Munis little changed while ratio richness lingers

5 min read

Municipals were little changed to start the week, while U.S. Treasuries were firmer and equities were up late in the trading session.

The muni market enters 2024 with “stable credit fundamentals, supportive demand/supply dynamics, and low [muni-UST] ratios and compressed credit spreads,” said Adam Stern, co-head of research at Breckinridge.

On the technical front, he said “demand is likely to outpace supply.”

“Investors continue to allocate to municipals to lock in reasonable, absolute after-tax yields and hedge against the risk that federal tax rates rise when provisions of the Tax Cuts and Jobs Act expire in 2026,” Stern noted.

Meanwhile, supply may tick up somewhat in 2024, he said.

The last several years have seen “tepid” supply, as issuers used the “one-time support they got for one-time purposes, including capital expenditures,” he said.

Additionally, some of the projects were scaled back due to inflation, along with the absence of advanced refundings, which contributed to the lower supply.

This year, issuers will “toggle back” and look to issue more bonds, including revenue sectors, helped by the backlog of hospital needs and the influx of airport financings, Stern said.

The period of “sharply” rising interest rates has slowed, providing more certainty on where interest rates will be.

This week issuance falls to $3.3 billion to close out the month.

In the primary market Monday, J.P. Morgan held a one-day retail order for $1.027 billion of Series P general revenue bonds from the

Next week already has several large deals on tap.

The New York City Transitional Finance Authority is set to price $1.25 billion of future tax-secured revenue bonds.

Massachusetts (Aa1/AA+/AA+/) is set to price on Feb. 7 $540 million of GO refunding bonds, 2024 Series B. Jefferies.

The Fort Worth Independent School District, Texas, is set to price on Feb. 6 $300 million of unlimited tax school building bonds.

The University of Washington (Aaa/AA+//) is set to price on Feb. 8 $291.795 million of general revenue and general revenue refunding bonds.

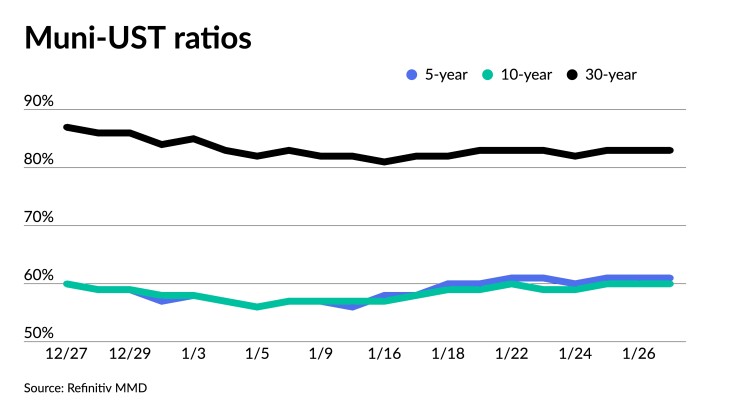

Elsewhere, muni-UST ratios and spreads are likely to “remain in their post-2017 range, given the stable credit environment, stagnant size of the municipal bond market and supportive demand-supply dynamics,” Stern said.

However, the ratio curve has moved lower, “as the buyer base for munis has migrated away from open- and closed-end mutual funds toward separately managed accounts and exchange-traded fund buyers, who are typically less ratio sensitive,” he said.

Even though the market has become used to sub-80 percent ratios in recent years, Stern said “recent outperformance pushed ratios into unattractive territory,” which seasonal factors have exacerbated.

The two-year muni-to-Treasury ratio Monday was at 63%, the three-year at 63%, the five-year at 61%, the 10-year at 60% and the 30-year at 83%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 64%, the three-year at 63%, the five-year at 61%, the 10-year at 60% and the 30-year at 82% at 3 p.m.

Currently, 10-year munis are yielding around 62% of USTs “while long-term averages are roughly 85% of Treasuries, and with recent averages, the 10-year ratio is approximately 73%,” said Jason Wong, vice president of municipals at AmeriVet Securities.

To achieve the 10-year muni average, yields would need to rise above 3%, he said.

“We should expect to see yields to continue rising for ratios to come back to normal levels but not in the immediate near term,” Wong said.

“The market seems to be coalescing around the view that these historically rich [MMD-UST] ratios can be sustained through February, but that the market technical becomes far less favorable in March and April,” said Birch Creek Capital strategists in a report.

If that happens, they said “investors will likely stick to new issues to pick up extra spread to hopefully cushion themselves from the impending adjustment back to more normalized valuations, while choosing to sit on extra cash that will help brunt the impact of a future downturn.”

Secondary trading

Connecticut 5s of 2025 at 3.01% versus 3.09% Friday. DC 5s of 2025 at 2.94% versus 2.98% Friday. Delaware 5s of 2026 at 2.71% versus 2.70% Friday and 2.71% on 1/18.

NYC TFA 5s of 2028 at 2.56%. California 5s of 2029 at 2.49% versus 2.57%-2.53% Thursday and 2.60% Wednesday. Fairfax County, Virginia, 5s of 2030 at 2.41%-2.40% versus 2.45%-2.44% Thursday and 2.47% original on Wednesday.

Private Colleges and Universities Authority, Georgia, 5s of 2033 at 2.61%-2.62% versus 2.67%-2.64% Thursday and 2.62% on 1/18. University of California 5s of 2034 at 2.42%-2.40% versus 2.52% original on Thursday. NYC 5s of 2035 at 2.67% versus 2.70%-2.69% Friday and 2.71%-2.72% Thursday.

Massachusetts 5s of 2049 at 3.88% versus 3.49% on 1/22. Massachusetts Transportation Fund 5s of 2053 at 3.91% versus 3.95% on 1/22 and 3.90% on 1/19.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 2.99% and 2.71% in two years. The five-year was at 2.43%, the 10-year at 2.46% and the 30-year at 3.61% at 3 p.m.

The ICE AAA yield curve was bumped one to three basis points: 2.96% (-1) in 2025 and 2.80% (-2) in 2026. The five-year was at 2.48% (-2), the 10-year was at 2.47% (-2) and the 30-year was at 3.57% (-3) at 3 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 2.99% in 2025 and 2.77% in 2026. The five-year was at 2.45%, the 10-year was at 2.47% and the 30-year yield was at 3.60%, according to a 3 p.m. read.

Bloomberg BVAL was unchanged: 2.96% in 2025 and 2.82% in 2026. The five-year at 2.48%, the 10-year at 2.53% and the 30-year at 3.63% at 3 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.315% (-4), the three-year was at 4.103% (-4), the five-year at 3.978% (-6), the 10-year at 4.070% (-7), the 20-year at 4.416% (-7) and the 30-year Treasury was yielding 4.308% (-7) at 3:10 p.m.

Primary to come

The Triborough Bridge and Tunnel Authority (/AA+/AAA/) is set to price Thursday $800 million of TBTA Capital Lockbox – City Sales Tax sales tax revenue bonds, Series 2024A. Goldman Sachs.

The Massachusetts Development Finance Agency (Aa2/AA//) is set to price Tuesday $442.355 million of Children’s Hospital Issue revenue bonds, Series 2024 T. J.P. Morgan.

The Rhode Island Health and Educational Building Corp. (/BBB+/BBB+/) is set to price Thursday $300 million of Lifespan Obligated Group Issue hospital financing revenue bonds, Series 2024. Morgan Stanley.

Tacoma, Washington, (/AA/AA-/) is set to price Tuesday $188.510 million of electric system revenue bonds, consisting of $94.370 million of new-issue green bonds, Series 2024A, and $94.140 million of refunding bonds, Series 2024B. J.P. Morgan.

The Indiana Housing and Community Development Authority (Aaa//AA+/) is set to price Tuesday $134.510 million of social single-family mortgage revenue bonds, consisting of $101.250 million of non-AMT bonds, 2024 Series A-1, serials 2034-2036, terms 2039, 2044, 2049, 2054; and $33.260 million of taxables, 2024 Series A-2, serials 2024-2031, term 204. RBC Capital Markets.

The Nassau County Interim Finance Authority, New York, (/AAA//) is set to price $127.830 million of sales tax secured bonds, Series 2024A, serials 2024-2030. BofA Securities.

The Alvin Independent School District, Texas, is set to price Thursday $102.455 million of unlimited tax schoolhouse and refunding bonds, Series 2024. Piper Sandler.

Competitive

The Spartanburg County School District No. 5, South Carolina, (Aa1/AA//) is set to sell $95 million of GOs at noon Tuesday.