Mutual funds see inflows; munis little changed post-CPI

8 min read

Municipals were little changed Thursday as the primary market activity slowed and inflows to municipal bond mutual funds returned. U.S. Treasuries were firmer after the consumer price index print suggested the Fed may not cut rates in March. Equities were down.

The two-year muni-to-Treasury ratio Thursday was at 61%, the three-year at 62%, the five-year at 58%, the 10-year at 57% and the 30-year at 82%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 62%, the three-year at 61%, the five-year at 59%, the 10-year at 57% and the 30-year at 81% at 3 p.m.

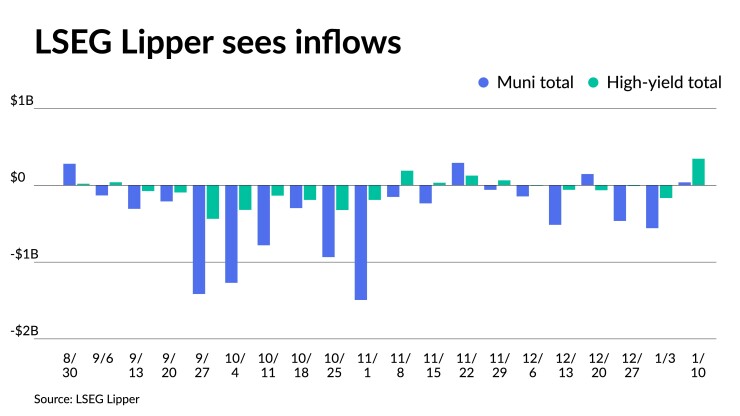

LSEG Lipper reported Thursday that investors added $38.7 million to muni mutual funds for the week ending Wednesday after outflows of $558 million the week prior.

High-yield saw inflows of $346.3 million after outflows of $165 million the week prior.

A “meaningful bear flattener” is happening as the one- to 30-year MMD curve has narrowed from 78 basis points seen at the end of 2023 to the current 55 basis points, said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

“The weakness that has developed in the first few years on the curve has almost everything to do with realigning ratios,” she said.

For the first week of the month, tax-exempt money fund balances saw a high of $125.6 billion, a level last seen in July 2020, she said.

“The allure of cash positions has been a worthy effort, but recent daily- and weekly-floater rates have plummeted (weekly yields topped out at 4.61% near the end of December) and could easily start to see some pushback with taxable money funds looking more promising on a net yield basis,” Olsan said.

While structured ladder programs are engaged, she said “more discretionary flows that were finding ample yields in cash might be enticed out the curve now that supply is increasing and spreads may loosen up a bit.”

As proved by several large deals Wednesday, longer demand is not a problem, she said.

Jefferson County, Alabama, (Baa1/BBB+/BBB/) returned to the market after a 10-year hiatus, with $2.2 billion of sewer revenue refunding warrants due 2024-2053, she said.

“The reported order book was 10 times oversubscribed — a figure that that is not quite a full month’s supply,” she said.

Yields were bumped up to 15 basis points from Wednesday morning’s preliminary pricing, “with the authority paying a maximum yield of 4.51% in a 2053 maturity, barely 100 basis points over AAA spot levels,” she said.

BofA Securities accelerated an upsized $1.882 billion of GOs from Massachusetts (Aa1/AA+/AA+/), with yields bumped up to three basis points from Wednesday morning’s retail offering.

After an “impressive tightening” in recent weeks among Texas PSF offerings, she said final levels on the Conroe ISD, Texas, issue needed some concession.

“The $103 million 5s due 2049 were finalized at 3.75% for a spread of +38/MMD, or about 15-18 basis points above recent comparable secondary trades,” she said.

The rest of the month “will bring additional volume and likely a stratified buyer base who is still navigating defensive (cash) and offensive (curve commitments) factors,” Olsan said.

In the primary market Thursday, HilltopSecurities priced for New Braunfels, Texas, (Aa1///) $118.745 million of utility system revenue and refunding bonds, Series 2024, with 5s of 7/2024 at 3.05%, 5s of 2029 at 2.48%, 5s of 2034 at 2.58%, 5s of 2039 at 3.12%, 5s of 2044 at 3.51%, 4.125s of 2049 at 4.19% and 4s o 2055 at 4.28%, callable 7/1/2034.

In the competitive market, Dallas (/AA-/AA/) sold $217.030 million of combination tax and revenue certificates of obligation, Series 2024A, to Wells Fargo Bank, with 5s of 2/2025 at 3.09%, 5s of 2029 at 2.47% and 5s of 2033 at 2.52%, noncall.

Colorado sold $100 million of Education Loan Program tax and revenue anticipation notes, Series 2023B, with 5s of 6/2024 at 3.24%.

Secondary market

Utah 5s of 2025 at 2.86% versus 2.72% Monday. Georgia 5s of 2026 at 2.71%. Oregon 5s of 2027 at 2.53%.

Triborough Bridge and Tunnel Authority 5s of 2028 at 2.40%-2.41%. Maryland 5s of 2029 at 2.28% versus 2.26% on 1/3. DC 5s of 2030 at 2.37%.

Washington 5s of 2033 at 2.45%. NYC 5s of 2035 at 2.56%. California 5s of 2035 at 2.44%-2.41%.

LA DWP 5s of 2048 at 3.33%-3.30% versus 3.33%-3.34% Monday and 3.23% on 1/2. Utility Debt Securitization Authority, N.Y., 5s of 2050 at 3.56%-3.55%. NY State Urban Development Corp. 5s of 2054 at 3.77% versus 3.75% Wednesday and 3.75% Tuesday.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 2.90% and 2.62% in two years. The five-year was at 2.25%, the 10-year at 2.28% and the 30-year at 3.45% at 3 p.m.

The ICE AAA yield curve was mixed: 2.91% (+2) in 2025 and 2.68% (+2) in 2026. The five-year was at 2.35% (+1), the 10-year was at 2.30% (unch) and the 30-year was at 3.43% (-1) at 4 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 2.89% in 2025 and 2.66% in 2026. The five-year was at 2.29%, the 10-year was at 2.32% and the 30-year yield was at 3.42%, according to a 3 p.m. read.

Bloomberg BVAL was cut on the short end: 2.79% (+2) in 2025 and 2.64% (+1) in 2026. The five-year at 2.29% (unch), the 10-year at 2.33% (unch) and the 30-year at 3.43% (unch) at 4 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.267% (-10), the three-year was at 4.026% (-9), the five-year at 3.902% (-8), the 10-year at 3.983% (-6), the 20-year at 4.316% (-4) and the 30-year Treasury was yielding 4.185% (-3) near the close.

CPI

The December consumer price index came in a little stronger than expected, perhaps eliminating the possibility of a rate cut in March, analysts said.

Markets had priced in about a “two-thirds probability” of a March rate cut, noted Tony Welch, chief investment officer at Signature FD. “I just think that that’s too optimistic.”

“Stickier inflation” combined with the 202,000 initial jobless claims for the week ended Jan. 6, which suggests “a job market that’s normalizing but it’s certainly not weak,” show the market is overly optimistic, he said.

There won’t be 150 basis points of cuts, as the market expects, this year, Welch said, if current trends prevail. But if the economy falls into recession, which is not his base case, there will be more than 150 basis points of cuts.

Welch sees rate cuts beginning in May or June. “It’s going to be very deliberate,” he added. “There’s other things that they can do, like they can stop the quantitative tightening.”

January through May of 2023 saw high core CPI readings, Welch said, “as those roll out of the [annual] calculation, I think core CPI is going to start to melt if you get a little bit of help from shelter as well. You should get core inflation readings in or around the Fed’s target.”

With economists getting better at predicting CPI, Welch said, “inflation is becoming less of an event for the bond markets.” Instead attention is turning to “how robust the labor markets are going to be throughout the rest of this year.”

“This print should challenge the market’s expectations of rate cut timing,” said Alexandra Wilson-Elizondo, deputy chief investment officer of multi-asset solutions at Goldman Sachs Asset Management. “There is nothing in the report to cause the Fed to hurry to cut rates. However, because it was not too hot, it should leave the hopes of a soft landing intact.”

She agreed labor market developments will “dictate the speed and extent of the cutting cycle, and we continue to believe the middle of the year to be more appropriate to start.”

But Scott Anderson, chief U.S. economist and managing director at BMO Economics, said, “The concern that must be growing in the Fed’s mind at this point is that we are now getting less deflation and disinflation from goods and energy prices, and we still have yet to see a measurable reduction in inflation in housing or most services components. This suggests the Fed’s journey to sustainable 2.0% inflation is still not complete.”

And while CPI wasn’t “a game changer for the Fed,” it wasn’t “comforting to a market that is looking for a first-quarter rate cut. It is probably discouraging enough to keep the Fed on hold longer than the market currently expects. We need to see more capitulation in services and shelter inflation before we can sound the ‘all clear’ on the inflation mandate.”

The uptick in inflation in December “serves as a healthy reminder that imminent rate cuts shouldn’t be taken for granted,” said Adam Hetts, global head of multi-asset and portfolio manager at Janus Henderson Investors.

Financial conditions have recently been “loosening at a historically rapid rate,” he noted, but “there is room to absorb some disappointment in this print and look forward to more progress on the inflation battle next month. However, with so much of the recent market optimism predicated on expectations of goldilocks rate cuts, investors are wise to expect disproportionately negative reactions to continued CPI stubbornness.”

But getting inflation down to 2% “will not be a straight line,” said Jeff Schulze, head of economic and market strategy at ClearBridge, and the Fed will need to be patient. “The key impediment for the next leg down in inflation is shelter which continues to remain stubbornly elevated.”

The report “should put some modest upward pressure on long-term Treasury yields as near-term expectations for rate cuts are pushed out slightly.”

A March rate cut “is unlikely, barring an economic or financial system shock,” said ING Chief International Economist James Knightley. “We continue to think the Fed will prefer to wait until May.”

While inflation should slow this year, Wells Fargo Securities Senior Economists Sarah House and Michael Pugliese said, “progress is likely to be slower-going and keep policymakers uneasy about how quickly inflation can return to 2% on a sustained basis.”

The key takeaway from CPI is “core inflation is proving sticky,” said Brian Coulton, Fitch Ratings chief economist. It’s a function of services inflation, which is higher than 5% year-over-year, he said.

“This is not consistent with overall inflation returning to 2% on a sustained basis,” Coulton said. “This will give the Fed grounds for caution and they are unlikely to cut rates as quickly as the markets currently expect.”

The report makes “higher for longer” more likely, said Giuseppe Sette, president of Toggle AI. “With CPI marginally higher than expected it becomes harder for the Fed to say that inflationary pressures have been tamed, especially in the face of a strong job market. For the entire history of the Fed, rates have always been kept considerably above inflation in any scenario short of a recession. This CPI print pushes the first rate cut further away, possibly not even in 2024.”

Primary on Wednesday

BofA Securities accelerated an upsized $1.882 billion of GOs from Massachusetts (Aa1/AA+/AA+/), with yields bumped up to three basis points from Wednesday morning’s retail offering. The first tranche, $1.045 billion of consolidated loan of 2024 bonds, Series A, saw 5s of 1/2026 at 2.62% (unch), 5s of 2028 at 2.41% (unch), 5s of 2034 at 2.50% (-1), 5s of 2039 at 3.11%, 5s of 2042 at 3.35% (-3), 5s of 2049 at 3.75% (unch) and 5s of 2054 at 3.85% (unch), callable 1/1/2034.

The second tranche, $837.265 million of refunding bonds, Series 2024 A, saw 5s of 3/2027 at 2.50% (unch), 5s of 2029 at 2.38% (unch), 5s of 2034 at 2.50% (-1), 5s of 2039 at 3.11% (-2) and 5s of 2044 at 3.48% (unch), callable 1/1/2034.

Gary Siegel contributed to this story.