November’s gains so far erase October’s losses

7 min read

Municipals were steady to start the week, while U.S. Treasuries were slightly firmer and equities ended mixed.

The two-year muni-to-Treasury ratio Monday was at 65%, the three-year at 66%, the five-year at 67%, the 10-year at 69% and the 30-year at 89%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 66%, the three-year at 66%, the five-year at 66%, the 10-year at 70% and the 30-year at 88% at 4 p.m.

November “continues to be off to a strong start as yields have fallen an average of 34 basis points across the curve since the start of the month,” said Jason Wong, vice president of municipals at AmeriVet Securities.

Last week, the Refinitiv MMD AAA curve was bumped 11 to 14 basis points. The 10-year AAA MMD yield ended the week at 3.20%, Wong said. Just one month ago, yields on 10-year AAA MMDwere at 3.36%.

The gains this month have pushed year-to-date returns back into positive territory “as we try to end the year positive,” Wong noted.

Month-to-date, munis are returning 2.66%, with the majority of gains coming from the long end with bonds gaining 4.37%. Meanwhile, 10-year bonds saw gains of 2.26% and two-year bonds saw modest gains of 0.57%.

“November gains have erased all of October losses as munis continue to try and avoid three consecutive down months,” Wong said.

As long as Tuesday’s consumer price print “doesn’t surprise us with higher-than-expected inflation … we can expect the Fed to be finished with their most aggressive tightening cycle in four decades,” he said.

The muni market was strong last week “amidst a slowdown in both bonds being put out for the bid and mutual fund outflows,” said Birch Creek Capital strategists in a weekly report.

Secondary trading last week totaled around $5.33 billion with 51% of trades being dealer sells, Wong said.

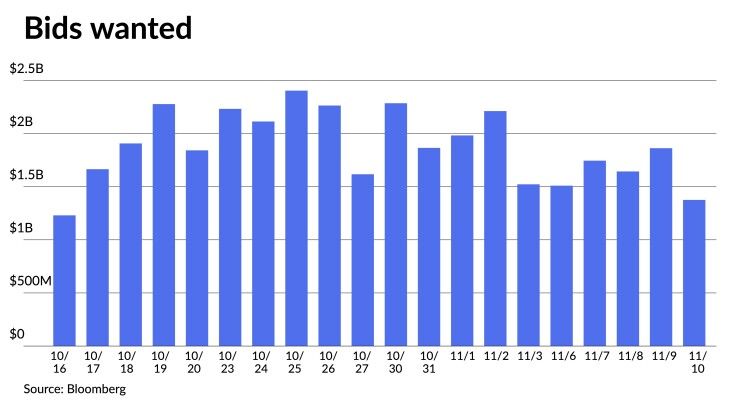

Investors put up roughly $8.13 billion for the bid, down from the $9.81 billion seen in the previous week, according to Bloomberg data.

Meanwhile, mutual funds continued to see outflows as investors pulled $151 million last week after $1.5 billion of outflows the previous week, according to LSEG Lipper. This marks the 10th straight week of outflows.

There were also $1 billion coming into exchange-traded funds, offsetting the $1.2 billion out of open-end funds, Birch Creek Capital strategists said.

“Outflows were concentrated in intermediate and short funds as investors began rotating into longer duration positions,” they said.

“While muni mutual funds have continued to lose assets, new-issue and secondary market demand have remained firm and muni ETFs have continued to attract new assets,” CreditSights strategists Pat Luby and Sam Berzok said.

Although bond and ETF demand slowed from the prior week, they think this saw due to last week’s surge in primary market supply.

New issues remained the focus after $11 billion in sales last week and $8 billion more slated to come to market this week. However, Birch Creek strategists said, “oversubscriptions led to broader participation in the secondary market after accounts came up disappointed in their allocations.”

Dealers also “drove secondary purchases as they tried to re-load their inventory after their shelves had been cleaned out the past week,” they said.

Customers showed a “preference for high-quality 4% coupon bonds that were still priced at a discount rather than 5s at a few point premium, but the opposite was true in mid-grades where 5s were just finally trading through par again,” Birch Creek strategists said.

In the primary market Monday, RBC Capital Markets priced for the Patriots Energy Group Finance Agency (Aa1///) $889.89 million of gas supply revenue bonds, Series 2023. The first tranche, $767.25 million of fixed rate bonds, Subseries 2023 B-1, saw 5.25s of 3/2020 at 4.77% and 5.25s of 2031 at 4.81%, callable 12/1/2030, and 5.25s of 2/2054 with a mandatory tender date of 3/1/2031 at 4.86%, callable 12/1/2030.

Deal information was not provided for the second tranche, $104 million of SOFR index rate bonds, Subseries 2023B-2.

The third tranche, $18.64 million of taxable fixed rate bonds, Subseries 2023B-3, saw 6.62s of 2/2054 with a mandatory tender date of 3/1/2031 price at par, callable 12/1/2030.

Citigroup Global Markets priced for the New York City Housing Development Corp. (Aa2/AA+//) $121.5 million of term rate sustainable development multi-family housing revenue bonds, 2023 Series D, with 4.3s of 11/2063 priced at par, callable 7/1/2027.

Muni CUSIP requests rise

Municipal CUSIP request volume rose in October on a year-over-year basis, following a decrease in September, according to CUSIP Global Services.

For muni bonds specifically, there was an increase of 15.8% month-over-month, but a 9.4% decrease year-over-year.

The aggregate total of identifier requests for new municipal securities, including municipal bonds, long-term and short-term notes, and commercial paper, rose 7.4% versus September totals. On a year-over-year basis, overall municipal volumes were down 7.2%. CUSIP requests are an indicator of future issuance.

Secondary trading

DASNY 5s of 2024 at 3.47%. Maryland 5s of 2025 at 3.31%. California 5s of 2025 at 3.33%.

Minnesota 5s of 2028 at 3.13%-3.11%. California 5s of 2029 at 3.20% versus 3.59% on 11/1. NYC 5s of 2030 at 3.37%.

Texas 5s of 2031 at 3.40%. DASNY 5s of 2034 at 3.54%-3.52%. NYC TFA 5s of 2036 at 3.68% versus 3.68% Friday and 4.12% on 11/1.

Baltimore County, Maryland, 5s of 2045 at 4.13%-4.14% versus 4.13% Thursday. NYC 5s of 2047 at 4.57%.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.42% and 3.29% in two years. The five-year was at 3.12%, the 10-year at 3.20% and the 30-year at 4.22% at 3 p.m.

The ICE AAA yield curve was cut up to one basis point: 3.37% (unch) in 2024 and 3.32% (unch) in 2025. The five-year was at 3.12% (+1), the 10-year was at 3.21% (unch) and the 30-year was at 4.20% (+1) at 4 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.43% in 2024 and 3.30% in 2025. The five-year was at 3.15%, the 10-year was at 3.21% and the 30-year yield was at 4.21%, according to a 3 p.m. read.

Bloomberg BVAL was cut up to a basis point: 3.46% (unch) in 2024 and 3.40% (+1) in 2025. The five-year at 3.17% (unch), the 10-year at 3.25% (unch) and the 30-year at 4.23% (+1) at 4 p.m.

Treasuries were firmer.

The two-year UST was yielding 5.025% (-4), the three-year was at 4.799% (-4), the five-year at 4.651% (-4), the 10-year at 4.627% (-3), the 20-year at 4.954% (-2) and the 30-year Treasury was yielding 4.741% (-2) near the close.

Primary on Friday

Goldman Sachs priced for the Black Belt Energy Gas District (A2///) $466.615 million of gas project revenue bonds, 2023 Series C, with 5.5s of 6/2026 at 4.87%, 5.5s of 2028 at 4.92% and 5.5s of 2032 at 5%, callable 3/1/2032.

Primary to come

The New Jersey Transportation Trust Fund Authority (A2/A-/A/A/) is set to price Thursday $1.25 billion of transportation program bonds, Series BB, serials 2032-2050. Wells Fargo Bank.

The District of Columbia (Aa1/AAA/AA+/) is set to price Wednesday $1.216 billion of income tax-secured revenue bonds, consisting of $482.230 million of tax-exempt bonds, Series 2023A, serials 2037-2043, term 2048; $227.360 million of taxable refunding bonds, Series 2023B, series 2025-2037; $186.68 million of tax-exempt refunding bonds, Series 2023C, serials 2024, 2031-2033; and $320.145 million of tax-exempt forward delivery refunding bonds, Series 2024A, serials 2025-2039. Citigroup Global Markets Inc.

The Indianapolis Local Public Improvement Bond Bank is set to price Wednesday $436.83 million of Convention Center Hotel revenue bonds, consisting of $184.625 million of Series 2023E senior bonds (/BBB-//); $52.205 million of Series 2023F-1 subordinate bonds (nonrated); and $200 million of BAM-insured Series 2023F-2 subordinate bonds. Piper Sandler & Co.

The Indianapolis Local Public Improvement Bond Bank (Aaa//AAA/) is also set to price Thursday $155 million of ad valorem property tax-funded project revenue bonds. BofA Securities.

The Municipal Improvement Corp. of Los Angeles (Aa3//AA-/) is set to price Thursday $193.92 million of lease revenue bonds, Series 2023-A, serials 2024-2043. RBC Capital Markets.

The Massachusetts Housing Finance Agency (Aa2/AA+//) is set to price Thursday $177.46 million of non-AMT sustainability bonds, consisting of $50.505 million of Series C-1 bonds, serials 2026-2035, terms 2038, 2043, 2048, 2053, 2058, 2063 and 2066; $124.755 million of Series C-2 bonds, serials 2027-2028; and $2.2 million of Series D bonds, serial 2024. BofA Securities.

The Virginia Housing Development Authority (Aa1/AA+//) is set to price Tuesday $167.855 million of non-AMT rental housing bonds, 2023 Series F, serials 2026-2035, terms 2038, 2043, 2048, 2053, 2058, 2063, 2067. Raymond James & Associates.

The San Diego Unified School District is set to price Tuesday $145.515 million consisting of $2.99 million of Series N-1 taxable green GOs (Aa2///), $97.01 million of Series N-2 green GOs (Aa2//AAA/AAA), $3.255 million of Series R-6 GO refunding bonds (Aa2//AAA/AAA) and $45.26 of Series SR-3A refunding bonds (Aa2//AAA/AAA). Jefferies.

The South Dakota Housing Development Authority (Aaa/AAA//) is set to price Wednesday $145 million of homeownership mortgage bonds, consisting of $105 million of non-AMT Series 2023G bonds, serials 2024-2035, terms 2038, 2043, 2049, 2055; and $40 million of taxable Series 2023H bonds, serials 2024-2033, terms 2038, 2040, 2054. Wells Fargo Bank.

The Maine Health & Higher Educational Facilities Authority (/AA//) is set to price Wednesday $124.72 million of revenue refunding bonds, Series 2023B, insured by Assured Guaranty Municipal Corp. Morgan Stanley.

Ohio (Aa1//AAA/AAA) is set to price Tuesday $121.18 million of GO highway capital improvement bonds, Series Y, serials 2025-2039. Loop Capital Markets.

The Missouri Housing Development Commission (/AA+//) is set to price Wednesday $120 million of non-AMT single-family mortgage revenue bonds (First Place Homeownership Loan Program), Series 2023 E, serials 2024-2035, terms 2038, 2043, 2048, 2053, 2054. Stifel, Nicolaus & Co.

The Successor Agency to the Redevelopment Agency Community Facilities District No. 6, City and County of San Francisco, (/AA//) is set to price Tuesday $119.86 million of Mission Bay South Public Improvements special tax refunding bonds, Series 2023, serials 2024-2043, insured by Assured Guaranty Municipal Corp. Stifel, Nicolaus & Co.

Cape Coral, Florida, (A1//A+/) is set to price Wednesday $100 million of water and sewer revenue bonds, Series 2023. Morgan Stanley.

Competitive

The Missouri Highways and Transportation Commission (Aa1/AA+/AA+/) is set to sell $381.610 million of State Appropriations Mega Projects state road bonds, Series A 2023, at 11 a.m. eastern Tuesday.