Munis firmer in spots; mutual funds see outflows to close 2023

4 min read

Municipals were steady to firmer Thursday as outflows returned. U.S. Treasury yields rose and equities ended up.

The two-year muni-to-Treasury ratio Thursday was at 59%, the three-year at 59%, the five-year at 59%, the 10-year at 59% and the 30-year at 86%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 60%, the three-year at 59%, the five-year at 59%, the 10-year at 61% and the 30-year at 87% at 3 p.m.

The market has an underlying firm tone going into the end of 2023, said James Pruskowski, chief investment officer at 16Rock Asset Management.

Treasury rates are “providing directional support, albeit flatlining,” he said.

There’s also a lot of pent-up balance sheet demand into the 11th hour, and that should follow through into early January, given the cycle of redemptions, he noted.

Pruskowski said he is wary of issuance’s “bifurcated outlook” for next year.

Preliminary figures for 2023 have issuance at $379 billion, down from $391.1 billion in 2022, according to Refinitiv data.

Next year, “there’s going to be a tale of two types of issuers: One that wants to quickly take advantage sooner than later of the rally and rates, and then there’s another camp that’s going to be more opportunistic to wait given the Fed’s pivoting,” he said.

Pruskowski expects light issuance until the second or third week of January.

For the first week of January, there are no deals over $100 million. The new-issue calendar is led by $62.5 million of water revenue bonds from the Truckee Meadows Water Authority, Nevada, in the primary market.

However, larger deals are set to come to market later in the month. Jefferson County, Alabama,

Additionally, Washington is set to sell $948 million of bonds in three series in the competitive market on Jan. 23.

Inflation remains a burden for issuers, and they are less willing to issue bonds to start infrastructure projects given the costs, he said.

However, with inflation coming down, he said it means issuers may be more willing to start a new project since it could be cheaper and see fewer COVID-related delays, he said.

Municipalities “worked pretty hard to get rainy day funds back up” and there are still lingering threats of a recession in the backdrop, prompting them to be more conservative.

However, there’s pent-up demand, “whether that be flip back tenders, refinancings that can be done, and select projects that have been waiting to access the market,” he said.

Heading into next year, he said the Fed has provided surety in terms of a pivot.

“That is what pent-up cash on the sidelines has been looking for: to get invested,” he said.

Many investors sat on the sidelines because of the Fed’s tightening actions over the past two years.

Now, he said there is greater comfort from both Fed rhetoric and slower, weaker economic data.

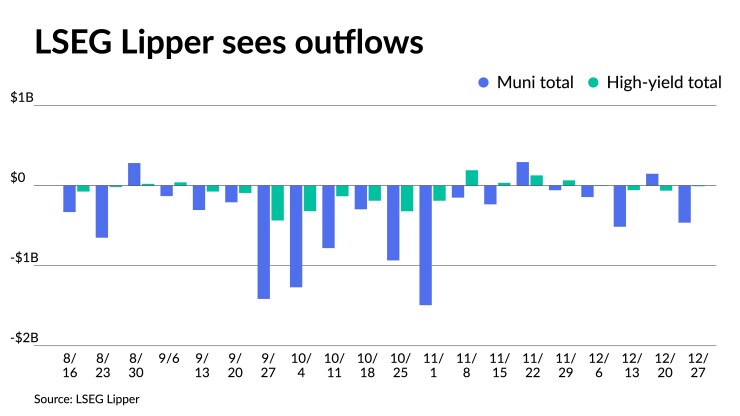

LSEG Lipper reported Thursday that investors pulled $463.7 million from muni mutual funds for the week ending Wednesday after inflows of $147 million the week prior.

High-yield saw outflows of $8.7 million after outflows of $64.2 million the week prior.

Next year, high-yield mutual funds will most likely see greater inflows than investment-grade funds, because it’s a market that’s harder to access, according to Pruskowski.

Secondary trading

NYC 5s of 2024 at 2.65% versus 3.15%-3.31% on 12/20. Washington 5s of 2024 at 2.85% versus 2.86% Friday and 2.91% original on 12/21. Florida 5s of 2025 at 2.62%.

Connecticut 5s of 2027 at 2.41%-2.39%. California 5s of 2027 at 2.36% versus 2.39% on 12/19. Maryland 4s of 2028 at 2.25% versus 2.35% on 12/14.

NY State Urban Development Corp. 5s of 2030 at 2.31% versus 2.34% Tuesday and 2.34% on 12/21. Knoxville waters, Tennessee, 5s of 2031 at 2.25% versus 2.30%-2.37% original on Wednesday.

LA DWP 5s of 2048 at 3.25%-3.13% versus 3.39%-3.40% on 12/19 and 3.46%-3.29% on 12/15. Massachusetts 5s of 2052 at 3.67%-3.66% versus 3.76%-3.72% on 12/20 and 4.05% on 12/12.

AAA scales

Refinitiv MMD’s scale was bumped up to three basis points: The one-year was at 2.67% (-2) and 2.52% (-2) in two years. The five-year was at 2.28% (unch), the 10-year at 2.28% (unch) and the 30-year at 3.42% (-3) at 3 p.m.

The ICE AAA yield curve was unchanged: 2.74% in 2024 and 2.55% in 2025. The five-year was at 2.24%, the 10-year was at 2.29% and the 30-year was at 3.42% at 3 p.m.

The S&P Global Market Intelligence municipal curve was bumped two basis points: The one-year was at 2.66% (-2) in 2024 and 2.53% (-2) in 2025. The five-year was at 2.27% (-2), the 10-year was at 2.30% (-2) and the 30-year yield was at 3.39% (-2), according to a 3 p.m. read.

Bloomberg BVAL was unchanged: 2.57% in 2024 and 2.48% in 2025. The five-year at 2.19%, the 10-year at 2.25% and the 30-year at 3.34% at 3 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.278% (+4), the three-year was at 4.028% (+4), the five-year at 3.841% (+4), the 10-year at 3.845% (+5), the 20-year at 4.141% (+4) and the 30-year Treasury was yielding 3.984% (+3) at 3:15 p.m.