Munis see more gains ahead of $1.6B calendar, final full week of 2023

4 min read

Municipals closed out the week firmer, boosted by Fed policy decisions and yearend positioning ahead of a fading new-issue calendar, while U.S. Treasuries traded in a narrow range all session and equities ended mixed.

Triple-A yields fell up to five basis points Friday while USTs were mixed. Munis still underperformed taxables on the week, but the setup for the asset class going into yearend is decidedly positive.

Municipals head into the final full week of 2023 with about $1.6 billion on the calendar and only two deals over $100 million.

Connecticut is bringing

As yearend approaches, Barclays PLC noted that the rally that started in November “has been quite remarkable, and strong market performance has continued in December, given the softer stance by the Fed.”

BofA Global Research strategists agreed.

“When the rally started at the beginning of November, we asserted that this rally in the minimum should extend to mid-December,” BofA strategists Yingchen Li and Ian Rogow wrote. “Clearly that timeline is more likely extended now.”

Since the 10-year AAA already went as low as 2.50% a few days ago, and the 10-year Treasury yield trades more definitively below 4.00%, BofA said they “believe the new Fed dovishness should bring 2.30% in focus for the 10-year AAA in the near term,” adding they “would not be surprised if this is done before year-end as a pleasant holiday gift from the Fed.”

“If so, we would gladly start evaluating the path to 1.80% or lower in 2024,” Li and Rogow said.

During the rally it has been “hardly surprising” that the more liquid parts of the muni market have outperformed, “ranging from higher-rated AAA bonds to some of the BBB/HY benchmarks,” said Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel.

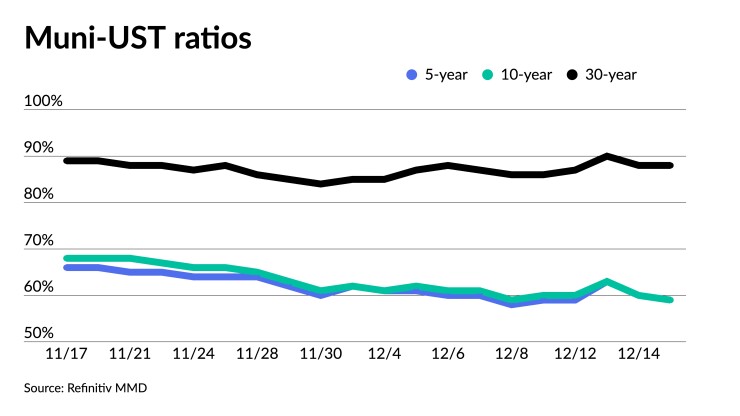

Longer-duration bonds have also outperformed in this massive rate rally, “despite a notable yield curve steepening,” they said. With municipal to UST ratios in the high 80s, and the 10s30s curve slope well above the 12-month average, “the long end has some value,” they said.

The two-year muni-to-Treasury ratio Friday was at 57%, the three-year at 58%, the five-year at 59%, the 10-year at 59% and the 30-year at 88%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 59%, the three-year at 59%, the five-year at 59%, the 10-year at 61% and the 30-year at 87% at 4 p.m.

“We expect the market to continue to do well in December, and possibly even in early January,” Barclays strategists said. “This is especially true if supply starts 2024 at a slow pace, while muni investors get about $35 billion in bond redemptions and coupons that would need to be reinvested; we also would not be surprised if fund flows turn positive in the near term, improving the market tone even further.”

However, they said it is “very hard for us to get overly bullish at current ratios and yields, which is why we recommend lightening up in late December while looking for a better entry point in Q1 24.”

Secondary trading

New Mexico 5s of 2024 at 2.86%. Georgia 4s of 2025 at 2.60%-2.59%. Ohio 5s of 2025 at 2.65% versus 2.78% on 12/7 and 2.84%-2.82% on 12/6.

Massachusetts 5s of 2027 at 2.38%. Denton County, Texas, 5s of 2028 at 2.48%. Maryland 5s of 2026 at 2.37%-2.36%.

DC 5s of 2032 at 2.37% versus 2.53% Monday and 2.65% on 12/5. NYC TFA 5s of 2033 at 2.40% versus 2.56%-2.42% Thursday and 2.69% Wednesday. Boston 5s of 2036 at 2.52%-2.51%.

California 5s of 2045 at 3.32%-3.28%. LA DWP 5s of 2048 at 3.45%-3.40% versus 3.56%-3.46% Thursday and 3.68%-3.67% Wednesday.

AAA scales

Refinitiv MMD’s scale was bumped two to five basis points: The one-year was at 2.71% (-2) and 2.56% (-2) in two years. The five-year was at 2.31% (-2), the 10-year at 2.33% (-3) and the 30-year at 3.53% (-4) at 3 p.m.

The ICE AAA yield curve was bumped up to two basis points: 2.76% (unch) in 2024 and 2.59% (unch) in 2025. The five-year was at 2.32% (unch), the 10-year was at 2.37% (unch) and the 30-year was at 3.52% (-2) at 4 p.m.

The S&P Global Market Intelligence municipal curve was bumped three to four basis points: The one-year was at 2.71% (-3) in 2024 and 2.58% (-3) in 2025. The five-year was at 2.37% (-3), the 10-year was at 2.47% (-3) and the 30-year yield was at 3.48% (-4), according to a 4 p.m. read.

Bloomberg BVAL was bumped three to five basis points: 2.60% (-3) in 2024 and 2.52% (-3) in 2025. The five-year at 2.24% (-4), the 10-year at 2.32% (-4) and the 30-year at 3.40% (-5) at 4 p.m.

Treasuries were mixed.

The two-year UST was yielding 4.450% (+7), the three-year was at 4.127% (+4), the five-year at 3.913% (+2), the 10-year at 3.908% (flat), the 20-year at 4.184% (-1) and the 30-year Treasury was yielding 4.006% (-2) near the close.

Primary to come

Connecticut (Aa3/AA-/AA-/AA+) is set to price $840 million of general obligation bonds consisting of $400 million of GOs, $250 million of social GOs and $190 million of social refunding GOs. Retail Monday, institutions Tuesday. Jefferies.

The California Public Finance Authority (Aa3/AA//) is set to price Tuesday $350.755 million of Sharp Healthcare revenue refunding bonds. RBC Capital Markets.