As redemptions begin, munis outperform UST selloff

4 min read

Municipals were slightly weaker Monday but outperformed U.S. Treasuries, which saw larger losses 10 years and out, while equities ended up.

Triple-A yields rose one to five basis points, depending on the curve, while UST yields rose up to 14.

The two-year muni-to-Treasury ratio Monday was at 65%, the three-year at 65%, the five-year at 66%, the 10-year at 64% and the 30-year at 81%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 66%, the three-year at 68%, the five-year at 68%, the 10-year at 67% and the 30-year at 83% at 3:30 p.m.

Seventy-six percent of the month’s principal and interest payments hit the market Monday as issuers return $27 billion of principal and pay $11 billion of interest, noted Pat Luby, head of municipal strategy at CreditSights.

Overall, he said July redemptions will be down around 13% month-over-month but rise 35% from last year’s monthly average of $27 billion.

The states with the largest redemptions this month are California with $7.1 billion, Arizona with $3.3 billion, New Jersey with $2.7 billion and New York with $2.4 billion, Luby said.

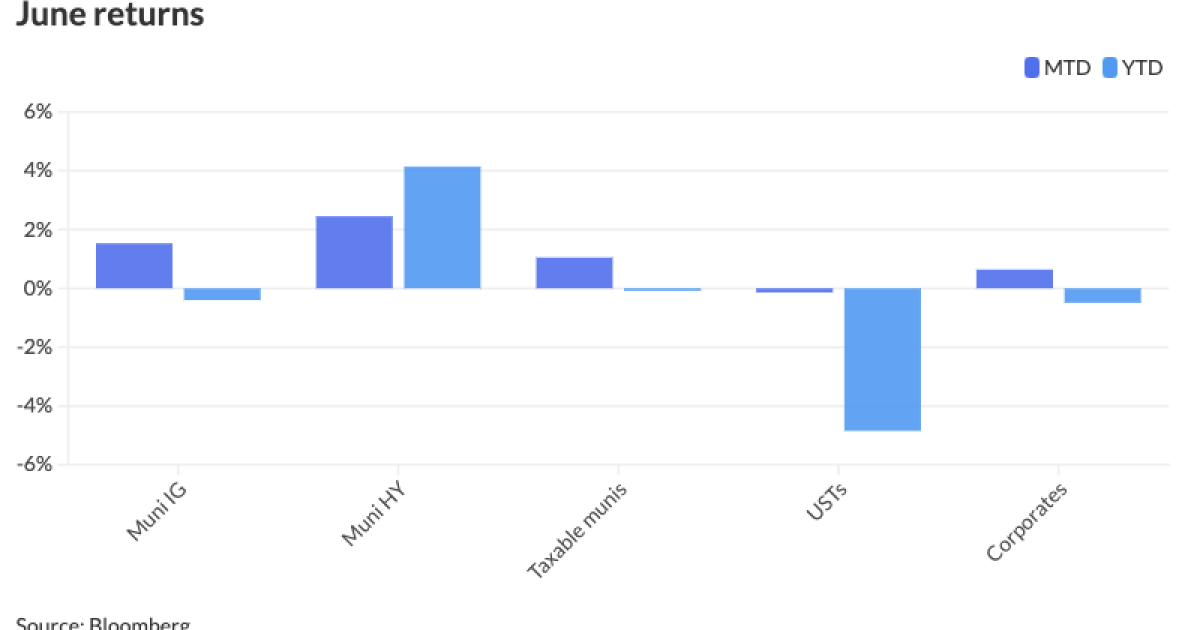

The reinvestment period begins following June’s positive performance, “a complete 180” from April and May as munis returned 1.53% for the month, “pushing year-to-date returns closer to positive territory with year-to-date returns now at negative 0.40%,” said Jason Wong, vice president of municipals at AmeriVet Securities.

Munis were positive in June as demand “outpaced” supply and the asset class is “riding the momentum of the rally in the Treasury markets as recent data indicates inflation has cooled supporting signs that the Fed may begin cutting rates later this year,” he noted.

As the second half of the year approaches, Wong expects July to “follow in the footsteps of June” even though the former is usually a “slow month” for munis.

July has seen negative returns for two consecutive years, but “the demand for reinvestment still remains high and could possibly snap July’s losing streak,” he said.

Muni yields rose during the final week in June, with the 10-year muni yield rising 5.2 basis points to end the month at 2.86%, Wong said.

Last week, the tone seemed to be “cautious” as investors digested a $12-plus billion new-issue calendar and waited for July 1 redemption cash, said Birch Creek Capital strategists.

Last week,

The outflows were led by long-term funds, “a complete reversal of what we have seen in the last few weeks which has been significant inflows into long-term funds,” Wong said.

Instead, bid wanted volumes rose around 20% relative to recent averages, “with the biggest increase seen in 20y+ bonds as long duration funds bore the brunt of the outflows,” Birch Creek strategists said, citing J.P. Morgan.

Around $51 billion of principal and interest payments will hit investor accounts in July, according to Bloomberg.

“While valuations are still historically tight, the extra demand through the summer should help support the muni market in the coming weeks,” Birch Creek strategists said.

Despite issuance falling to a paltry $245 million this week, there are already several large deals on the horizon. Bond Buyer 30-day visible supply sits at $7.25 billion.

The Dormitory Authority of the State of New York is set to price the week of July 8 $1.29 billion of state sales tax revenue bonds.

The Washington Metropolitan Area Transit Authority is set to price the week of July 8 $553 million of second lien dedicated revenue bonds.

The New York City Transitional Finance Authority is set to price the week of July 15 $1.7 billion of tax-exempt and taxable future tax-secured revenue refunding bonds.

New York City is set to price the week of July 29 $1.2 billion of GO refunding bonds.

The Port of Seattle is set to price the week of July 29 around $850 million of AMT and non-AMT intermediate lien revenue and refunding bonds.

Harris County is set to price a $730 million deal, consisting of $100 million of permanent improvement refunding bonds, $220 million of unlimited tax road refunding bonds and $410 million of permanent improvement tax and revenue certificates of obligation.

Houston is set to price a $720.445 million deal, consisting of $589.41 million of GO refunding bonds and $131.035 million of public improvement refunding bonds.

AAA scales

Refinitiv MMD’s scale saw cuts throughout most of the curve: The one-year was at 3.15% (unch, no Jul roll) and 3.10% (unch, -1bp Jul roll) in two years. The five-year was at 2.92% (+3, no Jul roll), the 10-year at 2.87% (+3, no Jul roll) and the 30-year at 3.75% (+3) at 3 p.m.

The ICE AAA yield curve was cut three to five basis points: 3.22% (+3) in 2025 and 3.14% (+3) in 2026. The five-year was at 2.96% (+4), the 10-year was at 2.93% (+4) and the 30-year was at 3.75% (+3) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut up to five basis points: The one-year was at 3.18% (+1) in 2025 and 3.11% (unch) in 2026. The five-year was at 2.93% (+5), the 10-year was at 2.91% (+3) and the 30-year yield was at 3.74% (+4) at 3 p.m.

Bloomberg BVAL was cut up to four basis points: 3.18% (unch) in 2025 and 3.13% (+1) in 2026. The five-year at 2.96% (+2), the 10-year at 2.87% (+3) and the 30-year at 3.77% (+4) at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.763% (+4), the three-year was at 4.583% (+6), the five-year at 4.438% (+10), the 10-year at 4.480% (+13), the 20-year at 4.754% (+14) and the 30-year at 4.639% (+13) at 4 p.m.