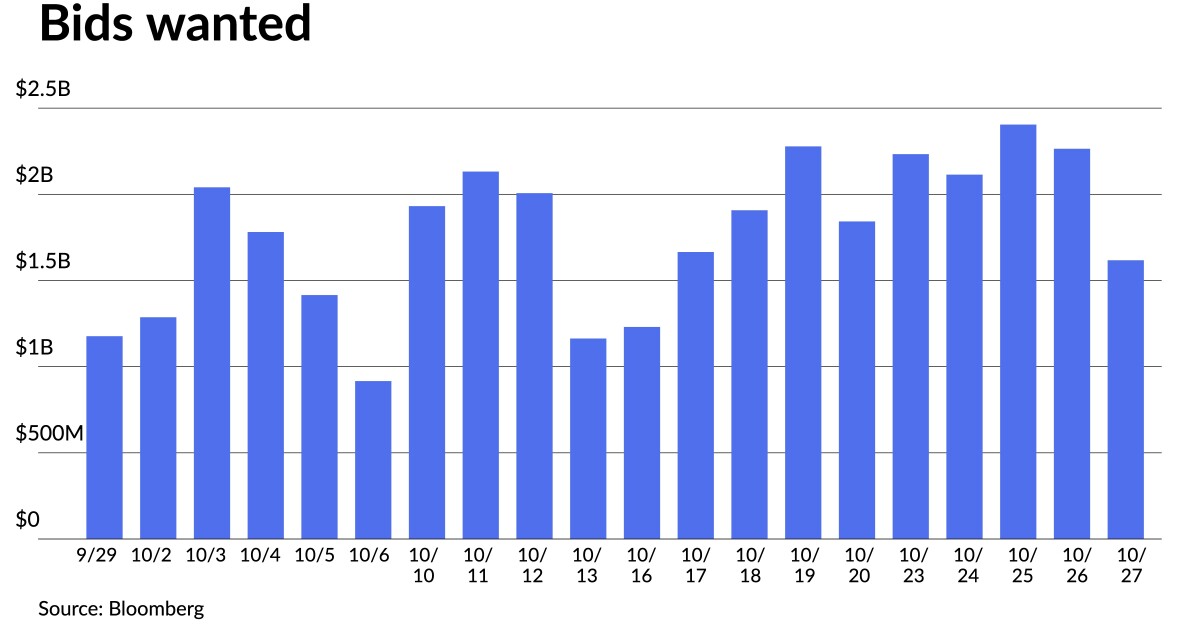

There was some “notable pressure on the street,” particularly as bids wanteds reached their highest levels of 2023, Gastall said.

That selling pressure was “due to the laggard impacts of broader interest rate movements, fund redemptions, and early tax-loss harvesting trades,” he said.

Last Wednesday saw the highest bids wanted volume since last year at $2.4 billion and “didn’t slow down from there,” Birch Creek Capital strategists said in a weekly report.

For the week, the Municipal Securities Rulemaking Board reported an average of 76,000 trades per day, also the highest of the year, they noted.

“The two main culprits were the robust new-issue calendar and continued fund outflows,” they said.

Investors continued to pull more money from muni mutual funds, with LSEG Lipper reporting $935 million of outflows after $297 million of outflows the week prior. This is the eighth straight week of outflows.

With yields continuing their “upward trend,” Wong said investors will continue to pull their investments from bond funds.

Gastall concurred, noting fund outflows may also persist if the rate volatility continues, he said.

“While accounts were laser-focused on raising cash and subscribing to new deals coming at healthy concessions to recent secondary prints, dealers began piling up inventory,” Birch Creek Capital strategists said.

With issuance set to drop due to the Federal Open Market Committee meeting this week and Nov. 1 cash hitting investor accounts, they said “there is a growing sense of bullishness heading into year-end.”

Anders S. Persson, Nuveen’s chief investment officer for global fixed income, and Daniel J. Close, Nuveen’s head of municipals, are also “fundamentally bullish” on munis, though they expect volatility through the end of the year for several reasons.

For one, they noted “muni trading volume has been heavy as investors retool portfolios.”

New-issue supply remains “outsized,” but Persson and Close don’t see a lot of new money entering the muni space.

They also believe Treasury yields and muni yields should be lower than current levels by sometime in 2024.

Secondary trading

North Carolina 5s of 2024 at 3.79%. Maryland 5s of 2024 at 3.80%-3.65% versus 3.82% Wednesday. Connecticut 5s of 2025 at 3.89%-3.86% versus 3.78% on 10/24.

NYC 5s of 2028 at 3.75%. Maryland 5s of 2029 at 3.57%-3.56%. Georgia s of 2029 at 3.65%.

NYC 5s of 2033 at 3.89%. DC 5s of 2033 at 3.73% versus 3.78% Friday. Austin 5s of 2034 at 3.98%.

NYC 5s of 2047 at 5.02%-4.93% versus 4.76%-4.56% on 10/18. Oregon 5s of 2048 at 4.83% versus 4.77%-4.76% on 10/23. Massachusetts 5s of 2053 at 4.86%-4.69% versus 4.84% Thursday and 4.80%-4.69% Wednesday.

AAA scales

Refinitiv MMD’s scale was cut up to two basis points: The one-year was at 3.76% (unch) and 3.67% (+2) in two years. The five-year was at 3.51% (+2), the 10-year at 3.61% (+2) and the 30-year at 4.57% (unch) at 3 p.m.

The ICE AAA yield curve was cut one to three basis points: 3.74% (+1) in 2024 and 3.72% (+2) in 2025. The five-year was at 3.54% (+2), the 10-year was at 3.59% (+2) and the 30-year was at 4.58% (+2) at 4 p.m.

The S&P Global Market Intelligence municipal curve was cut up to two basis points: The one-year was at 3.79% (unch) in 2024 and 3.71% (+2) in 2025. The five-year was at 3.56% (+2), the 10-year was at 3.62% (+2) and the 30-year yield was at 4.58% (unch), according to a 3 p.m. read.

Bloomberg BVAL was cut up to one basis point: 3.80% (unch) in 2024 and 3.74% (unch) in 2025. The five-year at 3.53% (unch), the 10-year at 3.63% (unch) and the 30-year at 4.59% (unch) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 5.034% (+3), the three-year was at 4.872% (+3), the five-year at 4.805% (+4), the 10-year at 4.883% (+5), the 20-year at 5.238% (+4) and the 30-year Treasury was yielding 5.043% (+3) near the close.

Primary to come

The Connecticut Housing Finance Authority (Aaa/AAA//) is set to price Wednesday $189.780 million of social housing mortgage finance program bonds, 2023 Series D, serials 2024-2035, terms 2038, 2043, 2048, 2051 and 2054. RBC Capital Markets

Dallas (/A-//) is set to price Tuesday $171.600 million of Kay Bailey Hutchison Convention Center Dallas Venue Project senior lien special tax revenue bonds, Series 2023, serial 2053. Ramirez & Co.

The Southern California Public Power Authority (Aa2//AA-/) is set to price Tuesday $162.100 million of green Windy Point/Windy Flats Project refunding revenue bonds, Series 2023-1. J.P. Morgan.

The Avon Community School Building Corp. (/AA+//) is set to price Thursday $150 million of ad valorem property tax first mortgage bonds, Series 2023, serials 2027-2043. Stifel, Nicolaus & Co.

The Rhode Island Housing and Mortgage Finance Corp. (Aa1/AA+//) is set to price Tuesday $149.845 million of homeownership opportunity bonds, consisting of $83.305 million of non-AMT social bonds, Series 81-A; $40.535 million of taxable social bonds, Series 81-T-1; and $26.005 million of taxables, Series 81-T-2. Morgan Stanley.

The Colorado State University System Board of Governors is set to price Tuesday $128.765 million of new-issue and refunding system enterprise revenue bonds, consisting of $56.495 million of Series 23-A1 (Aa3/A+//), serials 2024-2041; $60 million of Series 23-A2 (Aa3/A+//), terms 2048 and 2053; $4.710 million of Series 23-B1 (Aa2/AA//), serials 2029-2030, 2033-2037, 2039 and 2042-2043; and $7.560 million of Series 23-B2 (Aa3/A+//), serials 2031-2036 and 2040-2043, terms 2048 and 2051. BofA Securities.

Competitive

The Charleston County School District is set to sell $93.690 million of GOs, Series 2023B, at 11 a.m. eastern Tuesday.