High-yield funds, like flows, turn in uneven performance in 2023

5 min read

Recovering from last year’s brutal selloff, high-yield municipal bond funds this year have faced an improved but still rough performance amid large pockets of market volatility, as some, like Nuveen’s market-dominating fund, suffered more than others.

While portfolio managers said they’re optimistic that shifting market dynamics will boost performance in 2024, the market swings this year have made many PMs more conservative in picking among speculative or unrated credits. Others say that strategy will likely pivot if rates stabilize and the hunt for yield begins anew.

“The theme of the last two years up until very recently has been one of outflows,” said David Hammer, who leads PIMCO’s municipal bond portfolio management.

“With some rate stability and recent inflows, we see the potential for spread tightening over the next year,” he said. “We are constructive of high-quality, high-yield munis into next year.”

PIMCO

Many portfolio managers said they expect issuance to remain light next year.

“Over the next 18 months, high yield is probably the best-performing municipal asset class because it has that duration that you want in this environment and it has spreads that are wide to their intrinsic value,” said Daryl Clement, senior vice president and municipal bond portfolio manager at AllianceBernstein.

Muni mutual funds saw $66.6 billion of outflows in 2022 and $7.8 billion of outflows in 2023 year-to-date, according to LSEG Lipper. In the high-yield space, investors pulled $14.7 billion last year but the space has seen $3.4 billion of inflows year-to-date, according to LSEG Lipper.

Morningstar puts the total 2022 outflow figure at a record $120 billion, which followed on the heels of a record $104 billion of inflows in 2021.

“It really has been an uneven year for flows and for fund performance overall,” said Elizabeth Foos, an associate director of fixed-income strategies for Morningstar. “A lot of that overall is that it’s been a relatively challenging year for munis, which have been negatively impacted by the rate volatility for most of the year.”

All the largest high-yield funds reported positive returns, turning the corner from last year’s historic selloff that led to double-digit losses.

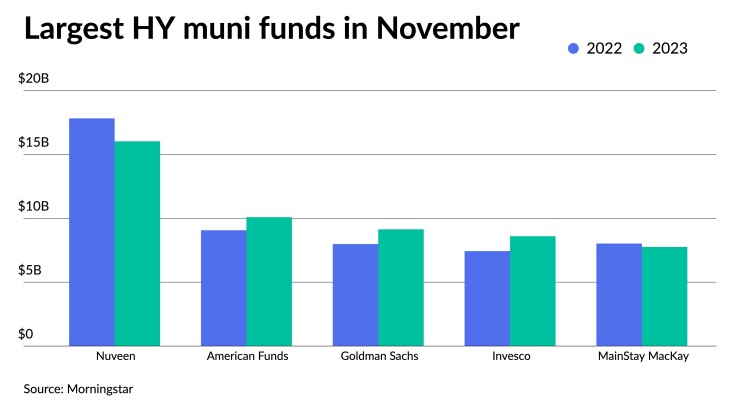

The market’s largest fund, Nuveen’s High Yield Municipal Bond Fund, had the worst performance through November of this year among the largest five largest open-end high-yield muni funds, with a 2.09% return, according to Morningstar. It also reported the worst losses for the category last year, with a 14.97% loss, according to Morningstar. Its net assets, which totaled $16 billion as of November, have declined 36% from nearly $25 billion in early 2020.

Just over 77% of Nuveen’s fund is unrated and its effective leverage is 27%, according to its website.

The fund’s nearly 15% loss in 2022 came as “money poured out of the muni market,” wrote Morningstar associate analyst Elizabeth Templeton in an April report that came out after longtime high-yield manager John Miller

Last year’s loss was “greater than almost two-thirds of typical high-yield muni peers,” she wrote. “The investment approach harbors a continued use of risky investment tactics that add volatility and detract from this strategy’s appeal.”

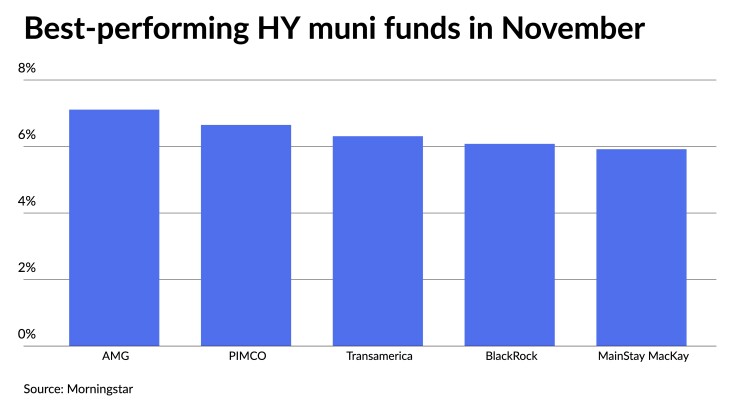

Meanwhile, through November, the much smaller AMG GW&K Municipal Enhanced Yield Fund, sized at $289.2 million, has seen the sector’s best performance with a 7.11% return, according to Morningstar data.

PIMCO Fixed Income Shares Series TE, with net assets of $76 million, saw the second-best return in the market, at 6.65%.

Behind Nuveen, the next-largest high-yield muni fund, American High-Income Municipal Bond Fund, has returned 4.56% through November, according to Morningstar.

The strongest return through the first 11 months of the year among the top five largest funds was from MainStay MacKay High Yield Municipal Bond Fund, at 5.92%, followed by Invesco Rochester Municipal Opportunities Fund, at 5.09%.

The S&P Municipal Bond High Yield Index, which consists of unrated or junk-rated bonds in the S&P Municipal Bond Index, showed a one-year return of 4.32% as of Dec. 8. The Bloomberg High Yield Index returned 7.01% year-to-date.

The recent shift toward inflows has buoyed the optimism of some fund managers heading into the new year.

“Sentiment has turned and funds are becoming less and less wary of outflows and having to manage for liquidity,” said Justin Horowitz, a senior portfolio manager at Birch Creek. “They’re starting to think about putting on risk again and using some of the cash that they had previously earmarked when they were concerned with outflows.”

In HilltopSecurities’ recently released survey on the state of the high-yield muni market, respondents said they expect senior living and project finance sectors to see the most defaults.

PIMCO’s Hammer said he plans to continue to avoid senior living, as well as project finance deals that are likely to need equity and general obligation bonds issued by some cities and states that may come under financial pressure amid a possible recession and the end of federal stimulus.

Municipal Market Analytics noted an uptick in technical defaults this year, which had hit 144 by the end of November. That could “portend more serious credit problems ahead,” MMA said in a Dec. 6 note. The traditional role that high-yield funds play in offering rescue financing has been “undermined by steady outflows and a possible diminution of risk taking,” the report said.

Like the rest of the market, high-yield managers said they’re looking forward to a pause in rate hikes that could eventually bring back the kind of hunt for yield and risk-taking that has long characterized the junk bond market.

“As flows return, as issuance continues to be pretty light, and as yields go lower, people are going be in search of other ways to generate income,” said Matt Norton, chief investment officer for municipal bonds at AllianceBernstein.

“We’re starting to see some spread narrowing, particularly in some of the liquid type high yield,” Norton said. Investors look at high-grade valuations “and they’re not as attractive as they were, so then they start stepping down the credit spectrum a little bit,” he said.