Munis firmer amid a slew of large deals

7 min read

Municipals improved amid a large new-issue slate pricing in the primary while U.S. Treasuries were back in the black and equities were mixed throughout the day.

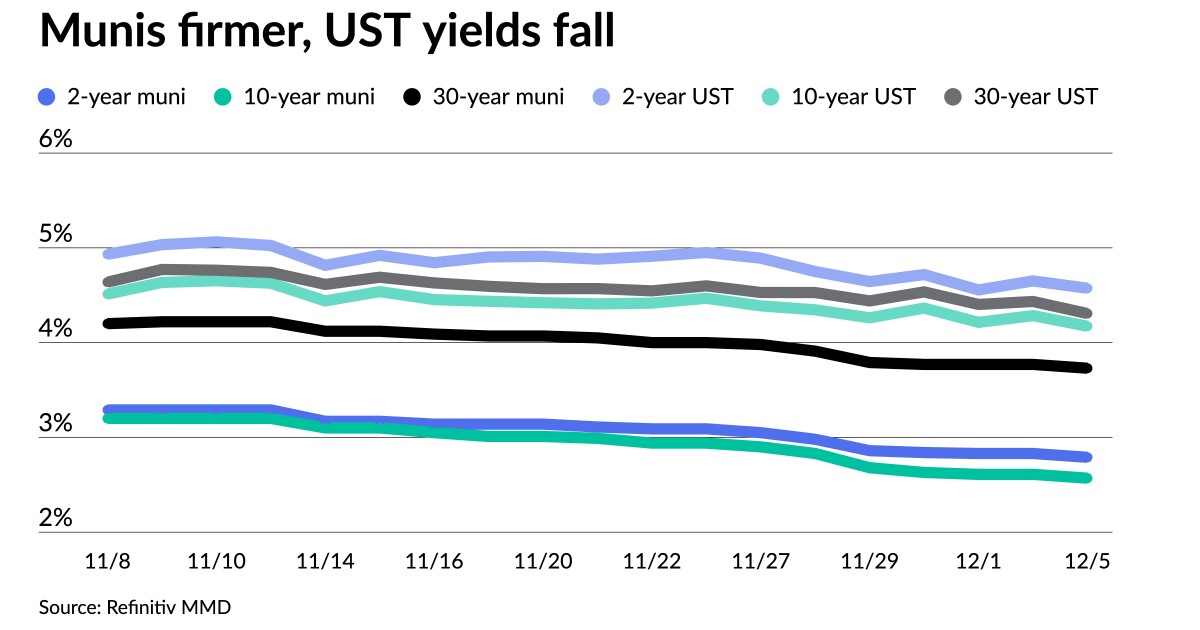

Triple-A yields fell three to four basis points, depending on the scale, while USTs saw the largest gains out long.

The primary market is robust this week, with several large deals coming to market Tuesday and more to follow Wednesday.

“This week’s new issue calendar should be well received,” said Anders S. Persson, Nuveen’s chief investment officer for global fixed income, and Daniel J. Close, Nuveen’s head of municipals.

“The new issue calendar should be strong for the next couple of weeks, then begin to slow as the holiday season approaches,” they added.

In the negotiated market Tuesday, Jefferies held a one-day retail order for $1.277 billion of tax-exempt future tax-secured subordinate bonds from the New York City Transitional Finance Authority (Aa1/AAA/AAA/). The first tranche, $1.203 billion of Fiscal 2024 Series D, Subseries D-1, saw 5s of 11/2026 at 2.78%, 5s of 2028 at 2.69%, 5s of 2033 at 2.83%, 5s of 2038 at 3.40% and 4s of 2042 at par, callable 5/1/2034.

The second tranche, $73.855 million of Fiscal 2024 Series E, Subseries E-1, saw 5s of 2030 at 2.74%, 5s of 2033 at 2.83%, 5s of 2038 at 3.40% and 5s of 2040 at 3.59%, callable 5/1/2034.

Morgan Stanley priced for the Kentucky Public Energy Authority (A1///) $812.170 million of fixed-rate gas supply revenue refunding bonds, 2024 Series A-1, with 5s of 8/2028 at 4.24% and 5s of 2/2032 at 4.48%, callable 11/1/2031.

BOK Financial Securities priced and repriced for the Garland Independent School District, Texas, (Aaa//AAA/) $746.120 million of PSF-insured unlimited tax school building bonds, Series 2023A, with yields bumped up to 12 basis points from the preliminary offering: 5s of 2/2025 at 2.92% (-3), 5s of 2028 at 2.66% (-4), 5s of 2033 at 2.75% (-6), 5s of 2038 at 3.22% (-12), 5s of 2043 at 3.66% (-3) and 5s of 2048 at 3.98% (-1), callable 2/15/2033.

BofA Securities priced for American Municipal Power (A1/A//) $360.160 million of Prairie State Energy Campus Project revenue refunding bonds, Series 2023A, with 5s of 2/2025 at 3.13%, 5s of 2028 at 2.93%, 5s of 2033 at 3.07%, 5s of 2038 at 3.59% and 5s of 2039 at 3.67%, callable 2/15/2034.

Barclays priced for the Monroe County Industrial Development Corp., New York, (Aa3/AA-//) $298.530 million of University of Rochester Project revenue bonds, Series 2023A, with 5s of 7/2034 at 2.86% and 5s of 2053 at 4.16%, callable 7/1/2033.

Siebert Williams Shank & Co. priced for the Arizona Industrial Development Authority (/A//) on behalf of the Equitable School Revolving Fund $280 million of social Senior National Charter School Revolving Loan Fund revenue bonds, with 5s of 11/2027 at 3.24%, 5s of 2028 at 3.20%, 5s of 2033 at 3.41%, 5s of 2038 at 3.94%, 5s of 2043 at 4.33%, 5.25s of 2048 at 4.42% and 5.25s of 2053 at 4.57%, callable 11/1/2032.

BofA Securities priced for the Sarasota County School Board, Florida, (Aa2///) $186.610 million of certificates of participation, Series 2023A, with 5s of 7/2024 at 3.05%, 5s of 2028 at 2.68%, 5s of 2033 at 2.86% and 5s of 2037 at 3.27%, callable 7/1/2033.

Barclays priced for San Diego County (Aa1/AA+/AA+/) $160.930 million of green County Public Health Laboratory and capital improvements certificates of participation, Series 2023, with 5s of 10/2027 at 2.52%, 5s of 2028 at 2.46%, 5s of 2033 at 2.56%, 5s of 2038 at 3.18%, 5s of 2043 at 3.57%, 5s of 2048 at 3.86% and 5s of 2053 at 3.98%, callable 10/1/2033.

Barclays priced for the New York State Housing Finance Agency (Aa2///) $131.770 million of sustainability affordable housing revenue bonds. The first tranche, $56.195 million of 2023 Series E-1, saw all bonds price at par: 3.35s of 11/2024, 3.6s of 5/2028, 3.625s of 11/2028, 3.95s of 5/2033, 3.95s of 11/2033, 4.2s of 11/2038, 4.6s of 11/2043, 4.75s of 11/2048, 4/875s of 11/2053, 4.95s of 11/2058 and 5.05s of 11/2063, callable 5/1/2032.

The second tranche, $75.575 million of 2023 Series E-2, saw all bonds price at par: 3.8s of 11/2063 with a put/tender date of 5/1/2027 and 3.875s of 11/2063 with a mandatory tender date of 5/1/2028.

In the competitive market, the Louisville/Jefferson County Metro Government, Kentucky, (Aa1//AAA/) sold $122.68 million of GOs, Series 2023A, to J.P. Morgan with 5s of 6/2024 at 3.05%, 5s of 12/2028 at 2.57%, 5s of 12/2033 at 2.65%, 5s of 12/2038 at 3.18% and 4s of 12/2043 at 3.94%, callable 12/1/2033.

Chattanooga, Tennessee, (Aa1//AA+/) sold $112.125 million of electric system revenue bonds, Series 2023, to J.P. Morgan, with 5s of 9/2034 at 2.74%, 5s of 2038 at 3.22% and 5s of 2043 at 3.54%, callable 9/1/2031.

Chandler, Arizona, (Aaa/AAA/AAA/) sold $106.415 million of GOs, Series 2023, to UBS, with 5s of 7/2024 at 2.97%, 5s of 2028 at 2.56%, 5s of 2033 at 2.58% and 5s of 2034 at 2.62%, callable 7/1/2033.

December performance and beyond

Technical factors will be a “key driver” of muni performance this month, “with new-issue supply expected to be manageable and reinvestment demand at active levels,” said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

As of Dec. 1, around $19.2 billion muni bond calls and maturing securities were available for reinvestment over the rest of the month.

While cash allocations into munis “are appropriate given the yield and income opportunities, we would point out that the end of tax loss harvesting should result in more normalized bid-wanted activity and may result in accretive benefits to fund flows,” Lipton said.

There is the potential for muni outperformance into 2024, Lipton said.

Upcoming data will “reveal a further slowing of economic conditions with more disinflationary progress taking hold,” he said.

Through yearend, Lipton said issuance “should remain well-received and dealers should continue to appropriately manage their inventory balances.”

For much of the earlier part of 2023, he said muni-UST ratios “were stuck in expensive ground, yet we have been seeing better relative value opportunities, although some of that value had eroded throughout November as munis outperformed UST.”

The two-year muni-to-Treasury ratio Tuesday was at 61%, the three-year at 61%, the five-year at 61%, the 10-year at 62% and the 30-year at 87%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 60%, the three-year at 60%, the five-year at 59%, the 10-year at 61% and the 30-year at 84% at 3 p.m.

While ratios have yet to offer fair value, “the market has moved closer to fair value throughout the second half of 2023,” Lipton said.

Periods of muni underperformance “give rise to value opportunities as the asset class cheapens and when the underperformance is followed up with spread tightening circumstances,” he said.

“Incoming demand is almost entirely from passive investment vehicles,” such as exchange-traded funds and separately managed accounts, “and not, or at least not yet, from active mutual funds or crossover buyers like banks and insurance companies,” said Matt Fabian, a partner at Municipal Market Analytics.

Active funds have lost $20 billion year-to-date, while ETFs have seen inflows of $14 billion, according to the Investment Company Institute.

“A reliance on SMAs and ETFs as lead buyers means strong demand within prospectus guidelines, little demand away from that,” Fabian said.

This favors “typical SMA allocations to very high grade, shorter maturity bonds, while story credits, lower ratings, riskier paper, and taxables need to wait for opportunistic buyers to emerge,” he noted.

This, Fabian said, should provide “an opening for the active mutual funds that, based on very strong recent NAV trends, should have been, by this time, receiving fresh capital to put to work.”

The issue may be “the still-attractive, if maybe fleeting, returns in cash alternative products, like money market funds and short duration taxable funds conveying good income without duration,” he said.

MMA still anticipates “this to turn in favor of the funds at some point, perhaps after or just before year-end, but the continuing dribble of fund outflows does imply a weaker trend of inflows (weaker meaning versus recent 2020-2021 performance) when it does occur,” Fabian noted.

Conversely, he said “lower current yields (and the seemingly endless SMA demand right now) mean a good entry point for issuers.”

Secondary trading

NYC 5s of 2024 at 3.12%. Ohio 5s of 2024 at 3.01%-2.96%. Georgia 5s of 2025 at 2.79%-2.78% versus 3.08%-3.05% on 11/27 and 3.09% on 11/22.

Wisconsin 5s of 2027 at 2.62%-2.61% versus 2.64% Thursday. NYC 5s of 2027 at 2.70%-2.62% versus 2.68% Monday and 2.73% Thursday. Louisiana 5s of 2028 at 2.65%-2.68%.

California 5s of 2032 at 2.60% versus 2.63% Friday and 2.67% Thursday. Ohio Water Development Authority 5s of 2033 at 2.61% versus 2.65% Monday and 2.70%-2.68% Friday. NYC Municipal Water Finance Authority 5s of 2034 at 2.67%-2.65%.

Oregon 5s of 2048 at 3.79%-3.80% versus 3.83% Monday and 3.85%-3.83% Wednesday. Massachusetts 5s of 2053 at 4.03% versus 4.03% Monday and 4.03%-3.99% Friday.

AAA scales

Refinitiv MMD’s scale was bumped four basis points: The one-year was at 2.96% (-4) and 2.79% (-4) in two years. The five-year was at 2.53% (-4), the 10-year at 2.57% (-4) and the 30-year at 3.73% (-4) at 3 p.m.

The ICE AAA yield curve was bumped three to four basis points: 2.96% (-3) in 2024 and 2.79% (-3) in 2025. The five-year was at 2.53% (-4), the 10-year was at 2.62% (-4) and the 30-year was at 3.73% (-3) at 3 p.m.

The S&P Global Market Intelligence municipal curve was bumped three basis points: The one-year was at 2.90% (-3) in 2024 and 2.77% (-3) in 2025. The five-year was at 2.61% (-3), the 10-year was at 2.68% (-3) and the 30-year yield was at 3.69% (-3), according to a 3 p.m. read.

Bloomberg BVAL was bumped three to four basis points: 2.84% (-3) in 2024 and 2.77% (-3) in 2025. The five-year at 2.51% (-4), the 10-year at 2.59% (-4) and the 30-year at 3.65% (-3) at 3 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.574% (-8), the three-year was at 4.328% (-9), the five-year at 4.138% (-10), the 10-year at 4.173% (-11), the 20-year at 4.482% (-13) and the 30-year Treasury was yielding 4.307% (-13) at 3:15 p.m.

Primary to come

Hawaii (Aa2/AA+/AA/) is set to price Wednesday $750 million of taxable GOs, Series 2023 GM. Morgan Stanley.

The Los Angeles Department of Water and Power (Aa2/AA-//AA/) is set to price Thursday $380.835 million of power system revenue refunding bonds, 2023 Series E, serials 2025, 2029-2045, term 2053. RBC Capital Markets.

The Indianapolis Local Public Improvement Bond Bank (A1//A/) is set to price Thursday $215.765 million of Indianapolis Airport Authority Project bonds, consisting of $70.025 million of non-AMT bonds, Series 2023I-1, serials 2026-2043, terms 2048, 2053, and $145.740 million of AMT bonds, Series 2023I-2, serials 2025-2043, terms 2048, 2053. Ramirez & Co.

The Housing Authority of Dekalb County, Georgia, (/A+//) is set to price Thursday $100.985 million of Kensington Station Project affordable multifamily housing senior revenue bonds, Series 2023A. KeyBanc Capital Markets.

Competitive

The New York City Transitional Finance Authority is set to sell $135.025 million of future tax-secured subordinate bonds, consisting of $113.425 million tax-exempts, Fiscal 2024 Series D, Subseries D-2, and $21.600 million of taxables, Fiscal 2024 Series E, Subseries E-2, at 11:15 a.m. Wednesday.

Pennsylvania (Aa3/A+/AA/) is set to sell $772.775 million of GOs, First Refunding Series of 2023, Bid Group A, at 10 a.m. Wednesday; $331.250 million of GOs, First Series of 2023, Bid Group B, at 10:30 a.m. Wednesday; $331.250 million of GOs, First Series of 2023, Bid Group C, at 11 a.m. Wednesday; and $672.500 million of GOs, First Series of 2023, Bid Group D, at noon Wednesday.