Munis underperform dramatic UST rally, ratios rise

6 min read

Triple-A municipal bond yields fell a few basis points Wednesday following the Federal Reserve’s decision to hold rates and signal that only three rate cuts were likely in 2024, which sent U.S. Treasury yields plummeting down more than a quarter point on the short end while equities rallied and the Dow Jones Industrial Average closed above 37,000, a record high.

Muni yields fell up to five basis points but dramatically underperformed USTs, as they are wont to do on Fed days. Treasury yields fell as much as 29 basis points on the two-year and sent the 10-year down closer to the 4% threshold.

Municipal to UST ratios rose as a result of the day’s moves.

The two-year muni-to-Treasury ratio Wednesday was at 63%, the three-year at 63%, the five-year at 63%, the 10-year at 63% and the 30-year at 90%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 58%, the three-year at 58%, the five-year at 58%, the 10-year at 60% and the 30-year at 85% at 3:30 p.m.

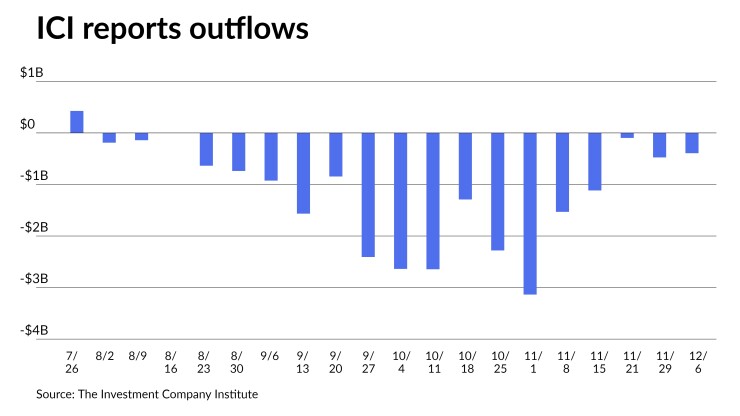

The Investment Company Institute reported more outflows from municipal bond mutual funds for the week ending Dec. 6, with investors pulling $393 million from the funds following $475 million of outflows the week prior. Exchange-traded funds also saw outflows of $40 million following $796 million of inflows the week prior.

In the primary Wednesday, a sole deal above $100 million priced with BOK pricing for the Northwest Independent School District, Texas, (Aaa/AAA//) PSF insured, $172.145 million of unlimited tax general obligation bonds with 5s of 2024 at 3.00%, 5s of 2028 at 2.62%, 5s of 2033 at 2.68%, 5s of 2038 at 3.26%, 5s of 2043 at 3.62% and 5s of 2049 at 3.98%, callable 2/15/2033.

AAA scales

Refinitiv MMD’s scale was bumped on the short and long end by two basis points: The one-year was at 2.90% (-2) and 2.75% (unch) in two years. The five-year was at 2.50% (unch), the 10-year at 2.53% (unch) and the 30-year at 3.74% (-2) at 3 p.m.

The ICE AAA yield curve was bumped up to 5 basis points: 2.88% (-3) in 2024 and 2.72% (-3) in 2025. The five-year was at 2.46% (-4), the 10-year was at 2.51% (-5) and the 30-year was at 3.67% (-5) at 4 p.m.

The S&P Global Market Intelligence municipal curve was cut one to two basis points: The one-year was at 2.90% (+1) in 2024 and 2.77% (+1) in 2025. The five-year was at 2.56% (+1), the 10-year was at 2.65% (+1) and the 30-year yield was at 3.68% (+1), according to a 4 p.m. read.

Bloomberg BVAL was bumped three basis points: 2.80% (-3) in 2024 and 2.72% (-3) in 2025. The five-year at 2.45% (-3), the 10-year at 2.53% (-3) and the 30-year at 3.66% (-3) at 4 p.m.

Treasuries rallied.

The two-year UST was yielding 4.443% (-29), the three-year was at 4.162% (-27), the five-year at 3.982% (-25), the 10-year at 4.026% (-18), the 20-year at 4.339% (-14) and the 30-year Treasury was yielding 4.183% (-12) at the close.

FOMC

The Federal Open Market Committee lowered its projections for the fed funds rate target, penciling in three rate cuts for next year, certainly disappointing market players, who expect as much as 130 basis points of cuts next year.

The updated Summary of Economic Projections now sees the rate, currently in a range between 5.25% and 5.50% based on no change at this meeting, falling to 4.60% at the end of next year, compared to September’s expected 5.10%, and 3.60% at the end of 2025, down from 3.90%. The 2026 projection remains 2.9%, with the longer run rate staying at 2.5%.

Looking at the dots, six officials see the rate at the end of next year in a range from 4.50% to 4.75%, five see it 25 basis points higher, four see it between 4.25% and 4.50%. Two see it staying between 5.25% and 5.50%, with one dot between 3.75% and 4%.

For 2025, the range is wider, with one official seeing no rate cuts through that year and one seeing the rate as low as between 2.25% and 2.50%. The next highest dot is between 4.25% and 4.50%. Five see it between 3.25% and 3.50%, three see it 25 basis points above that and four see it between 3.75% and 4.00%.

“The dispersion among officials on rate cuts is vast, indicating some disagreement,” noted Ali Hassan, Portfolio Manager at Thornburg Investment Management. “The number of cuts has notched up to five in 2024, and they have moved forward on the timeline to earlier in the year, with a 60% chance at the March meeting. Financial conditions further loosened and the two-year has dropped 20 basis points.”

In its statement, the FOMC noted inflation remains elevated, although it has “eased” in the past year. Its inflation projections were lowered from its September levels, with 2.4% inflation now expected next year.

In his press conference, Fed Chair Jerome Powell said, “inflation remains too high,” with no guarantee it will continue to decline, making the “path forward uncertain.” The Fed could raise rates if it believes that is the correct move, he added. “It is too early to declare victory.”

When asked about recession, Powell said the economy is not in recession now, but it is a “possibility” for next year.

The statement added the word “any” before additional policy firming, “suggesting the Fed is still concerned about sticky services and wage inflation and tight labor market conditions,” noted Fitch Ratings Chief Economist Brian Coulton. “We expect the fed funds rate to end next year at 4.75% (upper range), significantly higher than current market expectations.”

Powell said the adding of “any” meant the panel believes it is close or near the peak of rates but didn’t want to remove the possibility of the need for another rate hike. Responding to a question, Powell said, because of lags in monetary policy, the FOMC would not want to wait until inflation falls to 2% for the first rate cut, because that would be too late.

“The Fed communicated that the economy has slowed recently from its strong pace in Q3 and that while job gains have moderated, they remain strong,” noted Thomas Holzheu, Swiss Re chief economist for the Americas. “While bond yields have eased somewhat since their early Q4 spike, they remain elevated and are contributing to tight financial conditions that reduce the need for further monetary policy tightening.”

The Fed, he said, will be “particularly attuned to growth risks” in anticipation of a soft landing. But persistent inflation will mean no easing “until well into next year.”

“In one of the most uneventful statements this year the Fed keeps rates unchanged and remains ready to adjust policy to new information,” said Giuseppe Sette, president of Toggle AI. “The market rallied sharply in expectation of a dovish Fed, so the next days will show us whether this FOMC meeting will lead to a case of sell the news.”

“The Fed delivered a long-awaited holiday present today, not only in holding rates steady, but also in forecasting rate cuts in 2024,” said Greg Bassuk, CEO at AXS Investments.

“The market’s reaction to the Fed’s dovish sentiment underscored pent-up enthusiasm among investors that upcoming Fed policy will foster lower borrowing costs and stronger consumer sentiment, all right in time for the holiday season.”

Primary still to come:

The Illinois State Toll Highway Authority (Aa3/AA-/AA-/) is set to price Thursday $900 million of toll highway senior revenue refunding bonds, 2024 Series A. RBC Capital Markets.

The City of Virginia Beach Development Authority (//BB+/) is set to price $463.4 million of Westminster-Canterbury on Chesapeake Bay residential care facility revenue bonds, consisting of $297.9 million Series A, $21 million of Series B-1, $41.5 million of Series B-2, $103 million of Series B-3. Ziegler.

Chicago (//A/A/) is set to price Thursday $393.595 million of AMT Chicago Midway Airport senior lien airport revenue refunding bonds, Series 2023C. Jefferies.

Competitive:

The Empire State Development Corp. is set to sell Thursday three series of personal income tax bonds, consisting of $344.02 million of PITs at 10:30 a.m. eastern, $249.805 million of climate bond certified PITs at 11:00 a.m. eastern and $252.805 million of climate bond certified PITs at 11:30 a.m. eastern.

Gary Siegel contributed to this report.