Muni yields rise for first time since October

5 min read

Municipals saw weakness for the first time since October after falling upward of 100 basis points since then, as investors are digesting the lower muni yield set amid richer ratios and weaker U.S. Treasuries.

Triple-A yields rose one to three basis points with larger losses out long, depending on the curve, while USTs were mixed near the close but saw pressure out longer throughout the session.

On Nov. 1, the Refinitiv MMD triple-A 10-year sat at 3.58%. On Friday it was 2.50% and closed three basis points higher at 2.53% Monday.

The weakness came as the new-issue calendar grew to $5.9 billion with the addition of a $900 million refunding deal from the Illinois State Highway Toll Highway Authority slated for Thursday. Bond Buyer 30-day visible supply sits at $6.95 billion.

Prior to the weakness, “the first eight days of the month have returned 0.72%, bringing year-to-date returns to 4.73%,” noted Jason Wong, vice president of municipals at AmeriVet Securities.

Before the November rally, the market was on track to see back-to-back down years, he noted.

Since then, munis have rallied around 100 basis points across the curve, with the front-end gaining the most, Wong said.

The asset class has outperformed Treasuries with richer ratios following as a result.

The two-year muni-to-Treasury ratio Monday was at 58%, the three-year at 58%, the five-year at 59%, the 10-year at 60% and the 30-year at 86%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 58%, the three-year at 58%, the five-year at 58%, the 10-year at 61% and the 30-year at 86% at 3:30 p.m.

The 10-year ratio was at 73% one month ago.

Mutual fund outflows were “modest” last week at $144.5 million, but “with the growth engine of the industry coming from [separately managed] accounts that are not reported, this segment is clearly booming,” Birch Creek Capital strategists said in a report.

SMAs typically focus on high-quality bonds from 0 to 20 years, and as such, “dealers reported almost insatiable demand in this part of the curve for any AA bond with a little bit of spread or at a ratio north of 60%,” they said.

Outside of 25 years, they noted “dealers were left a bit bewildered” by the yield-curve bumps “as long duration bonds had trouble finding homes at stronger prices.”

Last week’s primary calendar was “easy to digest” and provided accounts to last chance to “put cash to work in the new-issue market for at least another month,” according to Birch Creek strategists.

“This dynamic of a lack of forward supply but plenty of cash left to invest, led dealers to aggressively add to their inventories, hoping to facilitate customer needs in the coming weeks,” they said.

That said, they noted there was some resistance beginning to build after the two- to 10-year muni-UST ratios fell to around 58%.

“Some dealers reported that clients were beginning to buy treasuries instead of munis in a bet that valuations would revert closer to their historical averages,” they said.

Secondary trading totaled around $48.6 billion with 53% of trades being dealer sells last week, Wong said.

“Secondary trading should start to dip slowly as many are beginning to wrap up the year,” he said.

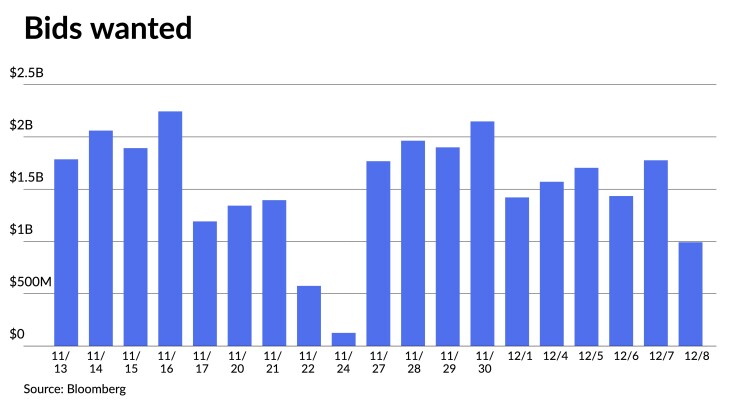

Investors put up about $7.42 billion up for the bid, with Thursday having the most volume of bids-wanted, according to Bloomberg data.

Secondary trading

California 5s of 2024 at 3.02%. LA DWP 5s of 2025 at 2.64%. NYC TFA 5s of 2026 at 2.70%.

Washington 5s of 2028 at 2.54%-2.52%. Connecticut 5s of 2029 at 2.54% versus 2.55% Thursday. Virginia Public School Authority 5s of 2030 at 2.58%-2.55%.

Board of Regents of the University of Texas System 5s of 2032 at 2.58%-2.57%. California 5s of 2033 at 2.60%-2.57% versus 2.53% Wednesday.

Triborough Bridge and Tunnel Authority 5s of 2044 at 3.73%-3.72%. NY State Urban Development Corp. 5s of 2053 at 4.02% versus 4.01% on 12/5 and 4.03% on 11/30.

AAA scales

Refinitiv MMD’s scale was cut three basis points outside one year: The one-year was at 2.92% (unch) and 2.75% (+3) in two years. The five-year was at 2.50% (+3), the 10-year at 2.53% (+3) and the 30-year at 3.74% (+3) at 3 p.m.

The ICE AAA yield curve was cut one to three basis points: 2.91% (+1) in 2024 and 2.74% (+1) in 2025. The five-year was at 2.49% (+2), the 10-year was at 2.57% (+1) and the 30-year was at 3.71% (+3) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut one to two basis points: The one-year was at 2.89% (+1) in 2024 and 2.76% (+1) in 2025. The five-year was at 2.55% (+1), the 10-year was at 2.64% (+1) and the 30-year yield was at 3.67% (+2), according to a 3 p.m. read.

Bloomberg BVAL was cut two to three basis points: 2.81% (+2) in 2024 and 2.73% (+2) in 2025. The five-year at 2.46% (+2), the 10-year at 2.55% (+2) and the 30-year at 3.63% (+3) at 3:30 p.m.

Treasuries were slightly weaker out long.

The two-year UST was yielding 4.718% (flat), the three-year was at 4.468% (flat), the five-year at 4.251% (flat), the 10-year at 4.241% (flat), the 20-year at 4.506% (+1) and the 30-year Treasury was yielding 4.33% (+1) at the close.

Primary to come:

The Illinois State Toll Highway Authority (Aa3/AA-/AA-/) is set to price Thursday $900 million of toll highway senior revenue refunding bonds, 2024 Series A. RBC Capital Markets.

The City of Virginia Beach Development Authority (//BB+/) is set to price $463.4 million of Westminster-Canterbury on Chesapeake Bay residential care facility revenue bonds, consisting of $297.9 million Series A, $21 million of Series B-1, $41.5 million of Series B-2, $103 million of Series B-3. Ziegler.

Chicago (//A/A/) is set to price Thursday $393.595 million of AMT Chicago Midway Airport senior lien airport revenue refunding bonds, Series 2023C. Jefferies.

Ohio (Aaa/AA+/AAA/) is set to price Tuesday $383.095 million of refunding general obligations bonds. Loop Capital Markets.

The San Bernardino Community College District (Aa1/AA//) is set to price Tuesday $221 million of general obligation bonds. Piper Sandler & Co.

The Grand River Dam Authority (A1/AA-//) is set to price Tuesday $150 million of revenue bonds. Goldman Sachs & Co. LLC.

The New York City Housing Development Corp. is set to price Tuesday $148.615 million of multi-family housing revenue variable-rate sustainable development bonds, in two series, consisting of $32.615 million of refunding Series E-3 and $116 million of Series L-1 remarketing. Jefferies LLC.

Competitive:

Bridgewater-Raritan Regional School District, New Jersey, (Aa1///) is set to sell $150.658 million of school revenue bonds at 11 a.m. eastern Tuesday.

The Empire State Development Corp. is set to sell Thursday three series of personal income tax bonds, consisting of $344.02 million of PITs at 10:30 a.m. eastern, $249.805 million of climate bond certified PITs at 11:00 a.m. eastern and $252.805 million of climate bond certified PITs at 11:30 a.m. eastern.