Southeast municipal bond volume fell in 2023 as uncertainty hit issuance

5 min read

States, municipalities and public entities in the Southeast sold fewer municipal bonds last year than they did in 2022 as the uncertainty about the direction of interest rates took its toll on new issuance during the

Full-year volume dropped 6.8% in 2023 to $65.8 billion from the $70.5 billion sold in 2022, according to data from LSEG, formerly Refinitiv. The number of issues sold last year also declined, dipping to 1,146 last year compared to the 1,271 sold in 2022.

Nationally,

Bond issuers in the Southeast sold $14.7 billion of debt in the first quarter , down 36.0% from Q1 2022; $17.2 billion were issued in Q2, down 15.9% year-over year; $16.4 billion in Q3, up 23.7% from 2022; and $17.4 billion in Q4, up 26.2% compared to $13.8 billion in 2022.

“Issuance in the first half of the year was quite subdued compared with the prior year,” said John Hallacy, founder of John Hallacy Consulting LLC. “In the second half, issuance climbed.”

He noted the effect that monetary policy and the Federal Reserve had on issuance last year.

“Parsing Fed actions was one of the critical factors in the mix. Once it became clear that the Fed was pausing on rate actions, issuance climbed appreciably despite somewhat higher municipal yields,” he told The Bond Buyer. “The 10-year municipal started the year at 2.43% in January and reached an elevated threshold

State supply

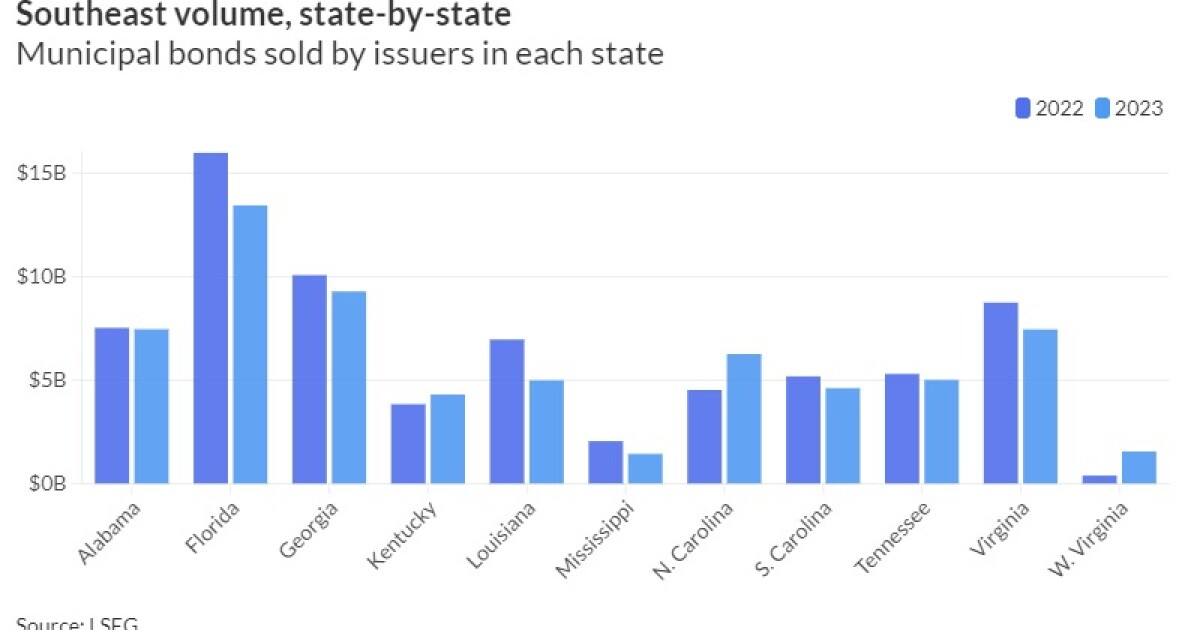

Issuers in Florida were the most prolific sellers among the region’s 11 states, offering $13.4 billion of bonds in 305 deals last year, a 15.9% volume decline from the $15.98 billion in 346 deals sold in 2022.

Georgia and Alabama took the second and third spots, respectively.

Issuers in Georgia sold $9.3 billion of bonds in 97 deals, down 7.9% in volume from the $10.1 billion in 145 issues sold in 2022. Alabama issuers sold $7.5 billion in 87 issues, down 0.9% from the $7.5 billion in 114 issues sold in 2022.

West Virginia saw the largest rate of increase last year, with issuance more than quadrupling $1.5 billion in 24 issues from $384.1 million in 24 issues in the previous year.

Mississippi saw the biggest percentage decrease in 2023 at $1.4 billion, down 30.1% from 2022.

Virginia issuers sold $7.4 billion last year, down 14.8% ; North Carolina issuers sold $6.3 billion, up 38.4%; and Tennessee issuers sold $5.0 billion, down 5.5%.

Issuers in Louisiana sold $4.98 billion in 2023, down 28.3% from $6.96 billion in 79 deals in 2022; South Carolina sold $4.6 billion in 99 deals, down 11.0% from $5.2 billion in 88 deals; and Kentucky sold $4.3 billion in 152 deals, up 12.2% from $3.8 billion in 143 deals.

“Volumes were mixed by state. Florida volume was down by 15.9%. What was issued was for transactions for housing and insurance,” Hallacy said.

“In North Carolina, volume was up by 38.4%. Most of the transactions were for general purpose and the security for these transactions was primarily in the GO format,” he said.

Tax-exempt vs. taxable

Taxable supply took the biggest hit in the region last year, down 29% to $6.7 billion in 110 deals from $9.4 billion in 150 deals in 2022. Tax-exempt volume held steady, off 0.4% to $55.9 billion in 1,013 deals.

Deals subject to the alternative minimum tax fell 36.7% to $3.2 billion in 23 deals from $5.0 billion in 22 AMT deals in the prior year.

New money deals dropped 7.4% to $53.7 billion in 1,043 deals last year. Refundings fell 6.7% to $8.1 billion. Deals LSEG categorized as combined new money/refunding issues rose 2.2% to $3.97 billion in 26 deals from $3.89 billion in 40 deals in 2022.

Negotiated deals rose 3.4% last year to $47.7 billion in 666 deals from $46.2 billion in 666 deals in 2022 while competitive sales fell 23.0% to $12.0 billion in 309 deals from $15.6 billion in 318 deals in the prior year.

Private placements dropped 31.1% to $6.1 billion 171 deals from $8.8 billion in 287 deals in the previous year

Top sectors

The utilities sector topped the Southeast in 2023, with $14.7 billion of bonds issued in 109 deals, down 8.2% from 2022.

Bonds LSEG classifies as general purpose followed, with $12.1 billion, down 7.8% year-over-year. Coming in third was education with $10.2 billion, down 13.0%.

Housing totaled $7.8 billion with 203 deals in 2023, up 49.6% from 2022.

Bonds for public facilities bond issuance saw the largest Southeast gain last year, more than doubling to $2.2 billion.

Biggest issuers

Energy companies were well represented on the list of the largest issuers last year, Hallacy noted.

“Top deals in the Southeast region were directed to energy and specifically to natural gas transactions,” Hallacy said. “Names such as Main Street, Tennessee Energy, Patriots, Southeast, Black Belt and Kentucky dominated the list.”

Main Street Natural Gas, a prepaid natural gas issuer in Georgia, sold the most bonds in the Southeast last year, offering $4.2 billion of securities in nine issues.

In second place was the Black Belt Energy Gas District in Alabama, which sold $1.96 billion in six deals last year. Rounding out the top three was the Louisiana Local Government Environmental Facilities and Community Development Authority, which sold $1.7 billion of bonds in 10 deals.

Coming in at number four was Patriots Energy Group Financing Agency in South Carolina, a natural gas supply agency that sold $1.5 billion of bonds in five deals, followed by the Southeast Energy Authority in Alabama which sold $1.2 billion in two natural gas prepay deals.

Adobe Stock

Biggest single deals

The Louisiana Local Government EFCDA’s $1.5 billion taxable system restoration bonds for the Louisiana Utilities Restoration Corp. project/ELL priced on March 21 was the biggest single deal of the year in the Southeast.

The deal, priced by J.P. Morgan Securities, was rated triple-A by Moody’s Investors Service and S&P Global Ratings. It was priced at par to yield 5.018% (+110 over UST) in 2031, 5.048% (+145 over UST) in 2034 and 5.198% (+160 over UST) in 2039.

Coming in second was the Main Street Natural Gas’ $1 billion of refunding bonds priced by RBC Capital Markets on Sept. 7. Rounding out the top three was the Virginia College Building Authority’s $961 million of new money and refunding bonds; BofA Securities priced the deal on May 16.

Coming at number four was the Kentucky Public Energy Authority’s $862 million refunding bonds priced by Morgan Stanley on Dec. 5, followed in the number five position by Main Street Natural Gas’ $834 million deal priced by RBC on Feb. 2.

League tables

BofA Securities came in as the top senior manager in the Southeast, credited by LSEG with $9.8 billion of bonds in 86 deals last year; it was followed by RBC Capital Markets with $7.0 billion in 47 deals, Morgan Stanley with $5.9 billion in 38 deals, Goldman Sachs with $4.7 billion in 23 deals and Wells Fargo with $4.7 billion in 58 deals.

Orrick Herrington & Sutcliffe was the top bond counsel in the Southeast last year, credited with $5.6 billion of business in 24 deals. It was followed by Butler Snow with $4.5 billion in 56 deals, Alston & Bird with $4.2 billion in nine deals, Greenberg Traurig with $3.7 billion in 69 deals and Kutak Rock with $3.5 billion in 32 deals.

PFM Financial Advisors was top financial advisor in the Southeast last year, credited with $12.9 billion of work on 98 deals. It was followed by Municipal Capital Markets Group with $5.2 billion in 13 deals, Public Resources Advisory Group with $3.6 billion in 29 deals, Kaufman Hall & Associates with $3.2 billion in 20 deals and HilltopSecurities with $2.1 billion in 19 deals.

Bond insurance

The use of insurance increased in the Southeast last year amid the overall decline of issuance. Offerings covered by bond insurance rose 7.3% to $4.6 billion in 99 deals, up from $4.3 billion in 113 deals in 2022.

Nationally, debt