Quiet close to a volatile October ahead of FOMC

5 min read

Municipals were steady to end a volatile month, as U.S. Treasuries were mixed and equities ended up.

Tuesday also marked the start of the FOMC meeting, which is unlikely to contain any major surprises at the conclusion of the meeting on Wednesday, said Cooper Howard, a fixed income strategist at Charles Schwab.

The Fed is expected to hold rates steady but “leave the door open for one more hike this cycle,” he said.

While the statement will likely have very few changes, the press conference will be the wildcard, he noted.

Due to the FOMC meeting, supply is at only $3 billion for the week.

In the primary market Tuesday, Siebert Williams Shank & Co. priced and repriced for Oregon $140.075 million of tax-exempt GOs, 2023 Series J, with bumps up to 10 basis points out long: 5s of 11/2024 at 3.80%, 5s of 2028 at 3.53% (-5), 5s of 2033 at 3.71% (-9), 5s of 2038 at 4.22% (-10) and 5s of 2043 at 4.53% (-10), callable 11/1/2033.

J.P. Morgan priced for the Southern California Public Power Authority (Aa2//AA-/) $162.070 million of green Windy Point/Windy Flats Project refunding revenue bonds, Series 2023-1, with 5s of 7/2024 at 3.61%, 5s of 2028 at 3.37% and 5s of 2030 at 3.42%, noncall.

BofA Securities priced for the Colorado State University System Board of Governors $121.100 million of system enterprise revenue bonds. The first tranche, $61.100 million of fixed-rate bonds, Series 2023-A1 (Aa3/A+//), with 5s of 3/2024 at 3.84%, 5s of 2028 at 3.69%, 5s of 2033 at 3.90%, 5s of 2038 at 4.39%, 5s of 2043 at 4.76%, 5s of 2048 at 5.01% and 5s of 2051 at 5.05%, callable 3/1/2033.

The second tranche, $60 million of term rate bonds, Series 2023-A2 (Aa3/A+//), saw all bonds price at par: 4.375s of 3/2048 with a mandatory tender of 3/1/2029, callable 9/1/2028, and 4.5s of 3/2053 with a mandatory tender of 3/1/2032, callable 9/1/2053.

In the competitive market, the Charleston County School District sold $93.565 million of GOs, Series 2023B, to BofA Securities, with 5s of 3/2024 at 3.85%, noncall.

However, lower supply “should be supportive of muni returns in the near-term,” Howard said.

Visible supply is roughly $3 billion, the lowest amount since early February this year, he noted.

Historically, Howard said low supply has been a positive for relative yields.

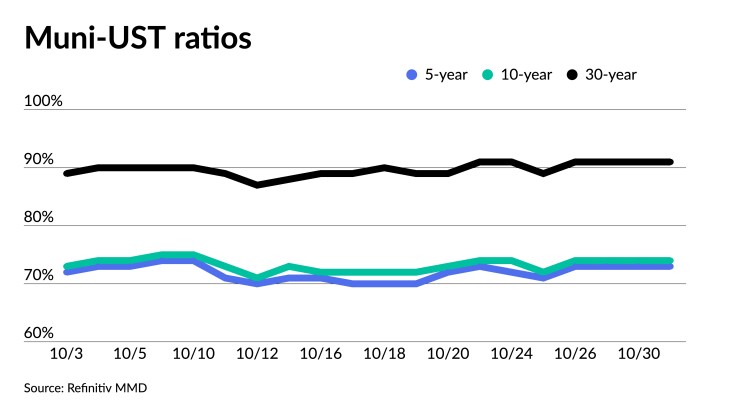

Since 2017, when visible supply has fallen under $5 billion, Howard said the 10-year muni-UST ratio declines by roughly 4 percentage points over the next month.

The two-year muni-to-Treasury ratio Tuesday was at 72%, the three-year was at 73%, the five-year at 73%, the 10-year at 74% and the 30-year at 91%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 73%, the three-year at 74%, the five-year at 73%, the 10-year at 73% and the 30-year at 90% at 3:30 p.m.

In other words, he said, “when supply is low it tends to be that munis outperform Treasuries over the next month.”

However, Matt Fabian, a partner at Municipal Market Analytics, argued muni underperformance appears “likely to be typical for at least the next few weeks: secondary selling, etc. overburdening any nascent demand from a flight to safety in USTs, such becoming more likely as UST yields exceed or approximate 5% while wars, shutdowns and equity losses stoke investor anxiety.”

Money continues to be pulled from muni mutual funds, which have seen 13 consecutive weeks of outflows from traditional funds. There have been $15.4 billion of outflows in the last quarter, with year-to-date outflows at $12.4 billion, he said.

This means that aggregate flows since Jan. 1, 2022, are at $157.5 billion or around 15% of fund holdings as of Dec. 31, 2021.

“Funds’ market value losses would perhaps double that impact, and although tax swaps can help monetize those losses, tax-exempt managers need to avoid selling their cheapest things,” Fabian said.

“Here meaning 2s and 3s, the sales of which could further depress fund NAVs and the purchase of which may generate too much ordinary income tax liability (because of de minimis rules for deeply discounted paper),” he said.

These suggest “less fund tax swapping than might otherwise be possible based on rates alone,” he noted.

The market’s current “overarching problem is a lack of institutional demand generally,” he said.

Muni mutual funds are just one case, Fabian said, as there is also less profitable insurance companies and sell-minded banks.

Retail is the “sole scalable demand vector,” and customer demand is being dominated by smaller lot purchases, he said,

Retail is being managed by more separately managed accounts than not, “limiting investors’ potential to opportunistically extend along the curve (or down the credit or liquidity spectra) to capture temporary value,” according to Fabian.

So while accounts are “looking to the secondary market for price discovery at a pace rivaling the worst of 2022, the likely responses they are getting won’t be encouraging a deeper investment or, at least not yet, the start of a bull market in bonds,” he said.

Secondary trading

North Carolina 5s of 2024 at 3.76% versus 3.79% Monday. California 5s of 2024 at 3.62%-3.58% versus 3.68% Friday. DC 5s of 2025 at 3.78%.

LA DWP 5s of 2028 at 3.36%. Wisconsin 5s of 2029 at 3.60% versus 3.65% Monday. DASNY 5s of 2029 at 3.78%.

Nashua, New Hampshire, 5s of 2033 at 3.65% versus 3.69% Thursday. NYS 5s of 2034 at 3.73%. California 5s of 2036 at 3.96%-3.94% versus 3.99% Thursday and 3.97% on 10/19.

Illinois Finance Authority 5s of 2048 at 5.13%. San Jose Financing Authority 5s of 2052 at 4.53%-4.52% versus 4.37%-4.36% on 10/10.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.76% and 3.67% in two years. The five-year was at 3.51%, the 10-year at 3.61% and the 30-year at 4.57% at 3 p.m.

The ICE AAA yield curve was bumped up to one basis point: 3.74% (-1) in 2024 and 3.72% (-1) in 2025. The five-year was at 3.53% (-1), the 10-year was at 3.58% (-1) and the 30-year was at 4.57% (unch) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.79% in 2024 and 3.71% in 2025. The five-year was at 3.56%, the 10-year was at 3.62% and the 30-year yield was at 4.58%, according to a 3 p.m. read.

Bloomberg BVAL was cut bumped up to two basis points: 3.79% (-1) in 2024 and 3.73% (-1) in 2025. The five-year at 3.52% (-1), the 10-year at 3.62% (-1) and the 30-year at 4.59% (unch) at 3:30 p.m.

Treasuries were mixed.

The two-year UST was yielding 5.068% (+3), the three-year was at 4.890% (+2), the five-year at 4.821% (+2), the 10-year at 4.887% (flat), the 20-year at 5.230% (-1) and the 30-year Treasury was yielding 5.038% (-1) at 3:30 p.m.

Primary to come

The Connecticut Housing Finance Authority (Aaa/AAA//) is set to price Wednesday $189.780 million of social housing mortgage finance program bonds, 2023 Series D, serials 2024-2035, terms 2038, 2043, 2048, 2051 and 2054. RBC Capital Markets

Dallas (/A-//) is set to price Tuesday $171.600 million of Kay Bailey Hutchison Convention Center Dallas Venue Project senior lien special tax revenue bonds, Series 2023, serial 2053. Ramirez & Co.

The Avon Community School Building Corp. (/AA+//) is set to price Thursday $150 million of ad valorem property tax first mortgage bonds, Series 2023, serials 2027-2043. Stifel, Nicolaus & Co.

The Rhode Island Housing and Mortgage Finance Corp. (Aa1/AA+//) is set to price Tuesday $149.845 million of homeownership opportunity bonds, consisting of $83.305 million of non-AMT social bonds, Series 81-A; $40.535 million of taxable social bonds, Series 81-T-1; and $26.005 million of taxables, Series 81-T-2. Morgan Stanley.