Large new-issues price into strong market as yields fall

7 min read

Several large new-issues priced into a stronger market with munis seeing gains across the yield curve amid constructive secondary activity as U.S. Treasuries pared back some of Mondays losses and equities also improved.

Triple-A yields fell three to five basis points while USTs made gains up to eight basis points out long.

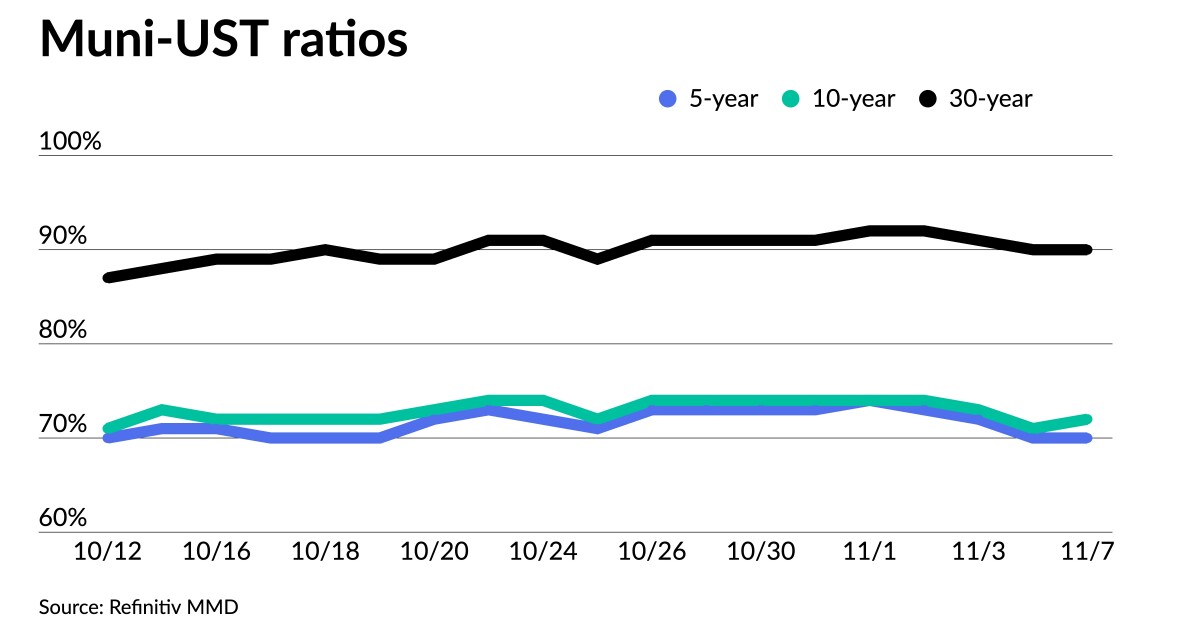

The two-year muni-to-Treasury ratio Tuesday was at 68%, the three-year at 69%, the five-year at 70%, the 10-year at 72% and the 30-year at 90%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 69%, the three-year at 70%, the five-year at 69%, the 10-year at 70% and the 30-year at 88% at 4 p.m.

With refundings on the upswing, California and Washington sold four large general obligation refunding deals in the competitive market while several deals of size priced in the negotiated market led by a $650 million electric system revenue bond deal for Arizona’s Salt River Project Agricultural Improvement and Power District.

In the competitive market Tuesday, California (Aa2/AA-/AA/) sold $373.130 million of various purpose general obligation refunding bonds, Bidding Group A, to Barclays with 5s of 9/2024 at 3.43%, 5s of 2028 at 3.19% and 5s of 2030 at 3.25%, noncall.

California also sold $325.325 million of various purpose general obligation refunding bonds, Bidding Group B, to Morgan Stanley & Co. Pricing details were not yet available.

Washington (Aaa/AA+/AA+/) sold $289.660 million of various purpose general obligation refunding bonds, Series R-2024A, to BofA Securities, with 5s of 2/2024 at 3.50%, 5s of 2028 at 3.28%, 5s of 2033 at 3.42%, 5s of 2038 at 3.94% and 5s of 2039 at 3.99%, callable 12/1/2033.

The state also sold $186.225 million of motor vehicle fuel tax and vehicle-related fees general obligation refunding bonds, Series R-2024B, to BofA Securities, with 5s of 6/2025 at 3.42%, 5s of 2028 at 3.28%, 5s of 2033 at 3.42%, 5s of 2038 at 3.93% and 5s of 2039 at 3.97%, callable 12/1/2033.

Mesa, Arizona, (Aa3/A+//) sold $195.325 million of utility system revenue obligation bonds, Series 2023, to BofA Securities, with 5s of 7/2024 at 3.60%, 5s of 2028 at 3.39%, 5s of 2033 at 3.54%, 5s of 2038 at 4.10%, 5s of 2043 at 4.44% and 5s of 2048 at 4.69%, callable 7/1/2033.

In the negotiated space, Morgan Stanley priced for the Salt River Project Agricultural Improvement and Power District, Arizona, (Aa1/AA+//) $650 million of fixed rate electric system revenue bonds, Series 2023B, with 5s of 1/2043 at 4.18%, 5s of 2048 at 4.46% and 5.25s of 2053 at 4.48%, callable 1/1/2034.

Barclays priced for the Texas Private Activity Bond Surface Transportation Corp. (Baa1//BBB+/) $267.590 million of senior lien revenue refunding bonds (NTE Mobility Partners Segments 3 LLC), Series 2023, with 5s of 12/2033 at 4.55%, 5.375s of 6/2038 at 4.90% and 5.5s of 6/2043 at 4.98%, callable 6/30/2028.

BofA Securities priced for the Illinois Housing Development Authority (Aaa///) $129.525 million of non-AMT social bonds, with all bonds priced at par — 3.625s of 10/2024, 3.95s of 4/2028, 3.95s of 10/2028, 4.35s of 4/2033, 4.4s of 10/2033, 4.75s of 10/2038 and 4.9s of 10/2041 — except 6.25s of 4/2054 at 4.75%, callable 10/1/2032.

Wells Fargo Bank priced for the California Educational Facilities Authority (/BBB-//) $110 million of Saint Mary’s College of California refunding revenue bonds, Series 2023A, with 5.25s of 10/2030 at 4.61%, 5.25s of 2033 at 4.82%, 5s of 2038 at 5.26%, 5.25s of 2044 at 5.42% and 5.5s of 2053 at 5.68%, callable 10/1/2033.

A stronger market, but caution warranted

The rally that began last week “came despite, and perhaps accelerated, a surge in tax loss swaps by smaller investors,” said Matt Fabian, a partner at Municipal Market Analytics.

The five-day rolling par sold nearly hit $30 billion for the first time since February “even as average trade sizes plunged to retail block levels,” he said.

Small and large investors “now worried about missing out on best performance of 2023 tax swaps can be expected to burden selling tapes (and relative performance) in at least the near term,” he said.

Therefore, the jump in bids wanteds may not subside soon, he said.

There are only two weeks until Thanksgiving, “so we’re moving through the period where we’ll likely continue to see more tax loss selling,” said Matthew Gastall, head of Wealth Management Municipal Research at Morgan Stanley.

And due to the recent strength in rates, now “might be advantageous to leverage that strength to complete some 2023 tax loss trades, particularly before liquidity declines in December,” he noted.

With equities up as well, “last week was a good one for financial assets, and headlines in the financial media — not to mention from valued independent research groups — may have begun to reshape municipal investor in favor of buying value now,” Fabian said.

Munis are an area of opportunity for high-income earners, said Cooper Howard, a fixed-income strategist at Charles Schwab.

Yields are “very attractive” after considering the impact of taxes, he noted.

Credit quality is “strong” and defaults are likely to remain “rare,” Howard said.

“State tax revenues have surged and many states have used the increase in revenues to build up their rainy-day funds,” he said.

Seasonal tailwinds should support near-term performance, according to Howard.

While monthly total returns have been negative for the past three months, they may improve because “returns have historically been favorable in the final part of the year,” he said.

Additionally, while supply is low, Howard noted “demand is likely to be solid given very attractive yields.”

In November, there will likely be healthy issuance, lower redemption-driven reinvestment demand, potential outflows from mutual funds, and tax loss selling, Gastall said.

“Yet, as we move into December … some seasonals may gradually become constructive for relative pricing once again,” he said.

Therefore, Gastall said “we still believe it’s a good time for interested investors to consider dollar cost averaging some exposure into the market.”

However, there are still points of uncertainty as the end of the year approaches.

For one, the U.S. House has “just two weeks to pass a government funding bill to avert a shutdown, and progress appears both slow and labored, with no short-term funding bill expected this week,” Fabian said.

Second, he noted “the war in Gaza continues to intensify; any widening could also have uncertain consequences for the U.S. financial markets.”

And third, Citibank’s potential exit from the municipal bond market is “a serious potential blow to current (and more importantly future) sector liquidity and financing ability,” he said.

So while bonds seem cheap by historical standards and momentum is favorable, Fabian said returns into Dec. 31 may be “highly volatile.”

Secondary trading

Texas 5s of 2024 at 3.59%. Minnesota 5s of 2024 at 3.50%. North Carolina 5s of 2025 at 3.35% versus 3.39% Monday and 3.56%-3.53% Thursday.

Baltimore County, Maryland, 5s of 2028 at 3.23%-3.26%. Maryland 4s of 2029 at 3.34%. California 5s of 2030 at 3.33% versus 3.35% Monday.

Massachusetts 5s of 2032 at 3.28% versus 3.43% Thursday. Tulare County Transportation Authority, California, 5s of 2035 at 3.26%-3.25%. NYC 5s of 2035 at 3.74%-3.65%.

NYC 5s of 2051 at 4.65% versus 4.67%-4.48% Monday and 4.70% Friday. Massachusetts 5s of 2053 at 4.53%-4.55% versus 4.63% Friday and 4.74%-4.69% Thursday.

AAA scales

Refinitiv MMD’s scale was bumped three to five basis points: The one-year was at 3.47% (-3) and 3.36% (-3) in two years. The five-year was at 3.19% (-4), the 10-year at 3.28% (-4) and the 30-year at 4.28% (-5) at 3 p.m.

The ICE AAA yield curve was bumped three to four basis points: 3.47% (-3) in 2024 and 3.42% (-4) in 2025. The five-year was at 3.19% (-3), the 10-year was at 3.27% (-3) and the 30-year was at 4.26% (-4) at 4 p.m.

The S&P Global Market Intelligence municipal curve was bumped four to five basis points: The one-year was at 3.48% (-4) in 2024 and 3.38% (-4) in 2025. The five-year was at 3.23% (-4), the 10-year was at 3.29% (-4) and the 30-year yield was at 4.28% (-5), according to a 3 p.m. read.

Bloomberg BVAL was cut bumped three to four basis points: 3.51% (-3) in 2024 and 3.44% (-3) in 2025. The five-year at 3.22% (-3), the 10-year at 3.31% (-3) and the 30-year at 4.28% (-3) at 4 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.912% (-2), the three-year was at 4.689% (-4), the five-year at 4.536% (-6), the 10-year at 4.572% (-8), the 20-year at 4.917% (-8) and the 30-year Treasury was yielding 4.738% (-8) at the close.

Primary to come

The Black Belt Energy Gas District, Alabama, (A2///) is set to price $432.9 million of gas project revenue bonds, Series 2023 C. Goldman Sachs & Co.

The Massachusetts Clean Water Trust (Aaa/AAA/AAA/) is set to price Wednesday $404.460 million of state revolving fund bonds, consisting of $148.965 million of green Series 25A bonds, serials 2025-2040; $114.58 million of Series 25B sustainability bonds, serials 2036-2044; and $140.915 million of state revolving fund refunding green bonds, Series 2023, serials 2025-2038. Citigroup Global Markets.

The Community Development Administration of the Maryland Department of Housing and Community Development (Aa1//AA+/) is set to price Wednesday $400 million of residential revenue bonds consisting of $75 million of non-AMT social bonds and $325 million of taxable social bonds. J.P. Morgan Securities.

The University of Connecticut (Aa3/AA-/AA-/) is set to price Wednesday $356.73 million of general obligation bonds consisting of $227.415 million of Series A and $129.315 million of refunding bonds. J.P. Morgan Securities.

The Westchester County Local Development Corp. (/AA//AA+) is set to price Thursday $298.47 million of revenue bonds (Westchester Medical Center Obligated Group Project) insured by Assured Guaranty Municipal Corp. Serials 2031-2034, 2050, terms 2048, 2053. BofA Securities.

Miami (Aa2/AA//) is set to price Wednesday $250.67 million of special obligation non-ad valorem revenue bonds, Series 2023A. Jefferies.

The North Carolina Housing Finance Agency (Aa1/AA+//) is set to price Wednesday $235 million of home ownership non-AMT social revenue bonds, Series 52-A (1998 Trust Agreement), serials 2025-2035, terms 2038, 2043, 2046, 2055. BofA Securities.

The Oakland Unified School District (A1///) is set to price Thursday $192.08 million of general obligation bonds and GO refunding bonds. Siebert Williams Shank & Co.

The Dripping Springs Independent School District, Texas, (/AAA//) is set to price Thursday $175.4 million of unlimited tax school building and refunding bonds. Permanent School Fund Guarantee Program, serials 2024-2053. Raymond James & Associates.