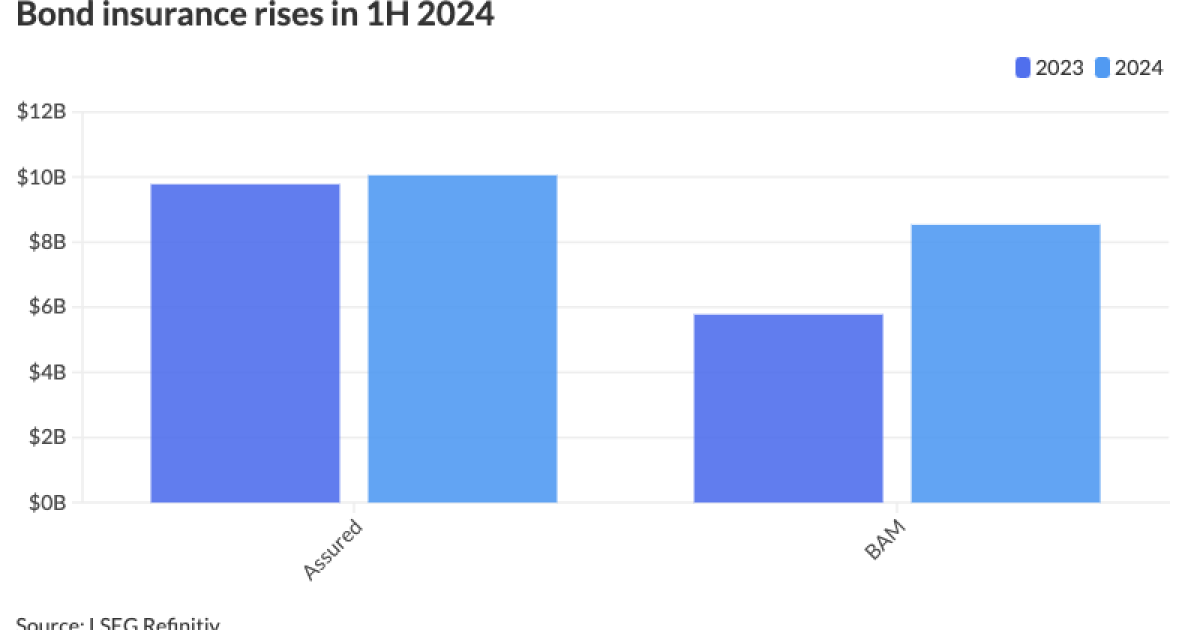

Bond insurance rises in 1H 2024

3 min read

Bond insurance continues to be used by issuers and sees strong demand from retail and institutional investors, as the amount of debt wrapped by bond insurance rose 19.5% in the first half of 2024 year-over-year.

Municipal bond insurers wrapped $18.592 billion in the first half of 2024, an increase from the $15.561 billion insured in the first half of 2023, according to LSEG data.

The industry par amount was achieved in 762 deals versus 622 deals in 1H 2023.

Assured Guaranty accounted for a total of $10.055 billion in 327 deals, accounting for 54.1% of the market share, compared to $9.776 billion in 290 deals for a 62.8% market share in the first half of 2023, according to LSEG data.

Build America Mutual insured $8.537 billion in 435 deals, or 45.9% of the market share. That is up from $5.785 billion in 332 deals, or a 37.2% market share, in the first half of last year, according to LSEG data.

Both insurers saw year-over-year growth. Bond insurance for Assured and BAM rose 2.9% and 47.6%, respectively.

Bond insurance penetration remained at 8.2% for the first half of 2024.

“Bond insurance is increasingly being utilized across a variety of transactions ranging from very small to very large in size,” said Robert Tucker, senior managing director of investor relations and communications at Assured Guaranty.

More investors have “realized that, in addition to the security it provides, bond insurance can support price stability and market liquidity, on transactions of all sizes, and that issuers use it to provide greater certainty of execution in less predictable market environments, in addition to reducing financing costs,” he said.

“Retail buyers — both directly and through separately managed accounts — remain an important force in this market and continue to show a preference for insured bonds when offered,” said Mike Stanton, head of strategy and communications at Build America Mutual. “Institutional investor demand complements that, and we anticipate those trends will continue to support solid insurance utilization into the second half.”

Assured Guaranty continued its “market leadership position for the first half of 2024,” with its total par amount ticking up in 1H 2024 year-over-year, Tucker said.

In Q2, Assured’s primary market was at 58%, a 13% increase year-over-year for a total of $7.2 billion, he said.

“One driver of our production is the ongoing demand for our guaranty on larger transactions, which typically see interest from institutional investors,” he said.

In 1H 2024, Assured insured 21 transactions that each utilized $100 million or more, 14 of which were in the second quarter, he said. The firm also added value on double-A credits during the first half of 2024, insuring $2.5 billion of par on 53 deals, Tucker said.

The firm saw “significant opportunities in large, high-margin transactions,” he said.

Assured backed several large deals, including $1.13 billion for the

The firm continues to add value on double-A credits, insuring $2.5 billion of par on 53 deals, he noted.

“We believe that investors see the extra protection of our guaranty as a mitigant of downgrade and market value risks,” Tucker said.

For BAM, “with the very heavy primary market calendars we saw for most of the first half, issuers could use BAM insurance to stand out and attract more potential buyers, particularly from the institutional buy-side,” Stanton said.

BAM saw “strong interest from retail investors, who are historically the most-active users of insurance and represented the largest pool of demand for all municipal bonds in the first half,” he said.

“We also saw continuing demand from institutional buyers who use insurance as a tool to diversify credit exposures and improve liquidity, particularly on larger and higher-rated transactions,” Stanton said.

Of the deals in 1H, BAM covered 20 new-issue transactions with par of at least $100 million and insured over than $1.5 billion of bonds rated double-A or stronger, he said.

Along with the increased volume from “traditional” bond insurance users, there was “an uptick in utilization by revenue bond issuers and more insured debt from states like Oklahoma, Wisconsin, and Colorado,” Stanton said.

BAM insured its first two new-issue healthcare transactions during Q2 — $100 million of the Marshfield Clinic Health System in Wisconsin and $87 million for the Midland County Hospital District in Texas, he said.

Additionally, BAM also insured large deals for flagship public universities, airports, and public power agencies, Stanton said.

Standouts in higher education include $281 million for Florida State University, $270 million for the San Francisco Community College District and $210 million for the University of Oklahoma, he said.