Munis underperform USTs as supply weighs down

6 min read

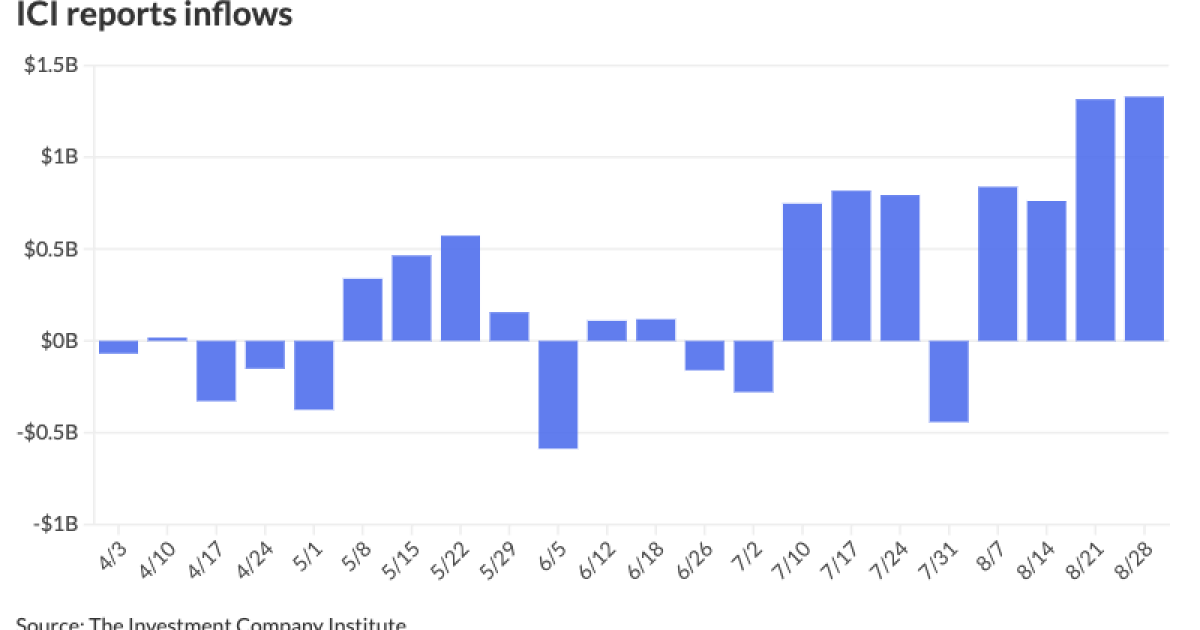

Municipals were slightly firmer as inflows into muni mutual funds topped $1 billion for the second consecutive week. U.S. Treasuries rallied and equities ended mixed.

Muni yields were bumped one to three basis points, depending on the scale, while UST yields fell seven to 13 basis points, pushing two-, three-, five- and 10-year UST yields to 2024 lows.

Muni to UST ratios rose slightly on the short end as a result.

The two-year muni-to-Treasury ratio Wednesday was at 64%, the three-year at 66%, the five-year at 67%, the 10-year at 71% and the 30-year at 88%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 63%, the three-year at 65%, the five-year at 66%, the 10-year at 70% and the 30-year at 87% at 3:30 p.m.

The Investment Company Institute reported $1.33 billion of inflows into municipal bond mutual funds for the week ending Aug. 28 after $1.316 billion of inflows the week prior. Exchange-traded funds saw $677 million of inflows after $243 million of inflows the previous week.

The U.S. Treasury market is rallying, but munis have generally been underperforming, said Jason Appleson, head of municipal bonds at PGIM Fixed Income.

“The underperformance can be placed squarely on the shoulders of very large amounts of supply,” he said. Bond Buyer 30-day supply sits at $16.46 billion.

Issuance has picked up for several reasons. For one, interest rate volatility is down, so issuers are becoming more comfortable with the cost of capital and stepping back into the market after a “brief pause” in 2022 and 2023, Appleson said.

There has also been a resurgence of Build America Bond refundings — including

“That’s taking money out of the taxable market into the tax-exempt market, adding to the deluge,” he said.

Lastly, 2024 is an election year, so issuers are front-loading deals ahead of November to avoid election-related volatility, Appleson said.

This means there has been a surge of supply over the past several weeks, and looking to September, most weeks should see around $10 billion of issuance, which could easily grow if a prepaid gas deal is thrown into the mix, he said.

This week boasts several large deals, with more sizable deals on tap for the next several weeks.

The New York City Transitional Finance Authority is set to come to market Sept. 11 with $1.8 billion of future tax-secured subordinate bonds in both the negotiated and competitive markets.

The District of Columbia is set to price Sept. 10 $1.6 billion of GOs.

The Empire State Development Corp. is set to sell the week of Sept. 16 $1.3 billion of sales tax revenue bonds.

New York City is set to price the week of Oct. 7 $1.5 billion of GOs.

But while supply is “the name of the game,” it affects other areas of the market like secondary volumes, Appleson said.

On the purchasing side, many investors are sourcing new bonds from the primary market, but with large calendars, larger concessions have to be “baked into” the new issues, he said.

The

Some issuers, like NYC TFA, DC and the Los Angeles Unified School District, “are all names that are pretty plain vanilla, but to get an extra five to 10 basis points baked in, that’s a lot more attractive than what you can get in the secondary [market],” he said.

In the primary market Wednesday, Goldman Sachs priced for the Curators of the University of Missouri (Aa1/AA+//) $363.72 million of system facilities revenue bonds, Series 2024, with 5s of 11/2025 at 2.58%, 5s of 2029 at 2.51%, 5s of 2034 at 2.91% and 5s of 2035 at 2.95%, callable 11/1/2034.

Jefferies priced for the Orlando Utilities Commission (/AA/AA/) $269.75 million of utility system revenue bonds. The first tranche, $89.635 million of new-issue bonds, Series 2024A, saw 5s of 10/2028 at 2.54%, 5s of 2029 at 2.52%, 5s of 2034 at 2.94%, 5s of 2039 at 3.21%, 5s of 2044 at 3.61% and 5s of 2050 at 3.86%, callable 10/1/2034.

The second tranche, $180.115 million of refunding bonds, Series 2024B, saw 5s of 10/2034 at 2.94%, 5s of 2039 at 3.21% and 5s of 2040 at 3.32%, callable 10/1/2034.

BofA Securities priced Baltimore County, Maryland, (Aaa/AAA//) $177.125 million of GO refunding bonds. The first tranche, $72.91 million of metropolitan district bonds, Series 2024A, saw 5s of 1/2025 at 2.58%, 5s of 7/2029 at 2.48%, 5s of 7/2034 at 2.80%, 5s of 7/2039 at 3.13%, and 4s of 7/2043 at 3.81%, callable 1/1/2035.

The second tranche, $104.215 million of consolidated public improvement bonds, Series 2024A, saw 5s of 1/2025 at 2.58%, 5s of 7/2029 at 2.48% and 5s of 7/2030 at 2.55%, noncall.

Wells Fargo priced for the Mississippi Development Bank (Aa3/AA-//) $148.025 million of Desoto County, Mississippi Highway Refunding Project special obligation refunding bonds, Series 2024A, with 5s of 1/2025 at 2.77%, 5s of 2029 at 2.70% and 5s of 2032 at 2.95%, noncall.

AAA scales

Refinitiv MMD’s scale was bumped one to two basis points: The one-year was at 2.51% (-2) and 2.43% (-2) in two years. The five-year was at 2.40% (-2), the 10-year at 2.70% (-1) and the 30-year at 3.59% (-1) at 3 p.m.

The ICE AAA yield curve was bumped up to a basis point: 2.52% (unch) in 2025 and 2.46% (unch) in 2026. The five-year was at 2.42% (unch), the 10-year was at 2.66% (-1) and the 30-year was at 3.58% (-1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was bumped one to three basis points: The one-year was at 2.51% (-3) in 2025 and 2.45% (-3) in 2026. The five-year was at 2.43% (-1), the 10-year was at 2.67% (-1) and the 30-year yield was at 3.58% (-1) at 3 p.m.

Bloomberg BVAL was bumped one to two basis points: 2.50% (-1) in 2025 and 2.45% (-1) in 2026. The five-year at 2.43% (-2), the 10-year at 2.66% (-2) and the 30-year at 3.56% (-2) at 3:30 p.m.

Treasuries rallied.

The two-year UST was yielding 3.762% (-13), the three-year was at 3.629% (-12), the five-year at 3.554% (-10), the 10-year at 3.757% (-9), the 20-year at 4.138% (-8) and the 30-year at 4.06% (-7) just before the close.

Primary to come:

The North Texas Tollway Authority is set to price

The San Diego Unified School District (Aa2//AAA/AAA) is set to price Thursday $670 million of dedicated unlimited ad valorem property tax general obligation bonds, consisting of $21.535 million of taxable green bonds, Series H-1; $328.465 million of green bonds, Series H-2; $12.45 million of taxable sustainability bonds, Series B-1; $177.55 million of taxable sustainability bonds, Series B-2; and $190 million of sustainability bonds, Series B-3. Goldman Sachs.

The Michigan State Housing Development Authority (/AA+//) is set to price Thursday $426.12 million of non-AMT rental housing revenue bonds, Series A, serials 2026-2036, terms 2039, 2044, 2049, 2054, 2059, 2064, 2067. BofA Securities.

The Municipal Electric Authority of Georgia (A2/A-/A-/) is set to price Thursday $372.645 million of subordinated bonds, consisting of $350.62 million of Project 1 bonds, serials 2026-2044, terms 2049, 2054, and $22.025 million of general resolution projects bonds, serials 2026-2034. BofA Securities.

The Metropolitan Water District of Southern California (Aa1/AAA//) is set to price Thursday (retail Tuesday) $215.71 million of water and revenue refunding bonds, serials 2025-2046, term 2049. Barclays.

Barbers Hill Independent School District, Texas, is set to price Thursday $189.19 million of unlimited tax school building bonds, Series 2024, Piper Sandler.

The Louisiana Local Government Environmental Facilities and Community Development Authority (A1/A+//) is set to price Thursday $151.435 million of East Baton Rouge Sewerage Commission Projects subordinate lien revenue refunding bonds, Series 2024. J.P. Morgan.

27J Schools, Colorado, (Aa2/AA//) is set to price Thursday $128.5 million of GOs, insured by the Colorado State Intercept Program. RBC Capital Markets.

Lake County, Ohio, (Aa1///) is set to price Thursday $120 million of County Correctional Facilities Series 2024, consisting of $70 million of bonds, serials 2025-2044, terms 2046, 2050, 2052, and $50 million of notes, serials 2025. Stifel.

Competitive:

Massachusetts (Aa1/AA+/AA+/) is set to sell $850 million of tax-exempt and taxable GO consolidated loan of 2024 bonds in four series Thursday, consisting of $130 million of series C exempts at 10 a.m. eastern, $220 million of Series D exempts at 10:30 a.m., $400 million of Series E exempts at 11 a.m. and $100 million of Series F taxables at 11:30 a.m.

Dane County, Wisconsin, is set to sell $144.61 million of general obligation promissory notes, Series A and $22.085 taxable general obligation promissory notes, Series B, at 11 a.m. eastern Thursday.