Swings in short rates giving issuers pause with VRDOs

4 min read

Market volatility, an inverted yield curve, higher yields and huge swings in the SIFMA swap index are giving issuers pause when considering floating-rate debt products.

Issuance of variable rate demand obligations and other floating-rate debt saw a small increase in 2023 year-over-year, but it’s unclear if that trend will continue into 2024 due to the recent volatility.

That volatility can be attributed to a “reaction function of Federal Reserve policy and the fluctuation in interest rates and outflows of the market as a result of

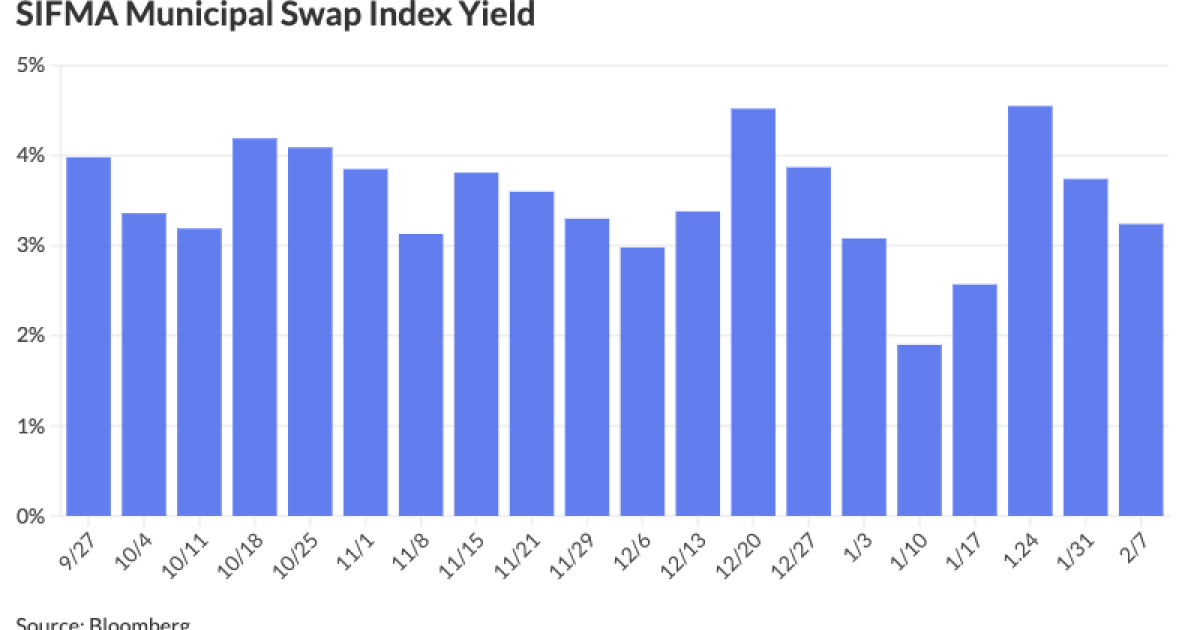

It can be seen in the whipsawing figures from the SIFMA Municipal Swap Index Yield over the past few months, but in January in particular.

For the week ending Jan. 10, the SIFMA Index was at 1.90% before jumping 67 basis points to 2.57% for the week ending Jan. 17. From there, the index surged a whopping 198 basis points to 4.55% for the week ending Jan. 24 before falling 81 basis points to 3.74% to end the week of Jan. 31. The index fell an additional 50 basis points to 3.24% for the week ending Wednesday.

“We can remember a time when variable rates moved 10 basis points and it was a lot,” David Womack, deputy director for financing policy and coordination for the New York City’s Mayor Office of Management and Budget, at the Demand Components, Alternative Financing Products panel at The Bond Buyer’s National Outlook conference on Thursday.

Another part of the volatility comes from the market being too small and the insufficient amount of floating-rate product available “versus the flows in and out,” said Matt Fabian, a partner at Municipal Market Analytics.

“It’s trying to fill up a teaspoon at your kitchen faucet. It’s very hard to do because it’s either overflowing or half empty,” he said.

The short-term market was primarily used in the pre-financial crisis to achieve a lower synthetic rate, with the VRDB bonds connected to an interest rate swap where the issuer would receive floating payments, according to Fabian.

But after the financial crisis and over the past few years, few issuers engage in swaps now, Fabian said.

There are still issuers who continue to integrate variable-rate debt and that structure into their overall debt portfolio, said Nicole Riggs, vice president of US Bank at Thursday’s panel.

However, Fabian noted there are very few traditional governments left in the VRDO market, with some hospitals, universities, industrial development funds and state housing agencies more likely to be issuers.

New York City and its governmental authorities and agencies, are “active users” of variable rate products, Womack said, thinking of them as alternatives to long-term fixed-rate bonds.

While VRDOs have allowed for savings in the past, the value proposition for floating-rate paper right now is “not great,” and there has been some reluctance to issue them, Womack said.

That reluctance may affect issuance.

Variable rate (short put) issuance rose 13.8% in 2023, increasing to $13.119 billion from $11.533 billion in 2022, according to LSEG Refinitiv data.

Bloomberg data shows that VRDB issuance (short resets) rose 12.1% in 2023, increasing to $12.584 billion from $11.221 billion.

However, the data for January 2024 has conflicting results, painting an uncertain picture of what the future might hold.

LSEG Refinitiv data shows variable rate (short put) issuance fell 8.7% in January 2024, declining to $486.4 million from $532.6 million in January 2023.

However, Bloomberg has VRDB issuance (short resets) issuance surging 142.8% last month to $1.363 billion from $561.3 million in January 2023.

While the effect on issuance is unclear at this time, market participants said issuers may hesitate to issue floating-rate debt products. for the remainder of the year due to recent market volatility.

“That’s a dangerous debt instrument these days for the borrower; it’s a completely unpredictable interest rate payment that you’re going to make,” Fabian said of VRDBs.

The reluctance on behalf of the issuers indicates market challenges “when you have some of the biggest issuers starting to think about possible alternatives,” Riggs said.

Several market forces are working against greater issuance, especially on the margins, she said.

For one, the curve is still not “normal,” she noted.

“So the savings that you would typically see in a normal interest rate environment on the short end of the curve, that magnitude of savings isn’t outweighing the risks and the volatility,” she said.

Additionally, regulatory changes that require banks to hold more capital for the credit liquidity facilities that support this debt are “eating into” the savings to some degree for VRDBs versus fixed-rate issuance.

“Are you saving money at that point, because you’re creating a headache for yourself,” said Giles Nicholson, head of the quantitative solutions group at Siebert Williams Shank & Co. at the panel.

Due to market volatility, there is a “sense of discomfort,” Pruskowski said.

“There’s a sense of not knowing what’s going on, which is creating a more cautious tone and greater research in work with your banker, which increases the cost of doing business, he said.

Additionally, the volatility from municipalities’ perspective adds some certainty to interest expense and ultimately, the budget, Pruskowski noted.

But once the Fed starts cutting rates, it should add comfort for issuers and be a “clear sign” for increased issuance, he said.

Additionally, variable rates have been “valuable” resources over time, and once the yield curve returns to a “more traditional shape,” it will make more sense to issue them, Womack said.