Yields rise, muni-to-UST ratios climb higher

4 min read

Munis were weaker Wednesday as the primary market saw a slew of new deals price, adding pressure to secondary market trading. U.S. Treasury yields rose throughout most of the curve and equities ended down.

Triple-A yields rose as much as 11 basis points while USTs were weaker by five basis points. As munis have seen more selling pressure amid the influx of new-issue supply, muni-UST ratios are now at or near year-to-date highs, and they continue to inch higher, J.P. Morgan strategists noted.

The two-year muni-to-Treasury ratio Wednesday was at 67%, the three-year at 66%, the five-year at 66%, the 10-year at 66% and the 30-year at 84%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 67%, the three-year at 67%, the five-year at 66%, the 10-year at 67% and the 30-year at 84% at 3:30 p.m.

Wednesday was another busy day for the new-issue market. BofA Securities priced and repriced for the Burbank-Glendale-Pasadena Airport Authority (A2/A/A-/) $732.195 million of airport senior revenue bonds, with yields bumped up to 15 basis points from the preliminary pricing. The first tranche, consisting of $34.71 million of Assured Guaranty-insured non-AMT bonds, Series 2024A, saw 4s of 7/2054 at 4.20% (-12), callable 7/1/2034.

The second tranche, $648.945 million of AMT bonds, Series 2024B, saw 5s of 7/2031 at 3.78% (-3), 5s of 2034 at 3.82% (-4), 4s of 2039 at 4.18% (-4) (insured by Assured Guaranty), 5.25s of 2044 at 4.20% (-6), 4.375s of 2049 at 4.56% (-15) (insured by Assured Guaranty), 5.25s of 2049 at 4.34% (-12), 4.5s of 2054 at 4.64% (-15) (insured by Assured Guaranty) and 5.25s of 2054 at 4.39% (-15), callable 7/1/2034.

The third tranche, $48.54 million of taxables, Series 2024C, saw all bonds price at par: 5.12s of 7/2028, 5.17s of 2029 and 5.15s of 2031 (insured by Assured Guaranty), noncall.

Piper Sandler priced for the Edmonds School District No. 15, Washington, (Aaa///) $288.89 million of unlimited tax GO and refunding bonds, Series 2024, with 5s of 12/2024 at 3.47%, 5s of 2029 at 3.13%, 5s of 2033 at 3.24%, 5s of 2039 at 3.53% and 5s of 2042 at 3.78%, callable 6/1/2034.

BofA Securities priced for the Astoria Hospital Facilities Authority, Oregon, (/BBB/BBB+/) $200 million of Columbia Memorial Hospital Project revenue bonds, Series 2024, with 5s of 8/2030 at 3.77%, 5s of 2034 at 3.80%, 5.25s of 2039 at 4.07%, 5.25s of 2044 at 4.42%, 5.25s of 2049 at 4.62% and 5.25s of 2054 at 4.67%, callable 2/1/2034.

In the competitive market, Clark County, Nevada, sold $206.895 million of highway revenue improvement and refunding bonds, to Jefferies, with 5s of 7/2025 at 3.35%, 5s of 2029 at 3.15%, 5s of 2034 at 3.18%, 5s of 2039 at 3.50% and 4s of 2044 at 4.20%, callable 7/1/2034.

Fort Worth, Texas, sold $148.305 million of water and sewer system revenue bonds, to Wells Fargo, with 5s of 2/2025 at 3.45%, 5s of 2029 at 3.06%, 5s of 2034 at 3.19%, 5s of 2039 at 3.50%, 5s of 2044 at par and 4.125s of 2046 at par, callable 2/15/2033.

“Supply continues to pressure the market as dealer and arbitrage buyers absorb the overflow,” J.P. Morgan strategists said.

Following this week’s underperformance, AAA high-grade muni yields 10 years and in have returned to year-to-date highs, while those out long are still off their year-to-date highs, they said.

For example, the 30-year MMD yield is 13 basis points from its year-to-date high.

“Naturally, this is on the heels of outperforming in April relative to the broader fixed-income market,” J.P. Morgan strategists said.

Absolute yields “look attractive in the context of the trading range over the past three years, recent underperformance versus taxable fixed-income, and our longer-term projections for lower rates this year,” they said.

They said “2-5-10-20yr IG municipal ratios cheapened versus taxable fixed-income” month-to-date.

Ratios look “progressively richer” in 10 years, as the “10-year spot is still far more attractive in taxables versus tax-exempts,” J.P. Morgan strategists noted.

The longest portion of the tax-exempt market has the most value, they said.

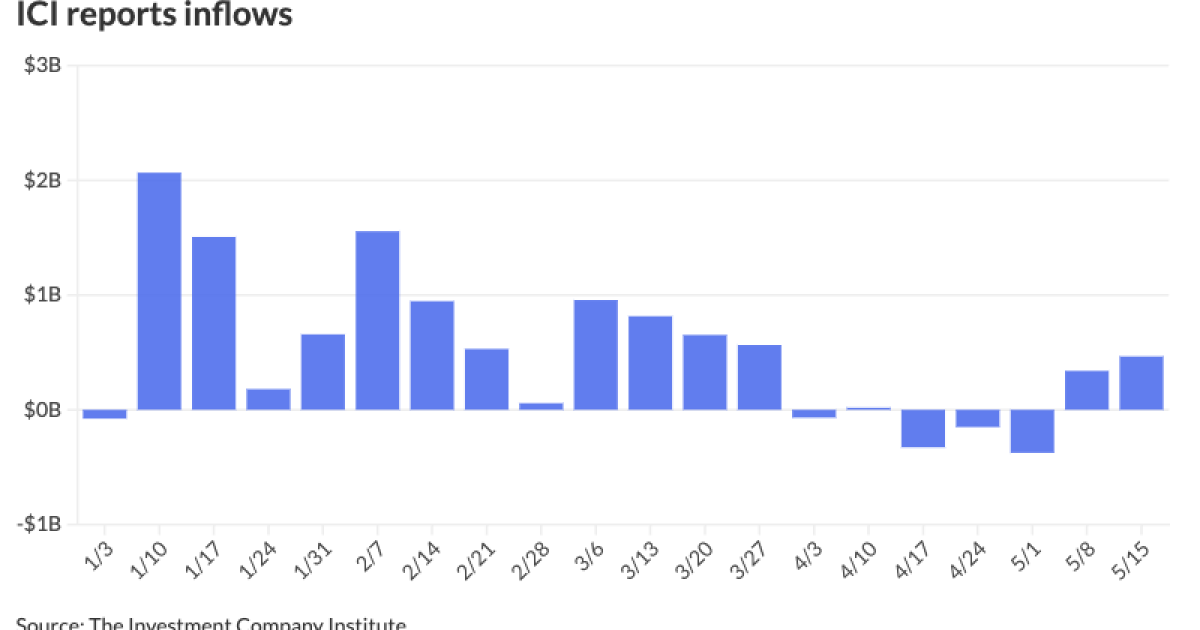

Following a “solid start to the year,” inflows have become more mixed this month.

The Investment Company Institute reported inflows into municipal bond mutual funds for the week ending May 15, with investors adding $465 million to funds following $339 million of inflows the week prior. This differs from the

ICI reported

The mixed inflows leave “the market susceptible to weaker technicals and the pop in supply thus far this year,” J.P. Morgan strategists said.

“If the UST market holds or extends the rally, fund flows will follow and tax-exempts will outperform,” they noted.

AAA scales

Refinitiv MMD’s scale was cut two to five basis points: The one-year was at 3.31% (+5) and 3.25% (+5) in two years. The five-year was at 2.94% (+5), the 10-year at 2.92% (+4) and the 30-year at 3.84% (+2) at 3 p.m.

The ICE AAA yield curve was cut three to eight basis points: 3.31% (+5) in 2025 and 3.23% (+8) in 2026. The five-year was at 2.95% (+6), the 10-year was at 2.92% (+6) and the 30-year was at 3.81% (+3) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut two to seven basis points: The one-year was at 3.30% (+5) in 2025 and 3.20% (+5) in 2026. The five-year was at 2.93% (+7), the 10-year was at 2.89% (+7) and the 30-year yield was at 3.82% (+2), according to a 3 p.m. read.

Bloomberg BVAL was cut one to 11 basis points: 3.35% (+3) in 2025 and 3.22% (+7) in 2026. The five-year at 2.89% (+9), the 10-year at 2.88% (+11) and the 30-year at 3.82% (+1) at 3:30 p.m.

Treasuries were weaker throughout most of the curve.

The two-year UST was yielding 4.872% (+4), the three-year was at 4.649% (+5), the five-year at 4.463% (+3), the 10-year at 4.423% (+1), the 20-year at 4.650% (flat) and the 30-year at 4.542% (-1) at 4 p.m.

Primary to come

The Illinois Finance Authority (Aa3/AA-//) is set to price Thursday $285.895 million of Endeavor Health Credit Group revenue refunding bonds, Series 2024A. BofA Securities.

Corpus Christi, Texas, (/AA-/AA-/) is set to price Thursday $244.765 million of utility system senior lien revenue improvement and refunding bonds, Series 2024, serials 2025-2044, terms 2049, 2054. Ramirez.

The Port of Beaumont Navigation District, Texas, is set to price $199.695 million of non-rated Jefferson Gulf Coast Energy Project Dock and Wharf Facility revenue bonds, Series 2024B. Morgan Stanley.