A can’t-do agency: the MTA can’t build or repair without congestion pricing

7 min read

Pausing congestion pricing may be even more destructive than the New York Metropolitan Transportation Authority predicted, according to a presentation at its board meeting last week.

The agency cannot afford to cover all basic maintenance, and must shelve any new upgrades or expansions until it finds $16.5 billion in revenue, the presentation said.

The system of tolls on vehicles entering Manhattan’s Central Business District was set to take effect on June 30, but was abruptly

All but one board member voted for Wednesday’s resolution, which authorizes the president of the MTA to “take such steps as may be necessary or desirable to implement the CBDTP until after such time as the required final agreement [with the Federal Highway Authority] has been executed.”

With no plan to replace the revenue, the MTA has been thrown into turmoil as staff calculates changes to its capital plan and operations and drafts the upcoming 2025-2029 capital plan.

The tolls would have generated $1 billion per year, and the MTA would have used that $1 billion to issue $15 billion of bonds — almost a third of its $55.5 billion capital program, and almost two thirds of the remainder of the program.

But accounting for other costs and grants that will be put in jeopardy, the hit to the 2020-2024 capital program is actually closer to $16.5 billion, according to the presentation from Deputy Chief Development Officer Tim Mulligan.

So the MTA is left with $12 billion to complete the $28.5 billion of projects left on its capital program.

Around two-thirds of the remaining capital program was supposed to be “state of good repair” projects, maintaining the safety and efficiency of the system. Those projects will be at the forefront of the pared-back capital plan, but some of them will also get shelved.

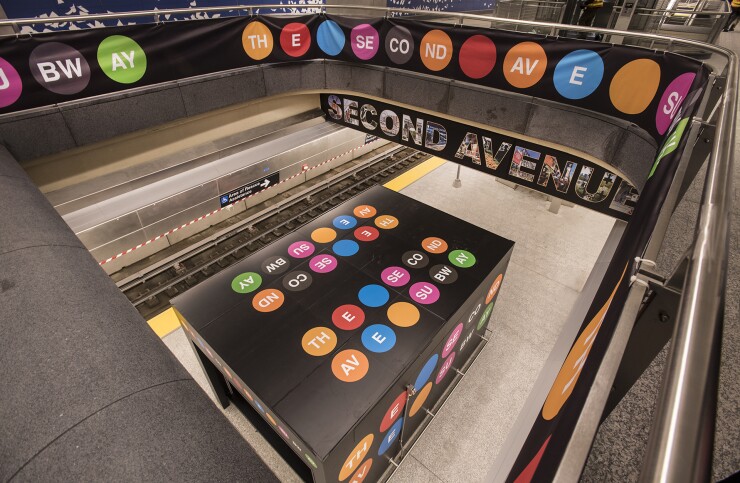

Most expansions and upgrades will be “deferred” until the MTA has the necessary funding. Those projects include the Second Avenue Subway extension into Harlem (projected to cost $5 billion), elevators

The agency will also delay $3 billion of state of good repair projects, a $3 billion project to replace 1930s-era signals on the AC and BDFM lines, and $1.5 billion of upgrades to the system’s oldest subway and train cars.

Hochul released a statement after the board meeting that said her office would work with the MTA to fund the remainder of the capital plan, but did not provide any specifics.

“While the timing of the next budget may necessitate temporary adjustments to the timeline of certain contracts, there is no reason for New Yorkers to be concerned that any planned projects will not be delivered,” Hochul’s statement said.

But the agency plans to cancel some projects that it already awarded contracts for, according to the presentation, including elevators for two stations and upgrades for train yards. And if these projects are delayed long enough, they may be included in the upcoming 2025-2029 capital program, displacing other repairs.

Even the delays, many board members noted, will have downstream effects. If the agency doesn’t replace old cars, trains will break down more often. That will make service less reliable, which will deter riders, which will create a drop in farebox revenue. The upgrades to signals, train yards and certain structural repairs would also have increased reliability, so shelving them could forfeit future revenue.

Other projects could cause problems if they’re delayed for too long. Lieber pointed out that America has a supply shortage of buses, and if the MTA waits too long to buy them, it could lose its place in line with the manufacturer.

Some infrastructure projects, like the Verrazzano-Narrows Bridge ramp reconstruction and a main cable dehumidification system to

; the longer that project is delayed, the more the 50-year-old bridge’s infrastructure becomes vulnerable to deterioration.

The federal government has agreed to provide $2 billion for the Second Avenue Subway extension. If the agency delays work on the project for too long, it may lose that grant.

And no one — except Hochul, perhaps — knows how long the MTA will be waiting for funding.

In the governor’s original announcement, she said congestion pricing would be “temporarily paused,” but she’s given no indication when she might lift that pause.

Many members of the MTA, including Lieber, appeared to hope they’ll be waiting a matter of months, but acknowledged that it could be years. If Hochul’s pause was politically motivated, as critics have alleged, the MTA might just be waiting for the election to pass in November.

But Hochul has been pushing for a new source of funding altogether. She tried to get the state legislature to pass an alternative source of $1 billion annually for the MTA after blocking congestion pricing, but it went nowhere and the legislature

Many alternatives are unattractive. Hochul’s recommendation for a payroll mobility hike is not going over well with the New York City residents and businesses who would pay, including the city-appointed members of the board; they argued they shouldn’t have to pay more to fund the subway, since it’s an economic engine for the rest of New York and surrounding states. And a new increase that would follow in short order a

Lieber said in a press conference after Wednesday’s meeting that he believes Hochul. After all, Hochul and the state legislature found alternate sources of funding for the MTA when it had funding shortfalls during and after the pandemic.

“We’re expecting that there will be a solution to the $15 billion,” Lieber said at a press conference after the meeting. “The governor, in the statement… did say she’s going to do it, and I said I take her at her word.”

The meeting had 140 public speakers, including New York City Comptroller Brad Lander, who

Although the board, largely appointed by Hochul, voted to delay the implementation, members stressed repeatedly that they had voted many times for congestion pricing and expressed dismay at the projects that have been tabled.

“I want to make it clear that a ‘yes’ vote on this resolution is not an endorsement of the congestion pricing pause, but rather a confirmation that the MTA is eagerly awaiting to implement the program as soon as the tolling contract is signed by all parties involved,” board member Blanca López said.

Board member Norman Brown described the pause as “political interference” that would have “catastrophic” consequences for the MTA’s operations and New Yorkers’ jobs.

The MTA won one of the eight

“We appreciate the thorough evaluation of the environmental review by Hon. Judge Lewis Liman, and his acknowledgment of the comprehensive analyses and public process that led to the federal government’s Finding of No Significant Impact for the Central Business District Tolling program,” the MTA’s general counsel Paige Graves said in a statement. “We stand ready to relieve congestion and improve transit service for millions of riders.”

Additionally, several parties, including Lander, have

Meanwhile, the MTA plans to issue $800 million in July to refinance various debt, including some

The loss of congestion pricing revenues has not changed the agency’s bond ratings: its transportation revenue credit is rated A3 with a positive outlook by Moody’s Ratings, A-minus with a positive outlook by S&P Global Ratings, AA by Fitch Ratings and AA with a stable outlook by Kroll Bond Rating Agency.

In next month’s meeting, the board will learn about how the lost congestion pricing revenue will impact operations and debt service. That meeting will also include the next capital plan, which it appears the agency will have to write without knowing when, if ever, it will implement the congestion pricing tolls or get another billion-dollar revenue source.

The current capital plan has been very delayed, first by the pandemic and then by the uncertainty around congestion pricing.

The capital plan is supposed to end this year, yet the MTA has committed only $32.5 billion to projects out of its $55.5 billion program. The agency has $12 billion for necessary upgrades, but a presentation at this month’s capital plan committee meeting revealed that the agency only intends to commit $2.9 billion to contracts this year — it does project that it will overshoot that budget, though, and commit $3.3 billion.

In a

“The slower the pace of commitments, the greater potential for capital disinvestment to occur, allowing assets to deteriorate,” the comptroller wrote.