Homebuilder sentiment turns positive for the first time since July

2 min read

U.S. homebuilders are feeling more confident about their businesses than they have since last summer, as they see better demand despite stubbornly high mortgage rates.

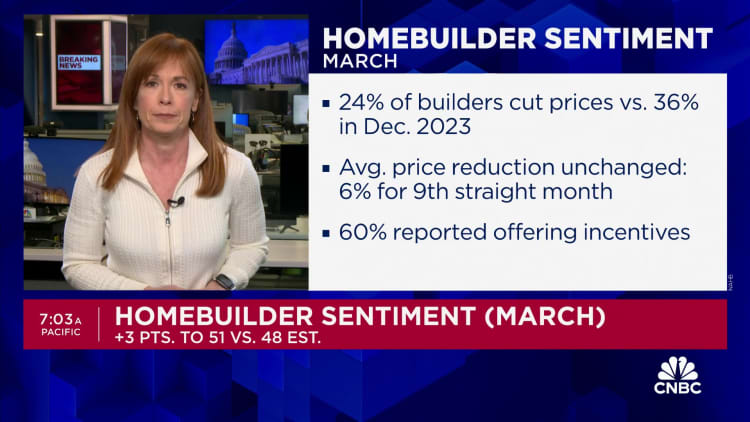

Homebuilder sentiment rose 3 points in March to 51 on the National Association of Home Builders/Wells Fargo Housing Market Index. The reading gained for the fourth-straight month, hitting its highest level since July.

Sentiment also moved into positive territory for the first time since July. Fifty is the line between positive and negative sentiment.

Mortgage rates came down in the first week of March, only to shoot back up in the second week. The average rate on the popular 30-year fixed mortgage has hovered around 7% since early February.

“Buyer demand remains brisk and we expect more consumers to jump off the sidelines and into the marketplace if mortgage rates continue to fall later this year,” said NAHB Chairman Carl Harris, a custom homebuilder from Wichita, Kansas. “But even though there is strong pent-up demand, builders continue to face several supply-side challenges, including a scarcity of buildable lots and skilled labor, and new restrictive codes that continue to increase the cost of building homes.”

Of the index’s three components, current sales conditions rose 4 points to 56, expectations in the next six months rose 2 points to 62 and buyer traffic increased 2 points to 34.

Regionally, on a three-month moving average, sentiment rose most in the Midwest and West.

The report also noted that fewer builders are lowering home prices to attract buyers. In March, 24% of builders reported cutting home prices, down from 36% in December 2023 and the lowest share since July.

The average price cut remains steady at around 6%. Builders are still using sales incentives such as buying down mortgage rates.

“With the Federal Reserve expected to announce future rate cuts in the second half of 2024, lower financing costs will draw many prospective buyers into the market,” said Robert Dietz, chief economist for the NAHB. “However, as home building activity picks up, builders will likely grapple with rising material prices, particularly for lumber.”