$300M crypto long liquidations — 5 things to know in Bitcoin this week

7 min read

Bitcoin (BTC) starts a key week for macro markets with a bump as the weekly close gives way to a sharp 7% BTC price correction.

The largest cryptocurrency broke down toward $40,000 in a fresh bout of volatility, reaching its lowest level in a week.

Arguably long overdue, Bitcoin’s return to test support nonetheless caught bullish latecomers by surprise, liquidating almost $100 million in longs.

The snap move provides a rude awakening for BTC investors at the start of a week, which already holds a multitude of potential volatility triggers. These come in the form of United States macro data that will immediately precede the Federal Reserve’s next decision on interest rate policy.

A bumper collection of numbers coming in swift succession means anything can happen on risk assets — and crypto is no exception.

Fresh from its first downward mining difficulty adjustment in three months, meanwhile, it appears that Bitcoin is finally cooling after weeks of practically unchecked upside.

What could happen before the year is out?

Traders and analysts alike are gearing up for curveballs into the 2023 candle close, and with just three weeks to go, BTC price action suddenly feels a lot less certain.

7% BTC price correction wipes longs

Bitcoin volatility returned immediately after a flat weekend as soon as the weekly close was done.

This time, however, it was bulls who suffered as BTC/USD fell more than 7% in hours to bottom at $40,660 on Bitstamp. This included a 5% drop in a matter of minutes, data from Cointelegraph Markets Pro and TradingView shows.

The sudden downturn, which punctured an otherwise “up only” trading environment, was not the expected outcome for leveraged long traders.

Data from the statistics resource CoinGlass had the long liquidation tally at $86 million for Dec. 11 at the time of writing. Cross-crypto long liquidations for the day stood at over $300 million.

A substantial BTC price correction was already anticipated. Nothing goes up in a straight line, as the popular crypto saying goes, and seasoned market participants were not shy in expressing relief.

“The daily and weekly close was at $43,792. Pullbacks are normal and even healthy. Hourly fluctuations mean nothing,” popular commentator BitQuant told subscribers on X (formerly Twitter) in part of his reaction.

An accompanying chart still predicted new higher highs to come over the course of the week, with $48,000 as the target.

Michaël van de Poppe, founder and CEO of trading firm MN Trading, likewise called for calm, especially among any frustrated altcoin traders.

“Markets do have corrections and with Altcoins, they’ll be deep as markets are illiquid,” he reasoned.

“Don’t stress out. Bitcoin momentum is slowly getting towards the end, through which Ethereum is easily going to take over next quarter.”

The majority of the top 10 cryptocurrencies by market cap followed BTC/USD downhill, recovering not as strongly to stay 4–6% lower over the past 24 hours.

Before the volatility, trading suite DecenTrader noted that funding rates were rapidly gaining — a classic sign to prepare for unsettled conditions.

#bitcoin funding rates were flat during the move up to $44k, but are now climbing rapidly as price goes sideways pic.twitter.com/QzjDKBA1K4

— Decentrader (@decentrader) December 11, 2023

Over the weekend, DecenTrader founder Filbfilb was among those eyeing potential benefits in a retracement.

“Let’s just be absolutely clear: We have run up massively this year… (from 16k!!) and a correction is due, i would really like that, so this is definitely not a call to buy,” he wrote in an X thread.

“A deep fud-induced correction would be great and is overdue.”

Filbfilb said that a return to significantly lower levels, specifically $25,000, was “low to the extent that it would need some sort of global disaster for it to occur.”

Fed FOMC meeting headlines intense macro week

The coming week marks a rare style of U.S. macro data releases thanks purely to timing.

The Consumer Price Index (CPI) and Producer Price Index (PPI) releases for November will hit on Dec. 12 and 13, respectively — the latter coming the same day as the Fed decides on interest rate changes.

Despite their overall significance, the preceding data prints will come too late to directly influence policy, but the Fed already has multiple other prints showing that inflation is declining.

The exception came last week, as unemployment figures showed that restrictive financial conditions were still not suppressing the labor market to the planned extent.

For markets, however, the roadmap is clear — no change to rates by the Federal Open Market Committee (FOMC) this month, but cuts in mid-2024. According to data from CME Group’s FedWatch Tool data, that forecast is practically unanimous at 98.6%.

“The most recent Fed statement was that rate cut hopes are ‘premature,’” financial commentary resource The Kobeissi Letter wrote in a commentary on its weekly macro calendar post on X.

“This week, we expect the Fed to reenforce that.”

Key Events This Week:

1. November CPI Inflation data – Tuesday

2. OPEC Monthly Report – Wednesday

3. November PPI Inflation data – Wednesday

4. Fed Rate Decision and Statement – Wednesday

5. Retail Sales data – Thursday

6. Initial Jobless Claims – Thursday

Volatility is…

— The Kobeissi Letter (@KobeissiLetter) December 10, 2023

Coming after the FOMC decision will be a speech and press conference by Fed Chair Jerome Powell — a classic source of risk asset volatility in itself — followed by more jobless figures the day after.

On-chain data warned on overextended Bitcoin

Following Bitcoin’s flash dip, analysts were keen to flag early warning signs, which could be used to identify similar incoming events in the future.

In an X thread, on-chain analytics platform CryptoQuant drew attention to no fewer than four data sources flashing caution into the weekly close.

Among these was the stablecoin supply ratio (SSR) metric, which at elevated levels shows a broad willingness to rotate out of stablecoins into BTC — a classic sign of potentially unsustainable optimism.

“From January 2023 to December 2023, the SSR (Stablecoin Supply Ratio) has significantly increased. This implies that Bitcoin holds a relatively higher value compared to stablecoins, indicating that market participants attribute greater value to Bitcoin, which has been a driving factor in Bitcoin’s price increase,” contributing analyst Woo Minkyu wrote in one of CryptoQuant’s Quicktake market updates on Dec. 9.

“However, historically, some investors have shown a preference for converting Bitcoin into stablecoins, suggesting that there might be a short-term price correction in Bitcoin.”

The day prior, fellow contributor Gaah noted that over half of the current BTC supply had been in profit compared to its acquisition point prior to the correction.

“At every historical moment when this indicator has entered this field it has signaled Distribution, either to a local top or a major top for Bitcoin,” he warned.

Supply in profit, in percentage terms, hit almost 90% this month — the most since Bitcoin’s all-time highs in November 2021.

Difficulty dip offers miners “welcome relief”

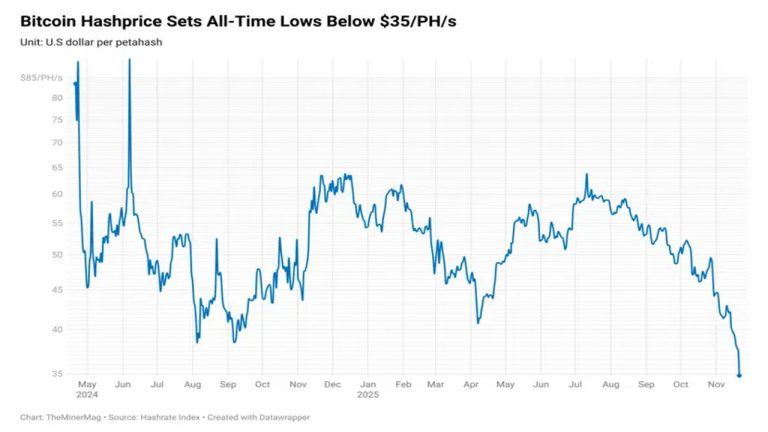

The latest Bitcoin mining difficulty adjustment stands out against months of new all-time highs.

Coming just before the BTC price dip, the biweekly tweak set difficulty back by approximately 1%, according to data from BTC.com.

This marked the first downward adjustment since early September, and this was the first change that did not result in added competition for block subsidies since then.

While initially pausing for thought, for James Van Straten, research and data analyst at crypto insights firm CryptoSlate, there is no cause for concern.

“The first negative difficulty adjustment for Bitcoin since September is a welcome relief for miners. That puts an end to six positive consecutive adjustments,” he reacted on X.

As Cointelegraph reported, miners have seen both fierce competition, increasing hardware deployment and a boost in fee revenue thanks to on-chain ordinals inscriptions.

I believe we’re at the start of a #Bitcoin bull run.

Miner revenues are starting to break to the upside above the 365DMA, which has occurred in previous bull runs.

Miners are flying, ETF will act as an extra catalyst. Another reason share prices should continue to increase pic.twitter.com/5TltWkGIAv— James Van Straten (@jimmyvs24) December 8, 2023

This all comes ahead of April’s block subsidy halving, which will cut the block subsidy by 50%. Previously, DecenTrader’s Filbfilb suggested that miners would thus wish to stockpile BTC in advance of the event, helping positive supply dynamics and even delivering a pre-halving BTC price of $48,000.

Still “going to $48,000 fast?”

Among the short-term Bitcoin bulls, the allure of $48,000 also remains.

Related: Bitcoin wipes nearly a week of gains in 20 minutes, falling under $41K

Over the weekend, this was reinforced by on-chain data, which strengthened the concept that $48,000 could act as a magnetic price target.

Produced by on-chain analytics firm Glassnode, this showed that a “newly identified cluster of addresses” last made a large-volume BTC purchase at an average of $48,050.

Glassnode’s entity-adjusted URPD metric, tracking the average price at which purchases are conducted and their volume, shows this address cluster is responsible for the second-largest purchase yet discovered — 633,120 BTC.

“We going to $48k fast,” X user MartyParty, a popular analyst and host of Crypto Spaces, responded.

DecenTrader meanwhile shows the bulk of leveraged short liquidity lying between current spot price and the $48,000 mark.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.