Investors greeted with yield opportunities across credits

6 min read

Constructive secondary trading and a firmer tone were evident Monday as munis took cues from calmer markets overall.

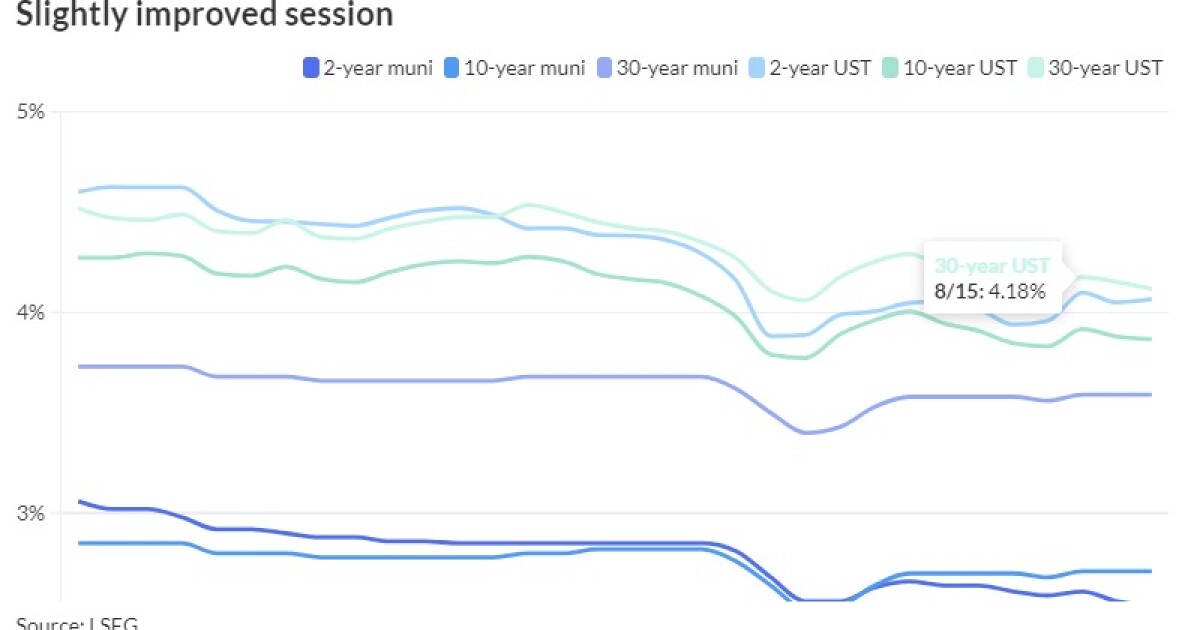

Triple-A yield curves saw small improvement, particularly on the short end, with bumps of one to two basis points, while Treasuries were better out longer.

With two weeks of market swings in the rearview, and some further certainty of a September rate cut, issuers are back in the fold with a nearly $12 billion calendar this week and Bond Buyer 30-day visible supply at $15.02 billion.

“The back half of the month begins with a stable, if slightly tentative, demand component,” noted Kim Olsan, senior fixed-income portfolio manager at NewSquare Capital.

With supply “meaningfully above average this week” and with ratios “trending towards the higher end of the summer long-range — 70% in 10s and 86% in 30s — opportunity may be available for the portfolio managers in their seats,” said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

Muni to UST ratios were mostly steady along with the markets Monday, with the two-year muni-to-Treasury ratio at 64%, the three-year at 67%, the five-year at 68%, the 10-year at 70% and the 30-year at 87%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 64%, the three-year at 66%, the five-year at 67%, the 10-year at 70% and the 30-year at 86% at 3:30 p.m.

Brigati said his firm’s clients have investment needs “that must be met, but are hoping for a better entry point following the early August grab-fest that aggressively pushed yields lower.”

The market “arguably got over-extended, so a little consolidation and patience may offer investors the opportunity to capture better levels,” Brigati said. “Keep in mind the traditional cyclical nature of the market as we move through the September/October period when municipal underperformance is a common theme.”

Anders Persson, chief investment officer and head of global fixed income, and Daniel Close, head of municipals, at Nuveen noted that “even if the muni market sells off slightly, we expect investors to find room to purchase new, cheap deals.”

“Investors feel confident that both Treasury and muni rates should be lower by year end, so they are looking to lock in higher rates now,” they said.

While the final portions of August’s redemptions have been paid out, “mixed economic data has left investors questioning more the size than timing of the first rate cut and what impact that will have on the municipal curve slope,” Olsan said.

For now, short-call bonds “have caught a renewed bid with buyers hedging the opportunity to reinvest in the next one to three years if call options are exercised,” she said. “For longer duration inquiry, the availability of 5% coupons with call protection offers yields above 3.50% (with taxable equivalent yields nearing 6%).”

Olsan said as investors contemplate rate policy for the remainder of 2024, “there have been a few strategies from which to choose to boost yield — short positioning, curve extension and credit quality.”

“Of those three, returns in lower credit alternatives have trounced other choices,” she said.

High-yield

“As demand remains firm and continues to build, high-yield municipal credit spreads continued to compress another four basis points on average last week,” they said. “New issuance remains heavily oversubscribed, and secondary market bidding is competitive.”

Nuveen points to one of the largest non-rated deals of the year to watch this week, the Atlanta Development Authority’s $556.11 million Convertible Capital Appreciation Economic Development Certificates (Gulch Enterprise Zone Project) and senior revenue bonds (Westside Gulch Area Project).

The firm said the deal may offer yields as high as 7%.

AAA scales

Refinitiv MMD’s scale was bumped two basis points on bonds out to 2030: The one-year was at 2.62% (-2) and 2.56% (-2) in two years. The five-year was at 2.52% (-2), the 10-year at 2.71% (unch) and the 30-year at 3.59% (unch) at 3 p.m.

The ICE AAA yield curve was bumped in spots: 2.68% (unch) in 2025 and 2.61% (-2) in 2026. The five-year was at 2.53% (-2), the 10-year was at 2.69% (-1) and the 30-year was at 3.57% (-1) at 4 p.m.

The S&P Global Market Intelligence municipal curve was better: The one-year was at 2.68% (-2) in 2025 and 2.63% (-2) in 2026. The five-year was at 2.54% (-1), the 10-year was at 2.70% (unch) and the 30-year yield was at 3.56% (unch) at 4 p.m.

Bloomberg BVAL was little changed: 2.66% (-1) in 2025 and 2.63% (-1) in 2026. The five-year at 2.57% (-1), the 10-year at 2.64% (unch) and the 30-year at 3.56% (unch) at 3 p.m.

Treasuries closed the session mixed.

The two-year UST was yielding 4.072% (+1), the three-year was at 3.871% (flat), the five-year at 3.762% (flat), the 10-year at 3.875% (-2), the 20-year at 4.236% (-2) and the 30-year at 4.126% (-2) at the close.

Primary to come

New York City (Aa2/AA/AA/AA+) is set to price Wednesday $1.5 billion of general obligation bonds, serials 2026-2031, 2037-2049, term 2052. Loop Capital Markets.

The Hillsborough County Industrial Development Authority, North Carolina, is set to price Wednesday $1.302 billion of BayCare Health System revenue refunding bonds. Morgan Stanley & Co. LLC

The California Community Choice Financing Authority (A1///) is set to price $1 billion of Athene Annuity-funded Clean Energy Project Revenue Bonds, Series 2024. Goldman Sachs.

Dallas and Fort Worth, Texas, (A1/AA-/A+/AA) are set to price Thursday $713.41 million of Dallas Fort Worth International Airport non-AMT joint revenue refunding and improvement bonds, serials 2028-2044, term 2049. Wells Fargo Bank, N.A. Municipal Finance Group.

Los Angeles County Public Works Financing Authority (/AA+/AA+/) is set to price Thursday $576.11 million of lease revenue bonds, serials 2024-2044, terms 2049, 2053. BofA Securities.

The Atlanta Development Authority is set to price Tuesday $556.11 million consisting of $356.110 million of Convertible Capital Appreciation Economic Development Certificates (Gulch Enterprise Zone Project) and $200 million senior revenue bonds (Westside Gulch Area Project). J.P. Morgan Securities LLC.

Louisiana (Aa2/AA//AA) is set to price Tuesday $464.02 million GO refunding bonds consisting of $89.760 million Series 2024C, serials 2024-2034; $22.375 million Series 2024D, serials 2024-2034; $160.77 million Series 2024E, serials 2024-2036; and $191.115 million of Series 2025A (forward delivery) serials 2025-2035. Raymond James & Associates, Inc.

The Allegheny County Sanitary Authority (Aa3/AA-//) is on the day-to-day calendar with $361.595 million sewer revenue refunding bonds, Series 2024, serials 2024-2044, terms 2049, 2055. PNC Capital Markets LLC.

San Antonio, Texas, (Aaa/AAA/AA+/) is set to price Tuesday $357.38 million, consisting of $177.13 million of general improvement bonds, $124.85 million of combination tax and revenue certificates of obligation, and $55.4 million of tax notes. Piper Sandler & Co.

The Illinois Finance Authority is on the day-to-day calendar with $281.02 million of Endeavor Health Credit Group revenue refunding bonds (Aa3/AA-//), serials 2030, 2034. BofA Securities.

The Kenton County Airport Board, Kentucky, (A1//A+/) is set to price Tuesday $273.535 million of Cincinnati/Northern Kentucky International Airport revenue bonds consisting of $258.760 million of AMT bonds, serials 2029-2044, terms 2049, 2054; and $14.775 million of Series 2024B, serials 2026-2044, terms 2049, 2054. BofA Securities.

The South Dakota Housing Development Authority (Aaa/AAA//) is set to price Wednesday $250 million of homeownership mortgage bonds, consisting of $200 million of non-AMT bonds, serials 2029-2030, 2036 and terms 2039, 2044, 2049, 2055; and $50 million of taxables, serials 2025-203. Wells Fargo Bank, N.A. Municipal Finance Group.

The Nevada Housing Division (/AA+//) is set to price Wednesday $220.525 million of single-family mortgage revenue bonds, consisting of $172.855 million of senior taxable bonds and $47.67 million of senior non-AMT bonds. J.P. Morgan Securities LLC.

The New York State Environmental Facilities Corp. (Aaa/AAA/AAA/) is set to price Tuesday $218.84 million of 2010 Master Financing Program green state revolving funds revenue bonds Series 2024 B, serials 2024-2037, 2044, terms 2038, 2039, 2040, 2041, 2042, 2043. Siebert Williams Shank & Co., LLC.

The Cabarrus County Development Corp., North Carolina, (Aa1/AA+/AA+/) is on the day-to-day calendar with $204.63 million of limited obligation refunding bonds, serials 2025-2044. BofA Securities.

The Public Utility District No. 2 of Grant County, Washington, (/AA/AA/) is set to price Wednesday $164.675 million of Priest Rapids Hydroelectric Project revenue refunding bonds. J.P. Morgan Securities LLC.

The Mabank Independent School District, Texas, (/AAA/AAA/) is set to price Thursday $117.97 million of unlimited tax school building and refunding bonds, PSF Insured. FHN Financial Capital Markets.

Competitive

The South Dakota Conservation District (Aaa/AAA//) is set to sell $162.555 million of state revolving fund program bonds at 11:15 a.m. eastern Tuesday.

New York City is set to sell $300 million of taxable GOs at 10:45 a.m. Wednesday.

The North Texas Municipal Water District (Aa1/AAA//) is set to sell $153.705 million of Upper East Fork Wastewater Interceptor System Contract revenue refunding and improvement bonds at 11:30 a.m. eastern Wednesday.